Project Guardian

Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology. While digital asset markets are rising higher to close 2023 on the back of positive momentum for a BTC Spot ETF approval, this is not where the innovation is happening in decentralized blockchain and digital assets. It is Project Guardian.

This week we are taking you through a deep dive into Project Guardian, which is where the real innovation is happening.

Are you a financial advisor or individual investor looking for help staying on top of important aspects to investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us!

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

Digital asset markets were down this week with the total industry market cap hovering around $1.4 trillion. The price of Bitcoin (BTC) closed at $35,994.04, down 1.38% on the week, while Ethereum (ETH) closed at $1,959.47, down 3.62% on the week. Year to date, BTC is up 118%, ETH is up 61%.

The S&P 500 is now positively correlated with Bitcoin when looking at a 30-day rolling correlation, while Ethereum continues to also be positively correlated with Bitcoin. Gold is now statistically uncorrelated with Bitcoin by the same metric. (See Correlation Chart Below).

Total Value Locked (USD$) in DeFi verified by Digital Asset Research came in just over $46b in line with the price movement of BTC, ETH, and many DeFi protocols. Stablecoin market cap remained flat at $126b showcasing the increase in TVL is mainly due to price action rather than new capital flowing into DeFi.

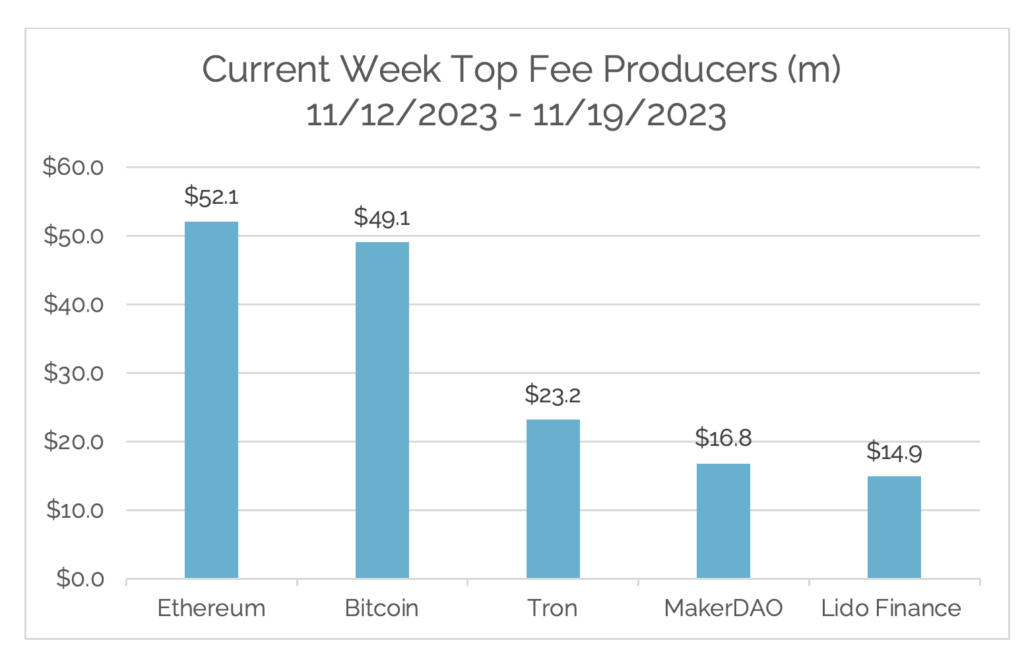

*Source: Token Terminal

*Fees in USD

Project Guardian: Where the Real Innovation is Happening

What is Project Guardian and its Purpose?

