In this edition of Digital Asset Friday, we discuss Merge Day, the winners, the losers, and what it means for the industry moving forward. Lastly, we discuss the other Merge, the one to which financial professionals should be paying close attention. First, a run of the numbers…

By The Numbers

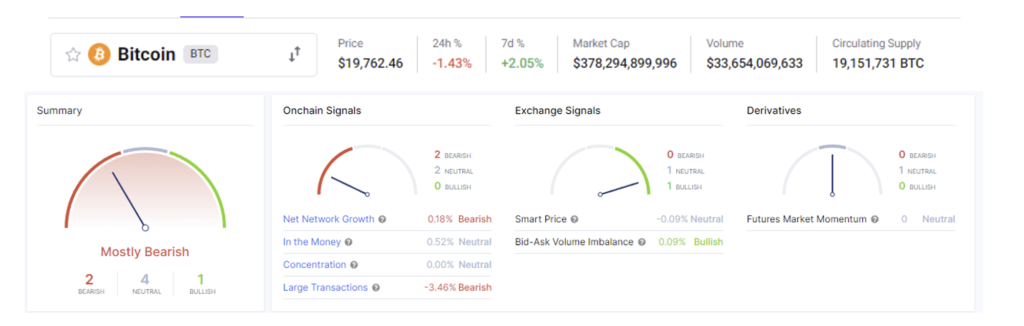

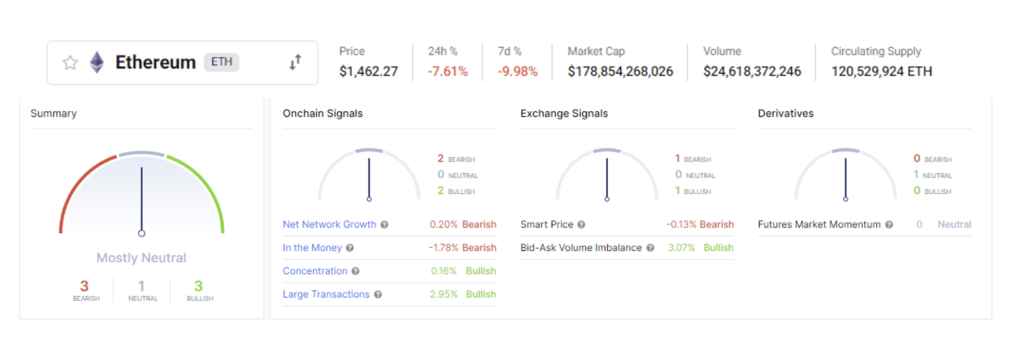

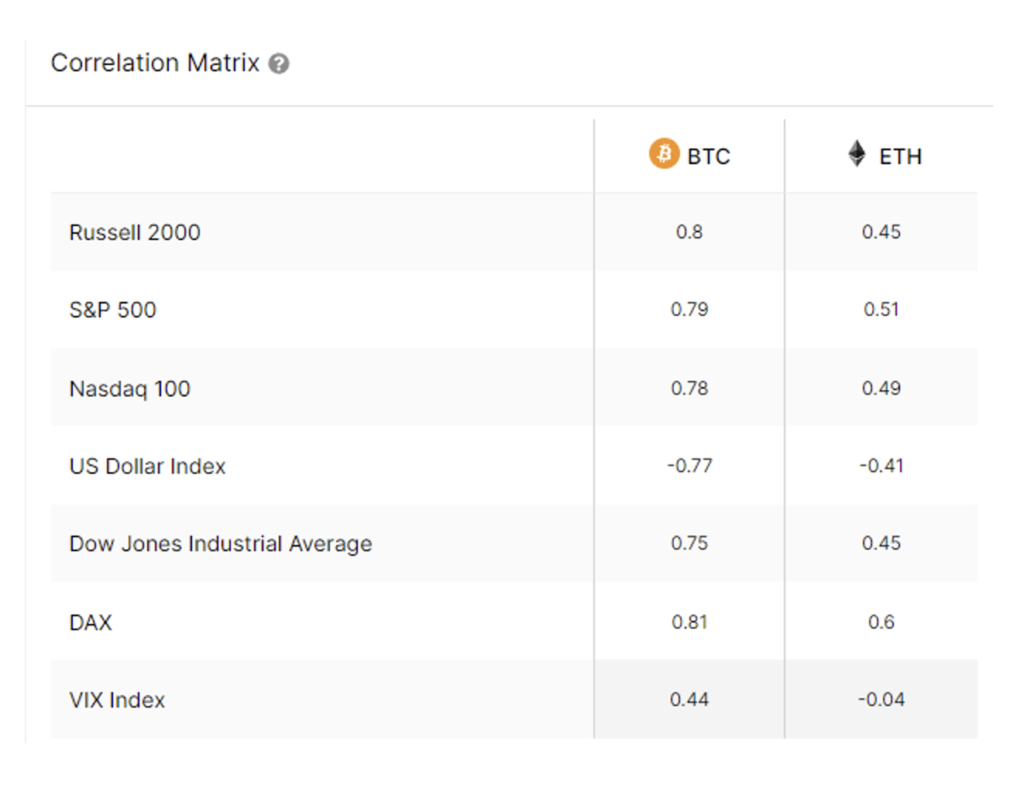

*All data above provided by CryptoQuant and Intotheblock

Dates to pay attention to:

- September 20th-21st – FOMC Meeting

- September 21st– 23rd – Messari Mainnet

A Historic Day

Thursday, September 15th, 2022, will henceforth be known as Merge Day. At 2:45 am EST on this day the high energy consumption Ethereum Proof-of-Work mainnet successfully merged with the low energy consumption Proof-of Stake Beacon chain. See here a recording of the historic moment from the Ethereum Foundation’s live watch party.

A who’s who showed up to celebrate this historic moment. The Ethereum foundation spent millions on marketing. They then threw a celebratory party at multiple locations all over the world to bask in its own glory for what it has accomplished. Fireworks, balloons, and musical guests all performed.

Wait, I’m sorry this was a thought exercise I did with a friend, “What would happen if a traditional tech/finance company were doing this?”

What happened was very anti-climactic, and I wouldn’t have had it any other way.

Merge Day Winners

The Crypto/Web3/Digital Assets industry as a whole.

The reason why is because of the things we are not talking about. We aren’t talking about a catastrophic failure of the merge. We aren’t talking about hackers successfully exploiting the transition siphoning hundreds of millions of dollars from investors across the world.

