Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

This past Thursday, the SEC warned financial advisers in the US that they need to know crypto before recommending to clients. The Financial Advisor community has made great progress in leveling up their knowledge of decentralized blockchain tech and tokens that accompany some of them. The SEC, however, is placing a heavy burden on adviser teams.

Living and breathing in this industry since November 2020 on behalf of clients and advisers, we have learned that it is not enough to do the work to get current. It takes even more energy and effort to stay current on an industry that operates 365 days a year, 24 hours a day, and 7 days a week. The speed at which this industry evolves is whipsawing.

Two ways we have seen advisers truthfully deliver on this burden.

- Building an internal team or committee dedicated to crypto.

- Utilizing a trusted 3rd party dedicated to crypto.

While we do consult with adviser teams to help them execute on #1, our firm is specifically dedicated to #2. We live and breath in this space so other advisers can focus on what they do best, which is stewarding individuals and families in living the life they want to live through sound financial decision making over their life cycle. To learn more about us and how we deliver for clients, be sure to book some time with us below.

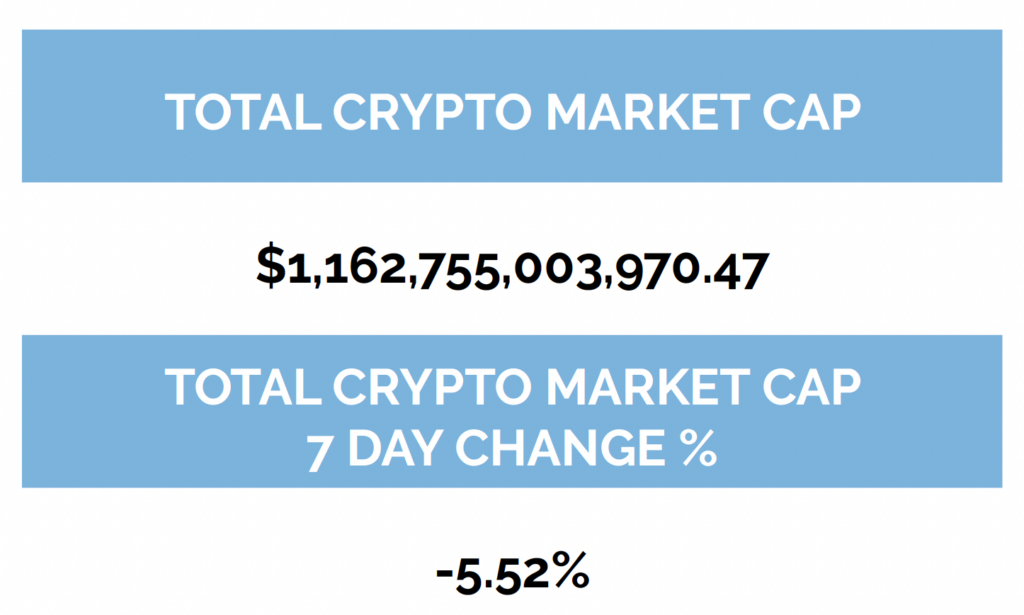

Before diving into this week’s content, a run of the numbers.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, April 20th, 7:00pm ET

