In this edition of Digital Asset Friday, we tackle the recent market rally, Blackrock’s partnership with Coinbase, and recent Fed guidance for banks.

The recent rally is not driven by fundamental adoption. We see two main factors being:

- Mean reversion from the recent extreme selling in May/June and…

- Ethereum Merge Anticipation

Many on-chain and off-chain technical metrics are still in historically low zones. We don’t know if we are at a bottom but suggest patience and dollar cost averaging in over the 2nd half of the year while in these zones.

By The Numbers

| 30-Day Correlation – 08/18/2022 | ||

| BTC | ETH | |

| NASDAQ100 | 0.75 | 0.89 |

| Russell2000 | 0.74 | 0.94 |

| S&P500 | 0.77 | 0.93 |

| Dow Jones Industrial | 0.73 | 0.93 |

| USD Index | -0.5 | -0.31 |

| DAX | 0.78 | 0.89 |

| VIX Index | 0.18 | 0.24 |

Market Update – Digital Asset Rally

It has been three months since the Terra crash, the downfall of over-levered hedge funds like Three Arrows Capital, and poorly managed centralized entities like Celsius and Voyager. While nothing is close to finished, over the last month we have seen partial recoveries from the extreme fear and panic we experienced in May. Analysis of the Bitcoin market & network metrics like MVRV, SOPR, NVT ratio show we are still in historical low zones.

Bitcoin’s MVRV-Ratio, the ratio of a coin’s market cap to its realized cap, which indicates whether the price is overvalued or not, is sitting at 1.0667 as of writing and has been under 1 since mid-June. In the chart below we see historically anything below 1 has been attractive point to enter long positions.

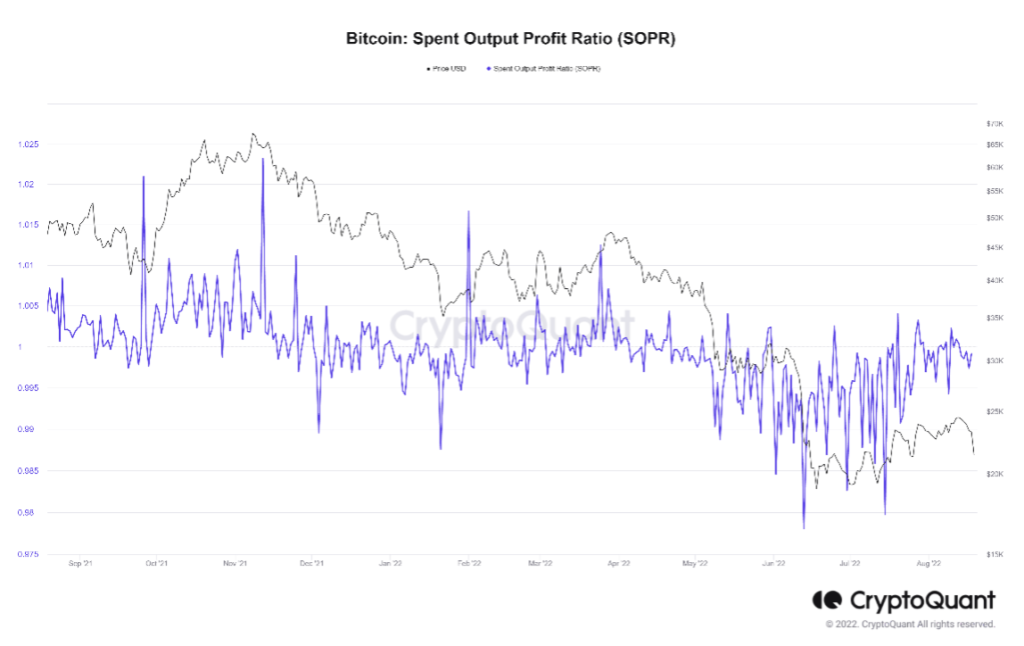

Spent Output Profit Ratio (SOPR) evaluates the profit ratio of the whole market participants by comparing the value of outputs at the spent time to created time. SOPR trending lower implies losses are being realized and coins that were in loss are being transferred to others. Also, it could be implied that the market conditions for sellers are getting less profitable, indicating we are close to a bottom. As you can see below, SOPR has been trending lower since April of this year and starting to uptrend in late June. Historically entering markets below a SOPR value of 1 on a downtrend has been your most attractive entry point. We are hovering near 1 now on a short-term up-trend which indicates that we may be leaving the bottom. Only time will tell, however.

