Weekend ETH PricesETH Friday at 5pm: $3,974 ETH Weekend Low: $3,959 ETH Weekend High: $4,177 ETH Price as of posting: $4,130 Performance YTD: +465.57% |

Weekend BTC PricesBTC Friday at 5pm: $61,231 BTC Weekend Low: $59,656 BTC Weekend High: $61,445 BTC Price as of posting: $62,967 Performance YTD: +113.94% |

Welcome back to the weekend round-up and be sure to read all the way until the end with crypto learning opportunities. Over the weekend we saw important news regarding phishing scams, largest bounty payout to date, Nigeria’s CBDC set for launch Monday, October 25th, and another DeFi project under investigation by the CFTC.

YouTube Channels hacked & 3 Million Coinmarketcap Emails Surface Online

Reported by Arijit Sarkar, “A new report shared by Google’s Threat Analysis Group (TAG) highlights an ongoing phishing campaign against YouTube creators, typically resulting in the compromise and sale of channels for broadcasting cryptocurrency scams. According to Google, the attacker live-streamed videos promising cryptocurrency giveaways in exchange for an initial contribution.”

“Given the ongoing efforts, Google has managed to decrease the volume of Gmail phishing emails by 99.6% since May 2021. “With increased detection efforts, we’ve observed attackers shifting away from Gmail to other email providers (mostly email.cz, seznam.cz, post.cz and aol.com),” the company added.

On top of this, it was reported on Saturday that 3.1 million email addresses of CoinMarketCap users were collected and sold on hacker forums. However in a blog post from Coin marketcap, “At this point in our investigation, we’ve come to the conclusion that the leak did not come from CoinMarketCap servers.”

Why is this important? Because safety and security are paramount to successfully navigating crypto in any form right now. Also, its Cyber Security Awareness month! Phishing, ransomware, and malware, to name a few, are important to be aware of and understand how to protect yourself. Password strength, Two-Factor Authentication, and hardware security are common ways to help shield yourself. See below for links to multiple Gemini Cryptopedia article to read up on what investors should be aware of from a security standpoint.

$2 Million bounty paid to White Hat Hacker – Largest to date

Reported by Turner Wright with Cointelegraph, “White hat hacker Gerhard Wagner has earned $2 million after reporting a solution to a potentially costly “double-spend” bug on the Polygon network. Polygon network’s Plasma Bridge was at risk of having $850 million removed by a knowledgeable hacker. According to the project, the vulnerability would have allowed attackers to exit their burn transaction from the bridge up to 223 times, quickly turning an amount like $4,500 into $1 million profit.”

A white hat hacker is a hacker who uses their skills and powers for the greater good. Different than a black hat hacker or a gray hat hacker. White hat hackers are given permission by a network to hack their systems to gain knowledge of any vulnerabilities. These white hat hackers are then paid a bounty by the network.

Smart Contract Risk or Technology Risk is very important because smart contracts are generally the most vulnerable points for cyber-attack and technology failures. In a report by Deloitte on Blockchain Risk Management, “Like any other software code, smart contracts require robust testing and adequate controls to mitigate potential risks to blockchain-based business processes.”

To mitigate this risk blockchain-based companies offer bounties to white hat hackers who can find bugs in the code or vulnerabilities in smart contracts on their platform. While consistent auditing of blockchains is important in analyzing the risk it’s also important to see how healthy a bounty program they run to incentivize the community to work on finding bugs so they can be fixed.

See below for Deloitte’s Blockchain Risk management paper, a deeper explanation into the different types of hackers, and the full story on Cointelegraph.

Nigeria’s CBDC set for launch Monday, October 25th

Reported by Kevin Reynolds at Coindesk, “The Central Bank of Nigeria (CBN) will launch its digital currency, the eNaira, on Monday.” To understand the possible impacts of the eNaira I highly encourage you to read an opinion piece from Olumide Adesina from Coindesk where he goes into the Good, Bad, and Ugly of the eNaira.

According to Adesina, “The CBN aims for the CBDC to increase financial inclusion rapidly and easily. Creating and holding funds for citizens in a central bank account could offer better access to financial services for the unbanked or underbanked. The CBDC will also make remittances easier. With restrictions on foreign exchange and the high transaction fees associated with transferring money in and out of the country, many Nigerians are already using bitcoin to make domestic and international transactions cheaper and faster. In addition, the central bank will be able to achieve its objectives of safeguarding people’s money, ensuring a safe and resilient payment system, and strengthening public confidence in the naira. As it provides transparency and is difficult to counterfeit, it could be a good way to combat economic crime and fraud.”

But it’s not all good. On the bad, “The eNaira could give the CBN greater control. A growing user base for bitcoin and other cryptocurrencies has already made Nigerian financial regulators worry about losing control over the money supply. The momentum is considered by them as a threat to economic stability and money in general. The eNaira also raises big concerns when it comes to privacy, especially with a government that violates human rights on a regular basis. The centralized digital asset could also eliminate the privacy that cash provides. This could serve as a tool for financial regulators monitoring human rights organizations and what they do with contributions they receive.”

Then with the ugly, “The hideous thing about the Nigerian digital currency is that it centralizes money even more and preserves the oligopoly power of the CBN. The Nigerian digital currency grants near-total control to the Nigerian apex bank. This would also enhance control over the level of access a Nigerian citizen has to a financial system, particularly if the citizen attempts to engage in behavior considered threatening by the financial authority.

Inevitably, the Nigerian digital currency would cause centralization, a situation that would exacerbate already rife cyber vulnerabilities and increase attack surfaces and vectors, making the Nigerian central bank a target.”