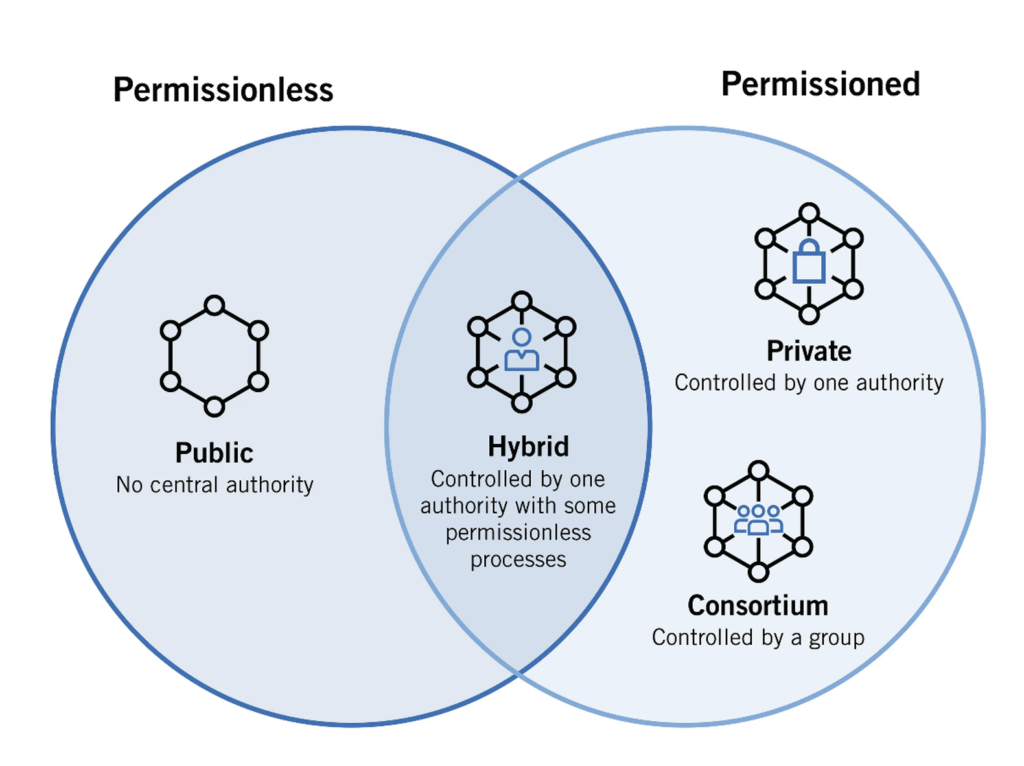

Launched in October 2022, Project Guardian is an industry initiative led by the Monetary Authority of Singapore, to deliver a proof-of-concept using permissioned blockchain infrastructure to test how tokenization and smart contracts could create a step change in the asset management industry through a new paradigm for portfolio management. With three core objectives:

- Establish and Execute Industry Pilot Programs

- Assess Long Term Transformational Impact

- Establish Policy Guidelines and Framework

Read More: Monetary Authority of Singapore – Project Guardian

Why is this important? What is the value of Project Guardian?

The value of Project Guardian lies in its ability to demonstrate how blockchain technology enhances the security, efficiency, and functionality of banking and investment management operations. Blockchain technology, public or private, is a transformative tool in financial services, providing robust security features, transparency, and the ability to facilitate fast, efficient transactions without the need for traditional intermediaries.

Project Guardian aims to accomplish the above while staying in compliance with regulatory standards. Project Guardian is designed to comply with all relevant financial regulations, ensuring that its operations are not only innovative and efficient but also legally sound and transparent. This compliance extends to data privacy and protection, which are critical concerns in the digital age. Project Guardian employs advanced security protocols to protect client data, ensuring the confidentiality and integrity of all transactions.

What are examples of active pilot programs?

Pilot #1: Swiss Bank UBS issues Tokenized Money Market Fund on Ethereum

*See here for the full list of pilots.

The fund is structured as a smart contract on the Ethereum network and was launched utilizing the bank’s proprietary tokenization service, UBS Tokenize. The pilot enables UBS Asset Management to carry out various activities including fund subscriptions and redemptions.

UBS Asset Management launched this pilot to explore the native issuance of Variable Capital Company (VCC) funds on digital asset networks. This aims to help to enhance fund distribution and facilitate improved secondary market trading of VCC fund shares, thus realizing industry-wide operational efficiencies. As part of this initiative, proof-of-concept technical tests have been successfully conducted with SBI Digital Markets.

