Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

Before jumping in, Arbor Digital is partnering with Polygon Advisory Group to bring a timely webinar on the current crypto tax landscape. Please join us on Wednesday, March 8th to get all your crypto tax questions answered!

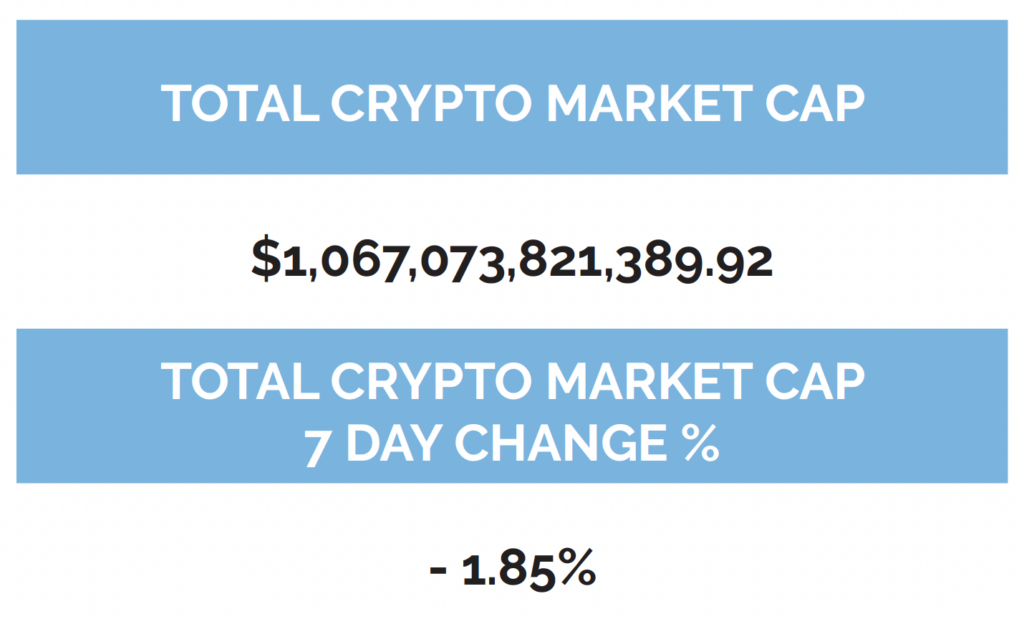

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, February 23rd, 7:00 pm ET

-as of Thursday, February 23rd, 7:00 pm ET

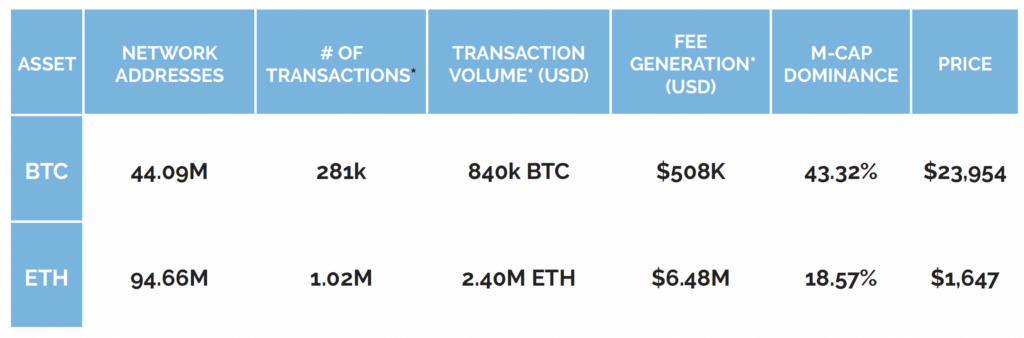

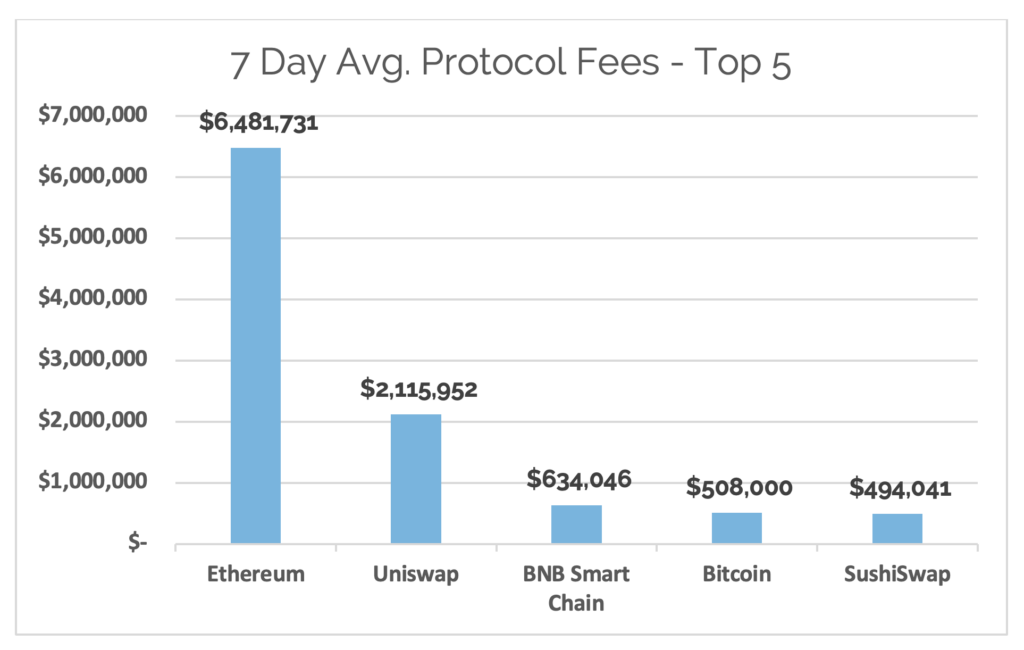

*7-Day Average

*Source: Cryptofees.info, Thursday, February 27th, 7:00pm ET,

*Fees in USD

Week in Review

Adoption

The Bitcoin network saw a decline of roughly 300,000 network addresses with a balance of BTC bringing the total to 44.09 million network addresses. The first weekly decline since early January. Daily active addresses were flat this week staying just above 1 million for the daily average. Network fees declined from $599k to $508k on a daily average. Daily average transaction volume (BTC) for the week decreased 18% moving from 1.01M BTC last week to an average of 840k BTC.

ICYMI

On the Ethereum network, roughly 360,000 new network addresses with a balance of ETH were added bringing the total amount to 94,667,701 network addresses with a balance, an all-time high. Daily active addresses for the week were up 7% to an average of 516k from 480k last week. Average daily fees for the week continued to move up, $6.48M up from $5.92M. Transaction volume (ETH) was down 17%, moving from 2.9M ETH to 2.4M ETH and continues to stay in a healthy range.

The biggest adoption news to come out of this week came on Thursday morning with the announcement of Base. Base is a layer 2 network built on top of Ethereum using Optimism’s OP stack. Why is this a big deal? Well, that’s because it was built by the publicly traded crypto exchange Coinbase. Base will not be limited to Ethereum, it will also provide easy and secure access to layer 2 networks such as Optimism, as well as other blockchains ecosystems like Solana.

“Today, we’re excited to announce the testnet launch of Base, an Ethereum layer 2 network offering a secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized apps or “dapps” on-chain,” Will Robinson, vice president of engineering at Coinbase, told CoinDesk. “We’re incubating Base inside of Coinbase, leveraging the last decade of our experience building crypto products, and plan to progressively decentralize the chain over time,” Robinson added.

