Since our last edition of Digital Asset Friday more has come to light on the degree of fraud committed at FTX, more dominos have continued to fall with Genesis Trading on the brink of collapse, and to no one’s surprise digital assets have severely underperformed equities.

Negative Correlation

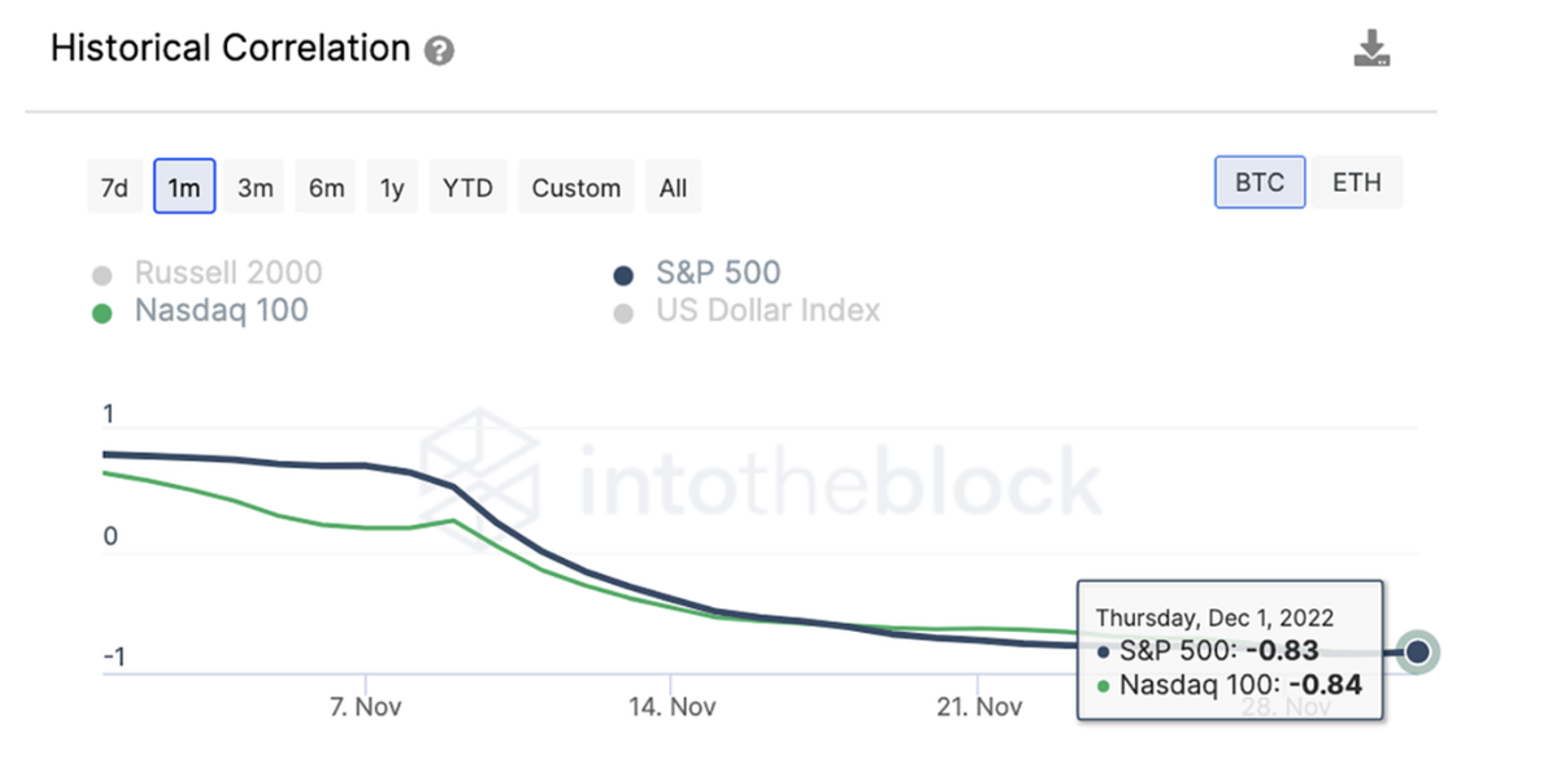

In November, optimism was reflected in markets as stocks rallied on the Federal Reserve’s commitment towards lower interest rate hikes in upcoming meetings. We expected digital assets to continue their trend of following macro tailwinds like this and experience their own rally. FTX and SBF had other plans though. The impact of recent events has created a contrast between digital asset markets and this positive momentum, which has led equities to become negatively correlated with BTC and ETH for the month of November, with BTC at -0.84 and -0.83 (See Figure 1) and ETH behaving similarly coming in at -0.79 for both equity indexes. This brings 2022 correlations between BTC and the S&P/NASDAQ to 0.52 and 0.51, where previously they were in the 0.75-0.8 range for the year. For ETH correlations between S&P500/NASDAQ100 for the year shot down a little further to 0.46 for each.

