The term “DeFi” is the abbreviation used for decentralized finance, which utilizes blockchain, crypto assets, and smart contract technology to manage decentralized financial services over the internet. If you’ve been curious about DeFi – or you’re wondering why it matters – read on to learn the basics.

What is Defi and Why it Matters

We’ve all grown accustomed to centralized financial institutions. Currently, centralized financial institutions have governing bodies and gatekeepers in place. These institutions provide the infrastructure, security, and tools to execute. In order to take advantage of these and gain access to financial services and products like basic banking, mortgages, and auto loans, consumers must work through these institutions. Since these middlemen earn a percentage on every transaction, we’re all paying to play – whether we like it or not – and this is part of what makes Decentralized Finance, or DeFi, (r)Evolutionary. It is, ostensibly, building a more efficient, transparent, secure, and global financial system where the consumers take control of what centralized institutions do.

DeFi consumers take direct custody and transact with other consumers, access financial services as long as they have an internet connection, and can access them 24 hours a day. Decentralized Finance provides another option from centralized financial institutions for consumers to access and utilize financial services.

DeFi can change the way we do our everyday banking, how we access mortgages and other loans, and our ability to trade assets, among other things, while also providing financial services to populations across the world that wouldn’t otherwise be able to access them in a safe and secure way.

DeFi gives the middlemen less power and consumers more ownership and power in their financial lives. DeFi also moves trust from centralized human authorities to software and code, i.e. math. Money moves from being managed by people to being programmable by software. An important piece here is that even in DeFi, the human element isn’t completely removed, but where the human element has impact and the degree to which the human element is present throughout the process of financial services is severely diminished.

Now, you may be saying to yourself at this point, “Well I don’t have this problem and I have full faith and trust in the financial system.” If so, that is great and you should consider yourself privileged. An important aspect to DeFi, and to crypto overall, is that it is globally accessible. A significant percentage of the world’s population doesn’t have access to any of the financial services mentioned so far. Then, of course, there are populations who do have access but don’t have good options. They are forced to pay exorbitant fees and give up their freedom and autonomy to gain access to financial services.

Another question you may be asking yourself is, “How does this affect me?” Here is a very basic example. Let’s say you have online savings account with an interest rate of 0.05%. Your bank can use your money to make a personal loan to another customer, let’s say at an interest rate of 3%. What happens with that 2.5% profit? Well, the bank pockets it. With DeFi, though, you could lend your savings directly to another person at an interest rate of 3%, and you earn the full profit on it.

While many will say that DeFi will replace all financial services in the future, it’s likelier that the future will have both options: Centralized Finance where you trust middlemen and institutions to secure, manage, and offer financial services, and Decentralized Finance where the consumer has ownership and is responsible for securing, managing, and engaging in financial services.

Understanding Blockchain and Smart Contracts

Decentralized finance runs on a few core technologies: Blockchain, crypto assets, and smart contracts. You can best understand decentralized blockchain by first thinking about how a transaction happens in a conventional account, like your checking account. Your transactions are recorded in a private ledger that is owned and managed by your centralized bank. Conversely, blockchains are decentralized and distributed public ledgers of financial transactions that are recorded in code. Everyone using a particular DeFi application has to access to an identical copy of this public ledger, where everything is encrypted. It’s a secure system that also provides anonymity to all users, and it keeps a record of asset ownership that is almost impossible to alter through fraud or other means. There’s no middleman managing the ledger; rather, parties who use the same blockchain go through a complex process to verify and record transactions and add new “blocks” of transactions to the chain.

Smart contracts are pieces of code that are simple “If-Then” or “If-Then-Else” statements. Example: If Sarah gives Jason $100, then Jason will pay 1% every month to Sarah. Instead of people handling this transaction, a smart contract will automatically execute these instructions, thus the phrase “programmable money”.

DeFi advocates believe in more secure and transparent financial transactions, asserting that our current centralized financial systems are too private and inaccessible to consumers. Blockchain solves that problem.

Current Uses for DeFi

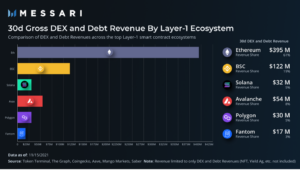

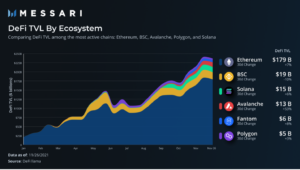

Whether it’s been on your radar previously or not, DeFi has permeated a wide variety of financial transactions, both simple and complex. DeFi is mainly built via decentralized applications, or dapps, which are programs called “protocols” to handle transactions, on top of a Layer-1 network (often referred to as mainnet) like Ethereum (ETH). In a recent DeFi study, Messari, crypto research, and data firm found that the majority of DeFi activity is done on Ethereum, measured through two basic metrics – Revenue and Total Value Locked (TVL):

Decentralize Exchange and Debt Revenue

Total Value Locked (TVL)

The Bitcoin network can be thought of as a decentralized finance network due to its primary use of moving value over the internet utilizing Bitcoin (BTC), which is the cryptocurrency most people are familiar with. Bitcoin maintains the largest market share (though there are more than one thousand different cryptocurrencies and ten thousand different crypto assets). Ethereum may be new to you, but it’s adaptability to a wide variety of use cases means many dapps and protocols run on an Ethereum-based code.