We aren’t talking about Vitalik Buterin being a snob rubbing the merge in every other network faces lambasting on social media saying, “See my blockchain is better than yours.”

The industry has taken a brand beating since May due to the horrendous bad actors, both individuals, and coordinated groups. The FUDsters and bears have come out in full force claiming the death of the space. They haven’t gone away, and they shouldn’t, we need them, but the merge was an unequivocal Win for the space.

Ethereum

So much is still unknown, but for the Ethereum network, this is a huge Win. Regulators and institutional investors across the world often highlight Proof-of-Work and its energy consumption as a reason why it cannot thrive or be adopted. That argument is now gone. The TLDR: Ethereum will use at least ~99.95% less energy post-merge.

This doesn’t mean that institutions are going to pour dollars in come September 16th. What this does is set the path towards adoption. It’s important to understand that the Merge was just one step towards bigger goals. Sharding, which aims to expand Ethereum’s transaction throughput and decrease its fees by spreading network activity across several “shards” – almost like lanes on a highway, is next up.

As Vitalik Buterin puts it we will have the Merge, post-merge, the Surge, and the Verge, the Purge, and the Splurge.

Open Source Software Development

A question we ask ourselves daily is: Do we need any of this?

Part of our investment thesis into the crypto/digital asset space is the concept and need for Open Source software development. We believe this will lead to more ownership of one’s production of data, control of it, and monetization of it.

