Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Happy New Year! To kick things off, this edition will be a short and simple primer on what advisors should be thinking about regarding the potential spot Bitcoin ETF approval.

If you are an advisor who is worried they aren’t caught up and ready to add value to clients who are engaging in digital assets, or for clients who will inquire about digital assets, then you need to book time with us. We are here to serve.

Before diving in, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

Digital asset markets were inconsistent this week with the total industry market cap hovering above $1.7 trillion. The price of Bitcoin (BTC) closed at $44,246.60, up 4.05% on the week, while Ethereum (ETH) closed at $2,279.91, down 3.15% on the week.

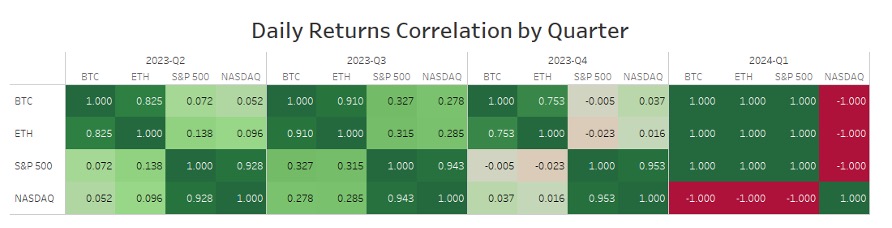

Ethereum is positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 and gold are uncorrelated with Bitcoin by the same metric. (See Correlation Chart Below).

Total Value Locked (USD$) in DeFi verified by Digital Asset Research came in just over $5.62b a slight decrease over the last week. Stablecoin market cap had modest growth coming in at $132b, up from $130b.

Spot Bitcoin ETF: What advisors need to know.

The Why

The spot BTC ETF is important because it gives advisors a digital asset investment option that fits into their current tech stack and solves many of the risks, real or perceived. By investing in a spot bitcoin ETF, advisors would be able to gain exposure to bitcoin without having to buy, store, or secure it themselves. Advisors buying shares of a spot bitcoin ETF would also enjoy greater investor protection since these ETFs would be regulated by the SEC, FINRA, and state securities regulators – the same way that stocks, bonds, mutual funds, and other ETFs are regulated. A spot bitcoin ETF differs from other bitcoin funds in that its Net Asset Value, or share price, is directly based on bitcoin’s price and is always current.

A spot BTC ETF means that hired 3rd party asset allocators building model portfolios for advisors now have a regulated vehicle to add exposure. Advisors may be gaining exposure via 3rd party managers without knowing it. It will be important for advisors to engage their 3rd party managers regarding their approach to potentially adding the spot BTC ETF to their model portfolios.

A spot BTC ETF also represents a moment where BTC becomes mainstream. Meaning clients will be asking questions like, “What is Bitcoin?”, “What am I investing in with BTC? Currency, commodity, or an equity?”, and “How does an allocation to BTC effect my overall portfolio?”

The What

A spot bitcoin ETF is an exchange-traded fund that buys bitcoin. A spot BTC ETF would enter the market as a less expensive option in the current landscape. GBTC, the Grayscale Bitcoin Trust, boasts a 2.5% management fee, whereas Fidelity’s spot BTC ETFs application indicates a 0.39% management fee. There have been futures-based Bitcoin ETFs in the market since 2021. New investment, familiar vehicle, and familiar price structure.

The Who

There have been over 50 BTC spot ETF applications over the last 10 years, all from crypto-native companies like Gemini and Grayscale. On June 15, 2023, BlackRock, the world’s largest money manager with $9 trillion in assets under management, submitted a spot bitcoin ETF application to the SEC. Others include trusted names like WisdomTree and Fidelity. For the advisor community, this is a vital piece to allocating on behalf of their clients, trusted counterparties.

The When

The SEC could approve or reject each application at any time, but it must act on all of them within 240 days of submission, which is currently by late March 2024 for the application filed most recently. January 10th is the next deadline for the SEC to approve one of the applications. Many speculate that all applications will get a decision simultaneously as not to create an unfair advantage in the market.

What happens to the price of BTC if approved?

Since the supply of bitcoin is fixed, the anticipated increase in both institutional and retail demand could cause bitcoin’s price to rise significantly.

Read More: Bitcoin Supply

What happens to the price of BTC if not approved?

It is highly likely that there will be increased volatility around BTC, especially if on January 10th the SEC does not send approval. This could create more opportunities in the short term for more attractive entry points into the market, however. Advisors would be wise to do what they do best, create a disciplined long-term investment plan for clients who want to gain exposure.

What should advisors do now?

It really depends on the time, energy, and effort you want to expend to bring Digital Assets to life in your practice. There are two approaches advisors should consider when preparing for a spot Bitcoin ETF entering the marketplace.

- Build your Digital Asset Stance and Approach Internally from Scratch.

- Hire 3rd

Building internally comes with the responsibility to educate oneself and your advisory team, building an investment thesis, understanding the data and how BTC fits into client portfolios, developing go to market strategy, and developing a framework for ongoing research and monitoring of BTC and digital asset markets to be able to effectively manage client relationships.

Or you can hire a 3rd party which has everything above built and ready to go to market with to engage clients.

While we believe a spot BTC ETF is an important milestone for the industry, we believe that advisors should be asking questions beyond Bitcoin, and beyond an ETF vehicle. Based on investor preferences, many would prefer direct ownership of the underlying asset opposed to wrapped vehicle.

Bitcoin, and digital asset markets as whole, trade 24/7 365 and a spot BTC ETF is an imperfect vehicle.

If you are an advisor who doesn’t have the time, energy, or expertise to build everything internally, then you need to engage with us. We have been in the market since 2020 delivering value for financial advisors incorporating digital assets into their practice. We have everything built for you on top of having a direct exposure investment solution for clients.

Book time with us here to learn more!

Thank you for your continued trust. Be sure to tell someone today you care about them!