Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

The past 7 days have been a roller coaster both in traditional and crypto markets, but for different reasons. In this week’s edition, we will not be diving into what happened, but rather what the takeaways are, from a crypto-centric lens. To get caught up on what has transpired please see below for the following resources before reading this week’s newsletter:

- Read: Bank Runs, Crypto Concerns, and Takeovers: A Timeline – NY Times

- Listen: The Banking System Broke – The Breakdown with NLW

- Long Listen: Unchained – The Chopping Block: Was Crypto Just Debanked?

A couple of important pieces that went under the radar while all of this was happening was that the $4.5 Trillion AUM financial services firm Fidelity Investments opened low-cost BTC and ETH trading to their entire client base. Fidelity has more than 37 million retail users. This can’t be understated.

The second was Salesforce, Inc., the cloud-based software company, announcing Web3, which enables brands to create connected customer experiences across Web2 and Web3 with a unified platform. Two of its early success stories are with established brands like whisky brand Crown Royal and toy manufacturing company Mattel.

Now that you are caught up, let’s dive in.

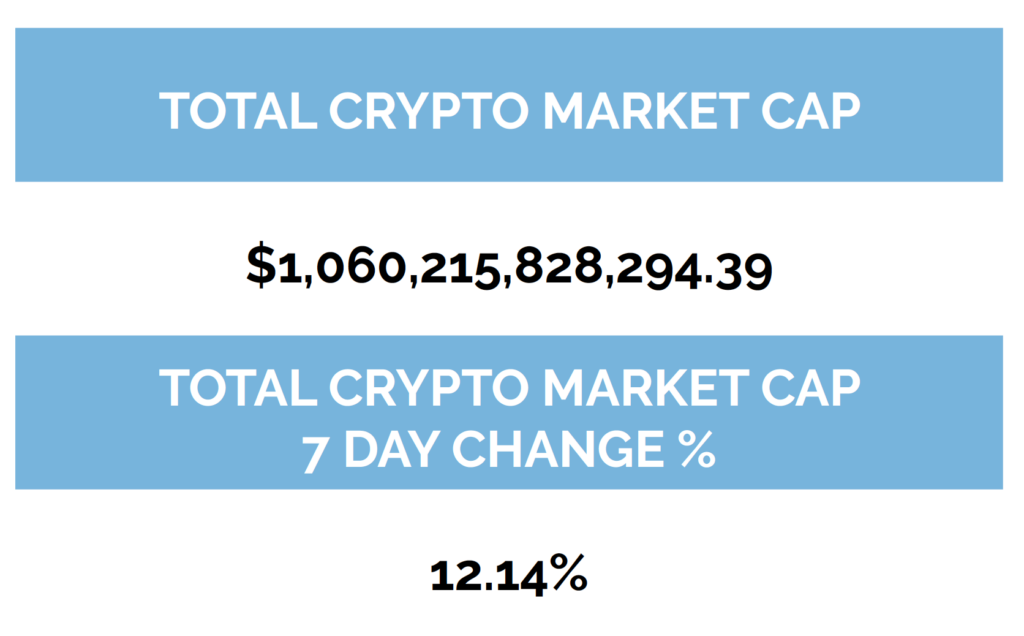

Run of the Numbers Sponsored by Digital Asset Research

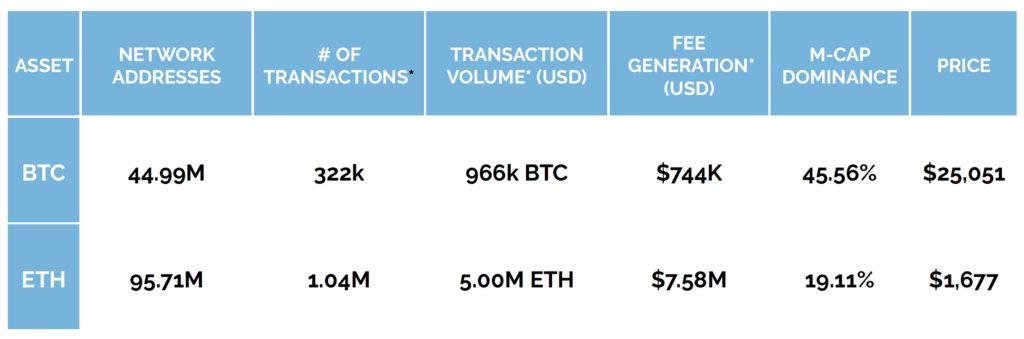

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, March 16th, 7:00 pm ET

