Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

In February of this year, the SEC proposed a dramatic expansion to the Custody Rule. Arbor Digital’s founder, Matthew Kolesky, submitted his comment letter to the SEC on May 7th. In it he highlighted second-order effects the proposed changes will have on the investment advisor industry:

- Accelerated industry consolidation by making it prohibitively costly for small and mid-size RIA’s to reasonably comply.

- Discourage new advisors from starting RIA businesses due to the additional cost burdens.

- Discourage crypto/digital asset advice and asset management in the US.

The end consumer will be harmed by having fewer choices, less innovation, and homogenized advice delivery. In our view, the future of the industry, and what investors want, is more customization and optionality. You can read Matthew Kolesky’s full comments here.

Arbor Digital is committed to working with regulators to bring forth reasonable rules of the road to enable Financial Advisors to adequately advise investors on Digital Assets. To learn more about how we currently enable advisors to fulfill their fiduciary duty and incorporate a Digital Asset strategy into their practice, book time with us here.

Now, a run of the numbers.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, May 11th, 7:00pm ET

*7-Day Average

*Source: Cryptofees.info, Thursday, May 11th, 7:00 pm ET

*Fees in USD

Week in Review

On-Chain Adoption

Before getting into Bitcoin and Ethereum the major story this week was the company Digital Asset’s announcement of the Canton Network, the first open blockchain network designed with the control and interoperability needed to power synchronized financial markets. Notable initial participants of this blockchain network:

- BNP Paribas

- Deloitte

- CBOE Global Markets

- Goldman Sachs

- Broadridge

- S&P Global

- Microsoft

Not investing, participating, and using blockchain technology. This blockchain was developed for the sole purpose of serving global enterprise users and linking global financial markets frictionlessly. How is this different from other decentralized networks like Bitcoin and Ethereum?

High-level Canton will be a private network with centralized governance with a focus on scaling, data control, and privacy, with no focus on decentralization. Applications built on top of the blockchain will be decentralized, however, meaning everyone can build and use them. In their words, “Canton is a “network of networks” with decentralized applications to serve financial institutions for asset tokenization, governance, payments, clearing, settlement, custody, and asset life cycle management.”

This is a massive development and will have far-reaching effects on the Global Blockchain industry. Given the institutional users on a global level already using, and investing in the development, of the Canton Network, it’s hard to imagine a world where Canton doesn’t thrive.

The institutions are here.

.png#keepProtocol)

Read the whitepaper to understand the vision for the Canton Network—a network of networks for smart contract applications. The paper outlines how the Canton Network addresses the constraints of current blockchain networks to empower financial institutions and enterprises to e…

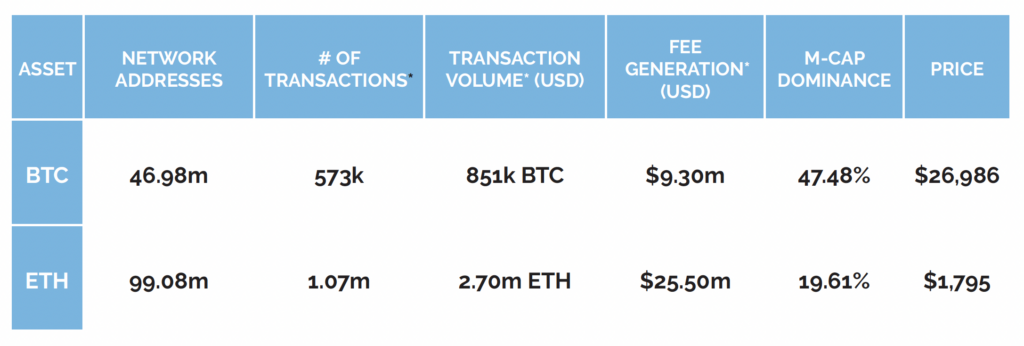

The Bitcoin network saw an increase of 700k network addresses with a balance of BTC bringing the total to 46.98 million network addresses, a new all-time high. Daily average active addresses continue to stay in a healthy range between 750k and 950k. The daily average transaction volume (BTC) for the week was up for the week at 851k BTC. 7-Day average Network fees continued to exponentially rise this week coming in at $9.3m, all-time highs by a large margin. Why?

Bitcoin achieved this historic figure due to the continued minting of BRC-20 tokens, which we wrote in depth about last week. The influx of activity on the blockchain related to the Ordinals protocol has led to extreme revenue generation for miners but it has come at a cost. The Bitcoin network became so congested earlier this week that Binance had to halt BTC withdrawals due to high fees and long wait times for transactions to process. In parts of the world like Latin America and Africa, the Bitcoin network is relied upon for everyday transactions and payments. What normally is a few cents cost has exploded to $10-20 in costs to execute transactions.

