In this edition of Digital Asset Friday, we discuss the SEC vs. Ripple case, another crypto company hack, and NASDAQS next attempt to dive into the digital asset space. First, a run of the numbers…

By The Numbers

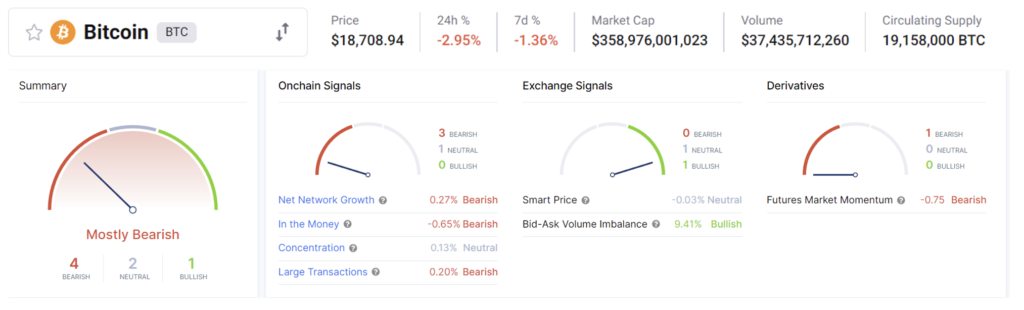

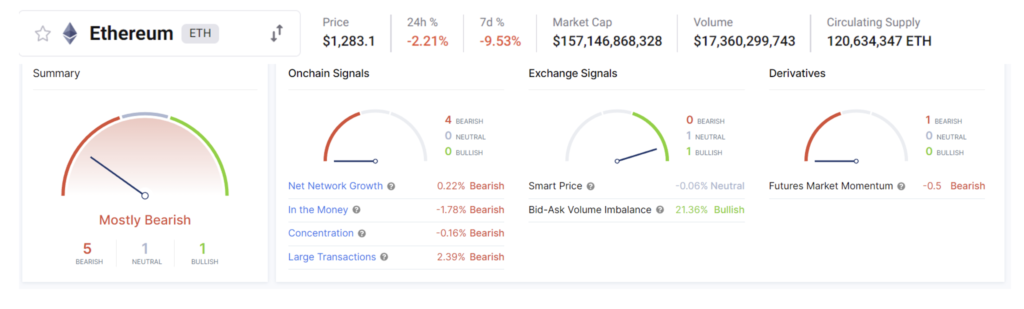

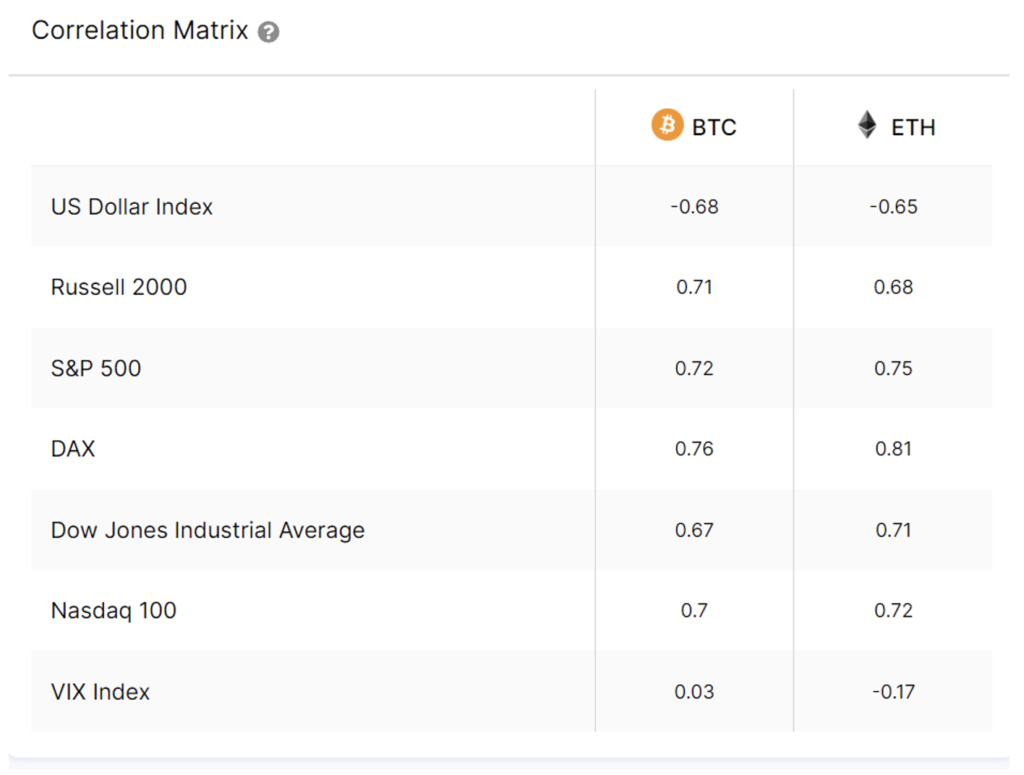

*all data above provided by CryptoQuant and Intotheblock and as of September 23rd, 2022, 2:29 pm EST

SEC vs. Ripple

“The laws and standards which we will practice in digital assets will mainly be decided in the court system, not with proactive legislation. This has been the pattern in market history.” – Matt Kolesky, Arbor Digital

The quick TLDR is the SEC sued Ripple Labs, CEO Brad Garlinghouse, and Chairman Chris Larsen in December 2020. The SEC claimed that Ripple had raised over $1.3 billion by selling its cryptocurrency XRP in an unregistered securities offering. Ripple maintained that XRP sales and trading did not meet the tenets of the Howey Test.

This is important because as Matt Kolesky so adequately put it, the U.S. Supreme Court case has acted to determine whether something is a security for the last several decades.

Why are we talking about this now? Last Friday, September 16th, 2022 both the SEC and Ripple legal teams filed motions for summary judgment in the Southern District of New York, asking District Judge Analisa Torres to make a ruling based on the arguments filed in the accompanying documents. The case has gone through a lot of twists and turns with both sides getting small wins in separate battles, but it is still up in the air who will win the war.

Why is this important? This case will have ripple effects, pun intended, across the entire industry and help determine the future of its existence. All digital asset/crypto companies, groups within larger firms, investors, and traders will be impacted.