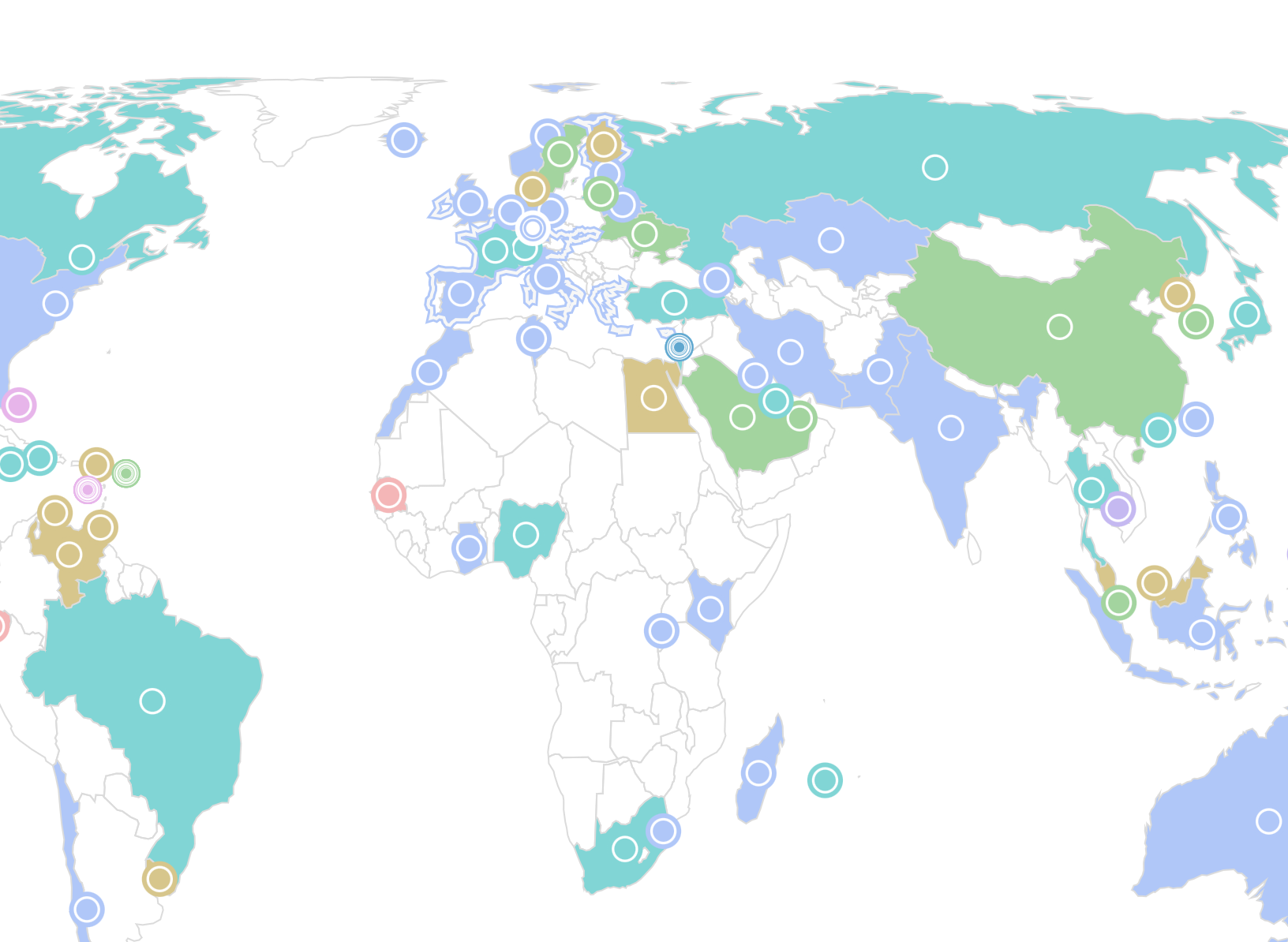

The world will be paying close attention at Nigeria adds to the growing list of countries that are either actively testing or officially launching a CBDC. A couple of resources we use to track the state of CBDC’s across the world is the Central Bank Digital Currency Tracker from atlanticcouncil.org and cbdctracker.org.

What you might have missed recently…

A good listen…

Why is the IMF afraid of cyrptoization? Is crypto really the problem, or is the IMF just afraid of the things it cannot control?

Learning Opportunities

2021 Forbes Wealth Summit

Wednesday, October 27th, 2021 from 2 pm-4:20 pm ET. In a rapidly changing world where affluent investors are increasingly challenged to stay ahead of the curve, the Forbes Wealth Summit will convene leading financial experts to discuss game-changing ideas, offer cutting-edge insights and give actionable growth strategies to help them plan for a successful financial future. With an eye on what’s ahead, the Summit will cast a spotlight on various opportunities that have the potential to transform wealth, inclusive of areas such as cryptocurrency, healthcare, tax policies, energy, and disruptive technologies.

Grayscale Deep Dive: SUSHI

Grayscale’s Deeper Dive into SushiSwap (SUSHI) with Lead Contributor Omakase and Core Contributor Rachel Chu on October 27, 2021, at 2:00 PM EDT. Omakase and Rachel will discuss the vision for SushiSwap, explain how the decentralized, community-driven platform works, and help us understand SushiSwap’s use cases. The discussion will be followed by Q&A.

Thank you for reading this all the way through. Be sure to tell someone today you care about them!

Stay safe, healthy, and happy!

– Marc

……………………………………………

Previous round-up: