In this edition of Digital Asset Friday, we discuss MiCA the EU’s landmark crypto legislation and the continued merge of traditional finance with blockchain finance infrastructure. First, a run of the numbers…

By The Numbers

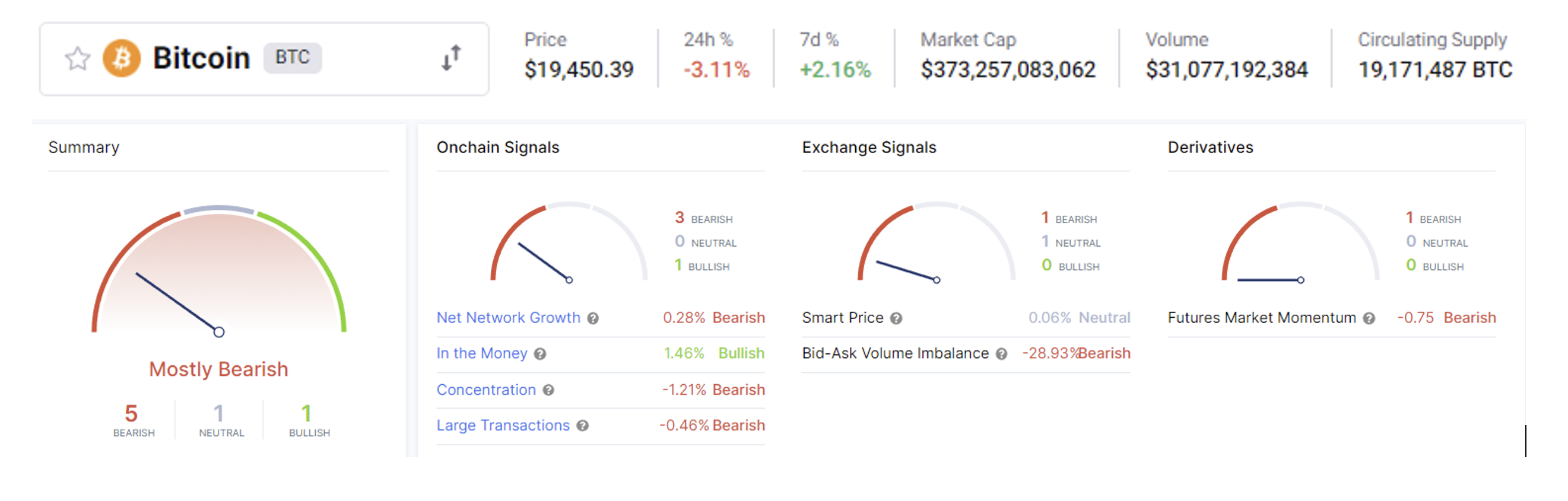

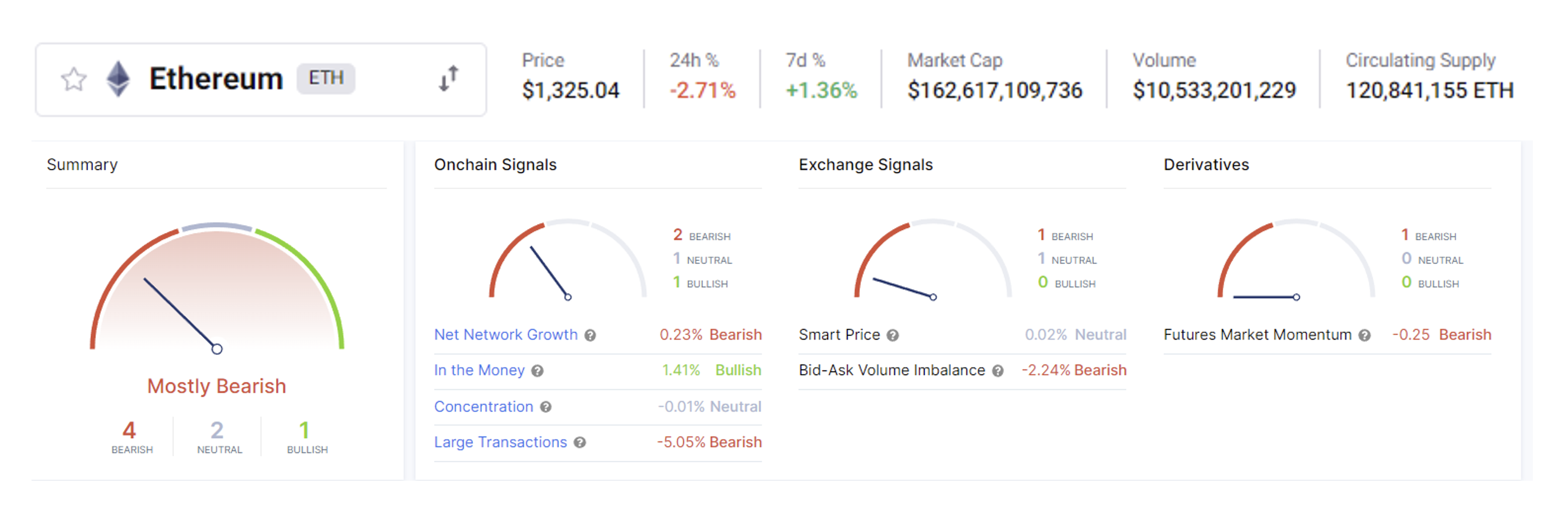

*all data above provided by CryptoQuant and Intotheblock and as of October 7th, 2022, 11:59 am EST

MiCA – Markets in Crypto Assets Regulation

This weekly newsletter is completely guilty of home bias when it comes to discussing and sharing thoughts on digital asset regulation. This is understandable, as we service the US market. However, the reason why it is important to curb that bias is that we invest in the first-ever asset class that is truly global.

That means that this asset class will be affected by regulatory bodies across the world. Some will have a greater effect on the industry, like the US, and thus the conversations tend to gravitate toward the places that will have this outsized impact. One other such regulatory landscape we see having a greater impact is that of the European Union.

What is MiCA?

Established in September 2020, MiCA is a regulatory framework established to govern crypto-assets and their EU providers and to provide all member states with a common licensing system by 2024. MiCA seeks to “unify the European framework for the trading and issuance, as part of Europe ‘s digital finance policy, of different forms of crypto-token”

There are four key objectives for the Markets in Crypto Assets Regulation:

- Provide legal credibility for cryptocurrency regulation

- Develop the market through competition

- Protect market integrity by safeguarding investors and consumers

- Create an environment for financial stability in the market

