Given the shifting narratives around the macro backdrop, combined with our on-chain analysis we feel this time there may be more room to drop as opposed to the significant bounce back we had last year in May 2021 when we last saw metrics at these levels. With the Fed’s decisions and regulatory oversight of crypto looming this year will continue to be choppy. We remain long-term bullish on the asset class and feel the impact of monetary policy on digital assets will wane over time as the disruptive features of the underlying technology are realized.

A lot has been happening in the broader economy. We wanted to take a high-level look at the traditional markets and tie that into what we are seeing in crypto. Thank you for your continued trust and please don’t hesitate to reach out with any questions or concerns.

Full Analysis

Traditional Markets

The markets are indicating that they feel inflation is not transitory. Interest rates have been on the rise and the yield curve is flattening out. The recent week ending January 8th was the worst week in terms of bond prices in 49 years for the 30-year treasury note (49 years is as far back as the data goes) with prices falling 9.35% in one week.

Why is this important?

The bond market leads all markets. When we see big moves in credit markets, it is only a matter of time before it hits equities and other assets like real estate. Fast forward to today and what do we see? Huge selloffs in high-growth tech and crypto, i.e. risk assets.

With inflation so high, 7% CPI, and holders of US Treasuries experiencing a negative real return of 5% on the long end of the yield curve. To counter this the Fed is looking to raise interest rates. The Fed’s decisions here will decide how markets will play out.

What happens next?

A couple of different ways this could play out. The Fed is currently signaling it will raise interest rates to get inflation under control which will cause risk assets to continue to suffer. However, they could pivot and decide to keep interest rates subdued and let inflation run as to not cause a shock in the markets.

The impossible question the Fed must answer: What short-term suffering do we want to go through to set the economy up for long-term health and success?

What this means for Arbor Digital portfolios

This is a valuable time to reiterate Arbor Digital portfolios are long-biased and will manage risk through strategic rebalancing and asset weightings. We use on-chain metrics and traditional technical analysis to decide whether the crypto markets are overheated or oversold. We use this information to decide on buy zones to establish long-term positions. We understand that we have talked about the volatility in crypto over the last few years, this is the first time many investors are experiencing it firsthand.

The questions right now are: Where is the bottom and when will markets stabilize? Based on the on-chain and traditional technical analysis we are in good times to buy. However, we could still see more short-term pain with rising interest rates. Another reason we could see some more sell-off specifically in crypto is futures open interest on Bitcoin has yet to be fully fleshed out.

What are we looking at?

Bitcoin’s MVRV Ratio, Market Value to Realized Value, measures the price of Bitcoin relative to its Realized Value (the avg. price each coin was purchased at). The MVRV helps us to get a sense of whether the price is over or undervalued. Historically, it has been useful in identifying market tops and bottoms. Values over 3.7 indicate a price top and values below 1 indicated price bottom. Currently, we are at 1.57 and are in a downward trend from early November when this metric was at 2.93.

