Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

The past 7 days have continued to be a roller coaster. In this week’s edition there is a lot to go over:

- On-Chain: Bitcoin network growth through Ordinals protocol, Ethereum network growth through Arbitrum token drop, and enterprise use cases.

- Off-Chain: The SEC had a very busy week, the US Economic Report blasts crypto, Coinbase is up and down, and Do Kwon is arrested.

- Financial: Arbitrum sparks DeFi TVL growth, Fed raises IRs a quarter point, and digital assets continue to lead all asset classes in performance for 2023.

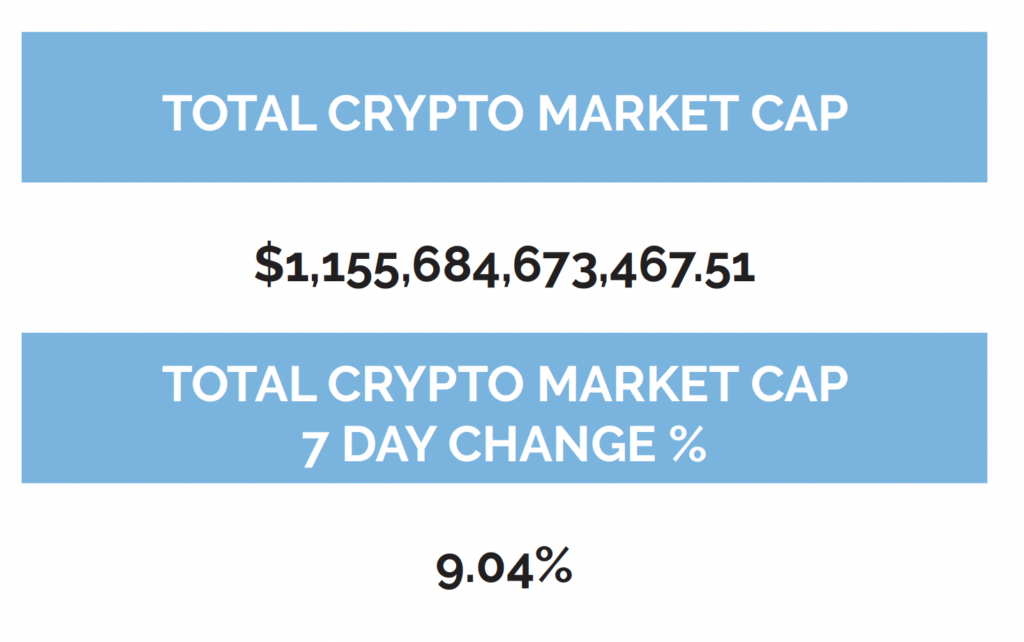

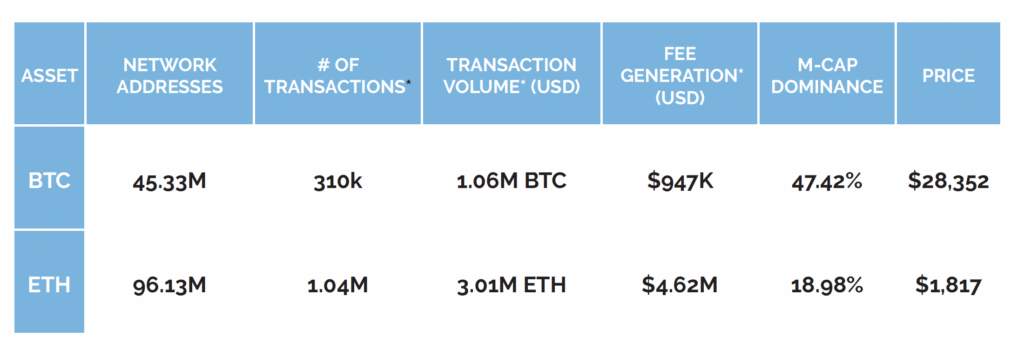

Before that, a run of the numbers.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, March 23rd, 7:00 pm ET

