Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

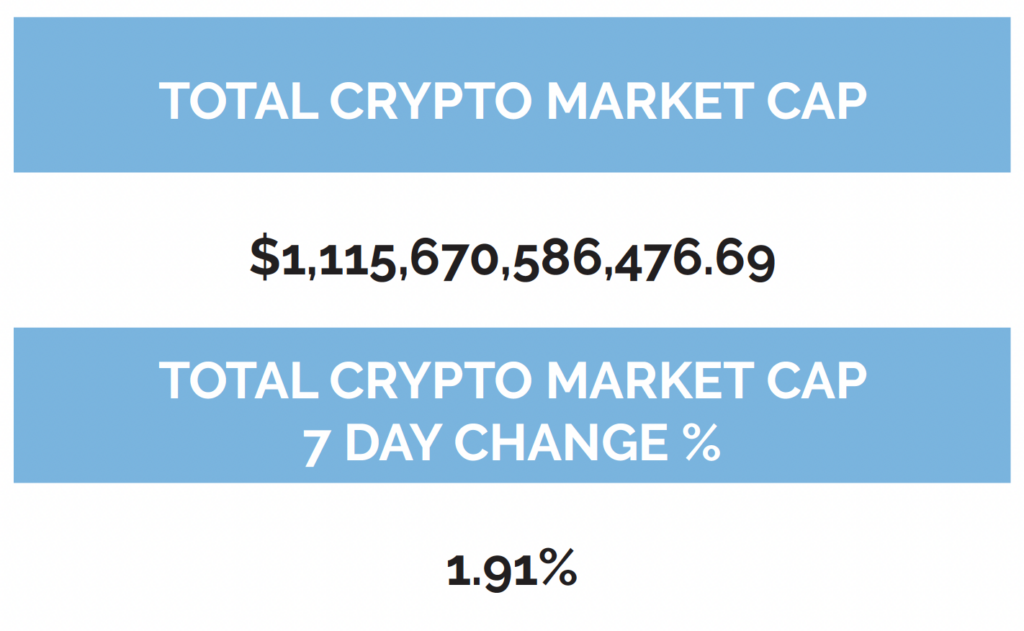

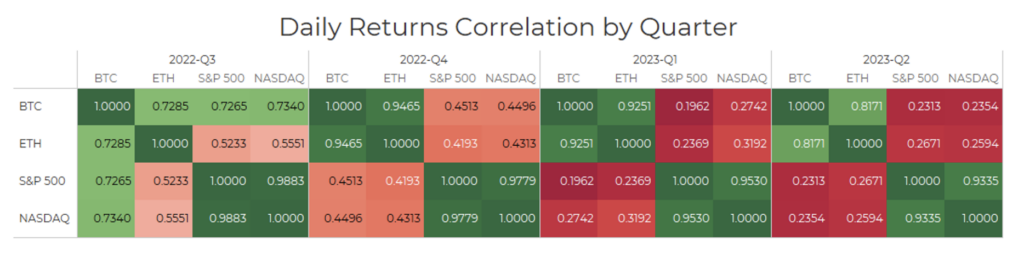

Digital asset markets were slightly up this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $26,828.40, up 1.32% on the week, while Ethereum (ETH) closed at $1,862.45, up 3.14% on the week. Gold is now positively correlated with Bitcoin when looking at a 30-day rolling correlation, while Ethereum continues to be positively correlated with Bitcoin and the S&P 500 continues to be uncorrelated with Bitcoin by the same metric. (See correlation chart just below).

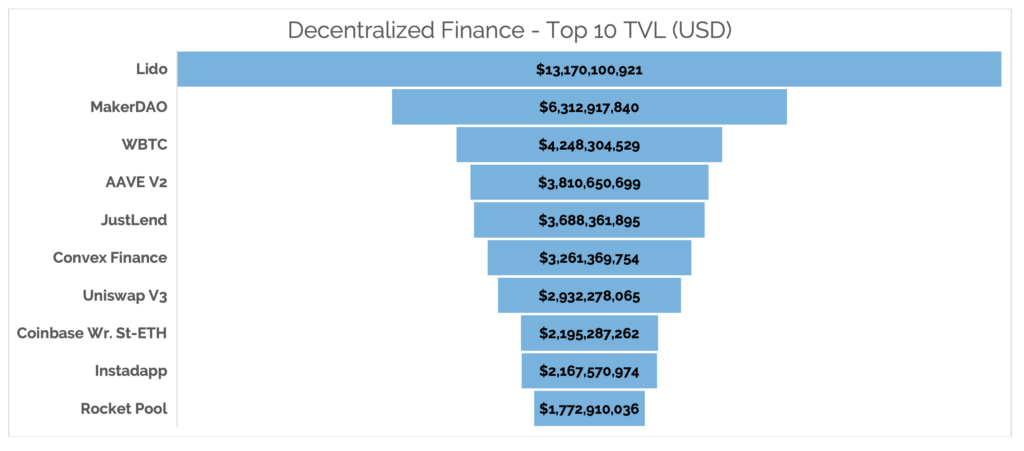

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was flat this week, coming in at $46.69b as of Thursday, June 1st.