Taken from Synopsys.com Open Source Software is defined as:

“Open source software (OSS) is software that is distributed with its source code, making it available for use, modification, and distribution with its original rights. Source code is the part of software that most computer users don’t ever see; it’s the code computer programmers manipulate to control how a program or application behaves. Programmers who have access to source code can change a program by adding to it, changing it, or fixing parts of it that aren’t working properly. OSS typically includes a license that allows programmers to modify the software to best fit their needs and control how the software can be distributed. It looks like Wednesday afternoon is when the merge will happen with some speculation it could be earlier or later.”

The Merge will be a case study among scientists, researchers, and professors across the globe. The question will move from, “Do we need any of this?” to “Why didn’t we do this sooner?”

Merge Day Losers

The FUDsters

Fear, Uncertainty, and Doubt. Commonly known as FUD. There is real innovation happening in the decentralized/private blockchain space. The successful Merge is a loss to everyone who proclaims nothing real is happening.

Regardless of how you feel about any of this, the Merge was one of the biggest technical feats accomplished in technology, ever. Please read that again and let it sink in.

I’m not a technologist. My education and training are not in tech or software. But when MIT, you know, that little know technical institute that is honored and respected across the globe, labels the Merge as a technological breakthrough, I pay attention, and you should too.

ETH-POW

What is ETH-Proof of Work? ETHW is a fork of Ethereum aimed to operate with miners who believe in Proof-of-Work Ethereum, largely comprised of Chinese miners. From the Defiant:

“The ETHPoW team was criticized for delaying its launch until hours after The Merge, with onlookers grumbling the delay was due to poor organization and a lack of tooling. On Twitter, Igor Artamonov, a former Ethereum Classic developer, highlighted the project’s failure to prepare a block explorer, wallet, and public Remote Procedure Call software well in advance of launching.

“They haven’t been able to prepare their chain launch on time for The Merge,” Kieran Warwick, the co-founder of Illuvium told The Defiant. “They had a unique chance and missed the momentum for a good launch.”

This has created a small winner in ETH-Classic.

Miners

A successful Ethereum merge is a blow to miners across Proof-of-Work blockchains. While we don’t think PoW will be rendered obsolete. If Ethereum continues to showcase more use case evolution, network adoption, and favor from regulators and institutional investors, this will put pressure on PoW networks and decrease their total addressable market and overall market share.

We believe there is a need for a Bitcoin network utilizing PoW and we don’t think Bitcoin is going anywhere. But for other PoW blockchains or future ones, this is a huge loss for them.

Major Concerns – We aren’t out of the woods yet.

While we are hugely bullish on the merger and its long-term effects, it is wise for everyone to consider risks and concerns.

What the merge didn’t do

The merge didn’t do much when it comes to solving other technical problems. The merge doesn’t impact scaling, doesn’t increase throughput, and doesn’t do much for the fee markets. This means that there will still be a need for Layer 2 solutions to solve these problems.

ETH as a Security

It didn’t help solve the issue of the ETH token as a security. In fact, it may have muddied the waters a bit. Staking rewards will be a hot regulatory item. Is this compensation for work? Are rewards an investment contract under the Howey test? Is staking similar to lending? We think the absence of mining puts ETH as an asset more in the crosshairs of the SEC and not the CFTC.

Centralization, centralization, centralization

One of the biggest concerns regarding the Merge is that moving to Proof of Stake will increase the centralization of the network, completely going against the ethos of the space and why the space was created when Satoshi wrote the Bitcoin whitepaper.

Case in point, In the hours following the Merge, over 40% of the network’s blocks were added by just two entities: Coinbase and Lido. “Out of the last 1,000 blocks, 420 have been built by just Lido and Coinbase,” Martin Köppelmann, co-founder of Gnosis, an Ethereum infrastructure firm, wrote in a tweet.

Xinyi Luo wrote wonderfully on this for Coindesk:

“So much money going to so few services has sparked concerns: If a single entity controls more than 66% of the network’s staked ether, it will be able to make it more difficult for others to write transactions to Ethereum’s ledger.

Fears of validator centralization became more prescient last month after U.S. government sanctions raised questions about whether validators might be forced to censor transactions coming from certain blockchain addresses. Some, though not all, U.S.-based validators have announced that they will begin to ignore transactions from the sanctioned Tornado Crash mixer program, meaning it might be more difficult for those transactions to make it onto Ethereum’s decentralized ledger.”