In November 2022, UBS launched the world’s first digital bond that is publicly traded. In December 2022, UBS issued a USD 50 million tokenized fixed rate note, and in June 2023 originated CNH 200 million of fully digital structured notes for a 3rd party issuer.

Pilot #2: P. Morgan and Apollo

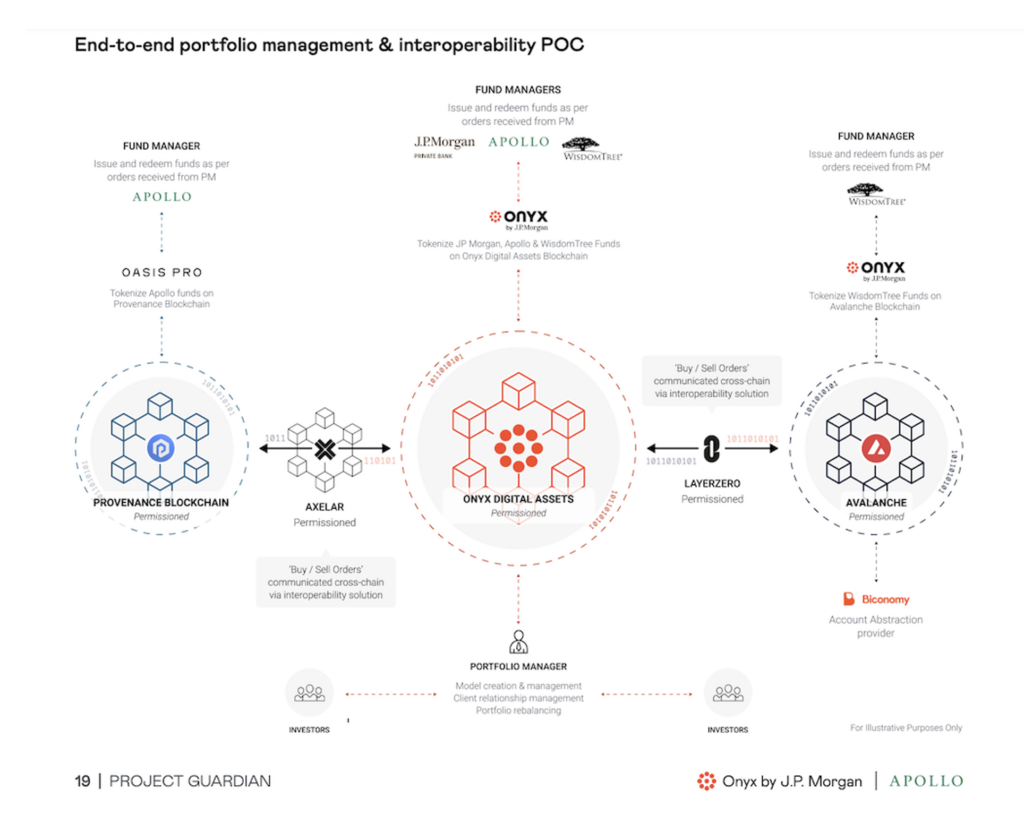

J.P. Morgan and Apollo are collaborating to demonstrate how tokenization and smart contracts could enable the seamless investment and ongoing management of discretionary portfolios, including Alternative Assets, through normalized subscription/redemption processing, automated portfolio rebalancing, and customization at scale. This initiative will further demonstrate how holistic portfolios could be built across the fragmented landscape of tokenized funds through interoperability solutions across multiple networks.

This pilot resulted in JPMorgan processing tokenized foreign exchange trades on Polygon’s mainnet in November 2022 via a modified version of the permission DeFi platform Aave Arc. J.P. Morgans’s Liink network of banks shares transaction data and pertinent insights, while its Coin Systems network facilitates the transfer of the dollar and other fiat currencies over a blockchain. Its Onyx Digital Assets network enables the tokenization of traditional assets, such as US Treasurys and money-market products.