Year to date, BTC is up 62.20%, ETH is up 56.83%.

Don’t Miss this Upcoming Week: Canton Network Powerful Connections Series in partnership with Deloitte.

Now, a run of the numbers.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, June 1st, 7:00pm ET

*7-Day Average

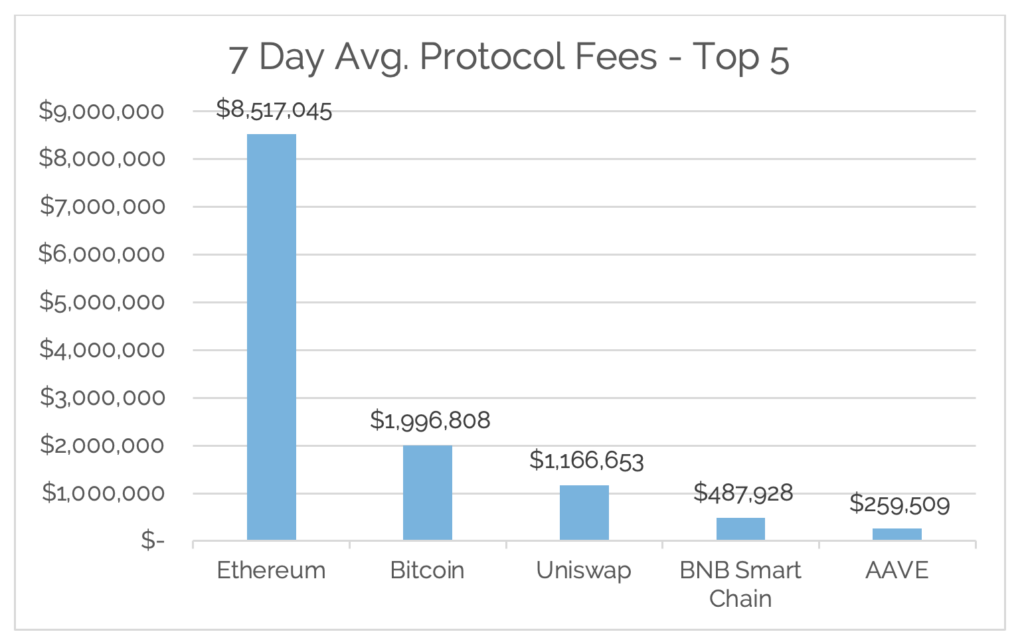

*Source: Cryptofees.info, Thursday, June 1st, 7:00 pm ET

*Fees in USD

Week in Review

On-Chain Adoption

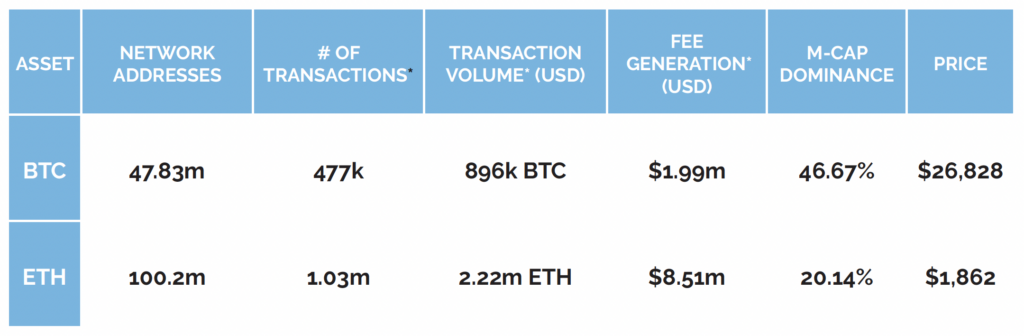

The Bitcoin network saw an increase of 700k network addresses with a balance of BTC bringing the total to 47.83 million network addresses, a new all-time high. Daily average active addresses continue to stay in a healthy range between 750k and 900k. The daily average transaction volume (BTC) for the week was flat, at 755k BTC. 7-Day average Network fees started moving down towards normal levels, but are still elevated relative to historical averages, coming in at $1.99m.

