Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

ICYMI: We have two on-demand webinars to share with you this week that are a must-watch.

Whether you are just starting or fully engaged in digital assets, these webinars will help anyone understand digital assets on a deeper level. Arbor Capital’s chief investment officer and former forensic accountant, Matthew Schechter, shares how he thinks about digital assets and how it fits in a traditional asset allocation. Sharon Y. and Phil G., co-founders of Polygon Advisory Group, dive into the current tax landscape with major pitfalls and how to avoid them when engaging in digital assets either as a user or investor.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, March 9th, 7:00 pm ET

-as of Thursday, March 9th, 7:00 pm ET

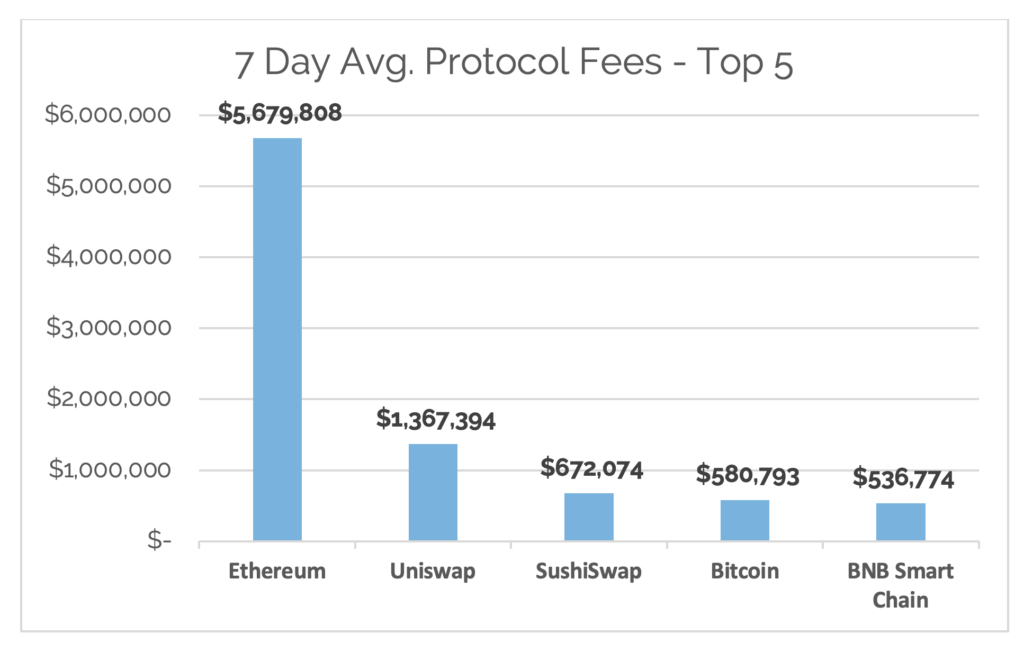

*7-Day Average

*Source: Cryptofees.info, Thursday, March 9th, 7:00 pm ET,

*Fees in USD

Week in Review

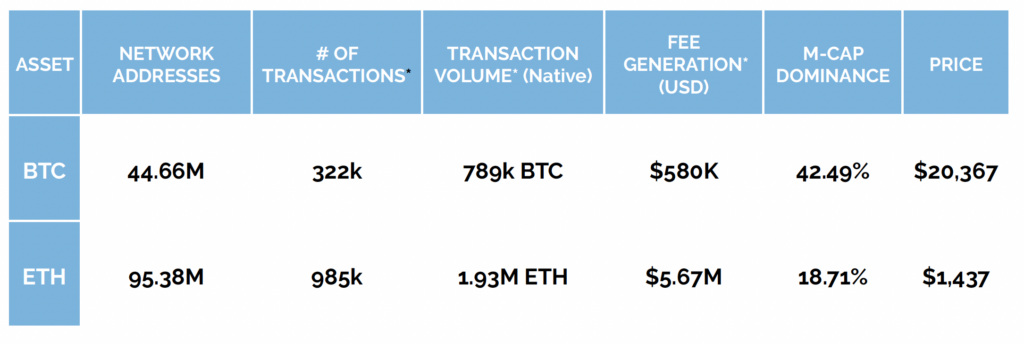

The Bitcoin network has hit a new all-time high in network addresses with a balance of BTC bringing the total to 44.66 million network addresses. Daily active addresses continue to stay in a healthy range between 930k and 1 million for the daily average. 7-Day average Network fees also continue to stay within the range of $500-600k, seeing a low of $390k and peaking at $920k. Daily average transaction volume (BTC) for the week had a slight decline from 818k BTC to 789k BTC.