Many are speculating that Coinbase will eventually launch their own token, which isn’t farfetched considering other exchanges like Crypto.com have done so. It would be a very risky move considering Coinbase is a publicly traded company. That speculation was shot down quickly though. Regardless, this is a huge development for the industry. Here are a few high-level thoughts on what this means:

- Coinbase has 108 million verified users, this is huge for bootstrapping network effects. Base has the potential to be a major layer 2 blockchain from day 1 launch of mainnet. However, no insight into how much of this would be net new users to the crypto economy.

- Coinbase will be in a prime position to showcase the power of decentralized blockchain technology on financial services. They can be the first company to onboard users where they don’t know they are interacting with crypto infrastructure.

- Coinbase will attract some of the best talent in the dApp landscape to build on the Base blockchain.

- The launch of Base may provide a blueprint for other centralized exchanges to follow.

Charles Schwab had to evolve in the mid-2000’s from a business reliant on transaction revenue. Similarly, Coinbase needs to evolve from a business reliant on transaction revenue and this is their strategy. Revenues are down roughly 60% from Q3 2021 and the SEC is targeting their staking-as-a-service product where users can stake their ETH and earn staking rewards. Going deeper into the unregulated crypto economy does increase the company’s regulatory risk profile. It’s important to note that Base is currently only live on a testnet, launching with a myriad of operational glitches. To be fair this is to be expected with these types of launches though.

Read More

The next piece of adoption news is around the streaming music giant Spotify. In 2022 Spotify, which has over 489 million users, launched a pilot program to test NFT galleries to help artists promote their NFT offerings. This was done in order to enhance the fan experience as well. Steve Aoiki is a popular artist who is part of this program. At the time this was seen as a very passive move to jump on the hype train that was digital collectible NFTs. This week, however, Spotify announced a much more active web3 feature. Token-gated playlists.

