In this edition of Digital Asset Friday, we have something special. Powering our individual token research that helps inform our portfolio construction and ongoing decision-making is digital asset research firm Digital Asset Research.

We are excited that coming soon they will also be helping power our weekly newsletter to you all who subscribe. With that, we thought it would be beneficial to get to know them a bit through their own newsletter, which will serve as a teaser for what is to come with us at Arbor Digital. This week includes an excerpt from Digital Asset Research, an Arbor Digital portfolio performance update, and crypto learning and reading suggestions.

Our commitment is to bring you the highest quality data and content. We feel this keeps us delivering on that mission. As always, we would love to hear any feedback from you. Please reach out to us at marketing@arbordigital.io

INCYMI: Arbor Digital Q3 Market Recap with Special Guest Matt Schechter

*Data Source: DAR, TradingView¹

Macro Overview

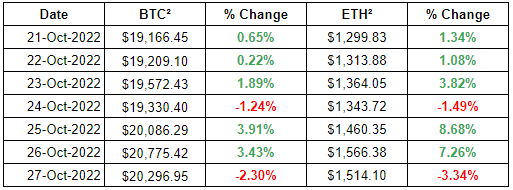

Digital asset markets were up this week with the total industry market cap hovering above $1 trillion. The price of Bitcoin (BTC) closed at $20,296.95, up 6.59% on the week, while Ethereum (ETH) closed at $1,514.10, up 18.05% on the week.

Bitcoin and Ethereum both saw a spike in their returns this week. Over the last 30 days, Bitcoin returned 8.13%, while Ethereum is up 18.00%. Alongside its higher returns, Ethereum also recorded an increase in its rolling volatility.

See a comparison of rolling volatility and net returns across Bitcoin, Ethereum, gold, and the S&P 500 over the last month in the chart below.

After briefly becoming uncorrelated, the S&P 500 is once again positively correlated with Bitcoin when looking at a 30-day rolling correlation, while gold is no longer correlated with Bitcoin. Ethereum continues to be positively correlated with Bitcoin when looking at the same metric.

See how Bitcoin’s performance was correlated to Ethereum, gold, and the S&P 500 over the last month in the chart below.

Bitcoin’s performance across regional trading sessions was up over the past week. The most significant downturn of the week happened on October 27 during the Asian session when Bitcoin’s price fell by 1.31%. The most positive price action of the week happened on October 25 during the North American session when the price of Bitcoin rose by 3.99%.

- Binance’s Stablecoin Clocks in Market Share All-Time High as Supply Tops $20 Billion – The Block

- MakerDAO Moves Ahead With $1.6 Billion in Coinbase Custody – The Block

- Crypto Exchange SushiSwap Approves Restructuring, Will Create 3 Firms for DAO – CoinDesk

- Google Introduces Cloud-Based Blockchain Node Service for Ethereum – CoinDesk

- Twitter Will Allow Users to Buy and Sell NFTs Through Tweets – Decrypt

Digital Asset Learning:

Webinar: The Current State of DeFi: Consolidation and New Trends

When: Wednesday, November 2nd, 2022, 12:00 pm ET

Presented by Intotheblock:

The Decentralized Finance landscape continues to evolve at a rapid pace. During this webinar you will hear from the expert team at Intotheblock, a blockchain data provider, on what they are seeing in the DeFi landscape currently and opportunities in the near future.

Reading: The Chainalysis 2022 Geography of Cryptocurrency Report

For the third straight year, Chainalysis is publishing our guide to cryptocurrency adoption and usage around the world. Despite a tumultuous year in cryptocurrency and the onset of a bear market, our research shows that crypto is still unlocking unique opportunities around the world, with users in no two regions transacting in the exact same way. Download your copy of the report today, and you’ll get original research and data on:

- Where cryptocurrency adoption is increasing the fastest

- The most prevalent use cases by region and the services supporting them

- Differences in usage between emerging and developed markets

- And much more!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.