From a report by BNP Paribas: The MiCA initiative will affect the ability of market players to diversify their business by developing a crypto-asset strategy. The regulation is likely to provide a harmonized legal framework with strong safeguards for historically non-regulated crypto assets as well as for the service providers engaged in that business and, ultimately, the consumer.

The Markets in Crypto-Assets regulation should not be considered as a standalone initiative. The European Commission’s digital finance strategy not only relies on MiCA, but also on the DLT Pilot Regime and the Digital Operational Resilience Act (DORA), thus demonstrating transversal reach. In addition, it cannot be excluded that market players are likely to have to observe certain ESG standards while engaging in digital finance.

Why is this important?

For the last two years, policymakers in the EU have been going back and forth on an agreed-upon framework. This past week on October 5th European Union officials agreed on the final wording for its crypto legislation which could pave the way for a Europe-wide regulatory approach.

From Alys Key at Decrypto.co, “The legal text will now go on to the European Parliament, where, subject to approval, it will likely be published in the Official Journal of the European Union early next year, with the rules set to come into force in 2024.”

While the legislation is good news overall there are still some important topics that are missing. Also from Alys, “Crypto advocates welcomed the news but said that the legislation had yet to address several key points, including non-fungible tokens (NFTs) and the future of decentralized finance (DeFi).”

This legislation will help inform other regulatory regimes in their approach to digital assets. “Mairead McGuinness, the European Commissioner with responsibility for financial services, said that crypto regulation would be top of the agenda in discussions with U.S. officials next week. Speaking at a Bloomberg event, she said that the EU is looking to exchange views and experiences with the U.S. at the International Monetary Fund-World Bank annual meetings next week.”

To finish: “I believe that the EU and the U.S. can together lead the way on a shared international approach to regulating crypto,” she wrote at the time.

What is our view?

When constructing our Compass portfolio, a risk factor we apply is Geographical risk. Many networks establish a primary presence for initial growth, a base of operations of sorts, where the user base is engaging. By implementing this risk factor, we can better understand the level of risk in the portfolio, and the asset class, and apply it to overall weightings and themes. We can then be nimble and tactical as the industry evolves. This is a primary benefit of utilizing an SMA like what we have at Arbor Digital, rather than an index vehicle that has a set rebalancing calendar or a private fund structure.

As I mentioned earlier, part of our investment thesis is that this is the first truly globally accessible asset class with no central authority. Every region will approach regulation in its own way but underlying it all is the technology of distributed ledger infrastructure. One thing we do have regulatory clarity on is that developed markets are currently competing for who will be the leader in this space and allow innovation to occur in a responsible way.

Every proposal put forth in governing bodies around the world moves us closer to global regulatory certainty. Even if a more restrictive, or even outright ban, regulatory structure is adopted in one area the industry would simply move elsewhere. We have seen this play out with China and Bitcoin mining moving oversea to the US, the Middle East, and parts of the EU.

One way we stay aware of what is happening beyond US borders is the work done by Chainalysis. The release of both macro and micro geography reports on digital asset markets and adoption. Taken from their 2022 Global Crypto Adoption Index which ranks grassroots crypto adoption:

“The data suggests that many of those attracted by rising prices in 2020 and 2021 stuck around and continue to invest a significant chunk of their assets in digital assets. That also aligns with our previous research showing that cryptocurrency markets have been surprisingly resilient through recent declines. Big, long-term cryptocurrency holders have continued to hold through the bear market, and so while their portfolios have lost value, those losses aren’t locked in yet because they haven’t sold— the on-chain data suggests those holders are optimistic the market will bounce back, which keeps market fundamentals relatively healthy.”

Other findings from the report:

- lower middle and upper-middle-income countries often rely on cryptocurrency to send remittances, preserve their savings in times of fiat currency volatility, and fulfill other financial needs unique to their economies.

- Vietnam is ranked first in cryptocurrency adoption. A look at the sub-rankings shows that Vietnam shows extremely high purchasing power and population-adjusted adoption across centralized, DeFi, and P2P cryptocurrency tools.

- The data suggest that a critical mass of new users who put capital into cryptocurrency during periods of price growth tend to stay even when prices decline, allowing the ecosystem to consistently grow on net across market cycles.

Explore More

Financial Services

As it pertains to RIAs and Wealth Managers it’s been a very active Q3 and start to Q4. In that time, we have had the following:

- Mastercard launches CryptoSecure

- FTX partners with Visa to roll out crypto debit cards

- BitGo Platform for wealth management

- Fidelity takes another step into crypto with a new Ethereum index fund

- Envestnet x Gemini

- Coinbase x Blackrock

- Nasdaq announces crypto custody

- EDX Markets Partners with Paxos

- Fidelity, Charles Schwab, and Citadel launch crypto exchange.

