Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

Blockchains and digital assets are transforming financial markets, with major banks and financial institutions actively:

- Investing in this emerging asset class to diversify their portfolios.

- Moving operations on-chain to access deep liquidity for previously illiquid assets, reduce costs via automated workflows, and manage risk.

- Critical to the success of on-chain financial markets are high-quality data and secure infrastructure.

Arbor Digital is proud to join Chainlink Labs on Wednesday, May 31st at 11:00 am ET to dive into these pieces and more on a live webinar. Get your most pressing questions answered by responsible leaders in the space:

- Erin Friez, Co-Founder and COO, Digital Asset Research

- Matthew Kolesky, Co-Founder, Arbor Digital

- Shawn Creighton, Director of Index Derivatives, FTSE Russell, An LSEG Business

- William Herkelrath, Managing Director, Chainlink Labs

This webinar is designed for business and technical leaders at the intersection of traditional finance and blockchain technology. You will learn from finance and blockchain experts about innovative use cases and critical strategies your organization can leverage when building its digital asset strategy.

Now, a run of the numbers.

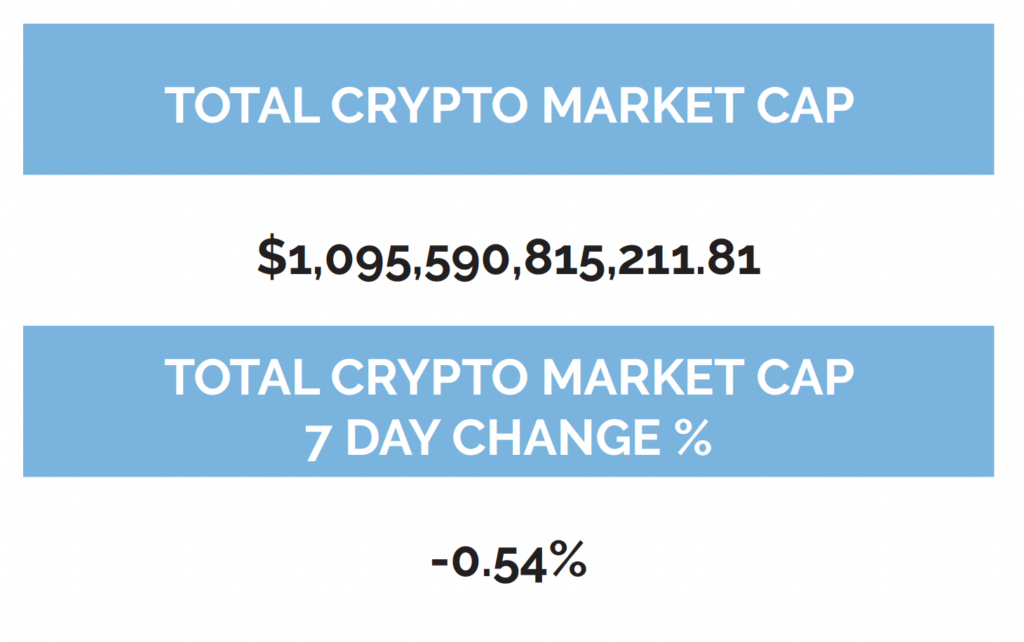

Run of the Numbers Sponsored by Digital Asset Research

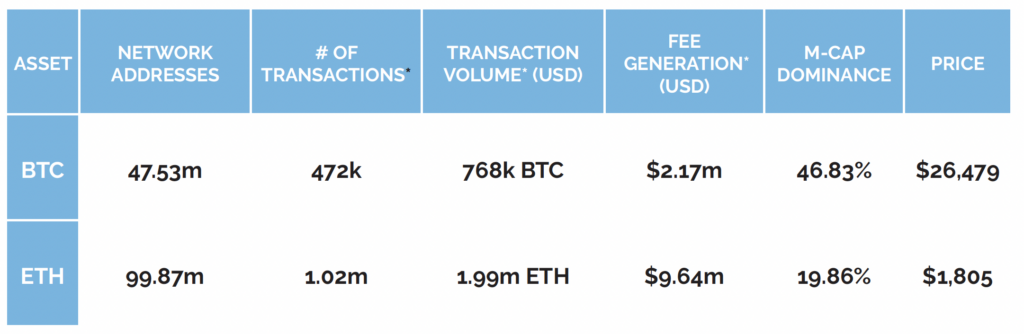

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, May 25th, 7:00pm ET

*7-Day Average

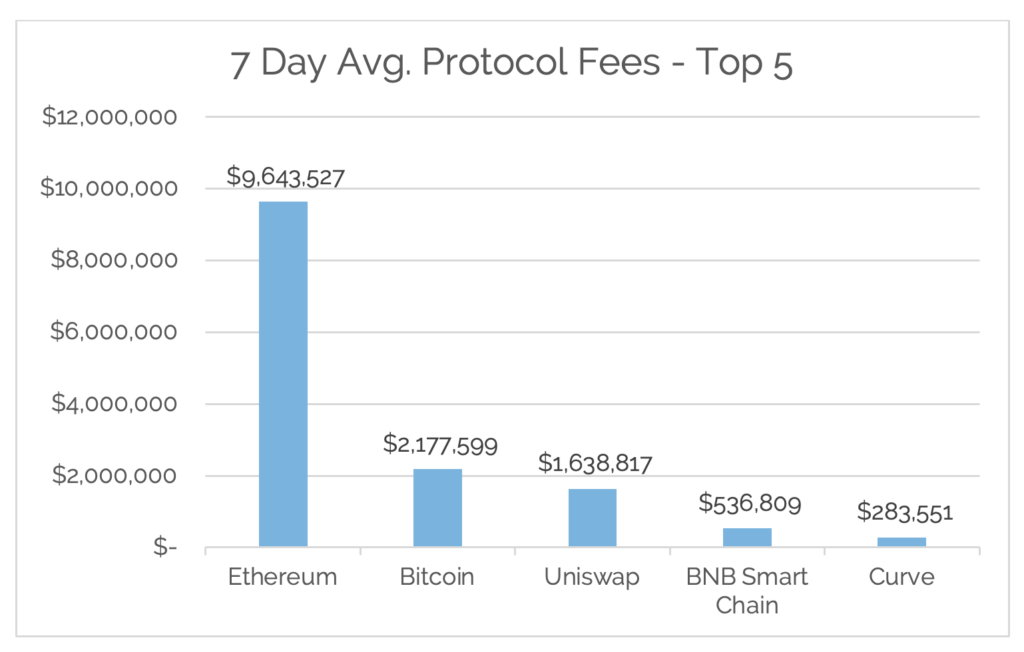

*Source: Cryptofees.info, Thursday, May 25th, 7:00 pm ET

*Fees in USD

Week in Review

On-Chain Adoption

The Bitcoin network saw an increase of 400k network addresses with a balance of BTC bringing the total to 47.10 million network addresses, a new all-time high. Daily average active addresses continue to stay in a healthy range between 750k and 900k. The daily average transaction volume (BTC) for the week was flat for the week at 755k BTC. 7-Day average Network fees started moving down towards normal levels, but are still elevated relative to historical averages, coming in at $2.19m.