*7-Day Average

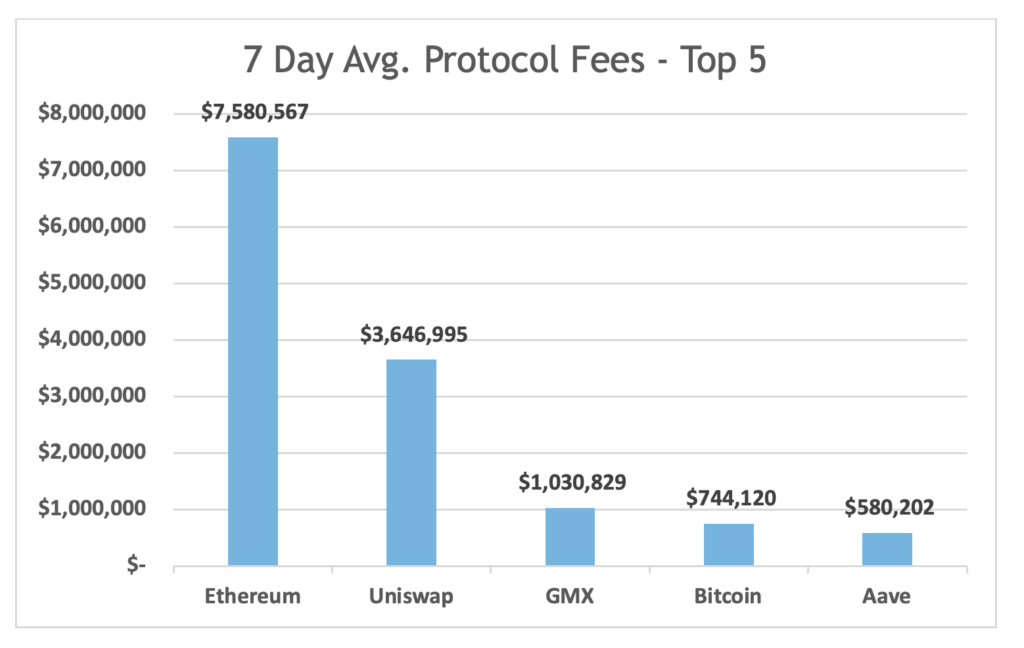

*Source: Cryptofees.info, Thursday, March 16th, 7:00 pm ET,

*Fees in USD

Week in Review

This Week’s Takeaways

- The merging of the traditional world and crypto economy continues with Salesforce Web3.

- Don’t be fooled by the surge in BTC and ETH prices. The de-banking of crypto slows and delays large flows of new capital into the crypto economy via US institutions. This is not likely to reverse until regulated on-ramps are established.

- Fee compression has kicked into overdrive with Fidelity enabling BTC and ETH trading for its entire retail client base. All centralized crypto exchanges like Coinbase and Gemini, as well as centralized investment products like GBTC, BITWISE, and SMAs (raises hand) who are relying on higher than normal fees and transaction revenue are likely to see compression soon. Which is a good thing for consumers.

- The Bitcoin network’s value was apparent as a permissionless, open-source, 24/7, globally accessible monetary network.

- The Ethereum network, and DeFi apps operating on top of it, showcased its use case for operating in a crisis…again.

- Both BTC and ETH tokens are seen as ‘safe’ in the crypto economy.

- Circle’s stablecoin USDC is stronger now and positioned well as a digital dollar within the crypto economy.

- Financial services are based on trust. The events this week only highlight the need for elevated trust models, which decentralized blockchain and DeFi offer.

