Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Since our last edition, there are three main Digital Asset topics that are important for investors and financial advisors to be aware of and have a fundamental understanding of:

- SWIFT Blockchain Experiment: Existing SWIFT Infrastructure can support Tokenization

- SEC must rescind Grayscales ETF Rejection & Delays Current Applications

- Judge Calls Ether (ETH) a Commodity: Dismisses Class Action Suit Against Uniswap

Are you a financial advisor or individual investor looking for help staying on top of important aspects to investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us!

Other News

- Binance Launches Send Cash in Latin America – The Block

- House Republicans ‘Express Concern’ Over the Fed’s New Crypto Oversight Program – Blockworks

- Bloomberg Analysts Estimate 75% Chance of a Spot Bitcoin ETF in 2023 – The Block

- Binance Japan to Offer 100 Crypto Assets Early – Bloomberg

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

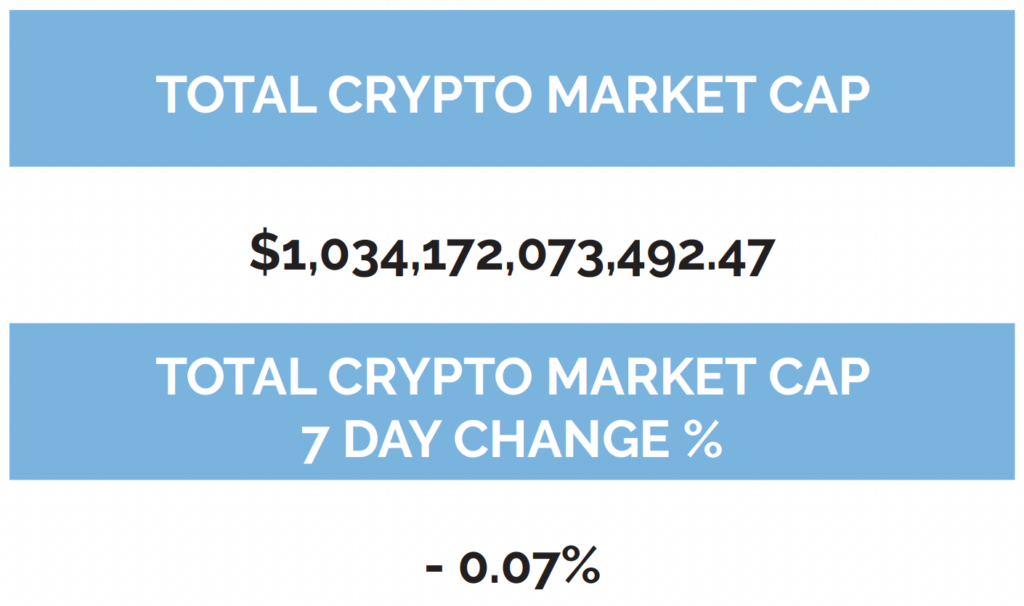

Digital asset markets were slightly up this week with the total industry market cap hovering around $1.09 trillion. The price of Bitcoin (BTC) closed at $26,179.08, up 0.63% on the week, while Ethereum (ETH) closed at $1,656.84, up 0.43% on the week. Year to date, BTC is up 55.58%, ETH is up 37.18%.

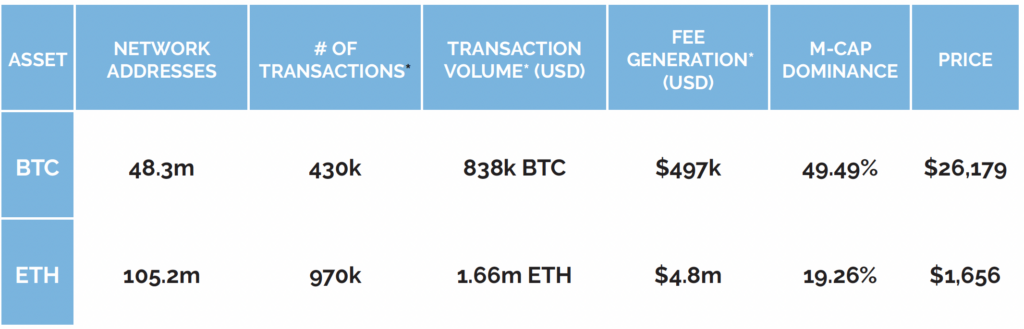

Ethereum and the S&P 500 continue to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while gold is now uncorrelated with Bitcoin by the same metric. (See correlation chart just below).