One year later in November 2023, J.P. Morgan’s Onyx collaborated with Provenance Blockchain, Avalanche, cross-chain communication protocol Axelar, and issuance/trading platform Oasis Pro to create a proof of concept that shows how tokenization can help better manage financial assets. J.P. Morgan is also focused on digital identity. This means creating a wallet that can interface with blockchain and take advantage of user’s ability to maintain control of their digital data and identity.

Pilot #3: Franklin Templeton Money Market Fund on Polygon

Franklin Templeton is launching a pilot to explore the issuance of tokenized money market funds through a Variable Capital Company (VCC) structure, which utilizes digital asset networks to maintain the records of fund shares. The tokenized fund will make the investment much easier for investors and aims to offer higher security, greater transparency, lower minimum subscription cost, faster processing as well as increased efficiencies.

In April 2021, Franklin Templeton released the Franklin OnChain U.S. Government Money Fund (FOBXX), the first U.S.-registered mutual fund to use a public blockchain to process transactions and record share ownership, on the Stellar network’s blockchain.

In April 2023 underneath the pilot, Franklin Templeton released the Franklin OnChain U.S. Government Money Fund (FOBXX), on the Ethereum blockchain via the Polygon blockchain. One share of the Franklin OnChain U.S. Government Money Fund is represented by one BENJI token. Token holders can gain exposure to the Fund in digital wallets through the Benji Investments app, available in mobile app stores.

Pilot #4: Citi Develops Blockchain FX Solution with T. Rowe Price Associates, Inc. and Fidelity International

In November 2023, Citi, T. Rowe Price Associates, Inc., and Fidelity International successfully tested institutional-grade mechanisms to price and execute bilateral digital asset trades efficiently and explored real-time post-trade reporting and analytics of digital asset trades. The current phase of the application tested spot FX for USD/SGD, utilizing the Avalanche blockchain.

Citi’s on-chain solution provides real-time streaming of price quotes, through oracles, while recording trade executions on a blockchain, which supports the immutable, cryptographically secure record-keeping of trade data. This enables best execution analysis through real-time post-trade analysis on a unified platform. At the same time, it allows for compliance and conformity with institutional practices and where applicable regulatory requirements, with only counterparties to a quote or trade having access to the underlying trade details.

Pilot #5: BNY Mellon and OCBC Innovating for the Future of Cross-Border Payments

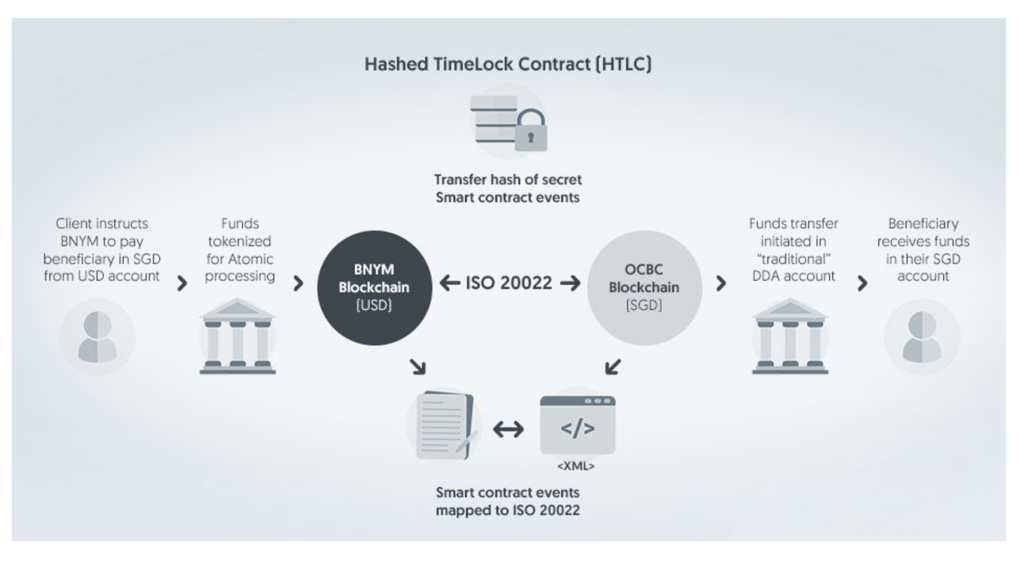

The Bank of New York Mellon (BNY Mellon) and Oversea-Chinese Banking Corporation Limited (OCBC) are trialing a cross-border FX payment solution using smart contracts that create blockchain interoperability. The initiative will demonstrate the use of digital ledgers to increase the speed and efficiency of cross-border settlement and enable secure, interoperable payment solutions across independent bank-owned infrastructure.

