Happy Monday after Thanksgiving! From our family to yours we truly hope your Thanksgiving was wonderful. We had a longer than normal weekend where we saw a ton of activity in global markets, both traditional and digital:

- Omicron variant triggers sell-off

- Bitcoin goes into “Extreme Fear”

- El Salvador and MicroStrategy BTD

- Vitalik Buterin proposes solution for ETH gas fees

- Other headlines: Hackers Target Cloud Accounts, Virtual Land Plot sales for $2.4 million, regulated Bitcoin funds launched in Singapore, Tanzania starts work on CBDC, and German and French governments focused on crypto regulation.

- Learning Opportunities: Liquidity Fragmentation and Capital Efficiency in Crypto Markets from Blockworks, Grayscale’s Metaverse Report, and NYDIG’s Bitcoin Taproot Report

Weekend ETH Prices |

Weekend BTC Prices |

|

ETH Wednesday at 5pm: $4,243 ETH Weekend Low: $3,952 ETH Weekend High: $4,558 ETH Price as of posting: $4,417 Performance YTD: +494.00% |

BTC Wednesday at 5pm: $56,754 BTC Weekend Low: $53,540 BTC Weekend High: $59,187 BTC Price as of posting: $57,525 Performance YTD: +94.24% |

Omicron triggers sell-off

After sleeping off Thanksgiving dinner we woke up to reports of a new Covid-19 variant found in South Africa which triggered a global sell off of risk assets. The Dow Jones Industrial Average dropped 905.04 points, or 2.53%, for its worst day of the year, closing at 34,899.34. The S&P 500 lost 2.27% to close at 4,594.62, while the Nasdaq Composite slipped 2.23% to finish at 15,491.66. The two biggest digital assets, Bitcoin and Ethereum each saw a sell of 8% and 11% respectively on Friday as well. Other top assets like Solana and Cardano saw sell offs of 20%+.

As of this writing we are seeing rebounds in markets as virus concerns ease.

Bitcoin goes into “Extreme Fear”

The Crypto Fear and Greed index is a tool many investors use to gauge market sentiment. Data is gathered from different sources such, volume, open interest, social media, and search data. Extreme fear can be a sign that investors are too worried. That could be a buying opportunity. When Investors are getting too greedy, that means the market is due for a correction.

We saw the index go to its lowest levels since September when Bitcoin was trading between 40-49K coming in at 21. On-Chain and off-chain data tells us that short term no one really knows where Bitcoin is going. Funding rates have reset to normal and have no directional bias. A note from Delphi Digital researchers, “Funding rates continue to be low on the futures markets. This could be a sign that the shorter-term leveraged traders are still undecided directionally. Looking back at the start of the year, the bullish run-up has been accompanied by a significantly higher funding rate.” Options traders sentiment has become more bearish in the month of November shifting towards fear on Nov. 23rd but easing on Nov 26th as measured by the 25% Delta Skew which compares call (buy) and put (sell) options side-by-side. It will turn positive when the protective put options premium is higher than similar risk call options, thus indicating bearish sentiment. As reported by Marcel Pechman at Cointelegraph, “Readings between negative 8% and positive 8% are usually deemed neutral, so Deribit’s analysis is correct when it states that a considerable shift towards “fear” happened on Nov. 23. However, that movement eased on Nov. 26 as the indicator now stands at 8%, no longer supporting traders’ bearish stance.” This contrasts with the futures basis rate, the futures primary risk metric, which was relatively stable at 11% between Nov. 16 and 25. Despite a minor drop, its current 9% is neutral for futures markets and not even close to a bearish tone.

To summarize, in the short term no one knows where the price is going. The next price to watch for is the $53,500 as that is the new average cost basis of short-term holders of Bitcoin. Long term fundamentals continue to be strong as…

El Salvador and MicroStrategy Buy The Dip

Both El Salvador and Michael Saylor, arguably the two largest outspoken Bitcoiner’s, bought the dip over the weekend. MicroStrategy announced early Monday that it had bought an additional 7,002 bitcoins for around $414.4 million in cash. El Salvador bought 100 BTC for roughly $5.4 million USD and now holds a total of 1,200 BTC.