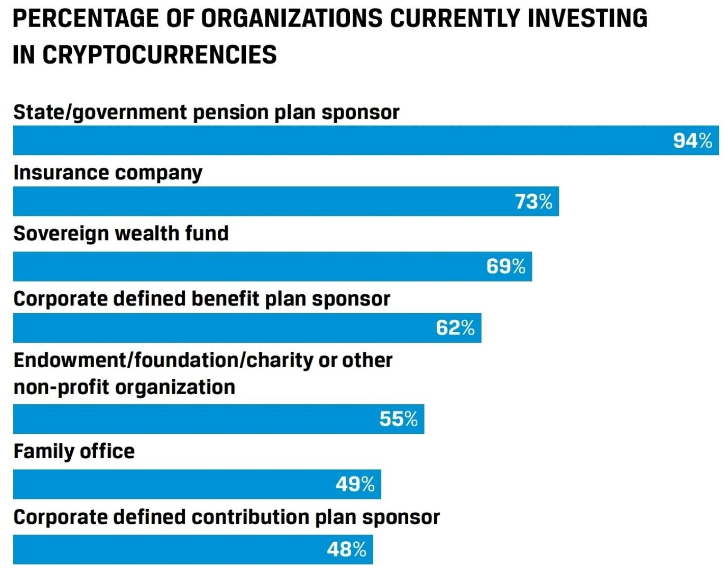

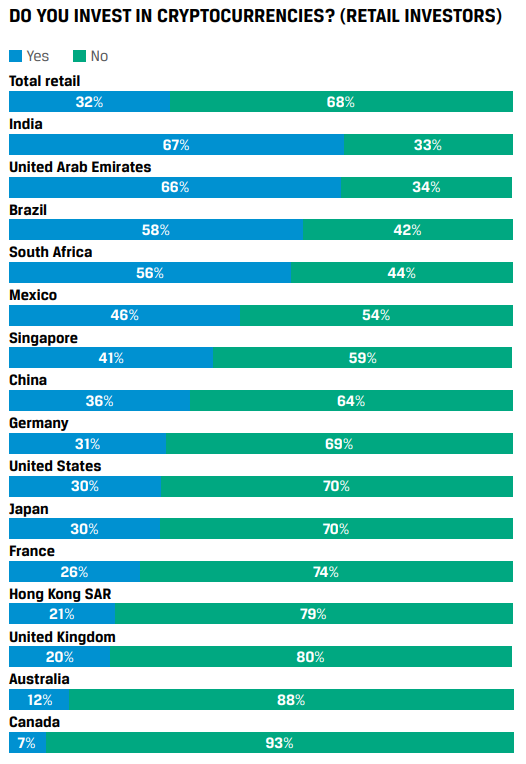

Also, in a recent study by the CFA Institute, 94% of pension plans are already invested in digital assets. Not planning to, are actively invested. While only 32% of retail investors are.

