Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

Before jumping in, in case you missed it, be sure to check out our 2023 Digital Asset Market Outlook.

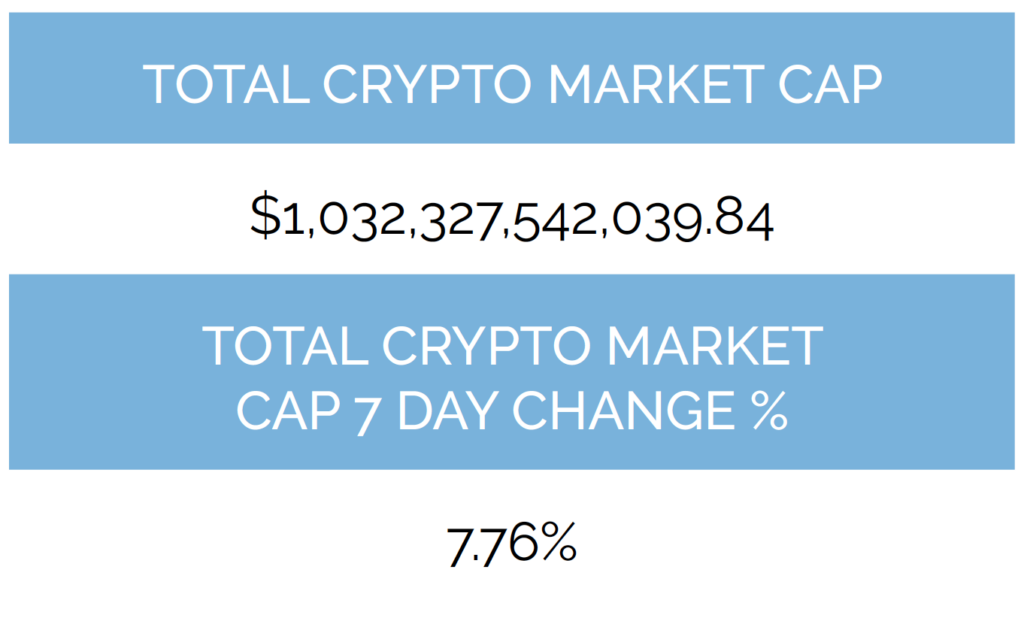

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

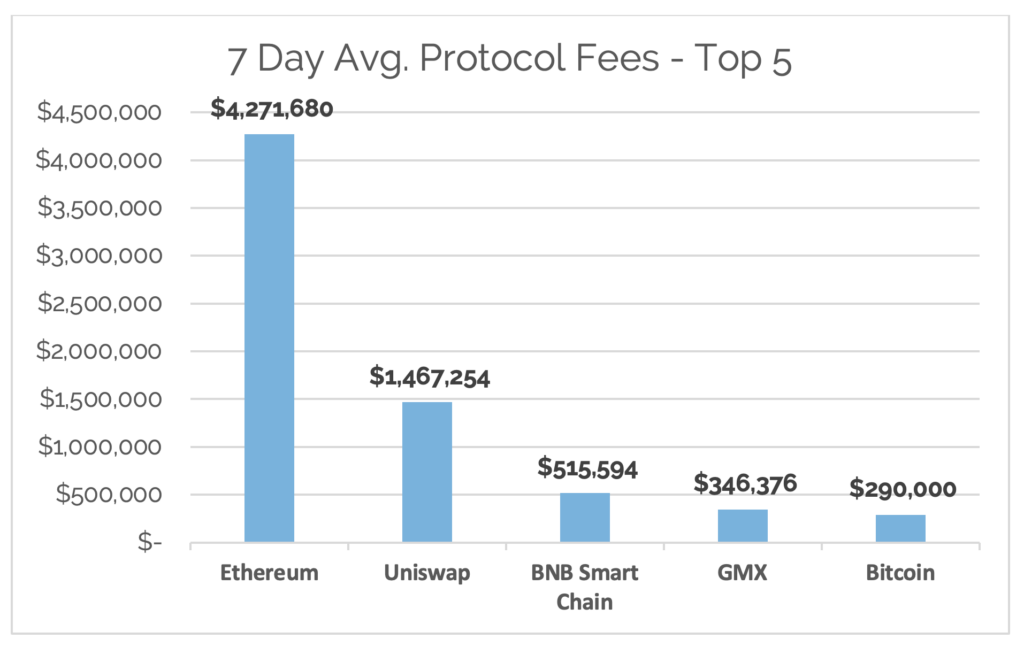

*Source: Cryptofees.info, Thursday, January 26th 7:00pm ET,

*Fees in USD

Week in Review

Adoption

On the Bitcoin network, over the last week, roughly 180,000 new network addresses with a balance of BTC were added bringing the total to 43,505,566 network addresses, bringing it closer to its all-time high from November of last year at 43,968,703. Network activity for the week was slightly down however moving from 933,000 daily active addresses to 892,000. While down for the week this remains within the average range since 2020. For context, active addresses hit a low in June 2021 at 515,000 daily active addresses.

The network continues to work flawlessly and brings in about $280k avg. daily fees for the week. Transaction volume (USD) declined slightly down to $7.87B from $8.21B last week, but still range bound. Blocks continued to be mined every ten minutes and the network continued to run as intended.

Lightening Labs, which builds infrastructure on top of the Bitcoin main network, and its developers continue to focus on its Taro protocol. This layer-2 protocol is meant to bring elements of Decentralized Finance to the Bitcoin blockchain taking it from a single-use blockchain to a multi-use. This started in November 2021 with the Taproot upgrade, which you can read more about below.