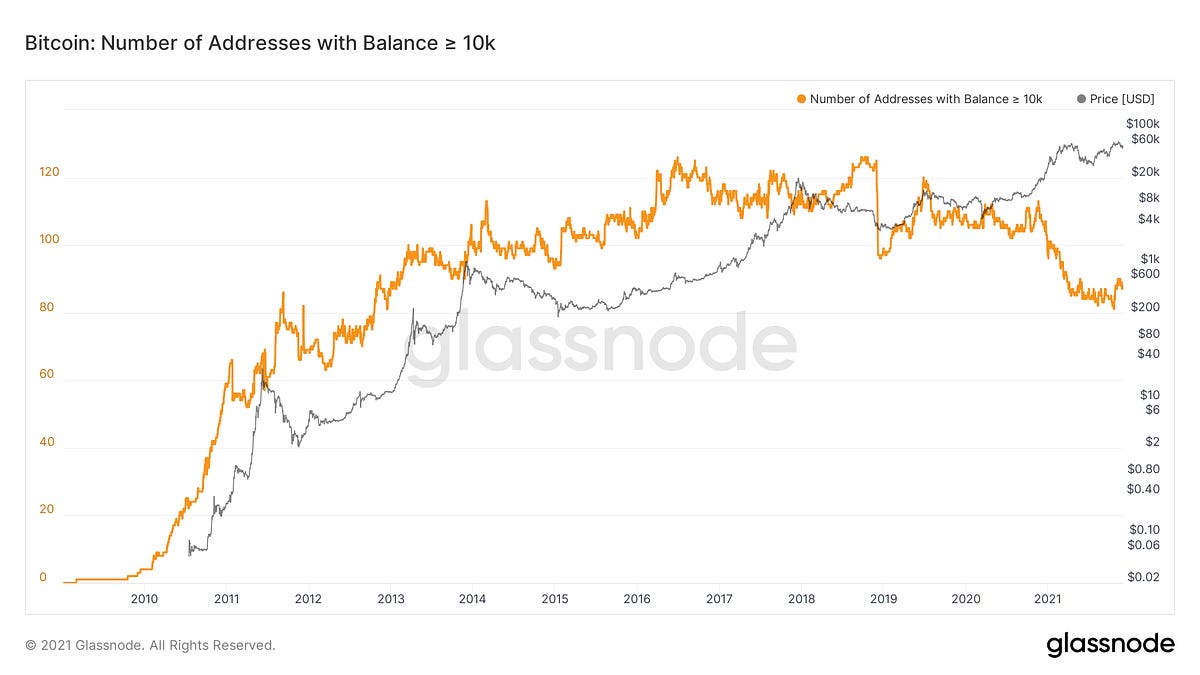

In a recent investor letter, Anthony Pompliano wrote about how “Bitcoin’s On-Chain Distribution Continues To Be More Decentralized” highlighting Bitcoin’s evolution as a fully decentralized, digital store of value that can’t be debased, censored, or manipulated. To prove this, he details Bitcoin’s distribution of holders across wallet sizes, with ownership growing amongst smaller long term holders.

Vitalik proposes solution to lower ETH gas costs

Reported by Arijit Sarkar at Cointelegraph, “Buterin issued a decrease-cost-and-cap proposal, which aims to achieve the goal of reducing unprecedented levels of strain and risk breaking the network, and believes that ‘1.5 MB will be sufficient while preventing most of the security risk.’ If accepted, the implementation of the proposal will require a scheduled network upgrade, resulting in a backward-incompatible gas repricing for the Ethereum ecosystem. This upgrade will also mean that miners will have to comply with a new rule that prevents the addition of new transactions into a block when the total calldata size reaches the maximum.”

Why is this important? Simple, high costs to operate on both base and layer 2 solutions have caused an outflow of users from the Ethereum network. This will provide the opportunity to competitor protocols like Solana to gain market share. While ETH 2.0 is meant to solve a lot of these issues it is clear that users aren’t willing to wait.

Other Headlines

Learning Opportunities

Thank you for reading this all the way through. Be sure to take time away from normal routines this week to practice gratitude. Stay safe, healthy, and happy 😊

– Marc

……………………………………………

Previous round-up: