Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

On behalf of the team at Arbor Digital:

Thank you to everyone who has been with us on the journey to bringing value to investors and financial advisors with our specialized Digital Asset SMAs and professional services. We look forward to continuing to serve the financial advisor and investor community in 2024 and beyond.

We hope everyone this holiday season can take time to love, laugh, and sing with loved ones.

Since our last newsletter, we have been hard at work creating valuable resources with insights into Digital Asset markets. As it is the season of giving, please receive the gifts below:

Arbor Digital Tax Education Series in partnership with Polygon Advisory.

With end-of-year planning coming to an end and tax time fast approaching, a large portion of questions we are getting from financial advisors are tax-based. We decided to bring on Polygon Advisory group to answer the questions we have been getting throughout a 6-episode education series in short-form videos.

- How are digital assets treated?

- What are the current tax proposals?

- What are the effects of FASB fair accounting rules?

- What should advisors and CPAs do when clients come to them with crypto?

These questions and more are answered here. To learn more about Polygon Advisory Group please visit their website.

*Arbor Digital and Polygon Advisory Group are affiliate partners.

Asset Manager AMA – How are liquid token asset managers approaching research and management of digital assets?

A price resurgence has occurred to finish off the year across all digital assets. Many advisors and investors are looking forward to the approval of a Bitcoin ETF approval. The fed has signaled interest rate cuts in the US for 2024. The next Bitcoin halvening is set for April 2024. We decided to bring together some colleagues to discuss digital asset markets and some of the most burning questions stemming from the above narratives.

- Are Digital Assets officially in a bull market?

- What does fundamental research look like in Digital Assets?

- What is the expected impact of a Bitcoin ETF approval on capital flow and digital asset prices?

- What valuation methodologies can be applied to Digital Assets?

These questions and more are answered in the AMA.

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

Digital asset markets were inconsistent this week with the total industry market cap hovering above $1.7 trillion. The price of Bitcoin (BTC) closed at $43,753.16, up 1.94% on the week, while Ethereum (ETH) closed at $2,233.75, down 2.45% on the week. Year to date, BTC is up 163% and ETH is up 86%.

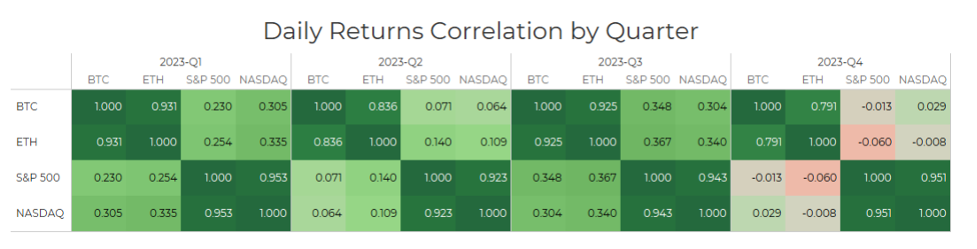

Ethereum and the S&P 500 remain positively correlated with Bitcoin when looking at a 30-day rolling correlation, while gold remains uncorrelated with Bitcoin by the same metric. (See Correlation Chart Below).

Total Value Locked (USD$) in DeFi verified by Digital Asset Research came in just over $53.35b in line with the price movement of BTC, ETH, and many DeFi protocols. Stablecoin market cap had modest growth at $130b showcasing the increase in TVL is mainly due to price action rather than new capital flowing on-chain.

Thank you for your continued trust. Be sure to tell someone today you care about them!