Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

In February of this year, the SEC proposed a dramatic expansion to the Custody Rule. Arbor Digital’s founder, Matthew Kolesky, submitted his comment letter to the SEC on May 7th.

“The proposed new rule will make it far more difficult for advisors to meet this rapidly growing demand for responsible advice and management of digital/crypto assets. This asset class trades 24/7/365, has unique characteristics, and doesn’t fit nicely with current regulatory or even product wrappers designed in the 1990s (e.g. ETFs).”

Arbor Digital is committed to working with regulators to bring forth reasonable rules of the road to enable Financial Advisors to adequately advise investors on Digital Assets. To learn more about how we currently enable advisors to fulfill their fiduciary duty and incorporate a Digital Asset strategy into their practice, book time with us here.

Now, a run of the numbers.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, May 18th, 7:00pm ET

*7-Day Average

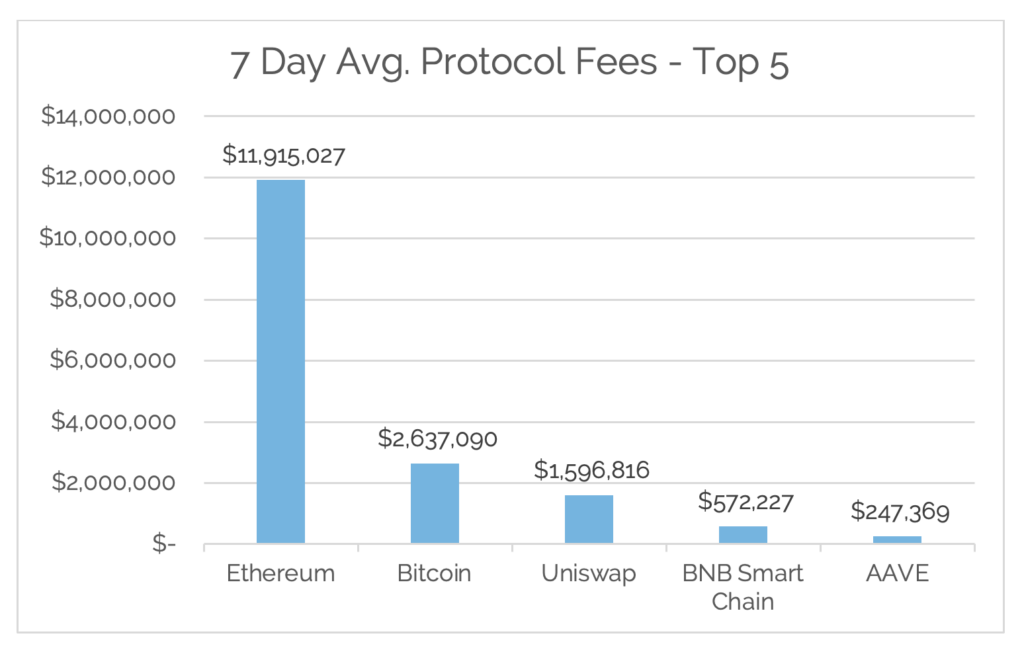

*Source: Cryptofees.info, Thursday, May 18th, 7:00pm ET

*Fees in USD

Week in Review

On-Chain Adoption

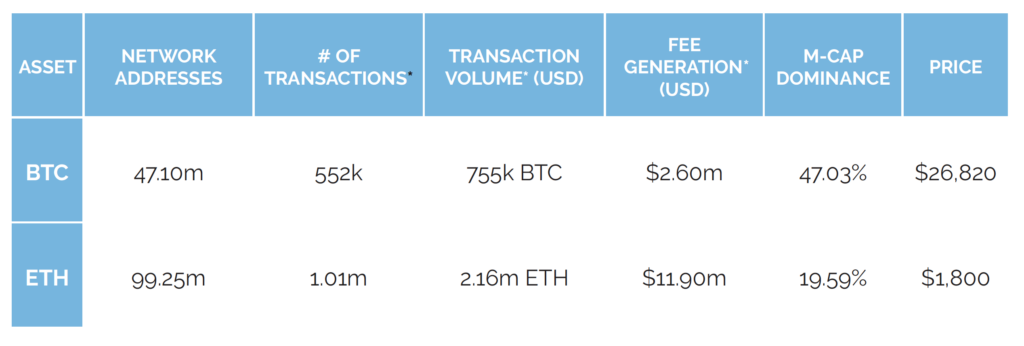

The Bitcoin network saw an increase of 100k network addresses with a balance of BTC bringing the total to 47.10 million network addresses, a new all-time high. Daily average active addresses continue to stay in a healthy range between 750k and 900k. The daily average transaction volume (BTC) for the week was slightly down for the week at 755k BTC. 7-Day average Network fees started moving down towards normal levels, but are still elevated relative to historical averages, coming in at $2.6m.

From intotheblock.com

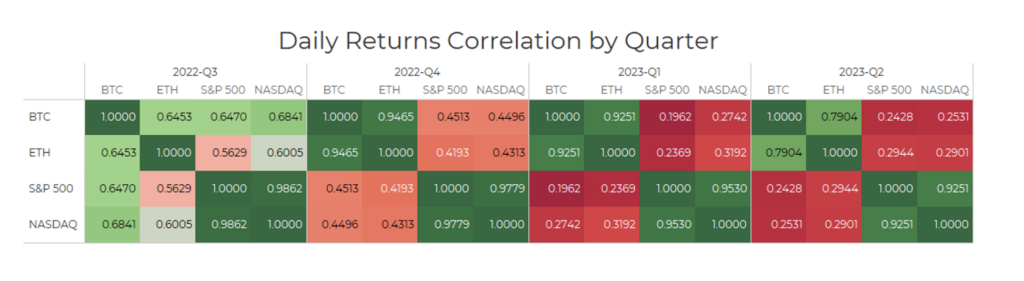

