Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Since our last edition, there are three main Digital Asset topics that are important for investors and financial advisors to be aware of and have a fundamental understanding of:

- LSEG Announces End to End Blockchain-Based Digital Assets Business

- FASB Approves Fair-Value Accounting Approach for Digital Assets

- Ark Invest & 21Shares File for Spot ETH ETF

Are you a financial advisor or individual investor looking for help staying on top of important aspects to investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us!

Other News

- Grab Adds Web3 Features to Its App – Tech in Asia

- Visa Taps Solana and USDC Stablecoin to Boost Cross-Border Payments – CoinDesk

- Coinbase Begins Offering Crypto Loans to Large US Institutional Investors – Bloomberg

- Metamask Adds ‘Cash Out’ Function Allowing Users to Sell Crypto for Fiat – The Block

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

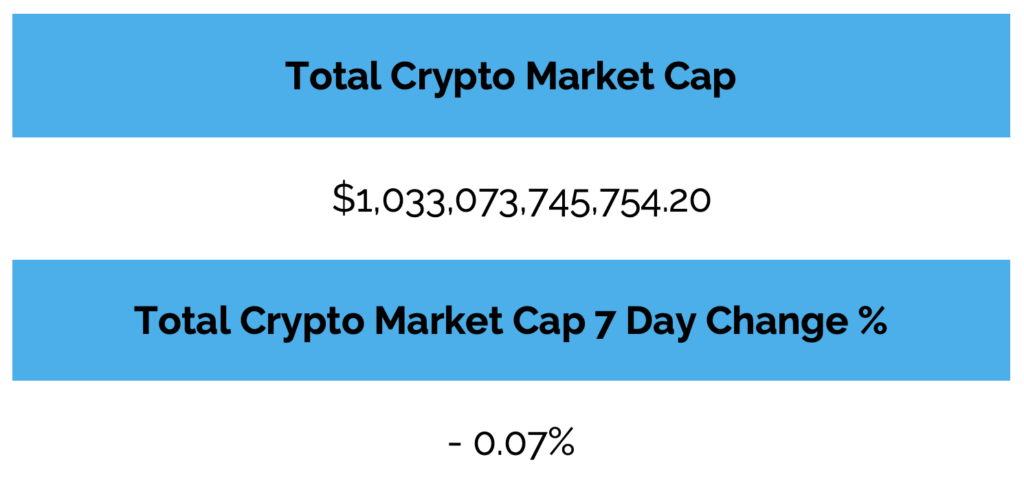

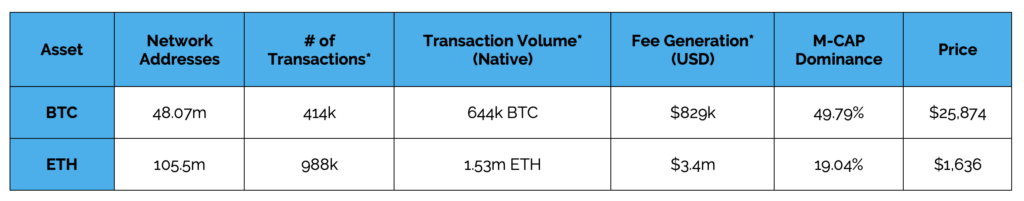

Digital asset markets were slightly down this week with the total industry market cap hovering around $1.09 trillion. The price of Bitcoin (BTC) closed at $25,874.81, down 1.16% on the week, while Ethereum (ETH) closed at $1,636.26, down 1.24% on the week. Year to date, BTC is up 54.36%, ETH is up 35.87%.

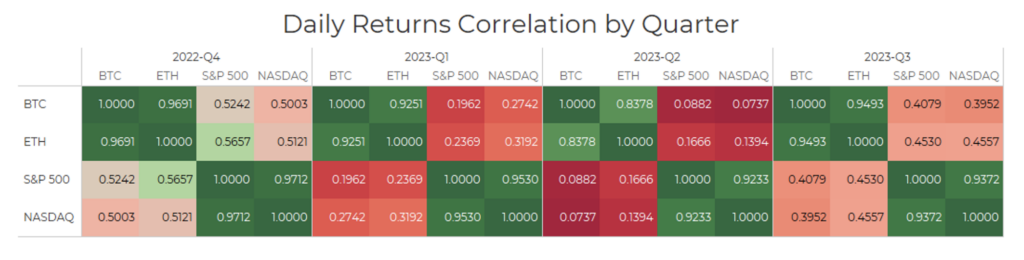

Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, but the S&P 500 and gold are both now statistically uncorrelated with Bitcoin by the same metric. (See correlation chart just below).