Detailed Week in Review

Adoption

The Bitcoin network has hit a new all-time high in network addresses with a balance of BTC bringing the total to 44.99 million network addresses. Daily active addresses continue to stay in a healthy range between 930k and 1 million for the daily average. We saw a large increase in the Daily average transaction volume (BTC) for the week moving from 818k BTC to 966k BTC. 7-Day average Network fees also saw a large increase to $744k. Both large swings can be attributed to the flight to safety after the closing of the largest banks servicing crypto, stablecoin USDC breaking the buck down to $0.88 last weekend, and Binance converting $1 Billion into BTC, ETH, and BNB.

On the Ethereum network, roughly 260,000 new network addresses with a balance of ETH were added bringing the total amount to 95.71 million network addresses with a balance, an all-time high. Daily active addresses for the week were relatively flat at 497k. Average daily fees for the week soared to $7.58M. Transaction volume (ETH) also soared, reaching a daily average for the week of 5.00M ETH. Similar to Bitcoin, the increase in volatility due to the events described brought the highest on-chain activity of the year.

What happened on-chain while traditional banks were failing and USDC depegged?

USDC transactions were suspended on many centralized crypto exchanges, including two of the largest Coinbase and Binance two of the biggest crypto exchanges over last weekend. The suspension came from uncertainty of USDC reserves held at Silicon Valley Bank, roughly $3.3 billion. With investors uncertain, they exited USDC into other stablecoins and crypto assets like Tether’s USDT, BTC, and ETH. These pieces combined caused USDC to depeg from $1.00 to $0.88.

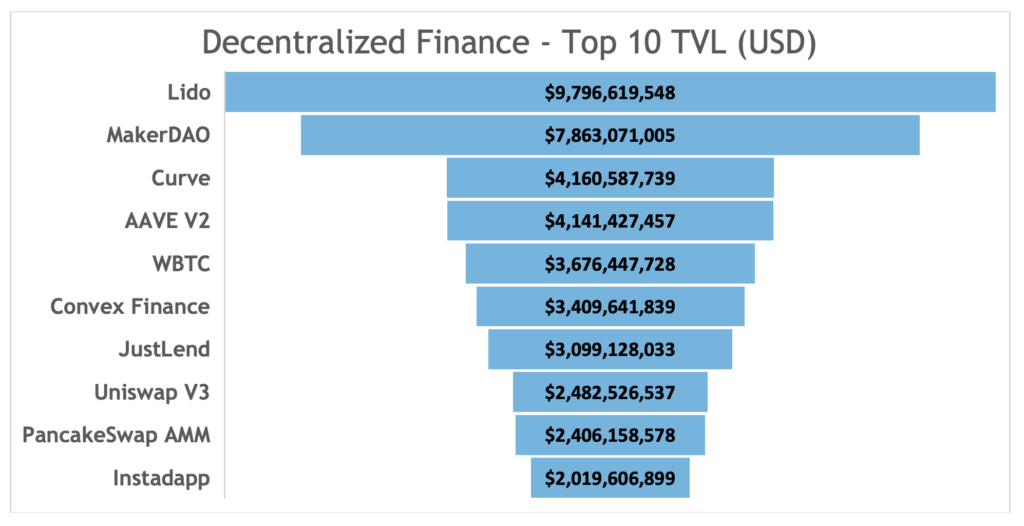

On-chain volumes surged in light of this. Uniswap saw its highest single-day volume ever of $11.84 billion on March 12th, this is almost double its second-largest single-day volume. Following volume comes fees with fees topping out on March 12th at $8.7 million. If you are a liquidity provider on Uniswap or any Ethereum-based decentralized exchange for that matter, then you enjoyed higher than normal payouts. Curve was another platform that recorded a record volume of over $15 billion during the same period.

In other adoption news: On Thursday, Arbitrum, a layer-2 Ethereum scaling solution, announced a retroactive airdrop to users of its ecosystem giving users 12.75% of the total token supply. The token announcement marks Arbitrum’s transition to a DAO-based governance model with chain ownership of Arbitrum’s general purpose L2s. Chain ownership refers to decisions regarding the chain parameters, sequencing, and verifying nodes, the members of the emergency upgrade Arbitrum Security Council, as well as the “data availability committee” (DAC) for Arbitrum Nitro. Arbitrum is driving value to the protocol by enforcing a stable inflow of builders that pay the protocol for the benefit of settling on its chains. In addition to the DAO announcements, Arbitrum introduced Arbitrum “Orbit,” “a path for launching new chains in the Arbitrum ecosystem” using the proprietary Arbitrum Nitro codebase.

