Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

BTC has broken through $30k and ETH has broken through $2k this week reigniting investors’ appetite for digital assets The 2023 tax deadline is this coming Monday, April 18th. Investors who engage in digital assets have questions about reporting and executing tax strategies in 2022.

- Are your clients asking questions about investing in digital assets?

- Do you need a trusted partner who can help answer crypto-specific questions and help investors make disciplined decisions when investing?

- Do you find it hard to keep up with the crypto industry?

- Are your clients asking how to take advantage of crypto losses for the 2022 tax year?

Arbor Digital is here to serve. As dedicated specialists in digital assets who live and breathe in this space, we provide solutions for financial advisors and wealth managers across the US to be able to serve clients who either already invest or plan to invest in digital assets.

To learn more and see a demo of how we serve you can schedule time with us at the link below.

Disclaimer: We are not tax professionals. To provide crypto tax services Arbor Digital has a partnership with Polygon Advisory, who are practicing CPAs to serve clients and all of their crypto tax needs.

Please be sure to view our recent webinar where Arbor Digital and Polygon Advisory dive into the Crypto Tax Landscape for 2022

Now, a run of the numbers.

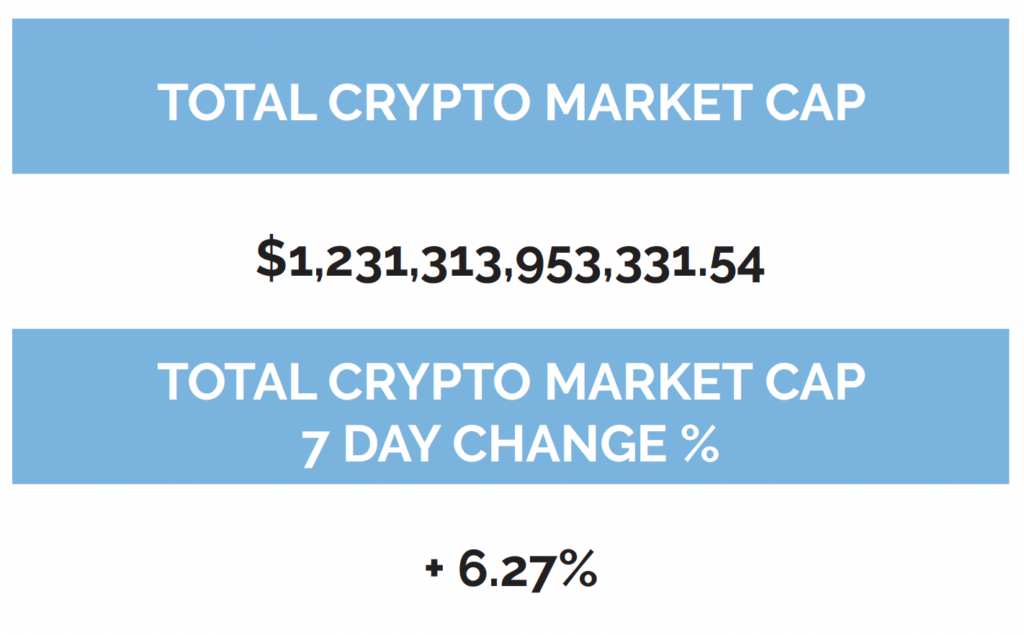

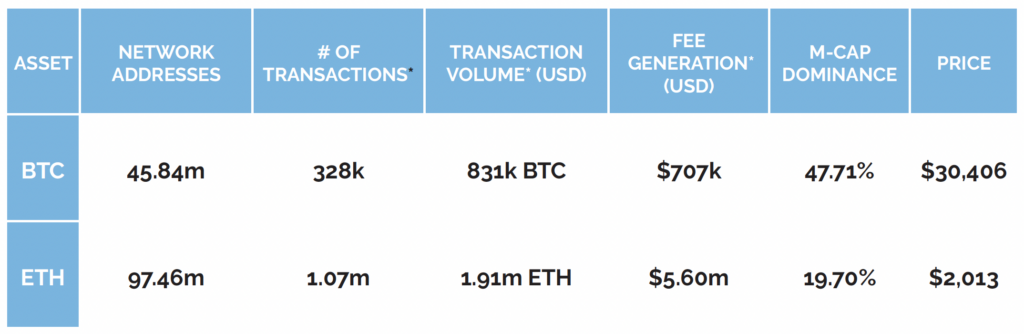

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, April 13thth, 7:00pm ET

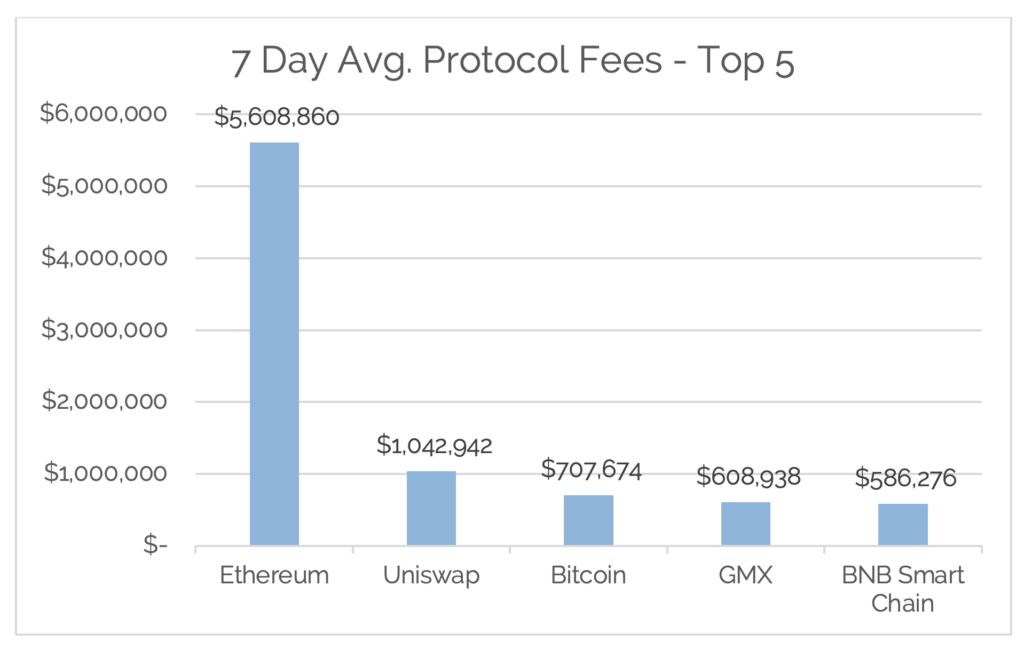

*7-Day Average

*Source: Cryptofees.info, Thursday, April 13th, 7:00pm ET

*Fees in USD

Week in Review

On-Chain Adoption

The Bitcoin network hit a new all-time high in network addresses with a balance of BTC on April 8th, 2023 at 46.02 million, since then we have seen a small decline to today, sitting at 45.84 million network addresses. Daily active addresses continue to stay in a healthy range between 900k and 1 million for the daily average. The daily average transaction volume (BTC) for the week has come down from its elevated levels above 1 million BTC to start the year and finding a new foundation at 831k BTC. In connection, 7-Day average Network fees continue to stay in line coming down slightly from their elevated levels at $707k for the week. As we mentioned in our March 31st edition, Bitcoin’s hash rate has consistently increased in 2023 and has been consistently elevated between then and now averaging roughly 350 EH/s. Increasing hash power means that miners are deploying more ASICs and may signify medium-term bullishness for the future.