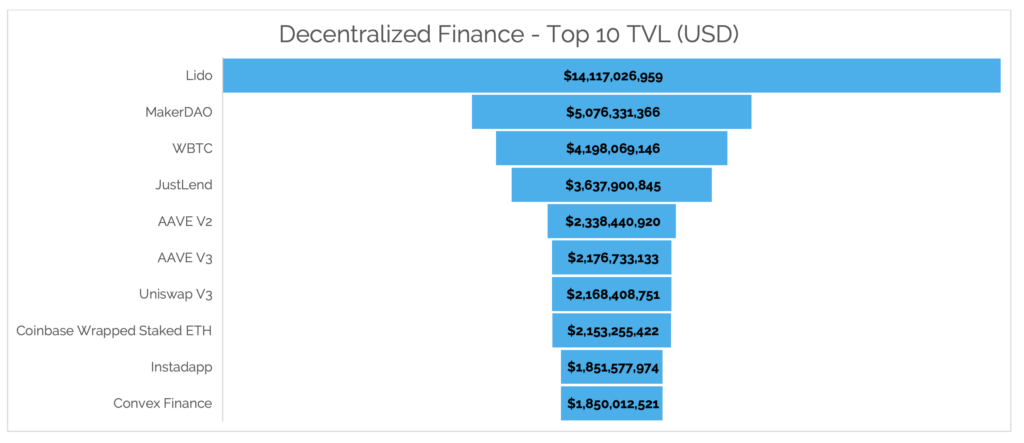

Total Value Locked (USD$) in DeFi verified by Digital Asset Research remained flat this week coming in at $38.17b as of Thursday, September 7th. The top 10 DeFi total value locked verified by Digital Asset Research no change.