On the Ethereum network, roughly 360,000 new network addresses with a balance of ETH were added bringing the total amount to 95.43 million network addresses with a balance, an all-time high. Daily active addresses for the week were up 7% to an average of 516k from 480k last week. Average daily fees for the week continued to move up, $6.48M up from $5.92M. Transaction volume (ETH) also saw a slight decline, moving from 2.05M ETH to 1.93M ETH but continues to stay in a healthy range.

In adoption news, there are “Good” and “short-term not too good, but long-term great”. Let’s start with the good:

- Digital Bonds: The Disruption is Underway

- 2022 Developer Report: Developers Community Continues Growth

- Ethereum Account Abstraction

- Grayscale vs. SEC Court Case

Now the ‘short-term not so good but long-term great’:

- Banking in Crypto: Silvergate Bank

- NYAG alleges ETH as a Security

- Binance and Binance.US

- Tether Transparency

This is a lot to digest and if you don’t live and breathe in the space, I can only imagine how confusing it must be. Personally, I’m an eternal optimist, which you can probably already tell. Arbor Digital’s co-founder and compliance officer continues to preach that much of the regulatory clarity that will come to digital assets will come through court cases, not proactive legislation, which isn’t dissimilar from how we got to the traditional investment regulatory environment we have today.

Rather than go into details on each point, over the next few weeks, we will be diving into each of these pieces in detail. History, current state, and our thinking points to consider for the future state. But at a high level, we continue to see institutions, both financial and non-financial, developing and testing products and services where the backend is decentralized blockchain infrastructure. In the courts, Grayscale vs. the SEC is in the early stages with Grayscale looking to be in a positive position judging from the overseeing judge’s questions and remarks so far.

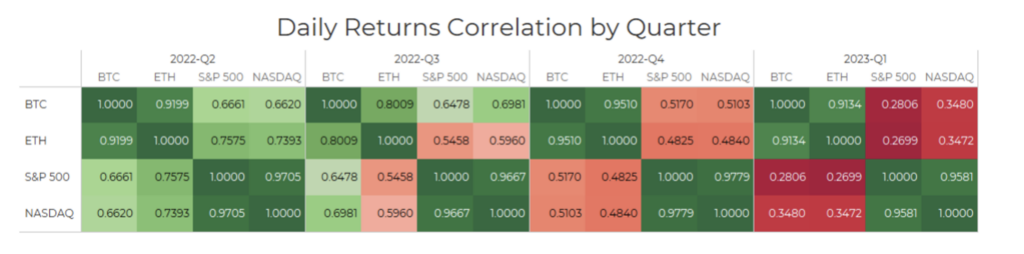

It is clear that US authorities, like the SEC, are focused on reigning in crypto. This has been apparent since FTX collapsed in November 2022. Many technical analysts and price predictors were so fast to call for the next bull market and praise digital assets as de-coupling from traditional markets ‘like they predicted’. But it was hard to buy into that considering what has been lying in wait. While we have the conviction that digital assets and crypto will be a major part of the future, there is still a lot of short-term pain we must go through in order to get to the other side. The truth is, no one knows how all of this will play out. For Arbor Digital, it trusts the process, and our investment thesis remains very much intact.