The Bitcoin network continues to shine, and Bitcoin the crypto asset continues to showcase itself as a safe haven asset within the crypto economy. The explosion of NFTs on the Bitcoin network continues to lead adoption numbers. The primary difference between NFTs on a smart contract-enabled blockchain and Bitcoin Ordinals is that the latter is stored completely on-chain. Ethereum NFTs often point to a centralized server or a decentralized storage provider to host the NFT’s metadata and are therefore prone to losing the contents of the NFT if the storage provider were to ever go down or discontinue service. Bitcoin Ordinals will remain fully intact for as long as the Bitcoin Network is running. Bitcoin blocks can only hold a maximum of 4MB of data post-Taproot, thus limiting the size of inscriptions. However, one of Bitcoin’s core value propositions is the minimal hardware requirements to run a full node, and inscribing text, images, videos, and other data could increase the storage requirements if Ordinals remain popular.

As we wrote in a previous edition, the amount of Bitcoin that hasn’t moved in at least 1 year is near all-time highs and the number of Bitcoin held on centralized exchanges, like Coinbase or Gemini, continues to hover at multi-year lows. This implies that many holders remain highly convicted despite the bear market and users are becoming more aware of the importance of self-custody to avoid any counterparty risks.

On the Ethereum network, roughly 350k new network addresses with a balance of ETH were added this week and last week, bringing the total amount to 97.46 million network addresses with a balance, an all-time high. Daily active addresses for the week were relatively flat at 514k. Average daily fees for the week continue to stay in their new normal range for 2023 averaging between $4.00m and $6.00m, with this week posting a 7-day average of $5.60m. Transaction volume (ETH) decreased, reaching a daily average for the week of 1.91m ETH. On the Ethereum network this week was the Shanghai

Ethereum’s Shanghai upgrade, also known as Shapella, officially went live on April 12th. Users who have staked their ETH to secure and validate transactions on the Ethereum blockchain are now able to withdraw. Shortly after its completion, withdrawals were processed for about 5,413 ETH ($10 million worth), according to beaconcha.in. It was anticipated that this upgrade would put severe selling pressure on ETH, which hasn’t been the case, so far. It makes sense considering the prolonged crypto winter has put all crypto entities under financial pressure. Bills need to be paid and there is a lot of staked ETH. As we wrote previously, we feel that this is overblown as there are systematic processes in place to ensure there is no shock to the Ethereum ecosystem. Also from a behavioral standpoint, with the full transition to Proof of Stake complete, there is still high demand for staking services.

Similar to the Merge event last year, the upgrade overall went very smoothly. We like to highlight what we aren’t talking about which are things like: “Ethereum network crashes trying to implement upgrade.” These are engineering feats that need to be celebrated. While staked ETH withdrawals garnered all of the attention, it’s important to note of a few other EIPs that will improve gas fees for developers to be mindful of that came with the recent upgrade:

- EIP-3651: This accesses the “COINBASE” address, a software used by validators (no connection to the popular exchange), at a lower gas cost. This code change to the blockchain could improve Maximal Extractable Value (MEV) payments for users.

- EIP-3855: This enables “Push0,” a code that will lower gas costs for developers.

- EIP-3860: This caps gas costs for developers if they use “initcode” (a code used by developers for smart contracts).

- EIP-6049: This will notify developers of the depreciation of a code known as “SELFDESTRUCT,” which also reduces gas fees.

Read More

Off-Chain Happenings

Mastercard Drops Free Music Pass NFTs With Perks for Holders

From Decrypt: Payments processing firm Mastercard debuted a free Music Pass NFT drop this week amid the annual NFT NYC conference, offering collectors a number of benefits ahead for holding the token. The digital collectible is a part of the Mastercard Artist Accelerator program launched in January. The Mastercard Music Pass NFT can be minted for free until the end of April. The drop is taking place on Polygon, an Ethereum scaling network that has also been adopted by brands including Starbucks, Nike, and Reddit for various Web3 initiatives.