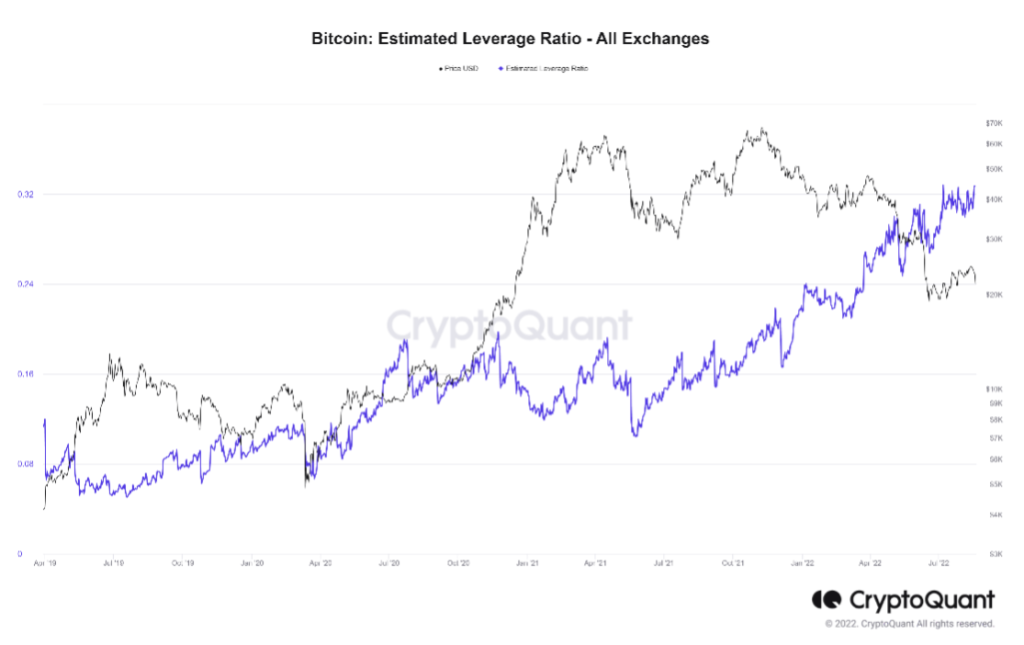

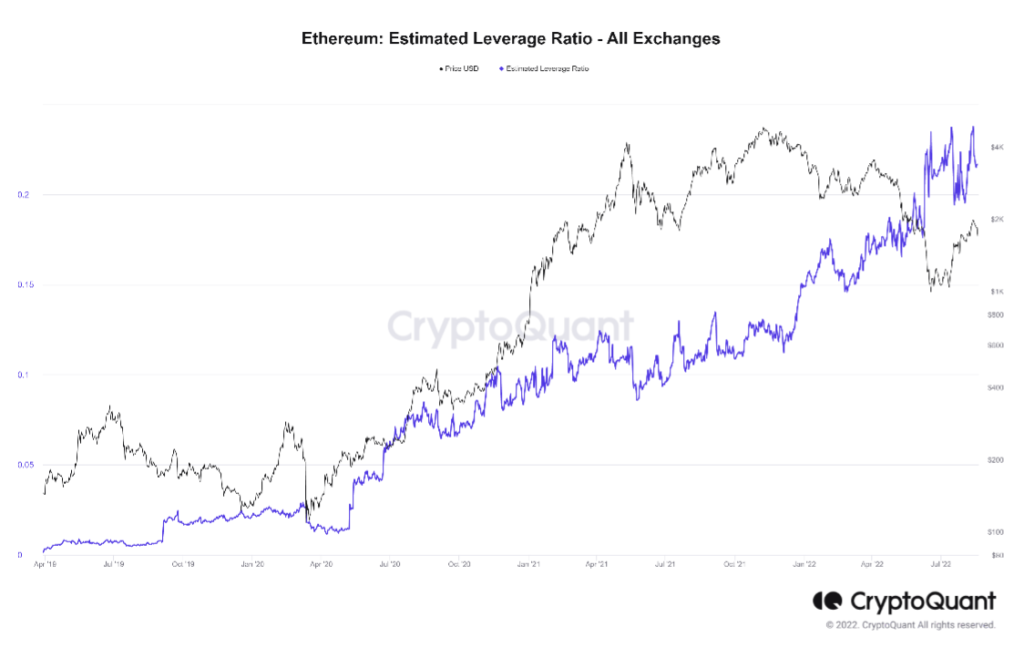

The Estimated Leverage Ratio (ELR) for a derivative exchange tells us how much leverage is used by users on average. This information measures traders’ sentiment whether they take a high risk or low risk. We can see that since the washout in May this metric has been trending higher for both Bitcoin and Ethereum indicating risk on behavior which is where some of the recent rally has come from. In May we saw a downward price trend converge with an upward trend ELR value which happened back in July 2020. We rarely see ELR stay higher relative to price longer than a month. We expect that in the future with the maturation of markets you will see less dramatic gaps.

Given there haven’t been meaningful changes in fundamental growth across digital asset networks, except in small pockets, as well as the macro landscape, we don’t see the recent rally as a reversal out of the bear market.

Another reason for the rally we feel is the anticipation for the Ethereum merge scheduled for September 15th. If you want to learn more in detail regarding the Ethereum merge, we suggest two resources to get caught up:

- Blockworks hosted a webinar on the Ethereum Merge which you can find here.