Figure 1: Intotheblock – Capital Markets Insights

We have anticipated a decoupling of Digital Assets from equities as the macro continued to evolve but we did not foresee the fraud of FTX and SBF to be its cause.

Until regulation comes, don’t expect any meaningful long-term price action to the upside. We never play the price prediction game, a fool’s errand, but we have a high degree of conviction in this general stance and I don’t think we are making any waves having it.

What To Pay Attention To

As we have learned more about the gross intent and mismanagement of FTX from the beginning, one good thing that has come from this is everyone is asking more questions about their service providers in digital assets. Another good thing is that all the poor risk management and leverage are being taken out of the markets and bringing them to reality. Genesis, owned by Digital Currency Group, is strategizing on how it can continue to operate as we have learned the increased risk and leverage, they were exposed to by now bankrupt entities like FTX, Alameda, and 3AC. Genesis is the company behind yield products on centralized exchanges like Gemini Earn. If Genesis goes under all who have assets on that platform are at risk of losing some or all their deposits.

BlockFi officially filed for bankruptcy and had its first bankruptcy hearing with the next one scheduled for January.

While it’s not good that investors have their funds locked up with the potential to lose them, it’s essential for those who aren’t in that situation to learn and act. If you invest or engage in digital assets here are three things, you should be paying attention to:

- Do you have assets on centralized exchanges that offer yield?

- Do you have assets on centralized exchanges that have issued their own token?

- Do you have assets on centralized exchanges that are not heavily regulated?

FTX was marketed as the “Safe and regulated way to buy crypto” and as we know regulation is a spectrum. Here are simple questions to answer of the centralized exchanges:

- Who regulates the exchange? Being regulated in the US is very different than being regulated in the Bahamas.

- What transparency do they practice? The hot thing now, which will become standard, is Proof of Reserves. Going deeper who verifies and audits those proofs of reserves? Can we see this on the chain?

- What insurance, if any, do they have and where do retail client deposits sit on the capital stack? Think FDIC or SIPC insurance in the US. This doesn’t exist on any centralized exchanges but some like Coinbase and Gemini have some levels of insurance.

A few months ago, everyone who held assets on Coinbase was woken up to the fact that their assets could possibly be used to pay off creditors in the event of bankruptcy at the exchange. Coinbase came out swiftly to denounce this and made changes. These are the types of things everyone needs to be on high alert about to absolutely understand the risk they are taking when engaging in digital assets. Nothing is safe in digital assets and crypto, even depositing cash into stablecoins like USDC/UST/GUSD is extremely risky and you could lose all of your money. Other exchanges to question heavily:

- com

- Binance

- io

What is going on with actual Crypto/DeFi?

Despite large liquidations, DeFi protocols remain solvent and operate as intended for the most part

- Aave did end up with $1.7M of bad debt, due to an unrelated economic attack, but it was “broadcasted” transparently on-chain for anyone to witness real-time

- Other lending protocols such as Euler and Compound have taken precautionary risk management measures and did not experience any losses in spite of customer outflows

- The restructuring of the crypto markets points to DeFi being the answer to the FTX saga

Although working as intended Ethereum transactions reached their lowest since June 2020, which is expected given the extreme winter we are experiencing. We expect Ethereum, and other protocols to solve real problems and add value, to be resilient. In order to be able to re-establish its long-term secular growth, regulation is needed on centralized entities engaging in true crypto/web3/DeFi and must continue to expand and build for less speculative use cases.

I end with what is happening in the real crypto world purposefully to highlight that the technology which we invest in at Arbor Digital we remain highly convicted in. Diversification, dollar cost averaging, and allocating only dollars you are willing and able to lose are stalwarts that we will continue to follow. Within dark times there is always an opportunity to pull wisdom that will propel you to future health and success. We are using this as an opportunity to do just that.

Other News

- Firm Behind FTSE 100 Unveils Crypto Index Series – CoinDesk

- Stripe Debuts Fiat-to-Crypto Payment Offering for Web3 Businesses – CoinDesk

- Telegram CEO Durov Plans to Build Crypto Wallets, Decentralized Exchange – CoinDesk

- Blockchain Group Animoca to Form Metaverse Fund – Nikkei

- Crypto Lender BlockFi Files for Bankruptcy, Cites FTX Exposure – Reuters

Digital Asset Learning:

Webinar: What To Consider When Contemplating Crypto for Client Portfolios

When: Tuesday, December 6th, 2022, 2:00-3:00 pm ET

Presented by DACFP: 1 CFP/IWI/CFA CE for Financial Professionals Only

Join Ric Edelman and Fidelity’s Paul Ma and Darby Nielson and you’ll learn:

- A fair and balanced analysis of crypto risks/rewards

- The asset class’s sensitivity to inflation

- Its potential use in client portfolios

- And more

Reading: A Simple Technical Guide to NFTs

From Keir Finlow-Bates, here’s a simple technical explanation of NFTs, with added valid use cases and tips for identifying flawed use cases.

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.