Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

Before jumping in, in case you missed it, be sure to check out our 2023 Digital Asset Market Outlook.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, February 2nd, 7:00 pm ET

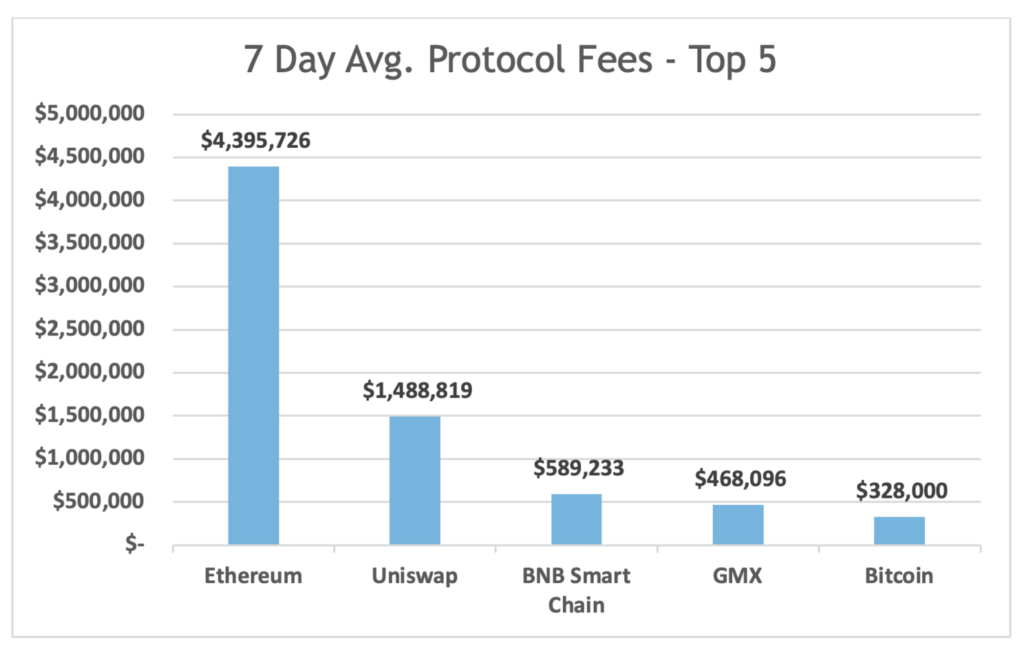

*7-Day Average

*Source: Cryptofees.info, Thursday, February 2nd, 7:00 pm ET,

*Fees in USD

Week in Review

Adoption

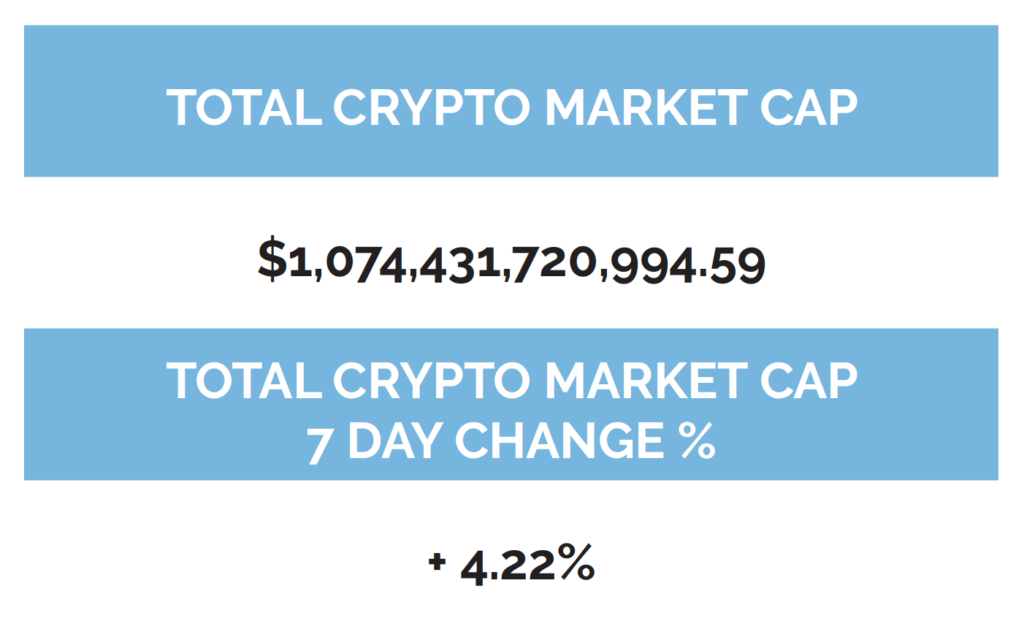

On the Bitcoin network, over the last week, roughly 180,000 new network addresses with a balance of BTC were added bringing the total to 43.68 million network addresses, bringing it closer to its all-time high from November of last year at 43.96 million. Network activity for the week was up 10.8% moving from 892,000 daily active addresses to 988,000. Rising activity brings rising fees. Network fees were up roughly 17% this week generating $328,000 on a daily average; last week the daily average was $280,000 for the week. Daily average transaction volume (USD) for the week increased as well moving from $16.85B the week prior to $17.95B.

ICYMI

As we mentioned in previous newsletters and in our 2023 outlook, one of the themes we believe is that with Bitcoin network upgrades Taproot and Taro, the network will evolve from a singular use case of transferring value through its cryptocurrency bitcoin, and become multi-use, bringing other financial uses and crypto native uses. We saw the beginning of this playing out this week with the creation of the Ordinal’s Protocol, which stores digital art non-fungible tokens on the Bitcoin network.