In addition, this will have an immediate impact on whether the SEC will purposefully pursue Ethereum next. Last week we wrote about how the move from Proof-of-Stake will firmly put ETH in the crosshairs of the SEC. The SEC vs. Ripple case will help determine the next steps for the SEC.

Why is Ethereum in the crosshairs of the SEC? Adam Levitin, a Georgetown Law Professor, wrote a long Twitter thread, but the TLDR is rooted in the Howey test. Levitin argues, and argues well, that there are many elements of the Howey test ETH satisfies. Frederick Munawa from Coindesk wrote a good piece on this back in August where he succinctly puts, “Levitin argues that a proof-of-stake system like Ethereum requires an investment of money (staking) in a common enterprise (Ethereum) with an expectation of profits (staking rewards) primarily from the efforts of others (other Ethereum participants).”

Now XRP, the token of the Ripple protocol, and ETH (and BTC) are vastly different tokens on many different levels but the definitions and legal precedence that the SEC vs. Ripple case will bring will have an impact on all tokens and protocols.

Love it or hate it, this is where the ‘regulatory clarity’ will come from. While things like ‘it’s a security!’ seem like dirty words we shouldn’t be afraid of it. The main thing is to plan for all scenarios and manage risk accordingly. Our very own Matt Kolesky is directly involved with organizations and legal teams providing guidance on how we can responsibly put forth regulations of digital assets.

We don’t know what will happen but we are watching very closely and consulting with others in the industry to ensure we plan for any scenario.

Wintermute Hack

The TLDR: Wintermute is a global crypto market maker which fell victim to a hack in their DeFi business.