Read More

What has inspired me this week is how well the crypto economy worked while the traditional banking world was being cut off from it and one of the most important stablecoins to the crypto economy was suffering because of it. With the banking system going through its current woes, this has only affirmed why Bitcoin and crypto exist in the first place. I’m less of an extremist on this, however. I personally feel that both systems can co-exist and make each other better. But after what has transpired this week, it’s hard not to think, “Maybe there is something to what these crypto people have been getting at.”

In case you are still concerned with Circle and USDC here is a quick rundown:

- 80%, roughly $33 Billion of their reserves are held at Blackrock via the Circle Reserve Fund registered with the SEC. See the prospectus here.

- Circle’s USDC is audited annually by Deloitte, one of the most trusted professional services firms in the world. From their most recent audit Circle, the rest of USDC’s cash was held at U.S. regulated financial institutions: Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, a division of Flagstar Bank, N.A., Signature Bank, Silicon Valley Bank, and Silvergate Bank.

- Three of those banks can now be crossed off this list, but Circle is not short of banking partners.

- From an interview shortly after the depegging, Circle CEO Jeremy Allaire disclosed that a large portion of the 20% is in process of being moved to BNY Mellon, one of the most trusted banking institutions in the world.

Read More

Financial

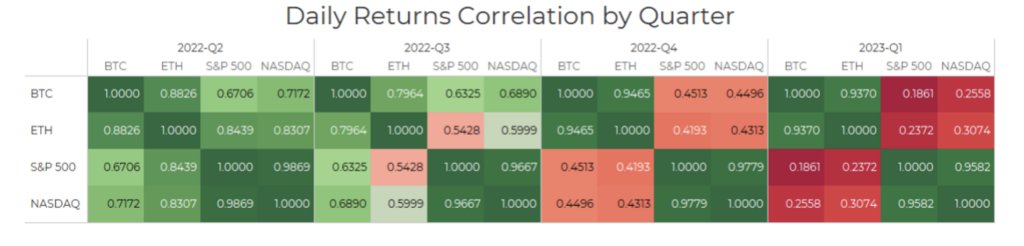

Digital asset markets were up this week as bank crisis concerns rose and declined following the Fed’s press release to backstop SVB and other banks on Sunday. The total industry market cap is now hovering just above $1.1 trillion. The price of Bitcoin (BTC) closed at $25,051.83, up 23.00% on the week, while Ethereum (ETH) closed at $1,677.25, up 16.68% on the week. This is in tandem with traditional markets with the Nasdaq climbing 7%. An important takeaway from this week is the outperformance of Bitcoin relative to Ethereum and other digital assets. The narrative of BTC as a non-sovereign store of value is back in vogue. The Bitcoin network showcased its value as a permissionless, 24/7, global monetary network this week.

Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 and gold both continue to be uncorrelated with Bitcoin by the same metric.

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was relatively flat over the last 7 days, now sitting at $46.49B as of Thursday, March 16th. The top 10 DeFi TVL, verified by Digital Asset Research, this week saw a lot of volatility due to the depegging event of USDC. While DeFi on the Ethereum network didn’t run into any issues, other chains which don’t have a native USDC token and have to use synthetic USDC saw a lot of issues within DeFi protocols and liquidity pools.

Digital Asset Learning

Webinar: 2023 Crypto Tax Landscape

Created By: Arbor Digital and Polygon Advisory Group

Abstract:

Similar to traditional finance, it is important to avoid tax pitfalls that could potentially put you and your wealth at risk and understand the opportunities in an ever-evolving tax landscape.

We understand it can be difficult to grasp the complexities, opportunities, and challenges. Whether you are a crypto power user or an average investor, we invite you to join us to gain an understanding of the current tax landscape.

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.