This has created a division within the Bitcoin network community. Core and OG Bitcoiners, including Satoshi himself, purposefully want the network to focus on its original: to be the most secure network in the world to transfer value over the internet that isn’t controlled by any one entity. Those on the other side of this are amenable to the Bitcoin network evolving beyond its first intended use case.

This got me thinking about Tim Berners-Lee, one of the important figures who helped make the internet what is it today, and his idea of the ‘World Wide Web’. “The dream behind the Web is of a common information space in which we communicate by sharing information.” The world wide web was first intended to be used as a common information space, a single-use case. Fast forward and now the internet is how we view and watch cinema, how we play video games, and so much more.

Will bitcoin be better off evolving, or do we have other decentralized blockchains to take on that responsibility so that the Bitcoin network can continue to act as the most secure network in the world to transfer value?

Only time will tell.

On the Ethereum network, roughly 282,000 new network addresses with a balance of ETH were added bringing the total amount to 93,498,068 network addresses with a balance, an all-time high. Network activity for the week was slightly up moving from 498,586 average daily active addresses to 501,384.. Average daily fees for the week were slightly up as well, $4.39M up from $4.28M. Transaction volume (USD) increased moving from $2.97B to $3.54B and continues to stay in a healthy range.

The Shanghai upgrade to Ethereum, which is expected to go live in March, got another update this past week with Ethereum developers announcing the launch of a testnet called “Zhejiang”, where validators can test the action of unstaking their ETH. Testnets run on top of and duplicate the main blockchain, in this case, Ethereum. They allow developers and users to test upgrades and applications in a low-stakes environment before going live.

Read More

BNY Mellon is the world’s largest custodian bank and securities service company. BNY Mellon is the result of a merger in 2007 between The Bank of New York and Mellon Financial Corporation. The Bank of New York was established in June 1784 and was one of the oldest banks in the world. This past week BNY Mellon made an announcement promoting Caroline Butler to CEO of Digital Assets. Butler will continue to lead the digital assets custody platform, as well as oversee any digital assets commercial initiatives company-wide.

The US Air Force in 2020 gave $1.5 million to blockchain-as-a-service company SIMBA Chain to research and develop a blockchain for supply chain logistics. This past week SIMBA received another $30 million from the US Air Force “as part of its aims of identifying and advancing technologies that have the potential to secure its future dominance.” While this is a private service on the front end, the back end is allowed ‘full-chain freedom’ and can choose blockchains that best fit their solutions.

The California DMV, which has the highest number of car registrations in the US, is partnering with Oxhead Alpha, a crypto-infrastructure company, to test verifying car titles and registrations using blockchain technology. Oxhead alpha chose the Tezos blockchain, an alternative to Ethereum, to run the proof-of-concept service. “It boiled down to three areas: a responsible consensus algorithm, on-chain governance that can reduce forking issues, and an overall robust security model.”

Network Addresses

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.

Financial

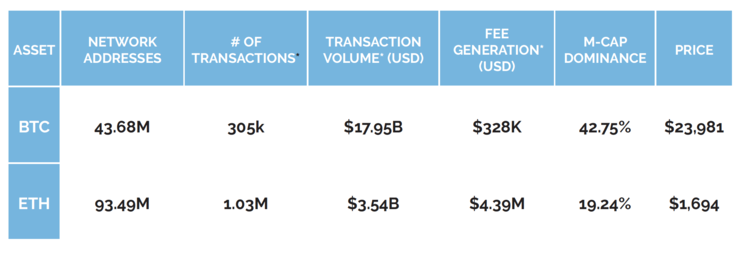

Over the past week, digital assets continued to post strong returns to start the year along with traditional risk assets. The Federal Reserve implemented a 0.25% interest rate hike Wednesday, slowing the pace of its increases from 2022. This is a sign that the central bank is seeing progress in its battle with inflation. In his post-meeting press conference, Fed Chair Jerome Powell signaled that while there’s still a long way to go in the fight against inflation, he believes the trend is moving in the right direction.

Markets didn’t react much on Wednesday, but Thursday kept its strong positive momentum. Year to date, the NASDAQ is up 17.86%, the S&P500 is up 9.3%, and BTC and ETH are up 41% and 36% respectively. Alternative Layer 1 tokens are leading the charge for digital asset markets with APT +375%, FTM +203%, SOL +141%, and AVAX +93% to name a few. It is important to note that many of these tokens are still 60-80% off their all-time highs set back in November 2021.

With prices moving back up we have seen an increase in interest from investors. This is to be expected as it lines up with traditional behavioral finance. This is a prime reason why we continue to preach a disciplined process of dollar cost averaging into markets, not one based on pure emotion. To learn more about how we help financial advisors and investors navigate digital assets, schedule time with us here.

Other News

- Silvergate Faces US Fraud Probe Over FTX and Alameda Dealings – Bloomberg

- UK Treasury Outlines Plans for Regulating Crypto Exchanges and Lenders – The Block

- Mastercard, Binance Launching Prepaid Card in Brazil – Reuters

- Twitter Preps for Payments With Crypto Option as Musk Eyes Super App, FT Says – The Block

- Judge Dismisses Proposed Class-Action Lawsuit Alleging Coinbase Sold Unregistered Securities – CoinDesk

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Digital Asset Learning

Reading: MetaMask Learn

Created By: MetaMask

Abstract: You may have heard a lot of jargon related to Web3: distributed ledgers, crypto, and NFTs. But what’s revolutionary about the technology is more than the sum of the technical parts; it’s the power it gives you. Our lives are increasingly digital and interconnected. Our screens are our windows, our data define our identity, and more and more of our time is spent online.

Historically, trust in society comes from subjective sources — from personal connections, platforms, and institutions. At its core, Web3 is a new foundation for trust, where everything can be verified and you don’t need to place your trust in a single source or entity.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.