*7-Day Average

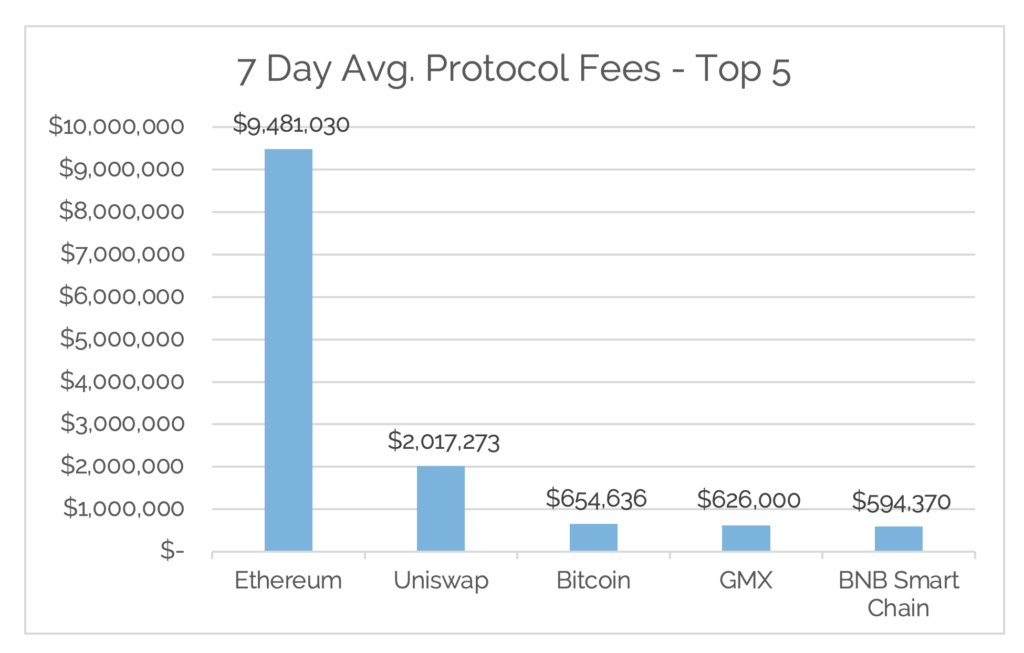

*Source: Cryptofees.info, Thursday, April 20th, 7:00 pm ET

*Fees in USD

Week in Review

On-Chain Adoption

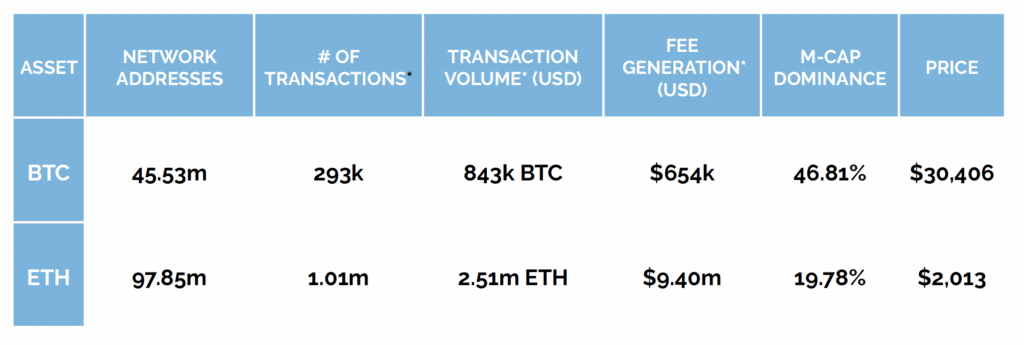

The Bitcoin network saw a decline of roughly 300k network addresses with a balance of BTC bringing the total to 45.53 million network addresses. This brings the year-to-date growth of network addresses to 4%, or roughly 2 million. Daily active addresses continue to stay in a healthy range between 900k and 1 million for the daily average. The daily average transaction volume (BTC) for the week was flat at 848k BTC. 7-Day average Network fees this week came in at $654k and continue to stay elevated from where they started at the beginning of the year.

BIP 324 is a long-standing Bitcoin Improvement Proposal to encrypt traffic between nodes on the Bitcoin network that is nearing completion. The purpose of this improvement is to combat large entities like governments and Internet Service Providers (ISPs) who could use the weakness of unencrypted traffic to wage “man in the middle” attacks on Bitcoin nodes. This makes network metadata, like the location a transaction is coming from, more private, making it harder for snoops to spy on what users are doing.

Why is this important? Censorship resistance. The Bitcoin network was designed to be censorship resistant so anyone can freely transact on the network from anywhere in the world at any point in time in the most secure way possible. In our view, censorship resistance is a spectrum, there are times and situations when it would be in the best interest of humanity to be able to censor some transactions, like human trafficking. Either way, this proposal is important to the future of the Bitcoin networks existence.

On the Ethereum network, roughly 300k new network addresses with a balance of ETH were added this week and last week, bringing the total amount to 97.85 million network addresses, an all-time high. Daily active addresses for the week were down roughly 20% at 428k. Average daily fees for the week skyrocket to over $9 million, more on this below. Transaction volume (ETH) increased, reaching a daily average for the week of 2.51m ETH, peaking at 3.58m ETH on Wednesday.