In October 2021 BNY Mellon joined the Marco Polo Network, a consortium of approximately 45 banks that provides an open software platform for trade, payments, and working capital financing to banks, corporates, and other market participants. It is a cloud-based blockchain-powered network that allows the seamless, secure, and fast exchange of trade data assets in a multi-channel environment. Utilizing Marco Polo, BNY Mellon will not only provide financing to suppliers but will also have real-time visibility into trade finance instruments and their status, such as purchase orders and invoices.

In November 2023, BNY Mellon and OCBC are collaborating to demonstrate the interoperable and cross-border capabilities of blockchain technology. This collaboration has two primary focuses:

- Increasing the settlement speed and cost competitiveness of FX Payments.

- Mutual 24/7 operations to support institutional clients globally.

BNY Mellon and OCBC are collaborating to put this construct into a proof-of-concept, which will demonstrate interoperability, shortened settlement cycles, free up trapped working capital, provide just-in-time funding capabilities for corporates, allow correspondent banks to establish mutual 24/7 operations for currencies that clear directly with central banks, and extend this capability to one another’s client base.

Conclusion

Project Guardian and its pilot programs represent a significant leap forward in the integration of blockchain technology in global financial infrastructure. The innovation born from Project Guardian will not only redefine the management of digital assets but also set a new benchmark for security and efficiency in financial services.

Whether you believe in blockchain/digital assets or not, a future where global financial services run on these core technologies is coming. Don’t take my word for it, see the body of work happening right now to bring its value promises to life throughout this newsletter.

Digital Asset ETFs are nice, but are a step backward, and a short-term solution, to the problem of safe digital asset investment exposure for the everyday investor. Wrapping innovative multi-dimensional assets into old investment wrappers takes away from the core values of security, transparency, and efficiency.

Don’t worry, we understand the need for these investment solutions in the grand scheme of things. The purpose of this week’s newsletter is to push to the forefront that the reason why blockchain networks and their related tokens are valuable is not because they will be wrapped into an ETF, but because of the value the blockchain networks and tokens are bringing to the world on a global scale.

We will leave you with the below diagram. Our long-held investment thesis, which is stronger than ever, is that Traditional Finance will converge with Decentralized Finance to create the below global financial landscape. Users will be able to choose which systems they want to give control of their data, assets, and digital identities. Users will likely engage with multiple systems across the diagram with each system providing different value adds to the user. Our goal is to ensure that advisors don’t wake up one day and wonder how we got here and are unable to operate and serve clients in the future landscape. Digital assets, wallets, and user-controlled experiences are coming, and Arbor Digital is here for it.

Thank you for reading and for your continued trust. Be sure to tell someone today you care about them!

Digital Asset Learning

On-Demand Video and White Paper: Project Guardian

Video Created By: DBS Bank

White Paper Created By: J.P. Morgan Onyx & Apollo

Abstract: J.P. Morgan, in collaboration with Apollo, has a new, bold vision: Creating a step change in the asset and wealth management industry through a new paradigm for portfolio management. We envision personalized investment portfolios at scale, with vastly simplified and streamlined order execution and settlement processes, regardless of whether investing in traditional funds or alternative investments.

A future where portfolios can be automatically rebalanced in real-time, at scale, across blockchain networks. In its final form, we see wealth managers being able to include alternative investments in model portfolios, providing investors with better access to portfolio-enhancing investments – not through sweeping changes to regulations or removal of investor protections, but through streamlined, automated processing and settlement of trades in an asset class agnostic manner. This future is powered by blockchain technology, smart contracts, and the tokenization of assets.