“If you think about it, it only makes sense to unlock a Web3-centered program with a Web3 technology,” Raja Rajamannar, Mastercard’s Chief Marketing and Communications Officer, told Decrypt. He added that the accelerator program is “designed to deepen the experience for the music and Web3 enthusiasts.”

eToro Announces Crypto, Stock Trading Integration With Twitter

From Decrypt.com: Stock and (maybe?) crypto trading is coming to Twitter via a new partnership with eToro. Users can now make use of eToro’s market charts on a range of financial investments, simply by searching for the relevant “cashtag,” usually by putting a “$” sign in front of the ticker, like “$TSLA” for Tesla stock. Despite reports that the integration would also include cryptocurrencies, such as Bitcoin, Ethereum, and Dogecoin, the social media platform has yet to deliver. Nothing appears when searching for a variety of crypto cashtags on the platform. An eToro representative told Decrypt via email that they were “having the same issue” when searching the BTC cashtag. “We are checking this with Twitter so hopefully it will be resolved soon,” they said.

Uniswap Wallet Goes Live on iOS After Apple App Store Challenges

From Yahoo Finance: Uniswap Labs, the crypto firm behind the DeFi trading platform Uniswap, has secured a spot in Apple’s App Store for their Wallet app. The Uniswap Wallet iOS app is now live for users in the U.S. and other select countries, the company announced Tuesday. “Apple approved the wallet for use in several countries throughout the world. We’ll continue to launch in other countries as soon as Apple lets us,” the announcement reads.

The Uniswap Wallet allows users to trade crypto assets on Ethereum’s mainnet as well as on Polygon, Arbitrum, and Optimism. It also lets users buy crypto, see NFTdetails (but not trade them), select “favorite” tokens and wallet addresses, and explore different cryptocurrencies

Why does all this matter?

The merge of the technology underpinning crypto-assets continues to take shape via the traditional companies initiatives listed above. These aren’t privately developed and controlled centralized blockchain, this is all utilizing the decentralized blockchain infrastructure, to which some have crypto-assets attached to them. While it’s scary to see all of the enforcement actions and live through this regulatory uncertainty, the innovation isn’t stopping. The target of those enforcement actions are not the disciplined actors like Arbor Digital and the companies above. The targets are the fraudsters, scam artists, and bad faith actors, to which we say, “Get ‘em out.”

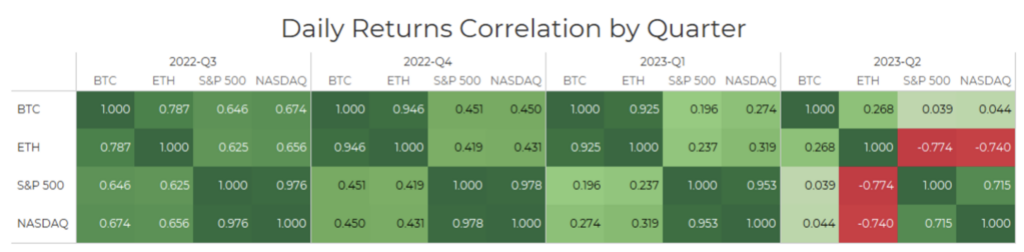

Financial

Digital asset markets were up this week with the total industry market cap hovering above $1.3 trillion. The price of Bitcoin (BTC) closed at $30,406.79, up 8.39% on the week, while Ethereum (ETH) closed at $2,013.97, up 7.51% on the week. Bitcoin and Ethereum both continue to post significant positive returns when looking across the last 30 days, with Bitcoin up 20.85% and Ethereum rising 16.70% in that period.

Year to date, BTC is up 82.06%, ETH is up 72.73%.