So why the skyrocketing fees? Gas costs.

For a quick TDLR of Gas: From MetaMask, ”The Ethereum network requires gas to execute transactions. When you send tokens, interact with a contract, send ETH, or do anything else on the Ethereum blockchain, you must pay for that computation. That payment is calculated in gas, and gas is always paid in ETH. The price of gas is dynamic and is essentially a product of demand: the more people that are trying to get their transactions processed by the network, the higher it will be.”

So what caused Gas prices to skyrocket?

From on-chain data partner intotheblock.com: A new meme coin, PEPE, rallied 1,000,000% within just five days. This led to a wave of new meme coins and derivative projects becoming some of the most traded pools in DeFi. The amount of speculation is reflected on Ethereum gas fees, which on Wednesday reached their highest since May 2022, and Uniswap consuming 10x more gas than OpenSea this week. Suffice to say, these levels did not persist, and we expect next week’s fees to come down to reflect this.

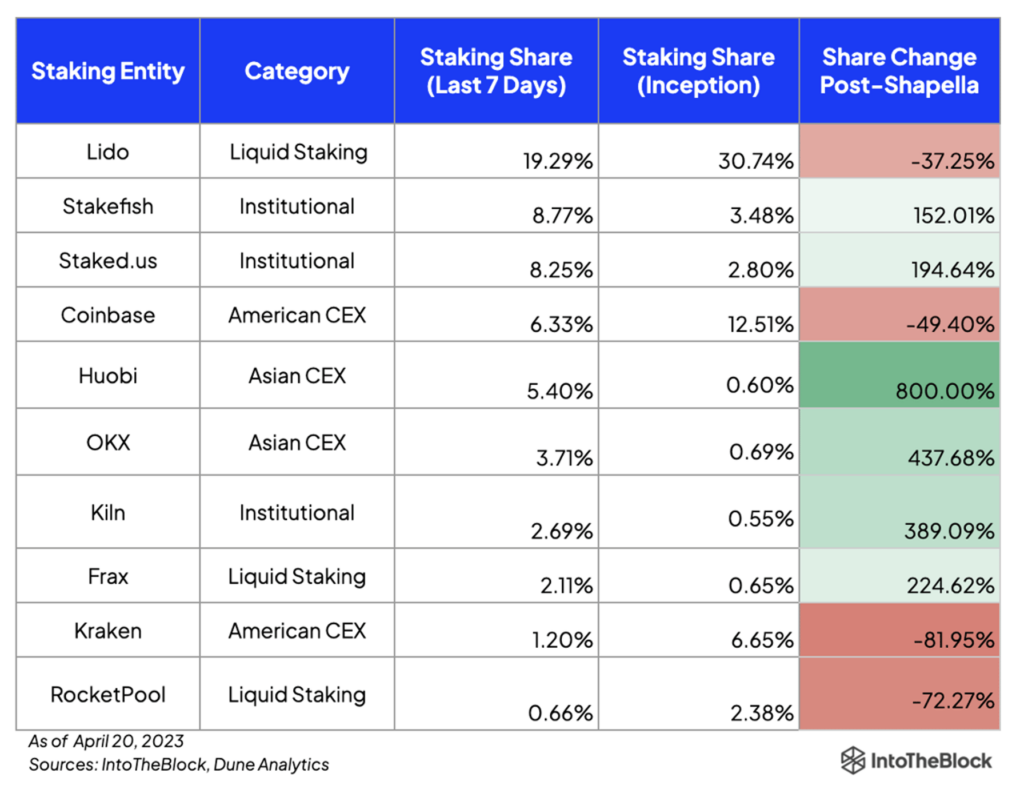

Following the Ethereum Shapella upgrade, withdrawals from the staking contract have begun. Approximately 1.37M ETH have been withdrawn so far, while 650k ETH were also deposited, making net withdrawals of 720k ETH. Which is severely muted compared to what some were predicting. Interestingly, the share of deposits by staking providers has changed significantly since the upgrade — and perhaps not in the way most expected.