Wintermute is a London-based algorithmic trading and crypto lending firm that provides liquidity to some of the largest exchanges and blockchain projects. As reported by Joseph Hall at Cointelegraph, “According to Etherscan, over 70 different tokens have been transferred to “Wintermute exploiter,” including $61,350,986 in USD Coin (USDC), 671 Wrapped Bitcoin (wBTC), which is roughly $13,030,061, and $29,461,533 Tether (USDT). The largest token sum appears to be USDC.”

Why is this important? One of the main values of a financial advisor is to help people make healthy money decisions. We have many conversations where parents, and children of parents, are going out into DeFi because a friend, colleague, or toxic influencer on YouTube told them of all the great wealth they could generate quickly.

Even big institutions with a lot of resources to have state-of-the-art security and white hat hacker bounty programs aren’t immune to hacks.

If your advisor isn’t at least asking the questions, then be sure to get with someone who will, like Arbor Digital. Therefore, we exist. We utilize many data and research partners to understand the space as well as we can and pass that on to our advisory firm clients so that way they feel adequately armed to fulfill their fiduciary duty to clients.

I digress. The point is if you, or anyone you know, is looking to actively engage with DeFi: it is still dangerous, you could lose all of your money in a hack, and if you haven’t done the work, get with someone who has.

NASDAQ goes deeper into Digital Assets

The merge continues.

From NASDAQ’s press release, “The launch underpins Nasdaq’s ambition to advance and help facilitate broader institutional participation in digital assets by providing trusted and institutional-grade solutions focused on enhanced custody, liquidity, and integrity.”

While crypto natives won’t really like this announcement. Everyone else from the traditional world will look to this as validation. Now, this doesn’t mean that there is zero chance now that digital assets will go away, but it gets it oh so close. There is still a lot of work to be done and it will still likely be a while before we see the fruits of this labor.

So why is this important? Every finance firm and I do mean everyone, is getting off zero. Doesn’t mean they all will build something meaningful or invest dollars into a digital asset. I mean that talent, budget, and time, our most precious resource, are being put towards what blockchain and decentralization mean for them. You can no longer ignore, or more important, you can no longer not take purposeful time to think about how this new technology and cultural revolution will impact you and your business.

Don’t know where to start? Give us a call at Arbor Digital. Another reason we exist and what our mission is rooted in. Even if we aren’t experts in your field, we have the network to get you to the people who are.

Other Digital Asset News

- US Judge Orders Tether to Prove What Backs USDT

- Why equity plus token warrants is the new go-to formula for crypto VCs

- Digital Dollar Likely Won’t Be Part of Retail Banking World, US Lawmaker Says

- Crypto Needs ‘Global Regulatory Framework,’ IMF Says

Crypto Learning:

Webinar: Diversification during a crypto winter: The benefits of broad digital asset exposure

When: Wednesday, September 28th, 2022, 10:00 am ET

Presented by NASDAQ: Diversification is a time-tested investment strategy, but does it work for an emerging asset class like crypto? Join Nasdaq’s VP, Global Head of Index & Advisor Solutions Sean Wasserman, and Hashdex’s Chief Product and Technology Officer Samir Kerbage as they discuss why the current environment might be an opportune time to diversify exposure to crypto assets.

Reading: Crypto-Assets: Implications for Consumers, Investors, and Businesses from the U.S. Department of Treasury

As part of Executive Order 14067 on Ensuring Responsible Development of Digital Assets; Section 5(b)(i)—the implications of developments and adoption of digital assets and changes in the financial market and payment system infrastructures for U.S. consumers, investors, businesses, and for equitable economic growth.

Digital asset markets have changed and grown dramatically over the past decade based on estimates of market capitalization, transaction volumes, and the number and types of assets. Millions of people globally have some exposure to crypto-assets, including at least 12% of Americans. President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets (Executive Order) observes that the continued expansion of crypto-based technology could have profound implications for the users of crypto-assets—namely, consumers, investors, and businesses.

Content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.