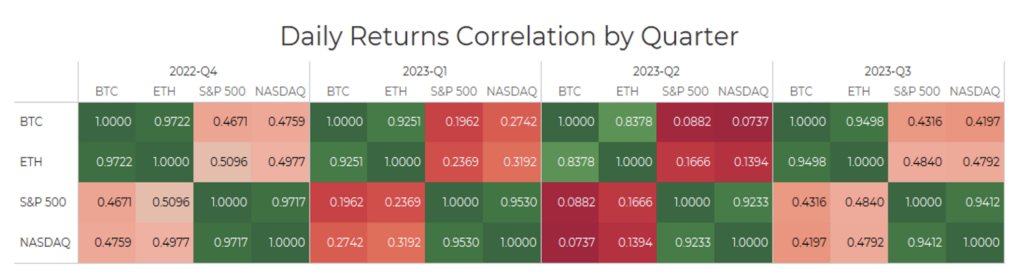

Total Value Locked (USD$) in DeFi verified by Digital Asset Research continued its gradual decline since Q1 of 2023, coming in at $37.28b as of Thursday, August 31st. The top 10 DeFi total value locked verified by Digital Asset Research no change.

-as of Thursday, August 31st, 7:00 pm ET

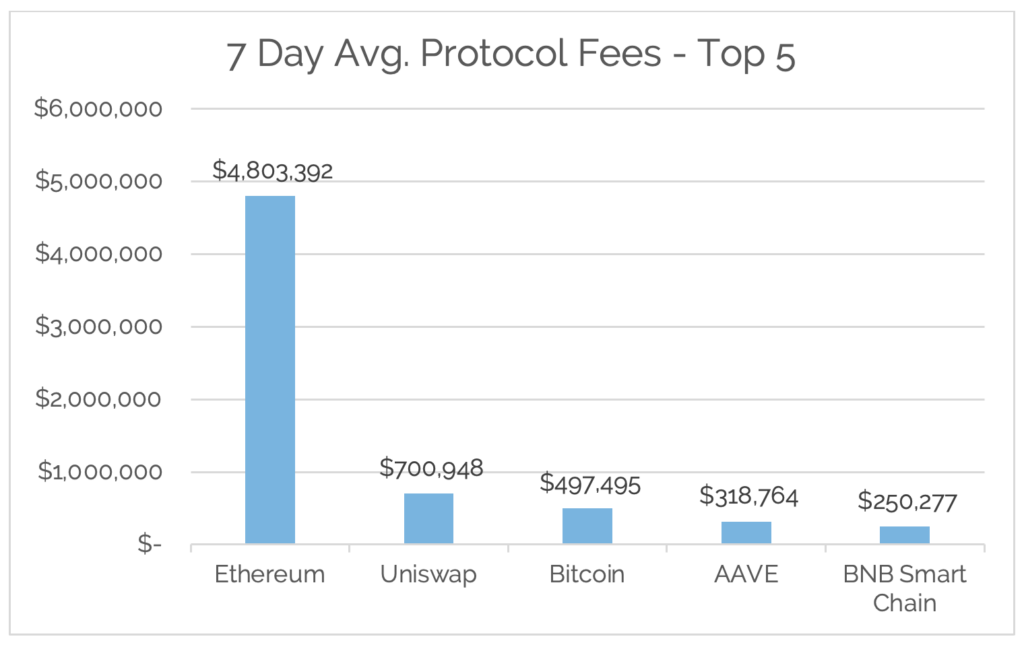

*7-Day Average

*Source: Cryptofees.info, Thursday, August 31st, 7:00pm ET

*Fees in USD

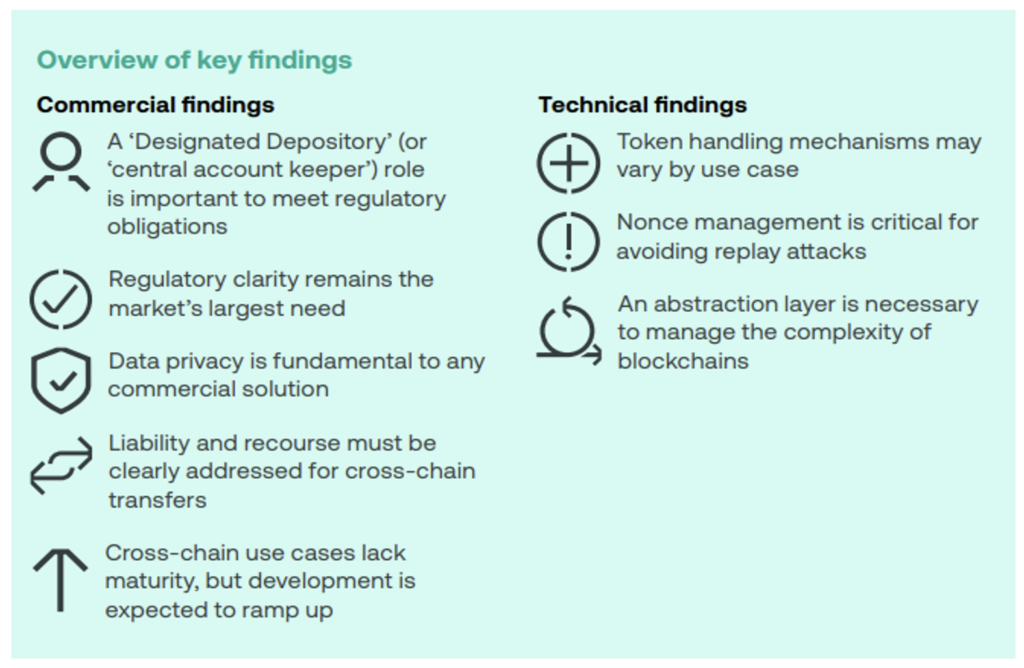

SWIFT Blockchain Experiment Findings

Swift has been collaborating with several major financial institutions on blockchain experiments, including Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX) and The Depository Trust & Clearing Corporation. Chainlink was used as an enterprise abstraction layer to securely connect the Swift network to the Ethereum Sepolia network, while Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enabled complete interoperability between the source and destination blockchains.

The Society for Worldwide Interbank Financial Telecommunications, or more commonly known as SWIFT, is a global member-owned cooperative that enables a global community of users to communicate securely, exchanging standardized financial messages in a reliable way, thereby supporting global and local financial flows, as well as trade and commerce all around the world.

SWIFT is part of the trust system in current global financial markets. SWIFT is monitored by G-10 central banks, which are: Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Sweden, Switzerland, the United Kingdom, and the United States. The European country of Belgium acts as the lead overseer alongside other members such as the U.S. Federal Reserve

The goal was to find out if:

- Can existing SWIFT infrastructure provide a secure and scalable way for financial institutions to connect to multiple types of public blockchain?