Learn more: CryptoQuant – MVRV Z-Score

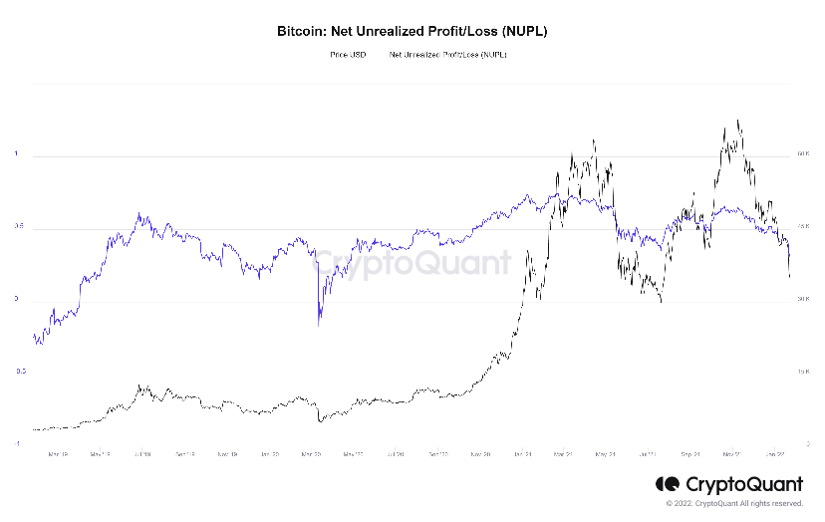

We also look at Net Unrealized Profit/Loss (NUPL). NUPL uses Realized Cap to show the ratio of Unrealized Profit/Loss. If there is an increase in Unrealized Profit in blockchain, the probability of price drop increases. Vice versa, if there is an increase in Unrealized Loss in blockchain, the probability of price rise increases. Historically, a NUPL above 0.75 is considered overvalued, and below 0 is considered undervalued. Currently, we are sitting at 0.34, trending downwards from 0.63 since early November. Back in May of 2021 when the crypto markets sold off more than 50%, this metric hit a low of 0.41.

Learn More: CryptoQuant – NUPL

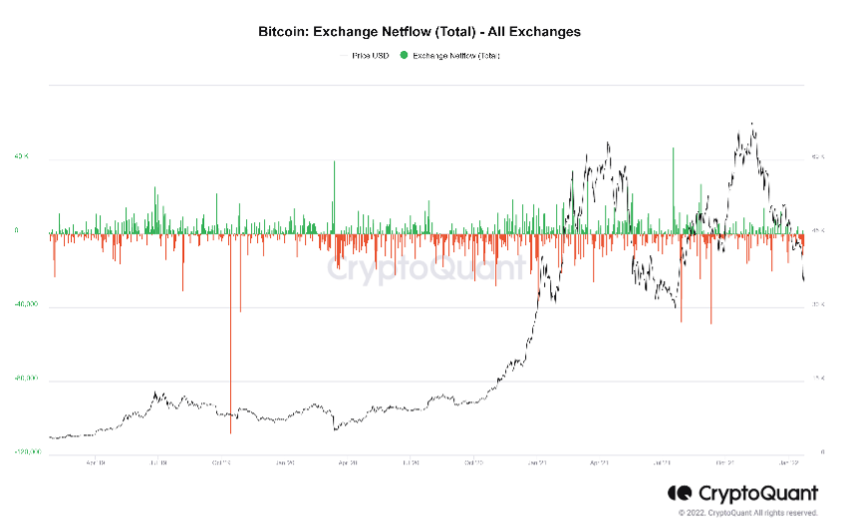

Another area we are looking at is net exchange flows. Exchange flows help us get a sense of what long-term holders are doing. If we see more flows off exchanges this indicates there will be less selling pressure and vice versa if we see flows on exchanges this indicates more selling pressure. The last two weeks and into this past weekend we have been seeing more outflows than inflows indicating investors are buying Bitcoin and taking off exchanges. We will be paying attention to this closely for large green spikes which would indicate we have more pain to some in the short term, but for now, it looks like this is not the case and we could be nearing a bottom.

Learn More: CyrptoQuant – Net Exchange Flows

Conclusion

Given the macro backdrop combined with our on-chain analysis, we feel that this time there may be more room to drop as opposed to the significant bounce back we had last year in May 2021 when we last saw metrics at these levels. With the Fed’s decisions and regulatory oversight of crypto looming this year will continue to be choppy. If this remains true, we will continue to establish long-term positions with sidelined cash at these levels. If you find yourself becoming more anxious seeing the large sell-off then this is a good time to revisit your level of exposure to crypto-assets. We are still recommending only to contribute as much as you are willing to lose, between 1-5% of total net worth. This asset class is meant for assets that have a long-term time horizon of 7+ years before needing to spend. However, if you had plans to contribute more to the asset class, now is the time to move funds. If you are in this position, please reach out to have a discussion with your advisor to ensure that it is the best decision for you and your situation.