*7-Day Average

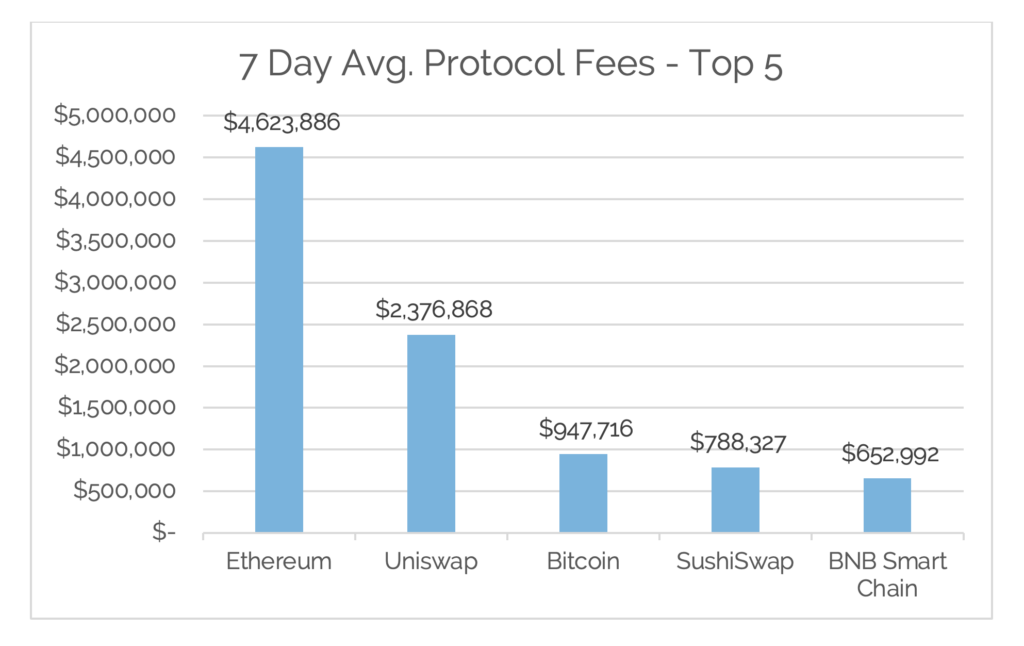

*Source: Cryptofees.info, Thursday, March 23rd, 7:00 pm ET,

*Fees in USD

Week in Review

On-Chain Adoption

The Bitcoin network has hit a new all-time high in network addresses with a balance of BTC bringing the total to 45.33 million network addresses. Daily active addresses continue to stay in a healthy range between 900k and 1 million for the daily average. We saw a large increase to the Daily average transaction volume (BTC) for the week moving from 966k BTC to 1.06m BTC, peaking at 1.31m BTC on Monday, March 30th. 7-Day average Network fees also saw a large increase from last week’s average of $744k to $947k. Continued growth in Bitcoin network adoption can be attributed to two main narratives:

- Bitcoin is a ‘flight to safety’: As the global banking landscape continues to show its flaws, the Bitcoin network’s value proposition has never been stronger. The most secure global monetary network, which operates 24/7 365, that isn’t controlled by any one entity, and is fully transparent and auditable on-demand.

- Digital Collectible NFT groups continue establishing their communities on the Bitcoin network which is driving transaction volumes and fee generation. Since the launch of the Ordinals project in January 2023, over $3.3 million in fees have been paid to put images, text, and even video games on the original blockchain.

On the Ethereum network, roughly 367,000 new network addresses with a balance of ETH were added bringing the total amount to 96.13 million network addresses with a balance, an all-time high. Daily active addresses for the week were relatively flat at 519k. Average daily fees for the week have reverted to more normalized levels at $4.62m, down from $7.58m in the previous week. Transaction volume (ETH) followed suit but are still at elevated levels, reaching a daily average for the week of 3.01m ETH. On the Ethereum network there are multiple narratives at work which can be attributed to it’s network growth:

- Visa working to make smart contracts smarter with self-custodial crypto wallets: Smart Wallets. Remember the term as it may catch as Visa continues it’s push to revolutionize payments with decentralized blockchain technology infrastructure on the back end. Read Visa’s recent report here.