- Is there value in a blockchain interoperability protocol for securely transferring data between existing systems and a potentially unlimited number of blockchains?

The findings?

- Yes, we think we can, but a lot of work needs to be done to do it in a secure and scalable way.

- Yes, it’s not just valuable, but a necessity.

“Overall, the results of the experiment give confidence that existing Swift connectivity and messaging standards can be enhanced, enabling financial institutions to transfer tokens within and across blockchain networks – all with minimal disruption to operations.”

The conclusion is that there is still a lot of work to be done with many questions to be answered. The most near-term business case for tokenization is secondary trading of non-listed assets and private markets. While tokenization and bringing RWAs (real-world assets) on-chain is the destination, we aren’t there yet and have a long way to go.

While headlines about price and enforcement actions get the most clicks, as professionals who are focused on the reality of the benefits and opportunities of decentralized public blockchain technology, this is where you find the important work being done in the space.

Judge orders SEC to rescind Grayscale’s Spot Bitcoin ETF Rejection

The SEC has had their power checked, which is great news.

A federal appeals court ordered the SEC to rescind its rejection of Grayscale’s bid to convert the Grayscale Bitcoin Trust into an exchange-traded fund, citing:

“The Securities and Exchange Commission recently approved the trading of two bitcoin futures funds on national exchanges but denied approval of Grayscale’s bitcoin fund. Petitioning for review of the Commission’s denial order, Grayscale maintains its proposed bitcoin exchange-traded product is materially similar to the bitcoin futures exchange-traded products and should have been approved to trade on NYSE Arca. We agree.”

