In this pre-Labor Day edition of Digital Asset Friday, we look ahead at what is in store for what is shaping to be a historical month of September. First, a run of the numbers…

By The Numbers

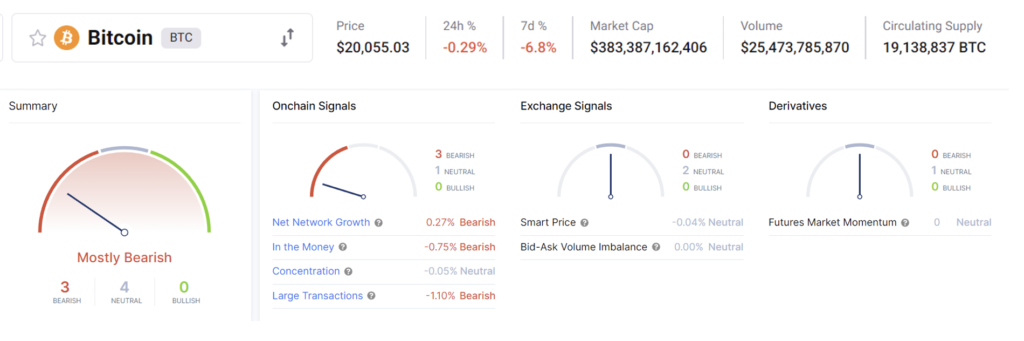

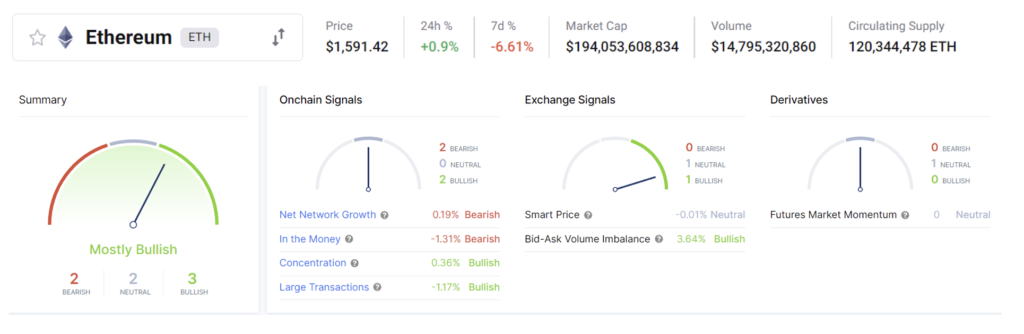

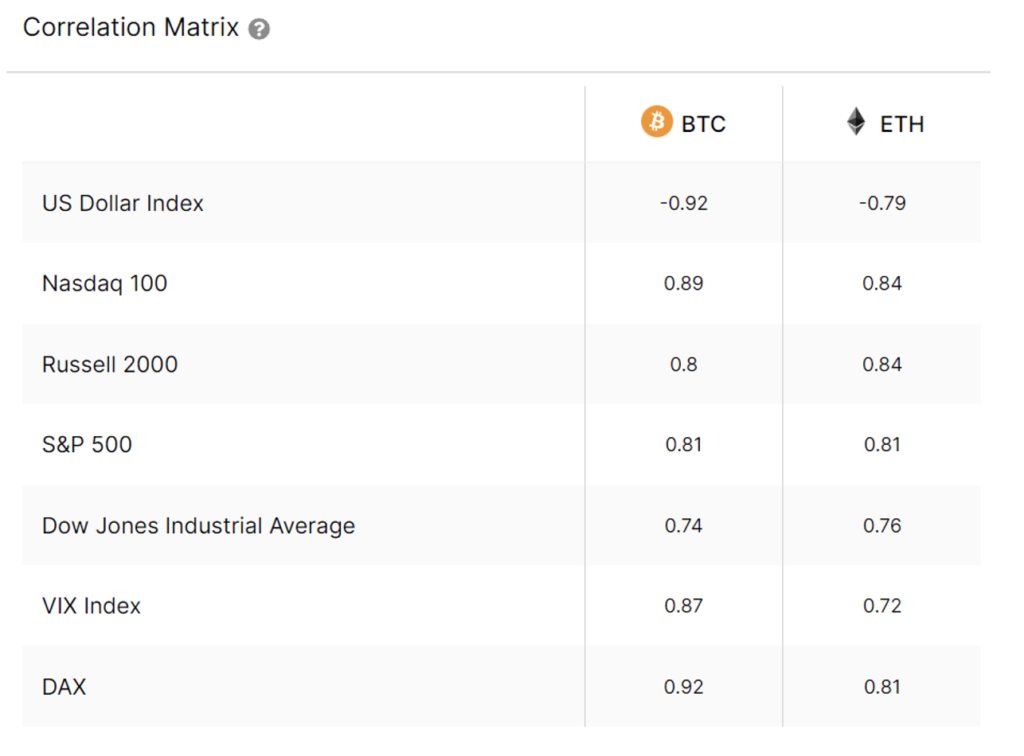

*All data above provided by CryptoQuant and Intotheblock

Dates to pay attention to:

- September 13th – Ethereum Merge

- September 13th & 14th – Digital Asset Summit NYC

- September 15th – Mt. Gox BTC repayments start as per the rehabilitation plan

- September 20-21st – Next FOMC Meeting

- September 21st, 22nd, and 23rd – Messari Mainnet

- September 28th & 29th – SmartCon by Chainlink

- End of September – Executive Order Reports from government agencies come due

A Historic Month

The Ethereum merge alone makes September a historic month. We have been writing for several weeks about the merger, why it’s important, what is changing, and our thoughts in the short and long term. Our first writing to help prepares advisors on the subject was in July 2021 and in recent market recaps. Be sure to check out past editions here.