What does the Merge mean?

In the grand scheme of things, the Merge is a step toward maturity. For the Ethereum network, The Merge will solve regulators’ and institutional investors’ concerns about environmental impact and set the network up to execute on next steps for its grander vision. At the same time, this puts ETH the asset firmly in the crosshairs of the SEC as a security, which isn’t necessarily a bad thing.

The impact of the Merge is largely unknown right now. The main thing currently was a test for the technology itself. From an adoption standpoint, it remains to be seen if this step towards maturity will position Ethereum to onboard the next billion users into crypto/web3/digital assets.

In some ways, ETH becomes a more investible asset, in other ways it doesn’t. It’s important not to blindly allocate towards ETH without fully understanding the risks. Therefore we are here, to help advisors and investors make responsible decisions allocating to this still nascent asset class.

The other, just as important Merge

The merge in which Arbor Digital’s mission is rooted. I’m talking about the merge happening between TradFi, CeFi, and DeFi. I’m talking about the first steps towards all assets being tokenized and living on a blockchain, private or public.

Some of the biggest names on Wall Street Charles Schwab, Fidelity Investments, Citadel Securities, and Sequoia Capital are backing a new digital asset exchange, EDX Markets. It’s important to note this isn’t new, this has been out in the world since early this year in digital asset circles and in public since July.

Why is this important? Simple, these include some of the most conservative names in the industry. Yet, they are building infrastructure and spending billions without regulatory clarity. Let that sink in and ask yourself, “Why would they take this risk?”

Whatever your belief system on current financial infrastructure vs. decentralized/centralized blockchain financial infrastructure, technology to elevate and enhance value sharing and creation is coming, and the current incumbents won’t let it happen without them.

The Merge is and has been, happening for some time now. It will only continue.

Arbor Digital will be with you through it all.

Other Digital Asset News

- SEC’s regulatory approach chills innovation and may send crypto overseas

- White House Releases ‘Comprehensive Framework’ for Crypto Regulation and Development

- Introducing BitGo’s Platform for Wealth Management

- Ex-Citadel Securities Duo Unveils Crypto High-Speed Trading Firm

- Starbucks Brewing Revolutionary Web3 Experience for its Starbucks Rewards Members

- Seven Industries Rife With NFT Investing Opportunities

Crypto Learning:

Webinar: The ETH Merge: What does it mean?

When: Friday, September 16th, 2022, 2:00 pm ET

Presented by DACFP: For many investors, their entrance into crypto starts with bitcoin. As they explore the landscape, their next stop is often Ethereum, the world’s second-most valuable blockchain. Indeed, many now believe Ethereum represents a bigger market opportunity than bitcoin. After all, Ethereum is the platform on which DeFi, NFTs, and stablecoins are largely built!

And, in September, Ethereum is completing what many say is the most significant software upgrade in crypto history. It’s called the “Merge.”

Join us for this special one-hour webcast, where Ric Edelman and Bitwise CIO Matt Hougan will reveal what the “Merge” means for Ethereum and holders of ETH – and how you can answer your clients’ questions about crypto’s second-largest asset.

1 CFP CE credit

1 CFA PL credit

Investments & Wealth Institute® has accepted this webinar for 1 hour of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA® certifications.

Reading: Blockchain Fundamentals for Web 3.0, by Mary C. Lacity and Steven C. Lupien, Foreword by Caitlin Long

This book explains the movement to establish online trust through the decentralization of value, identity, and data ownership. This movement is part of ‘Web 3.0’, the idea that individuals rather than institutions will control and benefit from online social and economic activities. Blockchain technologies are the digital infrastructure for Web 3.0. While there are many books on blockchains, crypto, and digital assets, we focus on blockchain applications for Web 3.0. Our target audience is students, professionals, and managers who want to learn about the overall Web 3.0 landscape—the investments, the size of markets, major players, and the global reach—as well as the economic and social value of applications.

Content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.