This last piece is vital, “The SEC did not explain why it was treating these products differently, making the Grayscale denial arbitrary and capricious.”

Why does this matter?

A few reasons, starting with the fact that GBTC is one of the most used vehicles for traditional financial advisors to gain exposure to BTC and crypto markets. RIAs have been among the big users of GBTC because it is easy from an operational standpoint. It is perceived as a safe, liquid, and effective way to buy BTC, or gain general crypto exposure, and still live in a familiar brokerage environment, rather than introducing additional layers of operational management buy opening accounts with Coinbase or other custodians.

Charles Schwab conducted a study of generational investor preferences and found that millennials and younger with Schwab accounts have GBTC as the 5th largest holding across the firm.

The SEC is going to have to find new reasoning to deny Grayscale’s application to convert GBTC to a spot BTC ETF, as well as all the other spot BTC ETF applications, most notably one from one of the world’s largest asset managers, Blackrock. Predictably, the SEC officially delayed all decision-making processes for current applications until October.

Our take is that the SEC has fertile ground to adjust their reasoning for the denial of a spot BTC ETF. They did make their own lives harder with their decisions in 2021 to approve futures-based ETFs along with the current reasoning for denial of spot BTC ETFs. That combo has made their own battle to fight the approval of a spot BTC ETF an uphill one, but not an insurmountable one. The blessing and a curse of a frontier market, like digital assets, is that there is so much gray and unknown area the SEC can point to.

As always, Laura Shin and the Unchained Podcast have delivered a great episode on this topic here. Ric Edelman, also recently released his updated white paper on everything you need to know about spot BTC ETFs, which you can access here.

Judge Calls Ether (ETH) a Commodity: Dismisses Class Action Suit Against Uniswap

The same judge overseeing the Coinbase vs. SEC case, Southern District of New York Judge Katherine Polk Failla, was also recently overseeing another crypto-centric case, a class action lawsuit against Uniswap, brought on by a trader on behalf of other Uniswap users in April of 2022. Uniswap developers and investors were accused of violating securities laws, alleging the exchange was an unregistered broker-dealer offering unregistered securities, and allowed token issuers to scam investors.

Judge Failla dismissed the case, saying the plaintiffs’ dilemma is the pseudo-anonymous nature of those token issuers, “In a perfect (or at least, a more transparent) world, plaintiffs would be able to seek redress from the actual issuers who defrauded them,” she wrote. “In the absence of such information, plaintiffs are left to argue that [Uniswap Labs] facilitated the trades at issue.”

“The Court declines to stretch the federal securities laws to cover the conduct alleged and concludes that plaintiffs’ concerns are better addressed to Congress,” she wrote.

Judge Failla put forth the payment apps Venmo and Zelle as part of an analogy. She said the plaintiff’s lawsuit would be equivalent to trying to hold those companies liable for a drug deal that tapped their platform to facilitate the transfer of funds, instead of the drug dealer.

Our takeaway is twofold:

- Recognition in a court of law that the rules and laws governing this space are developing and that regulators and Congress is where these plaintiffs should be taking their concerns.

- Smart Contract Execution vs. underlying code of the protocol is different and can’t be taken together.

While it is slow and inefficient, we see this as progress towards sensible regulation of digital asset markets and the crypto ecosystem overall.

Digital Asset Learning:

White Paper: What You Need To Know About Spot BTC ETFs

Created By: Ric Edelman & DACFP

Abstract: Any day now, the SEC may let bitcoin ETFs onto the market. You can expect client questions, so you need to understand how these ETFs work. Although the SEC has rejected all prior spot bitcoin ETF applications, there are indications the SEC will say yes. Among other reasons, BlackRock filed for the first time – quickly followed by ARK/21Shares, Bitwise, Fidelity, Global X, Invesco Galaxy, Valkyrie, VanEck, and WisdomTree, along with Grayscale’s request to convert GBTC into a spot bitcoin ETF.

Approval by the SEC would be a game-changer for crypto, as an introduction of a spot bitcoin ETF has long been considered the “Holy Grail” for broad investor adoption.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.