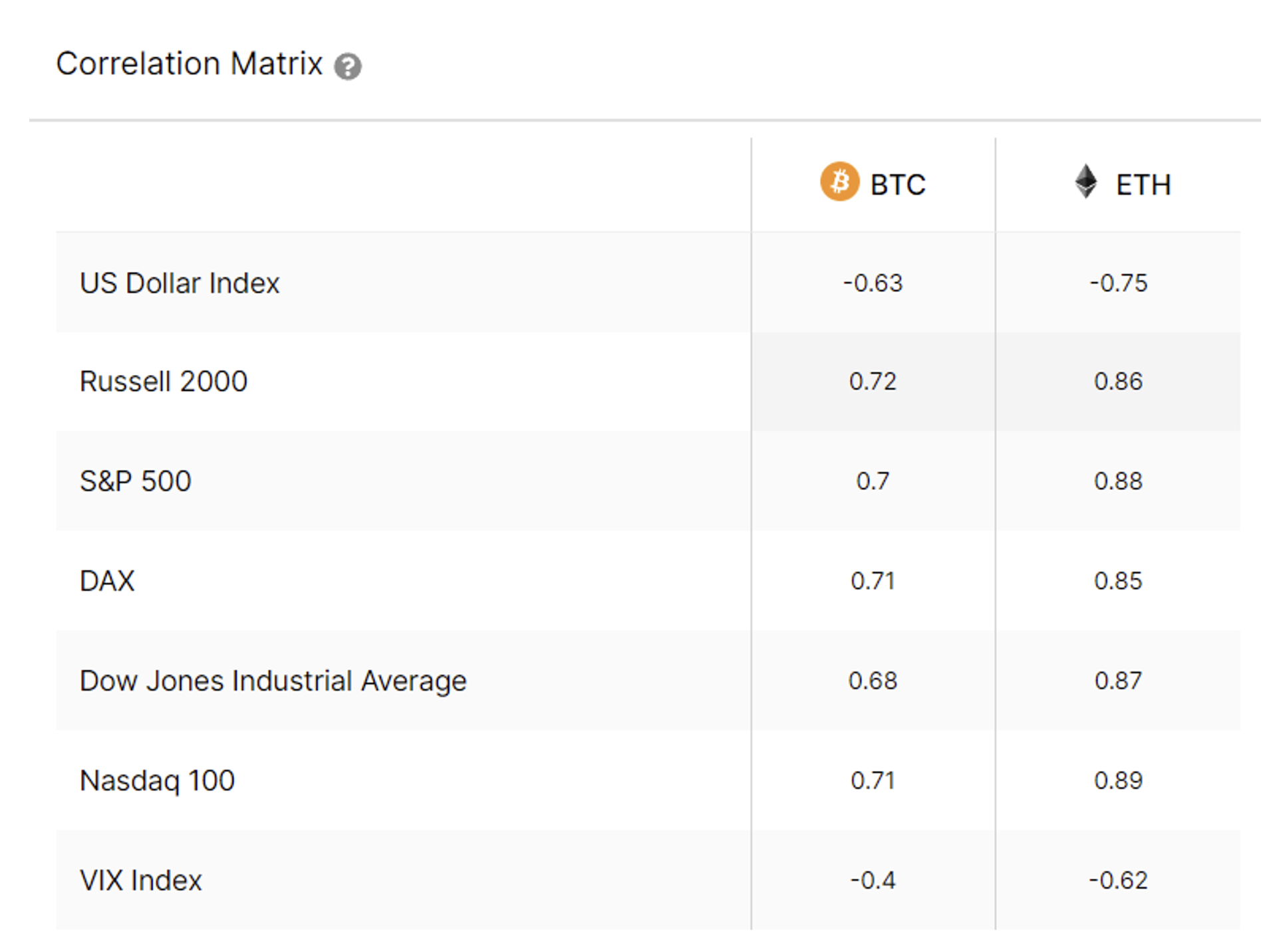

Another important piece of this study was the retail exposure across geographic regions. In the US, 30% said they did, while 70% said no when asked if they invested in digital assets. The below graphic demonstrates how much of a global asset class this already is and to think about investing in this space within your home country would be missing the impact and opportunity.

Also, within this study what I would say is the most important, is of those retail investors surveyed was who investors are more likely to trust recommendations from. 82% in the US said from a human advisor, 4% from a robo-advisor, and 14% said both were equal.

Therefore, all the platforms and traditional financial companies are making partnerships and jumping into the digital asset offering space. They know the opportunity.

The good news is there are already trusted solutions like Arbor Digital to help advisors and investors alike engage with this asset class. Be sure to schedule a demo below for more information. We would love to talk to you.

The merge continues.

Explore More

2022 CFA Institute Investor Trust Study

Other Digital Asset News

Digital Asset Learning

Webinar: Regulating Crypto: What You Need to Know (Pending 1 CE Credit for IWI and CFP professionals)

When: Tuesday, October 18th, 2022, 3:30 pm ET

Presented by Barron’s & Galaxy Digital:

Recent volatility in cryptocurrency markets has renewed calls for increased better industry oversight. With regulating digital assets a top priority among several federal agencies, we invite you to join the third webinar co-hosted by Barron’s Custom Studios and Grayscale that will help you navigate the current regulatory landscape around cryptocurrencies.

Find out what is in the proposed legislation for regulating digital assets and what it means for investors. We’ll discuss how regulators can balance consumer protection and supporting financial stability without stifling the DNA of cryptocurrencies — innovation.

Reading: Crypto-Assets: Implications for Consumers, Investors, and Businesses from the U.S. Department of Treasury

As part of Executive Order, 14067 on Ensuring Responsible Development of Digital Assets; Section 5(b)(i)—the implications of developments and adoption of digital assets and changes in the financial market and payment system infrastructures for U.S. consumers, investors, businesses, and for equitable economic growth.

Digital asset markets have changed and grown dramatically over the past decade based on estimates of market capitalization, transaction volumes, and the number and types of assets. Millions of people globally have some exposure to crypto-assets, including at least 12% of Americans. President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets (Executive Order) observes that the continued expansion of crypto-based technology could have profound implications for the users of crypto-assets—namely, consumers, investors, and businesses.

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.