More from intotheblock.com:

Liquid Staking Derivatives (LSDs) share of new staking deposits has lagged relative to their historical numbers.

- Lido has still been the largest staking entity over the past week, but with a deposit share 37% lower than its market share since its inception

- RocketPool’s share of deposits dropped even more drastically (by 72%), though it did just go through an upgrade on April 18, which enables users to host a validator with only 8 ETH (down from 16 ETH previously)

- Frax, on the other hand, recorded an increase of 225% on their share of deposits, making it the 8th largest staking entity over the past week

Institutional Staking & Asian CEXs Benefit from American CEXs’ Woes

- Institutional staking services such as Stakefish and Staked.us have seen their deposit share grow upwards of 150% relative to their historical numbers, likely as many of their institutional depositors were awaiting for withdrawals to be enabled to mitigate the risk of having their capital locked

- The real winners have been Asian exchanges, with Huobi and OKX recording an increase of 800% and 438% respectively

- Finally, as expected Coinbase and Kraken took a hit on their staking services, with their share of deposits dropping by 49% and 82% following pressure from American regulators in the last few months.

Despite Lido’s deposit share decreasing, it’s continued growth has led stETH to a market cap of over $12 billion for the first time.

- stETH supply increased by 127k ETH over the past seven days

- It’s supply has grown by 76% over the past year, and 24x from two years ago

This has led stETH to become the eighth largest crypto-asset by market cap

Off-Chain Happenings

Nike Drops First Digital Creation Selection on .Swoosh

On Tuesday, April 18th, Nike, yes that Nike, dropped its “first digital-creation collection” on .Swoosh, the blockchain-powered platform Nike announced late last year. Consumers will be able to buy digital images of virtual show boxes for $19.82, the company said. Each box will eventually unlock various digital versions of Nike’s “iconic Air Force 1” sneakers, which were first sold in … 1982

Nike said it will give every one of its more than 330,000 .Swoosh members an opportunity to buy one of the digital boxes. If the company sells at least one box to each one of its members Nike could generate more than $6.5 million in revenue.

This is technically an on-chain happening but done by a traditionally off-chain company and brand. The merge continues!

Starbucks brews a new NFT collection on Polygon

From TheBlock.com: On Wednesday, April 19th, Starbucks is launched another NFT collection on the Polygon network. The world’s largest coffeehouse chain’s new “The Starbucks First Store Collection” features art that recalls the company’s first location, which opened in 1971 in Seattle’s Pike Place Market. “People from all over the map come to see this historic landmark for themselves, experiencing a sense of nostalgia and being part of something bigger,” Starbucks said in its sales pitch on the Nifty Gateway NFT marketplace. “With the Starbucks First Store Collection, you can own a piece of history.”

5,000 “The First Store Collection Stamps” went on sale on Wednesday, each priced at $100. Those who own two or more unique “Journey Stamps,” Starbucks’ previous foray into NFTs, got early access to the First Store collection at 9 a.m. PDT. The general sale started at noon PDT, and there was a limit of one stamp per person for all collectors.

Starbucks is showcasing how it is using decentralized blockchain tech to engage on a deeper level with consumers and the next generation of digital native consumers. Same as Nike, this is technically an on-chain happening but done by a traditionally off-chain company and brand. The merge continues!

Coinbase Preparing

Given the current US regulatory environment, more on that below, Coinbase was busy this week. On Wednesday, April 19th, Coinbase announced they received a license to operate in Bermuda and is looking to launch an offshore derivatives exchange. We wrote about this a few weeks ago that there is a gap from FTX in terms of services. Coinbase is more than happy to come help fill that gap. Coinbase isn’t the only one as Gemini continues to explore their own offer.

Coinbase this week also continued to be very vocal about its willingness to move operations offshore as the regulatory landscape evolves globally. The EU just passed historical crypto regulation and is quickly positioning itself to get ahead of the US to attract players like Coinbase.

Whether the US wants to be involved or not, on a global scale, decentralized blockchain tech is being adopted and used in the world. The US must decide if they want to be a leader or a follower. This fact cannot be overstated to those in the US who view the space through a very small US-centric lens.

European Union’s landmark crypto regulation passes parliamentary vote.