On the Ethereum network, roughly 240,000 new network addresses with a balance of ETH were added bringing the total amount to 93,216,068 network addresses with a balance, an all-time high. Network activity for the week was slightly down however moving from 522,811 daily active addresses to 498,586. While down for the week this remains within the average range since 2020. For context active addresses hit a high in April 2021 at 905,234 and were at a low in June 2022 at 392,527 daily active addresses. Average daily fees for the week were $4.27M but transaction volume (USD) declined moving from #3.66B to $2.97B but is still range bound.

The Shanghai upgrade to Ethereum, which is expected to go live in March, began the first sets of testing this past week. Developers at the Ethereum Foundation reported that there were some glitches to work through but overall still on track for their March release. This is part of the broader plan for the Ethereum network to become more scalable, secure, and sustainable. The next major upgrade coming to Ethereum is the introduction of ‘sharding’. Read more below.

EY, one of the big four accounting firms, announced the launch of Nightfall, an open-source suite of tools designed to enable private token transactions over the public Ethereum blockchain, coming in May of this year. The goal for EY and Nightfall, which teamed up with scaling solution Polygon in September 2022, has always been to harness the power of the public Ethereum network for big business.

Network Addresses

The sum count of unique addresses holding any amount of native units as of the end of that

interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens

would not be considered).

Daily Active Addresses

The sum count of unique addresses that were active in the network (either as a recipient or

originator of a ledger change) that interval. All parties in a ledger change action (recipients and

originators) are counted. Individual addresses are not double-counted.

Read More

- Chainalysis: Bitcoin Taproot Upgrade – Everything You Need to Know

- Lightening Labs: Taro Announcement

- Ethereum Foundation: Sharding

- EY: Nightfall Github – Nightfall Press Release

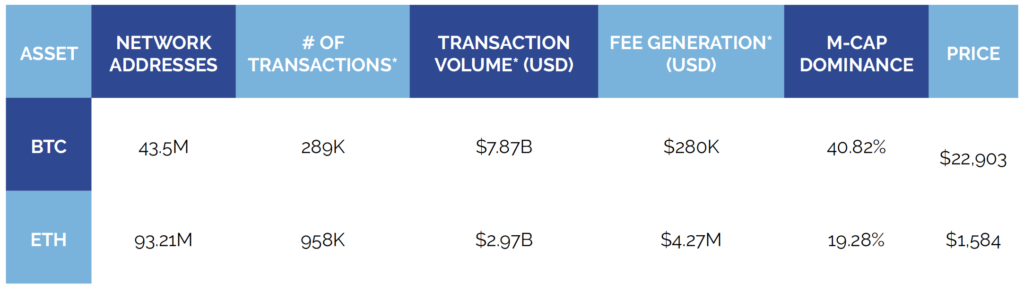

Financial

While ChatGPT and AI continue to make waves by passing different professional industry and MBA exams, Digital Assets have continued to rally along with traditional risk assets this past week to kick off the year. The NASDAQ is up 10%, the S&P500 is up 5%, and BTC and ETH are up 38% and 31% respectively. Alternative Layer 1 tokens are leading the charge for digital asset markets with SOL up 140%, NEAR up 96%, AVAX up 67%, FTM up 133%, and ADA up 53% so far.

Bitcoin is up approximately 50% from its bottom of $15,900 and expectations of a similar “echo bubble” are building up. The echo bubble is comparing the recent rise with the one recorded in the second quarter of 2019, when Bitcoin bounced back from $3k all the way to $13k within four months, echoing the bull run experienced two years earlier. But beware, all major crypto assets proceeded to lose 50% of their value after the 2019 bubble.

While an echo looks to be forming, It’s important to understand the overall macro environment and state of dollar liquidity in all markets were vastly different back in 2019. In the short term we may see continued price movement up, but with the Fed committed to quantitative tightening, leading to less dollar liquidity, we are not so sure we have come out of crypto winter just yet. Also important is the enforcement actions and legal battles all still playing out on some of the biggest entities in the space. We see this hot start in price as mean reversion from the bloodbath that was 2022 and not a fundamental shift to a bull market.

This is a prime reason why we continue to preach a disciplined process of dollar cost averaging into markets, not one based on pure emotion. To learn more about how we help financial advisors and investors navigate digital assets be sure to schedule time with us here.

Top News

- Feds Seize Almost $700 Million of FTX Assets in Sam Bankman-Fried Criminal Case – CNBC

- Investment Manager Wilshire Teams Up With Crypto Trading Firm FalconX to Develop Digital Asset Indexes – CoinDesk

- SEC Bats Down Ark’s and 21SHARES’ Second Bitcoin ETF Proposal – The Block

- Moody’s Is Working on Scoring System for Crypto Stablecoins – Bloomberg

- Crypto Lender Genesis Seeks Creditor Deal in Days or Mediator – Bloomberg

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Digital Asset Learning

Reading: Blockchain’s Evolution and Enterprise Use Cases

Written By: Blockdata Team

Abstract: Governments, business entities, and organizations have been pursuing blockchain technology to meet their unique needs, which seldom involve digital currencies. Blockchain technology is secure, traceable, immutable, and transparent across distributed networks. These traits make it a good fit for use cases that are hard to underpin using traditional infrastructure.

In this post, we’ll look at the most popular enterprise use cases for blockchain and whether so-called “killer apps” have already been found for blockchain technology.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.