Dapps and protocols are already heavily in use. Here are several examples:

- Traditional Financial Transactions – This includes making payments, lending and borrowing, trading securities, and insurance.

- DEXs – Decentralized Exchanges are facilitating peer-to-peer financial transactions, which allows users to retain full control of their money.

- Digital Wallets – DeFi developers have created e-wallets that operate independently of large cryptocurrency exchanges, like Gemini and Coinbase. They allow investors to access cryptocurrencies, but also things like blockchain-based gaming.

- Stablecoins – Since many cryptoassets are known to be quite volatile, stablecoins are cryptoassets designed to maintain a stable value. This can be done via fiat-backed stablecoins, like USDC or USDT meant to track the US Dollar or algorithmic stablecoins like DAI or US

- NFTs – Non-Fungible Tokens take assets that are typically non-tradable or hard-to-determine proof of ownership (think private equity, fine wine, or real estate) and create unique digital assets from them.

These are just a few current uses, and DeFi adoption is growing rapidly. To put this in perspective, as of January 1, 2021, TVL in DeFi across all ecosystems was 18.71 Billion. As of January 29, 2022, the TVL is 189.38 Billion! (Source: DeFi Llama)

Risks Associated with DeFi

Most centralized financial products, instruments, and technologies roll out to consumers slowly and are heavily regulated. This is not so in the world of DeFi. The exact moment a dapp is encoded on the blockchain, it’s available to everyone everywhere, existing outside the lines of centralized finance. While this increases the potential rewards associated with dapps, it also means there are increased risks.

DeFi is a recent innovation and is it is still considered an emerging technology. It continues to be stress-tested as markets evolve and adoption grows. The regulatory environment is in flux as regional economies work to catch up with a decentralized financial landscape.

Here are a few of the risks to be aware of:

Bugs in the Code

As mentioned above, Ethereum is where the majority of DeFi takes place. Smart contract risk, or risk to their being bugs in the code, is the most prevalent and underestimated risk according to the founder of Ethereum, Vitalik Buterin. See here for an expansive timeline of DeFi exploits from January 2020 to December 2021.

So, what is it? In a study of smart contracts published by Harvard Law School, “…most “hacks” associated with blockchain technology are really exploitations of an unintended coding error. As with many bugs in computer code, these errors are not glaring, but rather become obvious only once they have been exploited.” Get access to the study here.

The Threat of Hackers and Scammers

Blockchains themselves are nearly impossible to hack or alter, but other aspects of DeFi are more at risk for theft and loss, as mentioned above with smart contracts. Bounty programs are a popular way DeFi networks help protect against these risks.

Scammers are rampant throughout DeFi due to lack of consumer education and how new these systems operate. Scammers prey on consumers who don’t truly understand how to secure themselves to gain access and trick consumers into sharing information and stealing assets.

Consumer Responsibility & Self Custody

In the world of DeFi and cryptocurrency, crypto assets must be stored in secure wallets by the user. These wallets are secured with “private keys” – that is, lengthy codes known only to the wallet owner. If you happen to lose your private key, there is no way to recover it, meaning you lose access to your funds. There are no service teams to call and recover this. Storing, securing, and day-to-day managing falls completely on the consumer. Which leads to…

A Lack of Consumer Protection and Insurance

As mentioned, DeFi isn’t currently subject to the rules and regulations that govern centralized finance. Although this has allowed DeFi to grow and thrive, it also means consumers lack recourse. For instance, centralized banks are required by law to hold a certain level of cash reserves so that you can go to the bank and cash out your account anytime you’d like. Likewise, the Federal Deposit Insurance Corporation (FDIC) will reimburse you up to $250,000 if your bank fails. DeFi lacks any similar protections or insurance for consumers.

What Does the Future Hold for DeFi?

Removing the middleman and giving ownership and control to consumers is just one of the benefits DeFi is bringing to the world. Global access to everyone with an internet connection, full transparency, and unparalleled security are others – and why many believe DeFi has a bright future. Experts say DeFi is still in its infancy with regard to its capabilities with a lot of untapped potentials. However, risks are heavy in this emerging technology. Do not actively engage in DeFi without fully understanding the risks outlined in this article. Please reach out to us here to learn more about how we engage in DeFi and provide services to our clients who want to engage.

With the regulatory environment in flux, it remains to be seen whether adoption will become widespread anytime soon. One thing we do know is that DeFi is here to stay and it’s wise to continue educating yourself about it.