- Jackson Wood wrote up a piece for Coindesk on the Ethereum Merge here.

Why is the merge so highly anticipated?

This will be a first in digital asset history. Never has a network transitioned from Proof of Work (miners) to Proof of Stake (validators) like this. This transition to proof of stake is a step toward becoming more cost-effective, increasing transaction speed, and increasing transaction throughput without sacrificing security. The way this will be achieved in the long run is through a concept called sharding (What is sharding?).

The merge will also introduce changes to the tokenomics. ETH will now have to be staked (locked) into the network to run a validator node and earn fees. With ETH staked this will effectively diminish the amount of ETH circulating in the market. With EIP-1559 last year a fee burning mechanism was introduced where 70-80% of all fees are burned (destroyed). This will drastically change the rate of inflation comparatively to what it has been historically.

Another important piece in the merge will be Ethereum’s energy consumption. By moving to a less compute-heavy and energy-dependent Proof of Stake consensus mechanism, energy consumption will decrease substantially. This has been the main argument from detractors and politicians as to the downsides of digital asset networks like Bitcoin and Ethereum.

You are likely to hear all the great things the merge will accomplish. Many are also pointing out that the merger will increase the centralization of the network, going against the entire ethos of decentralized power. An interesting viewpoint comes from _Checkmate.weth where he goes into why he thinks the merge to be big plunder.

We anticipate some hiccups in the merge and its ongoing maturation. Along with this comes higher bouts of volatility. While we have experienced a rally of ETH in the short term, we believe this is the short-term volatility playing out as there is so much that is uncertain about the merger.

We are practicing patience and discipline in our process.

Blackrock x Coinbase Partnership

This is huge. There really is no other way to put it. While it is starting with Bitcoin there is work being done to support the entire ecosystem in the future. Even with Coinbase facing an SEC probe Blackrock is going through with this. From Silla Brush at Bloomberg, “BlackRock Inc. is partnering with Coinbase Global Inc. to make it easier for institutional investors to manage and trade Bitcoin, taking the world’s largest asset manager into a cryptocurrency market hammered by plunging prices and government investigations. Top BlackRock clients will be able to use its Aladdin investment-management system to oversee their exposure to Bitcoin along with other portfolio assets such as stocks and bonds, and to facilitate financing and trading on Coinbase’s exchange.”

While many point to price as an indicator of digital asset market health, those who are knee-deep in the building are pointing to the ongoing trend of adoption from an infrastructure standpoint. Blackrock is just one in a long line of global financial institutions creating Bitcoin and digital asset infrastructure to serve the needs and demands of clients.

Other global financial institutions establishing infrastructure:

New Guidance from Federal Reserve

It is still a painful process to onboard assets from traditional financial institutions to digital asset institutions. The Federal Reserve recently released more guidance to traditional banks that I wanted to share that highlight some of the reasons why we feel are still experiencing these issues.

- “…firms must notify the Fed beforehand and make sure whatever they do is legally permitted.” Most banks don’t have the communication channels in place for this and don’t have the means to meet this requirement.

- “Banks should also have adequate risk management systems and controls in place before getting involved in crypto to ensure that any endeavors were conducted in a safe and sound manner and were compliant with relevant consumer protection statutes.” Most banks don’t have these yet and it is the main reason they are making it difficult for everyone.

The frustrating piece to this is that those who are doing everything to help clients invest and engage with digital assets safely and securely aren’t getting the support they deserve, including us.

To anyone reading this that has been proactive about providing solutions and helping guide clients in making sound decisions when it comes to digital assets you deserve all the credit in the world, and you are truly doing your part in protecting investors. You have done the work and due diligence while our trusted institutions and banks are still getting caught up.

The silver lining? As mentioned above, they are starting to get caught up on their own without waiting for permission.

Other Digital Asset News

- CME Group to offer Ethereum Options Trading

- Netflix enters the Metaverse with Decentraland presence

- Starbucks Unveils Web3 Rewards Program

- South Africa CB Greenlights Institutions to Serve Crypto Clients

- Nigeria’s CBDC eNaira Update

Crypto Learning:

Webinar: The Merge: Will You Survive, Thrive, or Get Left Behind?

When: Thursday, August 25th, 2022, 12:00pm ET

Presented by Blockworks: The Ethereum mainnet will soon merge with the beacon chain and transition to proof of stake – marking one of the most ambitious software upgrades in crypto’s history. This webinar will discuss the expected impacts of the Merge and what this means for staking, MEV, and the future of Web3.

*Blockworks Research is a strategic partner in which Arbor Digital utilizes for data research and analysis in the digital asset space.

Reading: What is the difference between TradFi, CeFi, and DeFi?

A High-Level Look at Three Widely Used Terms in the World of Crypto

Thank you for your continued trust. Stay safe, happy, and healthy!