- Luxury Brands like LVMH continue to lead the way with web3 strategies and blockchain adoption. “When you talk about luxury, you are talking about long-term products, repair, and care,” Frank Le Moal, vice-chairman of Aura Blockchain Consortium and LVMH’s CIO, told Decrypt. “Digital passports backed by a blockchain are a way to provide better repair and care services to customers, and to develop a better one-to-one relationship with them.”

- Gaming continues to establish itself as the target indsurty to onboard the next billion users into the crypto economy. Tech giant Sony submitted an NFT-related patent application in September 2021 and publicly outlined its web3 strategy, “Sony’s intentions are to create standardized digital infrastructure that would allow gamers to own and transfer digital NFT assets across various video game platforms.” As of the end of 2022, Sony claimed to have 112 million PlayStation Network users. The network includes online-connected players on the PlayStation 5, as well as older console and handheld hardware.

- Also in Gaming: Polygon and Immutable partner to bring together Polygon’s tech and Immutable’s gaming platform for an Ethereum-centric home for Web3 game developers.

Off-Chain Happenings

US Economic Report

In early 2022 many responsible players in the crypto industry were elated that the white house announced it was tasking regulatory bodies with developing in-depth reports on crypto. We were one of them. Why? If one is being intellectually honest and completely unbiased in their research, it is hard to see how one can not inevitably come to the conclusion that we have. That this new technology represents the next iteration of the internet and financial systems on which the world operates on.

The “Economic Report of the President,” published on Monday, is an annual publication by the Council of Economic Advisers aimed at explaining the president’s economic priorities and policies. The March 2023 issue included an entire chapter on digital assets and “economic principles.” This is also a culmination of the in-depth analysis that was required from the 2022 March announcement.

From Coindesk report Nikhilesh De, “Monday’s report comes amid growing industry concern that federal regulators are looking to de-bank crypto companies, though state and federal regulators have thus far denied these claims. Still, the tone of the report is unlikely to assuage these concerns.” Matthew Homer, a former deputy superintendent with the New York Department of Financial Services, told CoinDesk the report was a “damning indictment of the space that makes [the administration’s] policy position crystal clear.”

Despite listing out these concerns, the report did not delve deeply into recommendations for future regulations or congressional actions that could address the stated risks. The section’s conclusion acknowledged that the underlying distributed ledger technology “may still find productive uses in the future” for both government entities and private companies. The report also acknowledged that “some crypto assets appear to be here to stay,” although it went on to note that “they continue to cause risks for financial markets, investors and consumers.”

So, what should you take away from this?

The crypto industry will fight to stay in the US. Many leaders were of the view that the US could be a hub for technological innovation in this space should they want it. If they understand that, then it is a low probability they regulate it out of the US. Now the US government is taking the clear stance that in its current form, digital asset markets and decentralized blockchain technology, are not ‘worth the squeeze’.

The US is just one of the global players, however. If the US decides it will not participate, everything will move offshore. There are developed economies that are set up to be a safe and regulated space for the industry to flourish and bring to life all the promised benefits.

A Busy Week for the SEC

The SEC was busy this week in the crypto space serving a Wells notice to Coinbase on Wednesday alleging that the company’s staking products constitute unregistered securities. The notice also mentions “aspects of Coinbase’s exchange… and Coinbase Wallet.” More on Coinbase later.

Also on Wednesday, the SEC announced that Tron founder Justin Sun and his companies violated securities laws, accusing him of market manipulation, fraud, and airdropping unregistered securities to investors. In addition to Sun himself, the financial watchdog said it was suing the Tron Foundation, BitTorrent, and Rainberry—three companies owned by Sun. In relation, the SEC also announced it was charging a litany of celebrities for not disclosing they were paid to promote the Tronix and BitTorrent tokens. The celebrities included social media influencer Jake Paul, actress Lindsay Lohan, and pornography actress Michelle “Kendra Lust” Mason to name a few.

Decentralized exchange SushiSwap, and one of its leaders Jared Grey, received a subpoena from the SEC on Tuesday, signaling they could soon be subject to regulatory enforcement action. The organization’s disclosure came in the form of a proposal submitted to the Sushi DAO for the establishment of a legal defense fund to cover potential legal costs.