Bitcoin markets attention shifted from Ordinals to the U.S. government’s debt ceiling negotiations. Reuters reported growing hopes of a debt ceiling deal being reached and stocks rallying as this uncertainty gets sorted. The news sent the Nasdaq 100 index to a yearly high, while crypto remains below its recently set highs. This divergence may be signaling a change in market regime after closely following stocks throughout 2022.

Bitcoin and precious metals have been increasingly correlated.

- Crypto has been following gold and silver more closely as the macro focus shifts from interest rates to bank failures and risk of default.

- The higher correlation regime with precious metals likely began following the Silicon Valley Bank failure and its corresponding government response and appears to be prevailing as the debt ceiling deadline approaches.

- The USD rebound may also be a factor in the recent decline in both crypto and precious metals, with Bitcoin and the DXY index having a strong negative correlation of -0.7 now.

Long-term Bitcoin holders’ actions help propel its potential as digital gold. Like with gold, arguably much of Bitcoin’s value derives from the shared belief their holders have that the asset will sustain its value over time. This behavior is evidenced by the total amount of Bitcoin held by “hodlers” approaching its all-time high set earlier in March. Considering the debt ceiling uncertainty, market participants may have anticipated increasing value of alternatives outside the traditional finance system (such as gold and Bitcoin), which may be the reason why these have dropped in value as odds of a debt deal being reached increase.

On the Ethereum network, roughly 300k new network addresses with a balance of ETH were added this week, bringing the total amount to 99.40 million network addresses, an all-time high. Daily active addresses for the week were flat at ranging from 400-480k. Average daily fees for the week came back down to more normal levels, coming in at $11.90 million. Transaction volume (ETH) remained in a healthy range, reaching a daily average for the week of 2.16m ETH.