In 2022, the Bitcoin mining industry suffered greatly with several Bitcoin miners going bankrupt and two of the largest public mining stocks, Riot and Marathon, dropping 86% and 90%. Lower Bitcoin prices and increased hash rate crushed miners’ margins and led them to be one of the worst-performing assets last year. These drops influenced the returns of many crypto equity funds, which many retail and institutional investors were using as proxies for digital asset exposure.

In 2023, Bitcoin mining companies have seen a strong start. Riot Blockchain and Marathon Patent Group have significantly rebounded, doubling in price in 2023. This makes sense since these stocks are heavily correlated with the BTC price. Another reason for the rebound however is that miners have increased revenue sharply in Q2 2023 due to growing transaction fees driven by BRC-20 ad ordinals adoption. The question becomes, is this a new normal?

Miners are hoping so because this makes the mining business more defensible as they rely less on one source of revenue, which previously was the inflationary rewards of mining BTC. This has always been a concern as the bitcoin halving events every four years decrease the supply rewards of miners. Many Bitcoin evangelists are not happy with this shift in the Bitcoin network however because the higher transaction costs will lead to pricing out its intended users.

Our view is that this is a needed evolution of the Bitcoin network and there are solutions, like the Lightening network, and others that are being built that will still lead to very low costs to using the Bitcoin blockchain.

On the Ethereum network, roughly 400k new network addresses with a balance of ETH were added this week, bringing the total amount to 100.20 million network addresses, an all-time high. Daily active addresses for the week were flat ranging from 400-480k. Average daily fees for the week continue to come back down to more normalized levels, coming in at $8.51 million. Transaction volume (ETH) remained in a healthy range, reaching a daily average for the week of 2.22m ETH.

Staked ETH continues to achieve new highs. This has caused growing concern in the Ethereum community, however. Why? The centralization of power, which in turn creates a central point of failure, makes the network vulnerable from a security standpoint. In a recent post from Ethical Tade:

Lido currently sits at the top with a 36% share of all staked ETH, roughly 7m staked ETH. Currently, there is a total of 19m ETH staked on Ethereum. This has caused Lido to have a 32% network penetration rate on the Beacon Chain as a validator. For reference, Vitalik Buterin, Ethereum’s co-founder, has historically said that no entity should control 15% of all validators. This gives the protocol too much power and creates a central point of failure.

When centralization becomes apparent on a network, it is common practice for the community to launch an initiative to get ahead of this or aim to reduce it. We have yet to see such a step in the Ethereum community when it comes to staking, however, there will likely be one considering Lido’s current position. The question circulating is what are the economic incentive structures that encourage small to solo stakers and discourage consolidation of staking services? Currently, the main reasons why Lido has accumulated so much stETH is due to ease of staking, higher liquidity, and more attractive staking rates. Rocketpool has been a challenger to Lido. Although Lido offers higher staking rewards, they are more expensive and carry more risk having fewer validators relative to Rocketpool.

This is an extremely important issue on the Ethereum network. Centralization of these areas brings central points of failure, which make the Ethereum network vulnerable from a security standpoint. The solution is incentivizing more diversity among Ethereum stakers and staking service providers. Creating more diversity in stakers would benefit the network by keeping an operator’s investment safe and minimizing the potential of a catastrophic event due to an error in a single client.

We will be watching this very closely as it is important to the future health and security of the Ethereum network. This is an opportunity to showcase how the Ethereum community comes together around this issue.

Off-Chain Happenings

- Hong Kong-based First Digital Introduces USD Stablecoin – The Block

- TradFi Giant TP ICAP Brings Crypto Spot Trading to Institutional Investors – CoinDesk

- Binance Explores Letting Some Traders Keep Collateral at a Bank – Bloomberg

- Former Coinbase Employee Agrees to Cooperate in Future SEC Investigations – The Block

- S. CFTC Warns About Clearing Derivatives Tied to Digital Assets – CoinDesk

Digital Asset Learning

On-Demand Learning: Canton Network Powerful Connection Series

Created By: Digital Asset and Deliotte

Abstract: Join Digital Asset, Deloitte, and DRW on Tuesday, June 6th at 10 a.m. EDT for the first session in our “Powerful Connections” webinar series. This series will provide insights into the valuable connections the Canton Network is helping create by looking closely at both business use cases and the technological underpinnings that make Canton unique.

We will investigate key use cases including tokenization, asset servicing, and securities financing from the perspectives of founding members, partners, and participants of the Canton Network. Explore why leading institutions launched the Canton Network to realize previously impossible connections across financial systems, while maintaining a safe operating environment.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.