Hot off Bitcoin Miami there is much to look forward to in Bitcoin world. OP_VAULT is a proposed vault mechanism for Bitcoin that would allow users to create additional protection for their bitcoin, on the blockchain itself. Why is this important? If this goes through, holding your private keys in self-custody will become significantly safer. For the first time in Bitcoin’s history, users will be able to intervene in case of a security breach.

There is more coming to the Lightning Network as well. Splicing, is the act of transferring funds from on-chain outputs into a payment channel, or from a payment channel to independent on-chain outputs, without the channel participants having to wait for a confirmation delay to spend the channel’s other funds. Why is this important? It removes friction on the network to allow smoother transfer between Lightening and the Bitcoin blockchain.

On the Ethereum network, roughly 400k new network addresses with a balance of ETH were added this week, bringing the total amount to 99.87 million network addresses, an all-time high. Daily active addresses for the week were flat at ranging from 400-480k. Average daily fees for the week continue to come back down to more normalized levels, coming in at $9.64 million. Transaction volume (ETH) remained in a healthy range, reaching a daily average for the week of 1.99m ETH.

Recently, one of the founders of Ethereum, Vitalik Buterin, shared his thoughts on the concept of exporting Ethereum network security, which has implications for the future of Ethereum and its ecosystem. From Messari research:

- The key point of Vitalik’s argument was that protocols should not expect Ethereum validators to socially coordinate to recover funds in case of exploits or bugs. In other words, no protocol will be bailed out by Ethereum’s validators for being “too big to fail.” This reduces the security guarantees of L2s and all applications on Ethereum.

- Vitalik discouraged the use of bridges that wrap assets, as the outstanding value of these assets may pose a risk to Ethereum if they collapse due to a bug. Instead, he recommended the use of atomic swaps. This may be bullish for native-to-native swaps like Thorchain.