The limitations of the base layer Bitcoin blockchain are at the forefront this week. On the other side, the Lightening Network, a layer 2 scaling solution becomes even more integral. Without a scaling solution, the Bitcoin network becomes unusable for the very people it is meant to serve. This has caused a debate, which we also wrote about earlier this year when we initially thought about the implementation of the recent Taproot and Taro upgrades, among the Bitcoin developer community.

From CoinDesk:

The debate is playing out on the Bitcoin-dev mailing list, which hosts discussions about Bitcoin development. The opinion is divided on whether more drastic steps should be taken to curb the sudden surge in BRC-20 mints.

“Real Bitcoin transactions are being priced out,” wrote mailing list member Ali Sherief, who started the thread on Sunday. “Such justifiably worthless tokens threaten the smooth and normal use of the Bitcoin network as a peer-to-peer digital currency, as it was intended to be used.”

Not everyone agrees. Michael Folkson, an organizer for the London Bitcoin Dev meetup group, said Bitcoin should maintain its status quo.

“Consensus rules are set and the rest is left to the market,” Folkson wrote. “You may not like this use case, but assuming you embark on a game of Whac-A-Mole, what’s to stop a group of people popping up in a year declaring their opposition to your use case?”

Just like with Ethereum in late 2020 and early 2021, we are seeing an explosion via Digital Collectible NFTs to usher in millions of new users to the Bitcoin network. As we have been mentioning since we wrote about Taproot and Taro in early 2022, these upgrades unlock completely new use cases for the Bitcoin network. Real World Assets (RWA) on-chain has been largely an Ethereum network narrative, but with this upgrade, the Bitcoin network enters the room.

This is just the beginning. We anticipate more focus on scaling solutions, continuing exploration with BRC-20 tokens beyond digital collectibles, and community debates on the future of the Bitcoin network and how it should exist in a BRC-20 world.

On the Ethereum network, roughly 350k new network addresses with a balance of ETH were added this week and last week, bringing the total amount to 99.08 million network addresses, an all-time high. Daily active addresses for the week were flat ranging from 400-480k. Average daily fees for the week skyrocket to over $25 million, more on this below. Transaction volume (ETH) remained in a healthy range, reaching a daily average for the week of 2.7m ETH, peaking at 3.34m ETH on Wednesday, May 10th.

NFTs aren’t just the story on Bitcoin, the Ethereum network continued its trend this week alongside Bitcoin with fees and network congestion coming from meme coin, as well as legitimate NFT projects.

- Star Wars “digital toys” NFTs are set to launch on May 24 per Decrypt

- Spotify is testing NFT-gated features, with Moonbirds confirming their holders will be able to access these features.

- Rumors of Amazon launching their NFT marketplace as soon as this month continue across Twitter and news outlets though no official dates have been shared.

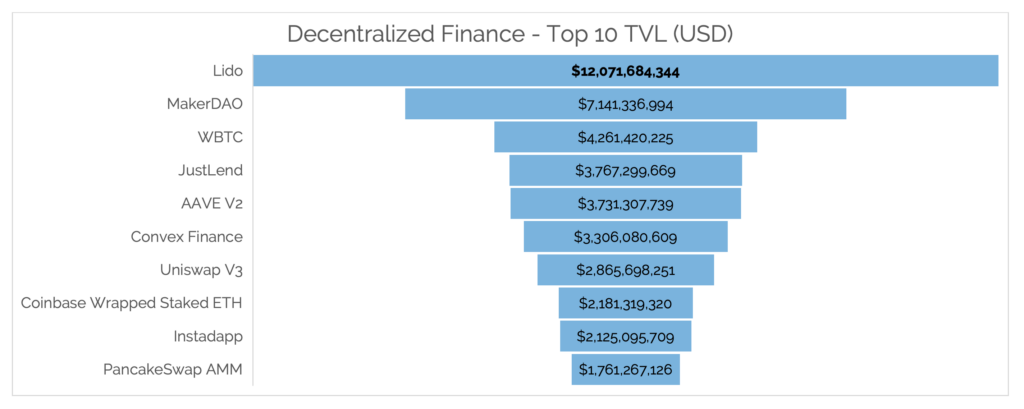

Due to NFT volumes, Decentralized Exchange Uniswap, overtook Coinbase in volume levels. This isn’t the first time Uniswap has beat Coinbase on volume. It happened several times in 2022, after the collapse of FTX in November drove traders away from centralized exchanges.