Read More

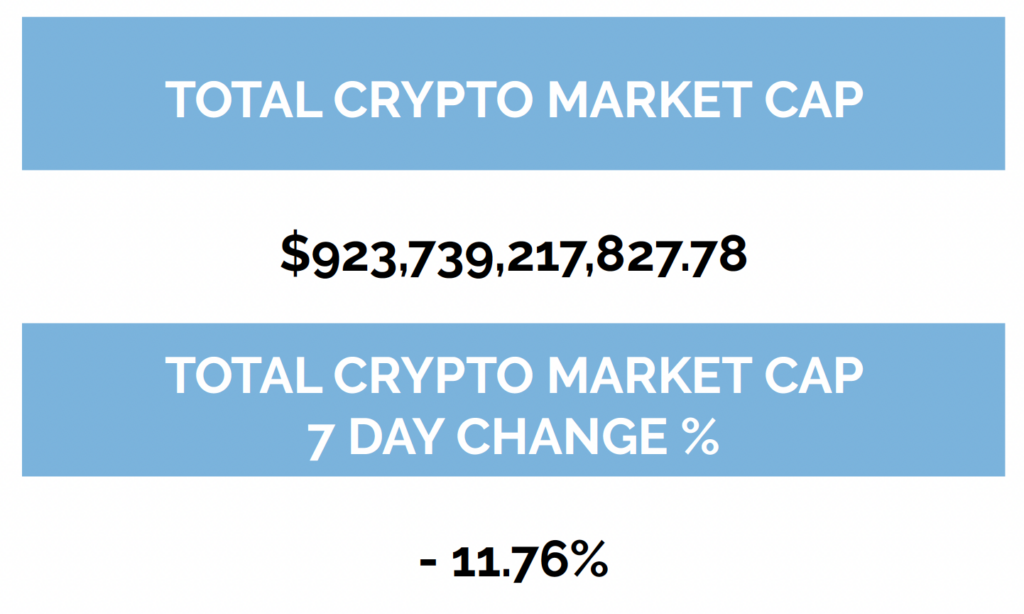

Financial

Digital asset markets were down this week with the total industry market cap hovering above $900 billion. The price of Bitcoin (BTC) closed at $20,367.03, down 13.21% on the week, while Ethereum (ETH) closed at $1,437.42, down 12.77% on the week. This puts BTC’s return year to date at +19.23% and ETH at +17.29%. Both BTC and ETH also saw an increase in their rolling volatility over the last few days.

Gold became significantly negatively correlated with Bitcoin from March 4-6, before returning to being uncorrelated. Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 continues to be uncorrelated with Bitcoin by the same metric.

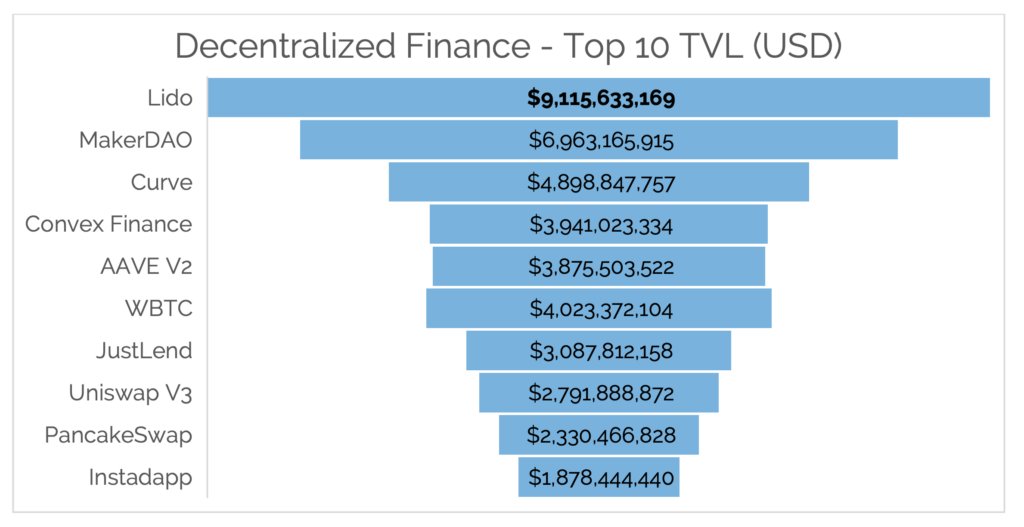

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) has seen a decline over the last 7 days, now sitting at $47.21B as of Thursday, March 9th, down from $50.32B. The top 10 DeFi TVL, verified by Digital Asset Research, this week didn’t see many changes other than proportional declines in their TVL due to the recent negative price action.

Digital Asset Learning

Webinar: 2023 Crypto Tax Landscape

Created By: Arbor Digital and Polygon Advisory Group

Abstract: Similar to traditional finance, it is important to avoid tax pitfalls that could potentially put you and your wealth at risk and understand the opportunities in an ever-evolving tax landscape.

We understand it can be difficult to grasp the complexities, opportunities, and challenges. Whether you are a crypto power user or an average investor, we invite you to join us to gain an understanding of the current tax landscape.

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Definitions

Network Addresses

The sum count of unique addresses holding any amount of native units as of the end of that

interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens

would not be considered).

Daily Active Addresses

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.