So, what does all this SEC activity mean?

The SEC is clearly trying to establish itself as the entity to regulate all digital asset markets. There is a turf war happening between other governing entities like the CFTC and state-operating entities like the NYDFS. It also means that there is more certainty that if you are going to operate in the US, either directly or indirectly, you will be subject to the traditional rules currently established, even if you don’t think they apply.

This means that along with the court cases currently in motion like Ripple vs. the SEC and Grayscale vs. the SEC, there are likely many more court cases that will decide the fate of digital asset markets and the industry as a whole. Responsible actors have long been clamoring for regulatory guidance and clarity. How we get it is clear now: in the courts.

Coinbase

This week was up and down for Coinbase. The US-based firm announced its expansion into Brazil this week. In an article from Decrypt.com, “America’s biggest digital asset exchange said Tuesday that it would provide customers in the country with a platform that allows them to buy and sell crypto with Brazilian reais. Customers will also be able to withdraw reais from the exchange by using the Brazilian instant payment platform Pix.”

As we mentioned earlier, however, it also served a Wells notice from the SEC. “Over the past 9 months, Coinbase has met with the SEC more than 30 times, sharing details of our business to build a path to registration,” wrote Paul Grewal, Chief Legal Officer at Coinbase. “During this time, the SEC has given basically zero feedback on what to change, or how to register. Instead, today we received a Wells notice.” Decrypt.com reported, “A person familiar with the matter told Decrypt that Coinbase is “confident it will be able to defend its position in court.” The source also said Coinbase leadership is frustrated that the SEC has allowed American investors to participate in crypto for years before “suddenly deciding to pull the rug out.”

Many are scratching their heads at the SEC’s behavior specific to Coinbase.

- Why did the SEC allow Coinbase to go public on the NASDAQ given that their S-1 form included 57 references to staking?

- Why did the SEC allow them to operate for the last few years and only now bring all their issues to light?

I have a simple answer: FTX and its downfall.

Given everything that is coming to light from the FTX fraud and the intertwining of FTX with politicians and regulators. The reality is that all US regulatory entities took a big black eye from the downfall of FTX. With news of campaign donations, back door deals with regulators on potential legislation, and family connections between Bankman-Fried with Gary Gensler have almost left the SEC with no choice but to choose this path. It almost makes sense. On top of that is the failure and fraud of FTX and Sam Bankman Fried on its own. These two pieces combined make for what the industry is experiencing right now and will have to get through over the next couple of years.

The takeaway here is that Coinbase will be at the forefront of how the digital asset markets and decentralized blockchain industry will be shaped in the future.

Do Kwon Arrested

Terraform Labs co-founder and CEO Do Hyeong Kwon was reportedly arrested Thursday at an airport in Montenegro’s capital city of Podgorica, according to the country’s Minister of Interior, Filip Adzic. Kwon was charged with violating securities law by the Securities and Exchange Commission last month, which accused him of “orchestrating a multi-billion dollar crypto asset securities fraud involving an algorithmic stablecoin and other crypto asset securities.” This is a wonderful message to all who operate in crypto that you can’t hide and you are not exempt from being held accountable for your actions.