Off-Chain Happenings

Lawmakers across the US are drafting legislation to bring regulatory clarity to the digital asset industry. While some states like Florida, California, Texas, and New Jersey are looking to support innovation, other states like Illinois and New York are taking a more antagonistic approach. See below for a list of important pieces of legislation:

Less Crypto Friendly

- New York: CRPTO, Crypto Regulation, Protection, Transparency, and Oversight

- Illinois: Bills to Modernize Current Structure

More Crypto-Friendly

- California: DAO Legal Framework

- Florida: Lawmakers send CBDC ban to governor’s desk

- Texas: Require Proof of Reserves

- New Jersey: Crypto Regulatory Framework

Financial

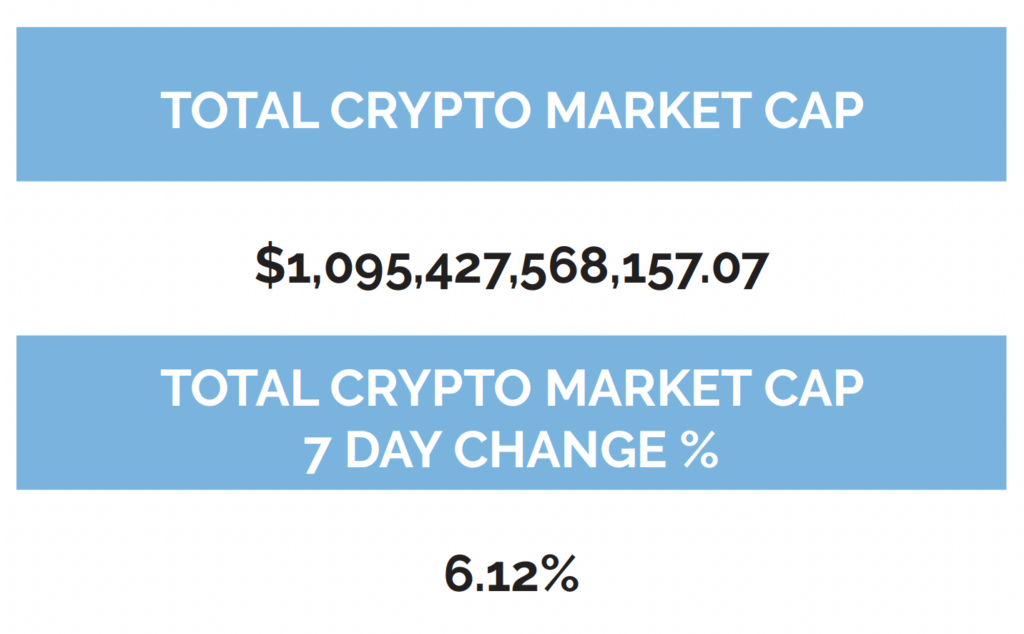

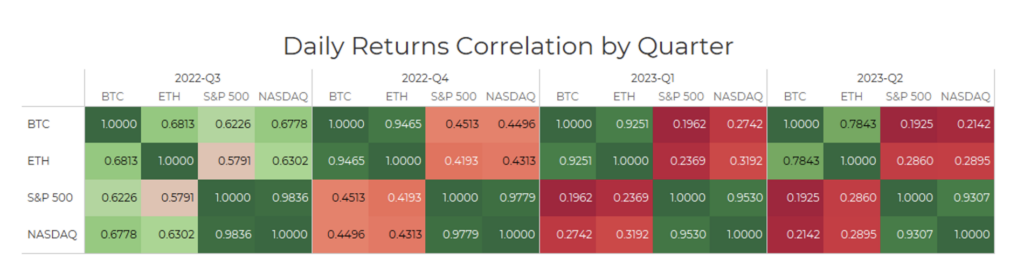

Digital asset markets were down this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $26,986.55, down 6.48% on the week, while Ethereum (ETH) closed at $1,795.23, down 4.41% on the week. Ethereum still continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 and gold both continue to be uncorrelated with Bitcoin by the same metric (see correlation chart at the top of this newsletter). Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was down in conjunction with ETH and overall market token prices, coming in at $45.86b as of Thursday, May 11th.

Year to date, BTC is up 58.96%, ETH is up 47.57%.

Digital Asset Learning

CE Opportunity: Using Digital Assets to Grow AUM and Engage the Digitally Native Investor

Created By: Arbor Digital and DFD

Abstract: In this webinar, Arbor Digital will guide you through why engaging the digitally native next generations of investors through digital assets like Bitcoin and Ethereum is important, whether you align with or are staunchly against this emerging technology and asset class. Then, no matter which side you are on, we will share specific tactics to use digital assets to deepen relationships with an advisor’s current client base, as well as, how to grow new relationships engaging this new emerging demographic of investors.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.