From TheBlock: The European Union officially passed its Markets in Crypto Assets (MiCA) regulation after lawmakers in the European Parliament approved the rules. Policymakers finalized the crypto regulation, which they hope will be a “global standard-setter” and a magnet for digital asset businesses. MiCA focuses on the centralized points of the crypto industry and provides clarity over the scope and definitions of crypto regulation. The landmark legislation has divided opinion across the crypto space and traditional regulatory landscape while also attracting the attention of jurisdictions that have yet to legislate.

Crypto Asset Service Providers have more clarity under MiCA. If a firm has a license in one EU member state, it now legally has access to the whole EU market. Moreover, traditional finance firms can now choose licensed partners to work with when developing their crypto solutions. The closest thing the crypto industry has to certainty is MiCA in Europe, Curtis Ting, Senior Managing Director for Global Operations at crypto exchange Kraken, told The Block. It offers clarity, but it’s not a definitive regulation, he noted. Ting said there likely won’t be a flight to Europe by crypto firms, saying what Europe leads, the U.S. will help to define.

While this is a big step forward, it will be some time before this manifests in terms of adoption and price action. This is an opportunity for those who want to engage in markets prior to that manifestation.

The House Financial Services Committee Unveils Stablecoin Legislation

From CoinDesk: In short, the bill would create categories of stablecoin issuers, whether they’re banks or nonbank entities; push for a temporary ban on algorithmic stablecoins, and call for a study of the potential impact from a central bank digital currency.

The stablecoin bill has long been rumored as a piece of bipartisan legislation with genuine support from Reps. Maxine Waters (D-Calif.) and Patrick McHenry (R-N.C.), then the chair and ranking member of the House Financial Services Committee (they swapped titles after Republicans secured a majority in the House of Representatives). Especially coming after last year’s terraUSD collapse, the bill seemed to have momentum and interest while focusing on a specific subsector within the broader crypto industry.

For a full breakdown, be sure to read the linked CoinDesk article. This is significant due to the implications of the crypto industry’s future in the US. Stablecoins are an integral piece to the crypto economy. Especially for those developers who work in the US and are paid in stablecoins like USDC. The legislation, as it currently stands, would most likely position Circle’s stablecoin to be the dominant US dollar-backed stablecoin in the US. For others, like Tether, this would severely diminish their ability to flow through the US. But why pass stablecoin legislation in the US if there is no future for crypto here?

Gensler grilled by Republicans over SEC’s approach to cryptocurrencies.

On Tuesday, April 18th, Gary Gensler appeared before the House Financial Services Committee to answer questions from representatives on a wide range of topics, one of them being how the SEC is handling the regulation of digital assets. Gensler faced criticism from the outset of the hearing when the committee’s chairman questioned him about whether he views the cryptocurrency with the second-largest market capitalization, ether, as a security. Gensler responded with previous statements about the number of digital asset projects and tokens in violation of securities law.

“I’ve never seen a field that’s so non-compliant with laws written by Congress and affirmed over and over by the courts,” as digital assets, Gensler said. “We talk to the crypto firms about tokens and how they can register.” Chair Patrick McHenry grew exasperated with Gensler after repeatedly attempting to get him to weigh in on whether ether is a security or commodity. “Give me a break, come on,” said McHenry. “There’s a lack of clarity here, can you at least agree with that?” Gensler replied that securities laws are clear and that the SEC enforces securities laws that require disclosures to investors on investment vehicles.

Considering this section, as well as the other sections, what became clear was that the SEC itself isn’t consistent in its approach to all regulation, not just crypto. Cracks in its logic, or lack thereof, were shown consistently throughout the hearing. This is what has disciplined, good-faith builders within the US crypto industry so frustrated. The competition between regulatory agencies was also apparent. Considering all these agencies exist to help the everyday person, it is frustrating that our agencies can’t collaborate and come to an agreement.

Regardless of if the crypto industry likes it or not, meaningful clarity will mainly come from the court battles currently underway, as well as any future ones to come.

Financial

Digital asset markets were down this week with the total industry market cap hovering above $1.2 trillion. The price of Bitcoin (BTC) closed at $28,248, down 7.10% on the week, while Ethereum (ETH) closed at $1,943, down 3.52% on the week.