WenMerge.com has a countdown and resources about the merge from a technical perspective and we absolutely love Certified Digital Asset Advisor designation program founder Adam Blumberg’s recent blog post about the merge from a financial advisor’s perspective. His 5 main points were:

- A new issuance policy could make ETH deflationary.

- It may be easier to value ETH more accurately.

- Energy consumption will be reduced after The Merge.

- Staking may become more lucrative.

- The Merge could increase demand for Ethereum.

And risks to be mindful of:

- There could be problems with the implementation of The Merge itself

- Long-term we haven’t seen a proof-of-stake blockchain operate at this scale

- We still don’t know how regulators are going to handle ETH

Another major date in September is connected to one of the most influential events in Bitcoin’s history. Mt. Gox was one of the first Bitcoin exchanges in the world and started automated trading on July 18, 2010. It once represented over 80% of the global Bitcoin trading volume. On Feb. 28, 2014, the company filed for bankruptcy after finding out it was hacked, losing most of its assets. There were some 200,000 Bitcoins in the exchange at the time of bankruptcy.

Fast forward to the present, where on September 15th repayments by an appointed trustee will begin to those who have legal claims according to a rehabilitation plan established by the courts, a total of ~140,000 BTC. There has been speculation that this full amount will be put into the market and everyone will sell, causing a large sell-off in Bitcoin. We believe this is overblown. Payments are set to start on September 15th but could take quite a while before they finish. Matt Kolesky, the co-founder of Arbor Digital, will be joining the Asset (r)Evolution podcast for a special episode as he has been part of this process directly and will share his firsthand experience.

We also have the next FOMC meeting scheduled for September 20-21st. This highly anticipated meeting will have a profound effect on the short-term outlook for risk on assets like digital assets. As of writing, the projections are between a 50-75 basis point hike and possible plans for increased quantitative tightening. What this means for digital asset markets is we may be due for some short-term pain from where we currently are.

Reports from government agencies that were required by the executive order released back in March 2022 start coming due in late September as well. You can expect a lot of events-driven volatility based on the release of these reports. Depending on the findings, as well as the tone of how these findings are communicated, could have significant effects on short-term movements.

What are we doing?

We recently finished executing a full rebalance within our Compass portfolio. This included the removal of assets that no longer fit our investment thesis as well as increasing weightings to protocols that have strengthened their position during this crypto winter.

Cash on the platform is being deployed at very specific ranges with the goal of establishing attractive long-term positions. We will continue to follow our disciplined process and not rush into the markets.

We are here to help advisors and investors implement responsible digital asset management. If you find yourself struggling to gain an understanding of what to do, please reach out to us.

Other Digital Asset News

- G20 Watchdog to Propose First Global Crypto Rules in October

- FDIC Issues Cease and Desist Orders to FTX US and Other Crypto Firms

- California Assembly Passes Crypto Regulation Bill That Requires Bank-Issued Stablecoins

- Binance Froze Russian Gun Maker’s Crypto Assets

- Ticketmaster partners with Dapper Labs to issue NFT tickets

Crypto Learning:

Webinar: The ETH Merge: What does it mean?

When: Friday, September 16th, 2022, 2:00 pm ET

Presented by DACFP: For many investors, their entrance into crypto starts with bitcoin. As they explore the landscape, their next stop is often Ethereum, the world’s second-most valuable blockchain. Indeed, many now believe Ethereum represents a bigger market opportunity than bitcoin. After all, Ethereum is the platform on which DeFi, NFTs, and stablecoins are largely built!

And, in September, Ethereum is completing what many say is the most significant software upgrade in crypto history. It’s called the “Merge.”

Join us for this special one-hour webcast, where Ric Edelman and Bitwise CIO Matt Hougan will reveal what the “Merge” means for Ethereum and holders of ETH – and how you can answer your clients’ questions about crypto’s second-largest asset.

1 CFP CE credit

1 CFA PL credit

Investments & Wealth Institute® has accepted this webinar for 1 hour of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA® certifications.

Reading: Value Creation in the Metaverse, by McKinsey & Company

This report examines the emergence of the metaverse: its history and characteristics, the factors driving investment, how consumers and businesses are using it today and may in the future, its value-creation potential, and how leaders and policymakers can plan their strategies and near-term actions.

Thank you for your continued trust. Be sure to tell someone today you care about them.

Stay safe, happy, and healthy this Labor Day weekend!