-as of Thursday, September 7th, 7:00 pm ET

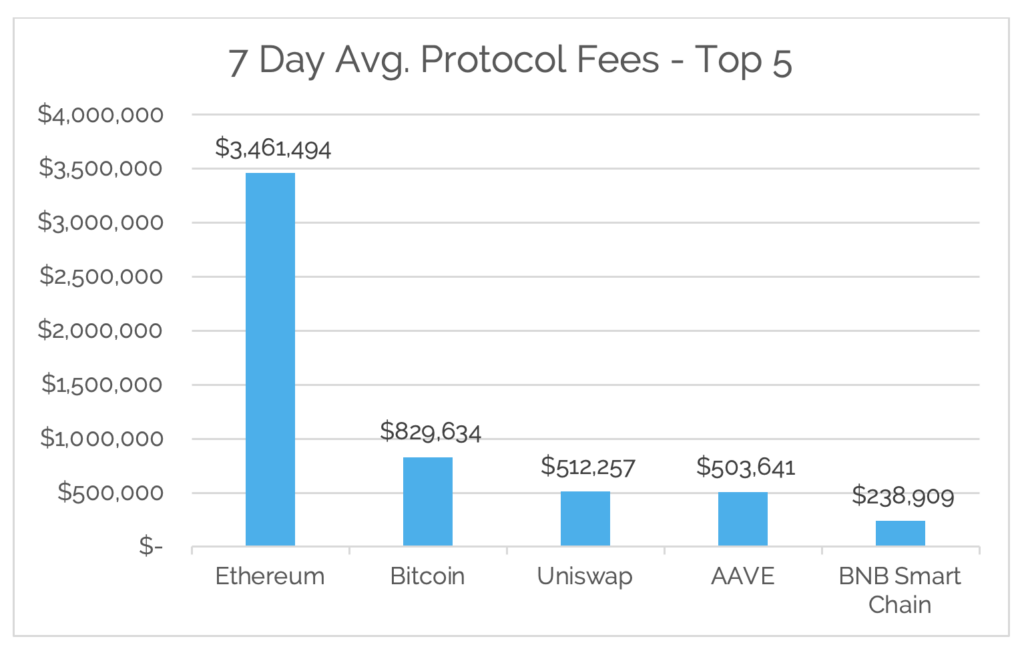

*7-Day Average

*Source: Cryptofees.info, Thursday, September 7th, 7:00pm ET

*Fees in USD

LSEG Announces End to End Blockchain Based Digital Assets Business

London Stock Exchange Group (LSEG) plans to launch a blockchain-powered digital markets business to enhance the trading of traditional financial assets. The group aims to build an end-to-end digital market ecosystem that allows for seamless and cost-efficient capital raising and transfer across asset classes. LSEG is in talks with regulatory bodies and the UK government to make this venture a reality within the next year. The focus is on using blockchain technology to improve the security, accessibility, and transparency of asset trading, rather than building anything around cryptoassets.

This public announcement is important for a couple reasons. First, a major global financial institution publicly committing to building needed infrastructure and adhering to a defined timeline, in this case by the end of 2024. Second, notice that this isn’t to service current crypto assets like BTC or ETH, but to utilize the underlying networks to bring traditional asset structures on those networks, i.e. tokenized assets. “The idea is to use digital technology to make a process that is slicker, smoother, cheaper, and more transparent… and to ensure it is underpinned by regulatory standards,” Roos told the Financial Times.

We have consistently talked about updating the current systems at which global financial institutions operate. There continues to be commitment from those institutions to work towards it. Every day more come to understand that the benefits of adopting this technology are worth it to bring more accessible and transparent financial markets to the world. We are slowly moving away from the hype and speculative narratives that dominated the industry for so long, bringing animosity and anger to them. Headlines like this don’t get the clicks or emotional reaction from the masses, but for us, that is just fine.

Boring is beautiful.

FASB Approves Fair-Value Accounting Approach for Digital Assets

The Financial Accounting Standards Board (FASB) has voted to set a new rule on cryptocurrency accounting and disclosure, requiring businesses to use fair-value accounting for bitcoin and certain other crypto assets.

Previously, crypto assets were classified as indefinite-lived intangible assets, like intellectual property. Companies had to review the value of these assets at least once a year and write it down if it dropped below the purchase price. Gains could only be recorded when the asset was sold. The new standard requires businesses holding crypto to recognize losses and gains immediately. They must review the value of these assets at least once a year and write it down if it drops below the purchase price. Gains can only be recorded when the asset is sold.

The FASB’s decision reflects the argument made by companies holding crypto assets that the previous accounting and disclosure rules did not accurately reflect their financial condition.

Many ask, “What is it going to take for Digital Assets to be adopted by financial advisors?” Our answer is the continued professionalization of the digital asset industry. This is part of what that looks like and what we are continuously looking for in our continued diligence of the digital asset ecosystem.

Ark Invest & 21Shares File for Spot ETH ETF

Ark Invest and 21shares have applied for a spot ether ETF with the SEC, while their spot bitcoin ETF application has been delayed. The ether ETF would provide direct exposure to ether and trade on the Cboe BZX Exchange using the CME CF Ether-Dollar Reference Rate – New York Variant. The move comes amid a flurry of excitement as the crypto industry continues its progress towards regulatory clarity, specifically when last week a federal appeals court ordered the SEC to rescind its rejection of Grayscale’s bid to convert the Grayscale Bitcoin Trust into an exchange-traded fund.

Ark Invest Chief Futurist Brett Winton said earlier this week that the U.S. would be better served to embrace crypto rather than trying to suppress it. “The U.S. attempts to wound bitcoin come at the expense of U.S. long-term strategic interests,” he wrote.

Digital Asset Learning:

Webinar: Institutional DeFi Unlocked

Created By: Intotheblock

Abstract: In an evolving DeFi landscape that’s bursting with potential, the management of complex risks—particularly economic risks—stands as a cornerstone for institutional adoption. Understanding, measuring, and, mitigating these risks is key for any organization looking to capture DeFi’s potential.

In this webinar, Our head of research, Lucas Outumuro, will go through our latest research and share what you need to know to secure your advantage in DeFi.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.