Year to date, BTC is up 68.89%, ETH is up 59.03%.

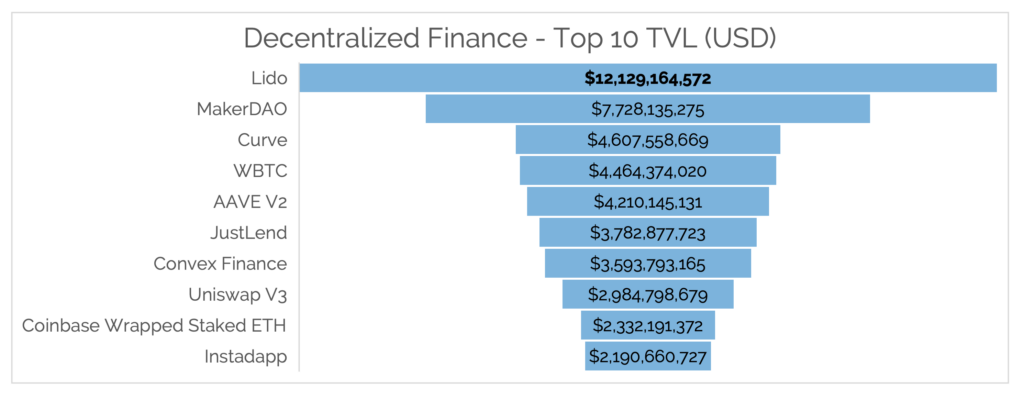

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was down slightly, mostly due to stETH dominant performance this week, coming in at $50.84b as of Thursday, April20th. The top 10 DeFi TVL, verified by Digital Asset Research, saw staked ETH across the globe continue it’s DeFi dominance.

Digital Asset Learning:

Annual Report: a16z State of Crypto 2023

Created By: a16z

Abstract: Emerging technologies evolve in cycles; in crypto, this includes periods of high activity, followed by so-called crypto winters. In the period marked by our now-annual State of Crypto report, it would be easy for a casual observer to overlook the rapid progress the crypto industry is making. Major infrastructure improvements like The Merge – a momentous achievement in decentralized and open source development – simply don’t make headlines as often as high-profile bankruptcies, busts, and flameouts.

Our 2023 report aims to address the imbalance between the noise of fleeting price movements – and the data that tracks the signals that matter, including the durable progress of web3 technology. Overall, the report reflects a healthier industry than market prices may indicate, and a steady cycle of development, product launches, and ongoing innovation.

Crypto Security Alert

Source: CoinDesk

There’s reportedly been a nasty bug going around OG crypto holders, notably affecting one of the most critical parts of Web3 infrastructure: the MetaMask wallet. Over 5,000 ether (ETH) worth about $10.5 million have been stolen from crypto veterans using a variety of non-custodial wallets since December, crypto-skeptical news site Protos reported, citing an informal investigation done by MyCrypto founder Taylor Monahan. The attack is widespread, affecting keys created between 2014 and 2022 and at least 11 blockchains, according to Tay’s preliminary investigation. Monahan’s on-chain sleuthing has found the unexplained vulnerability may impact “all wallets,” including but not limited to MetaMask.

It appears that developers at ConsenSys, the private blockchain software firm that’s built much of Ethereum’s open-source tooling, including the MetaMask wallet and Infura application toolkit, are investigating the exploit, which appears to be “deliberately” targeting people who should know the ins and outs of crypto self-custody and security.

What to do:

- Never store your private key or secret recovery phrase anywhere online, always write it down somewhere and keep it safe.

- Get and use a hardware wallet, but just like with MetaMask, don’t store your private key or secret recovery phrase anywhere online (or realistically, in any internet-enabled device).

- If you ever get to the point where your wallet is so old that you can’t remember if you’ve been always 100% diligent with its keys, then consider creating a new wallet (which means a new secret recovery phrase, not a new account) and migrating your funds there.

- Perform regular security checks and audits to ensure that you’re up to speed with the best security practices and just as [Monahan] mentioned, consider splitting up your assets across multiple recovery phrases, and using hardware wallets.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.