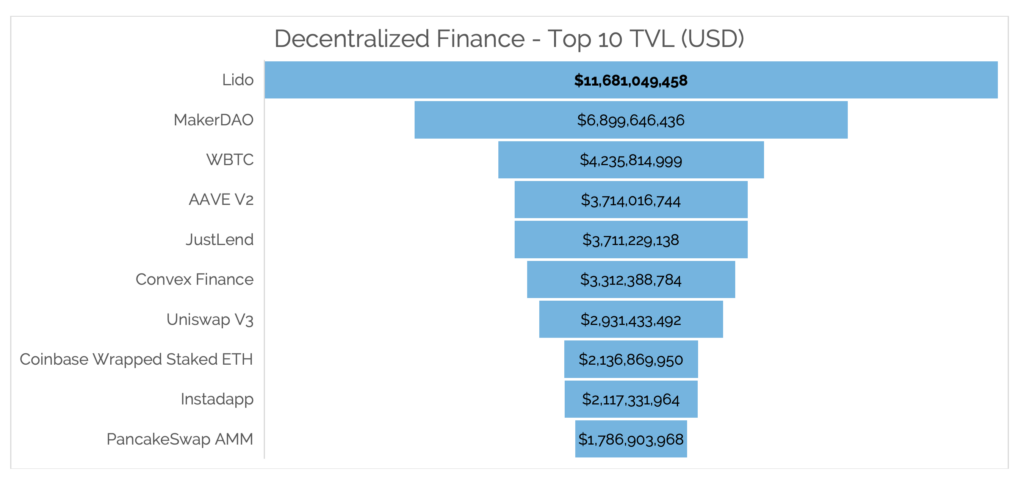

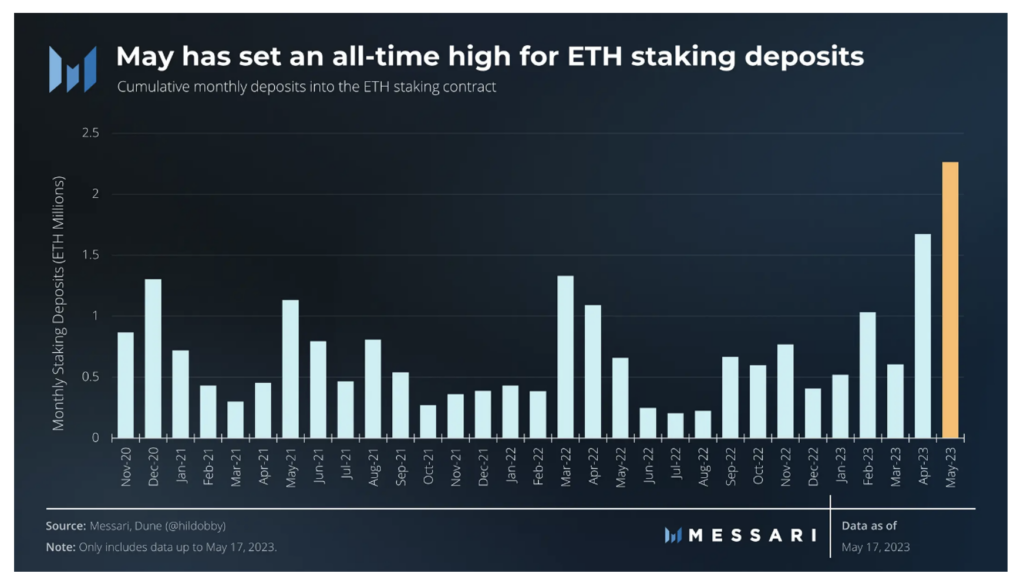

Staking has continued to shine on the Ethereum network. From Messari: Shapella was a massive derisking event for staking ETH and enabling withdrawals has increased the amount of ETH staked. In just the first 17 days, May has already become the month with the highest deposits into ETH staking, with more than 2 million ETH deposited. At the time of writing, there is a grand total of zero validators waiting to withdraw, while 55,000+ validators (representing 1.7+ million ETH) are waiting to stake. Any new validator must wait 29 days before their stake gets deposited. In the coming months, the amount of ETH staked will likely continue to increase. A higher staking ratio benefits Ethereum reducing its free float and providing higher security for all its users and applications. A growing supply of staked ETH also increases the opportunity size for Ethereum’s staking solutions, like Coinbase, Lido, Rocketpool, etc.