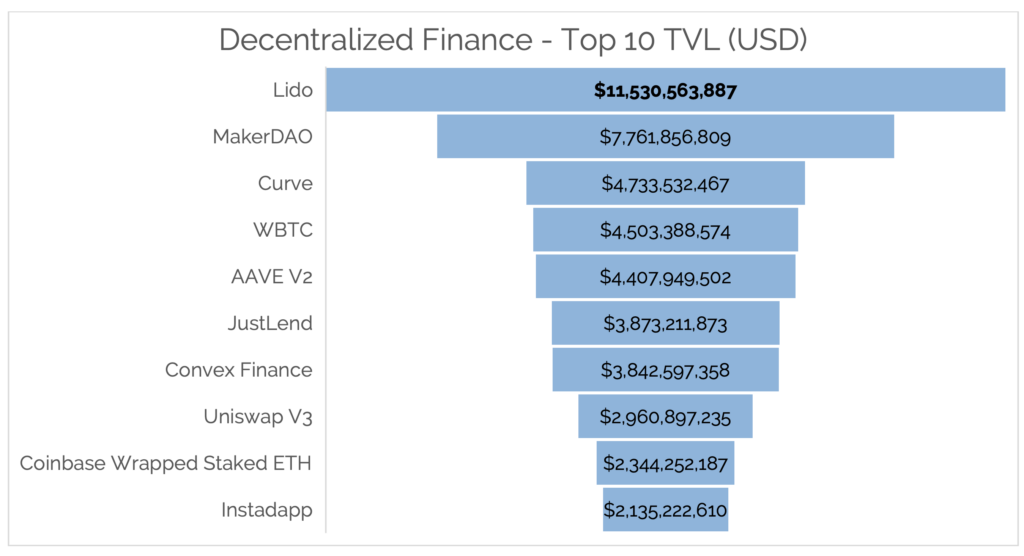

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) continued its recent upward trend, in line with the upwards price movements, coming in around the $51.25b as of Thursday, April13th. The top 10 DeFi TVL, verified by Digital Asset Research, saw staked ETH continue to hit all-time highs through Lido and Coinbase in anticipation even after the Shanghai upgrade.

Digital Asset Learning:

Annual Report: a16z State of Crypto 2023

Created By: a16z

Abstract: Emerging technologies evolve in cycles; in crypto, this includes periods of high activity, followed by so-called crypto winters. In the period marked by our now-annual State of Crypto report, it would be easy for a casual observer to overlook the rapid progress the crypto industry is making. Major infrastructure improvements like The Merge – a momentous achievement in decentralized and open source development – simply don’t make headlines as often as high-profile bankruptcies, busts, and flameouts.

Our 2023 report aims to address the imbalance between the noise of fleeting price movements – and the data that tracks the signals that matter, including the durable progress of web3 technology. Overall, the report reflects a healthier industry than market prices may indicate, and a steady cycle of development, product launches, and ongoing innovation.

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

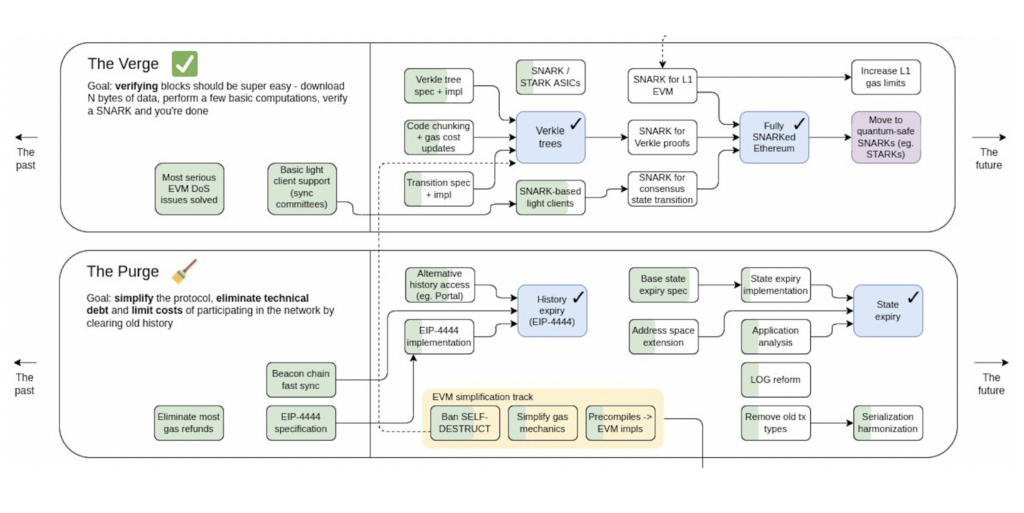

Next up for Ethereum is Part 3 of the Ethereum Road Map: The Verge and The Purge. More on that next week.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.