The TLDR is that an artist can create a playlist of unreleased songs and the only way a fan can access that playlist is by proving ownership of a specific digital collectible NFT. There isn’t much info about the economics both for Spotify and for the artists though. The music industry remains one of the primary vehicles for crypto adoption due to the evolving relationship between artists and fans. Artists are demanding more ownership over their creations, more ownership of the economic flow from those creations, and ways to directly engage with their fanbase. Fans want to support their favorite artists, not the companies who represent those artists and want to feel connected to the artist.

The music industry is ripe for disruption. Spotify disrupted the way fans consumed their favorite artists’ music and now they are positioning itself to disrupt the way artist engage their fan base and how the artist benefits from that relationship.

Financial

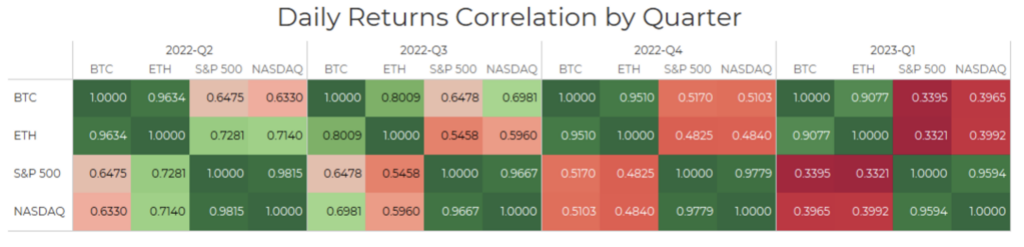

Digital asset markets were slightly up this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $23,943.31, up 1.82% on the week, while Ethereum (ETH) closed at $1,650.63, up 0.78% on the week. This puts BTC’s return year to date at +39.63% and ETH at +33.06%. Ethereum also continues to record slightly higher rolling volatility than Bitcoin. Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 and gold both continue to be uncorrelated with Bitcoin by the same metric.

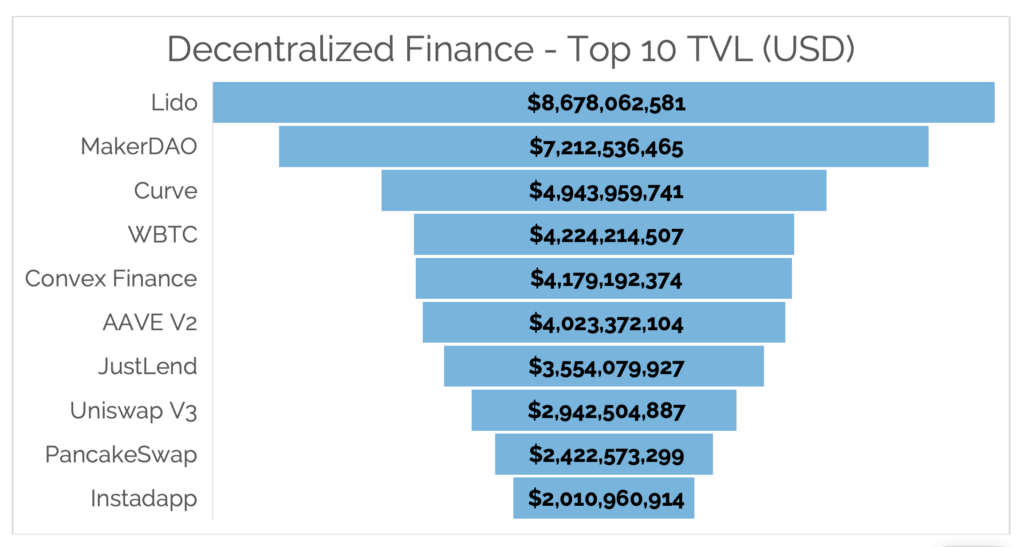

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) remained flat over the last 7 days, sitting at $49.74B as of Thursday, February 23rd. The top 10 DeFi TVL, verified by Digital Asset Research, this week didn’t see many changes. Locked values were relatively flat, and rankings were all the same, except for PancakeSwap re-entering the top 10.

Digital Asset Learning

Webinar: 2023 Crypto Tax Landscape

Created By: Arbor Digital and Polygon Advisory Group

Abstract: Similar to traditional finance, it is important to avoid tax pitfalls that could potentially put you and your wealth at risk and understand the opportunities in an ever evolving tax landscape.

We understand it can be difficult to grasp the complexities, opportunities, and challenges. Whether you are a crypto power user or an average investor, we invite you to join us to gain an understanding of the current tax landscape.

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Definitions

Network Addresses

The sum count of unique addresses holding any amount of native units as of the end of that

interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens

would not be considered).

Daily Active Addresses

The sum count of unique addresses that were active in the network (either as a recipient or

originator of a ledger change) that interval. All parties in a ledger change action (recipients and

originators) are counted. Individual addresses are not double-counted.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.