- Vitalik encouraged the use of validiums over sidechains. Validiums have an additional layer of security as they post proofs on Ethereum. This helps them gain censorship resistance, along with protection against finality reversion. If followed, this reduces the opportunity set available to restaking protocols like EigenLayer.

Another important item in the Ethereum world is it’s next upgrade, EIP-4844. known as “proto-danksharding” is a major improvement for Ethereum scalability and it’s scheduled to be implemented in late Q3-early Q4 of 2023 as part of the Dencun upgrade. Through EIP-4844, the cost of using Ethereum layer-2s is projected to decrease by at least 10x. This is an important upgrade because proto-danksharding will lead to a reduction in mainnet costs, reduction in L2 fees, which will make the network more accessible to global users.

Off-Chain Happenings

- Paradigm Broadening Crypto-Only Focus to Areas Including AI – The Block

- Binance’s CZ Says China Is ‘Buzzing’ After Bitcoin Seen in TV Segment – The Block

- Hong Kong Securities Regulator to Accept License Applications for Crypto Exchanges Starting June 1 – CoinDesk

- FTX CEO’s Legal Billings Continue to Hint at ‘2.0 Reboot’ – CoinDesk

- Gemini Says Genesis Parent DCG Missed $630 Million Payment – CoinDesk

Financial

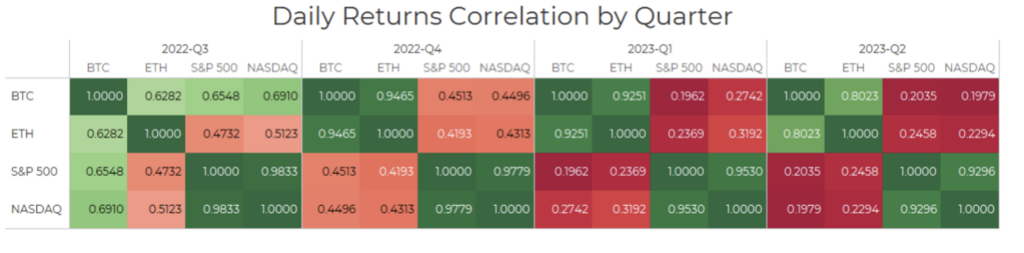

Digital asset markets were inconsistent this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $26,479.05, down 1.27% on the week, while Ethereum (ETH) closed at $1,805.81, up 0.29% on the week. Ethereum still continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 and gold both continue to be uncorrelated with Bitcoin by the same metric (see correlation chart at the top of this newsletter).

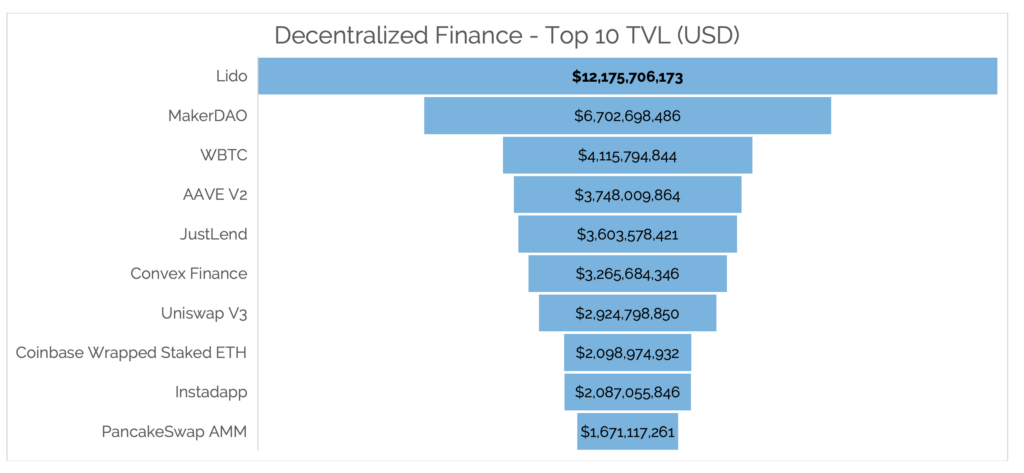

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was down in conjunction with ETH and overall market token prices, coming in at $46.67b as of Thursday, May 25th.

Year to date, BTC is up 60.88%, ETH is up 52.09%.

Digital Asset Learning

On-Demand Learning: The Keys To Unlocking On-Chain Finance

Created By: Chainlink Labs

Abstract: This webinar is designed for business and technical leaders at the intersection of traditional finance and blockchain technology. You will learn from finance and blockchain experts about innovative use cases and critical strategies your organization can leverage when building its digital asset strategy.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.