Financial

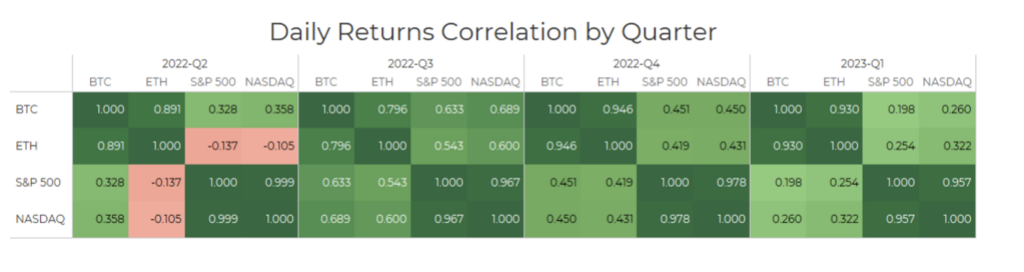

Digital asset markets were up this week with the total industry market cap hovering above $1.2 trillion. The Fed announced a quarter-point hike in interest rates bringing the range to 4.75-5%. Both traditional and digital asset markets were mixed on this news. The price of Bitcoin (BTC) closed at $28,352.95, up 13.18% on the week, while Ethereum (ETH) closed at $1,817.48, up 8.36% on the week. Year to date, BTC is up 68.74%, ETH is up 47.42%. Gold is now significantly positively correlated with Bitcoin when looking at a 30-day rolling correlation, while Ethereum continues to be positively correlated with Bitcoin by the same metric and the S&P 500 continues to be uncorrelated with Bitcoin.

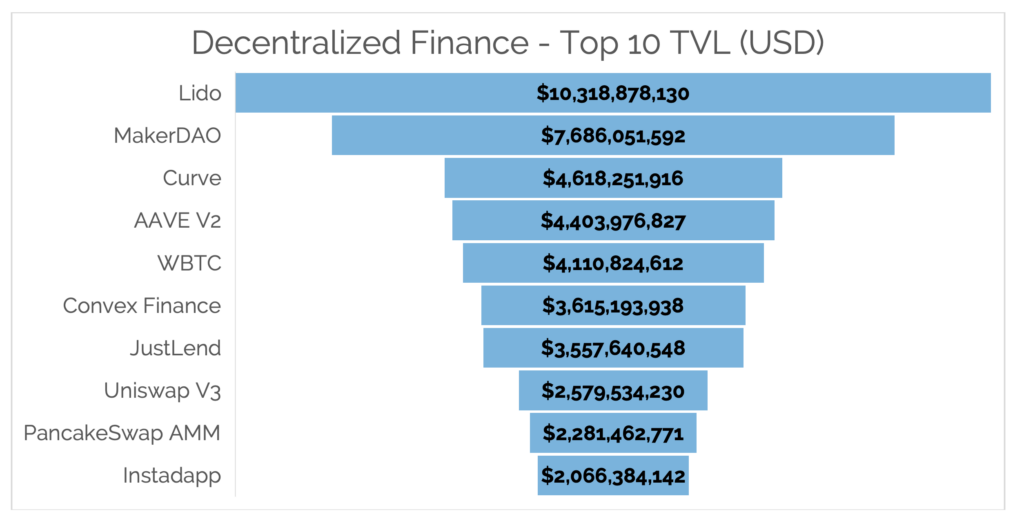

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was up over the last 7 days moving from $46.58b to $49.32b as of Thursday, March 23rd. The top 10 DeFi TVL, verified by Digital Asset Research, did not see much change other than positive price movements from the underlying assets. The big story in DeFi was from Ethereum Layer-2 network Arbitrum’s airdrop. ARB’s token release pushed Arbitrum to record levels in terms of total value locked in DeFi applications. From research partner Intotheblock.com:

- Arbitrum is the only chain within the top 15 listed on DeFi Llama at all-time highs in TVL

- It is also the fastest growing in the last week, with Uniswap and Aave being some of the largest benefactors, recording a 70% and 50% weekly increase in TVL on Arbitrum respectively.

- 1% of the total ARB supply (worth ~$150M) was also allocated to 100+ projects building on Arbitrum, leading to speculation that some of these funds could be used as incentives to attract users now that all eyes are on Arbitrum.

Although it is yet to be seen if Arbitrum can keep up its momentum, it is clear that competing layer 2 networks will try to bring users their way.

Digital Asset Learning<

Webinar: 2023 Crypto Tax Landscape

Created By: Arbor Digital and Polygon Advisory Group

Abstract: Similar to traditional finance, it is important to avoid tax pitfalls that could potentially put you and your wealth at risk and understand the opportunities in an ever-evolving tax landscape. We understand it can be difficult to grasp the complexities, opportunities, and challenges. Whether you are a crypto power user or an average investor, we invite you to join us to gain an understanding of the current tax landscape.

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.