Ledger, a cold storage digital asset wallet solution, introduced a new product update this past week which did not go over well with its current customer base. Ledger’s new product update introduced the capability for private key splitting via a technique called Shamir Secret Sharing (SSS). The update sparked uproar throughout the crypto community as users realized that one implication of this update is that Ledger may now export user private keys, a capability thought impossible up until a few days ago.

Ledger is learning a hard lesson about Trust when it comes to dealing with investors assets; that it can be lost in an instant.

The theme of technology driven strategy being carbon copied into financial services products and services, yes I would called an asset storage solution a financial services product, does not work in every situation. Tech firms and leaders building next generation financial services infrastructure need to understand the concept of trust in this context. You can have the greatest tech product in the world but if you don’t build and lead through the lens of establishing and maintaining trust, then you are dead in the water.

Off-Chain Happenings

- Blockchain Advocacy Group Calls on Congress to Get it Together

- CFTC Chair Says DeFi Crypto Exchanges Will Be Regulated Even if They Are ‘Just Code’

- EU Finance Ministers Give Final Go-ahead to MiCA

- Bitcoin Companies Must Provide ‘Proof of Reserves’ in Texas

- Crypto should be regulated as gambling, UK lawmakers say

Financial

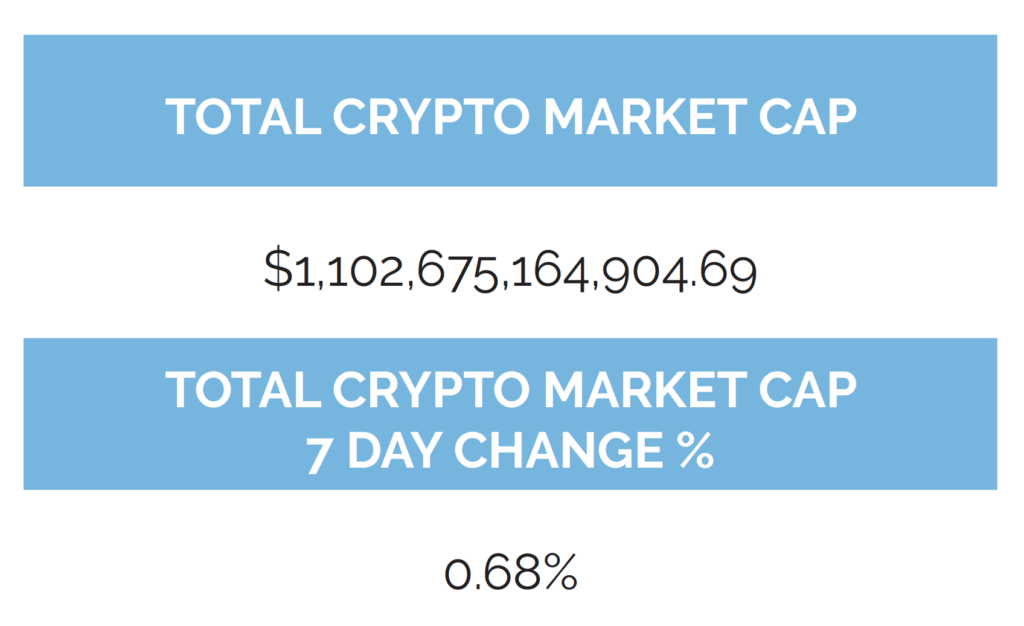

Digital asset markets were inconsistent this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $26,820.48, down 0.62% on the week, while Ethereum (ETH) closed at $1,800.63, up 0.30% on the week. Continuing a recent trend, Ethereum remains positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 and gold both remain uncorrelated with Bitcoin by the same metric (see correlation chart at the top of this newsletter).

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was down in conjunction with ETH and overall market token prices, coming in at $46.94b as of Thursday, May 18th.

Year to date, BTC is up 61.85%, ETH is up 51.23%.

Digital Asset Learning

On-Demand Learning: Guide to Staking

Created By: Digital Asset Research

Abstract: This video is a “Staking Primer: What is Proof-Of-Stake?” It explains what a consensus mechanism is and covers the differences between Proof-of-Stake (PoS) and Proof-of-Work (PoW).

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.