Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Since our last edition, there are two main Digital Asset topics that are important for investors and financial advisors to be aware of and have a fundamental understanding of:

- IRS Ruling 2023-14 – Tax Implications of Cryptocurrency Staking.

- PayPal’s launch of PYUSD, its own stablecoin on the Ethereum blockchain.

In our opinion, PayPal’s launch of PYUSD will have a much greater impact on the adoption of crypto and decentralized blockchain technology than that of a BTC ETF.

- Are you an investor who engages in staking services or earning staking rewards and is unsure if you are adhering to current IRS rules?

- Are you a financial advisor who wants to ensure your clients aren’t opening themselves up to any crypto wealth destruction events by not following IRS rules?

- Are you looking for help staying on top of important aspects of investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us and our tax partners.

Other News

- Ark 21Shares Bitcoin ETF Application Decision Pushed by SEC

- Telegram, 4th largest Messaging App worldwide, to Integrate Crypto Wallet

- SEC files Ripple appeal in a challenge to XRP securities outcome

- Maple Finance’s Tokenized Treasuries Available to U.S. Investors After Securities Exemption=

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

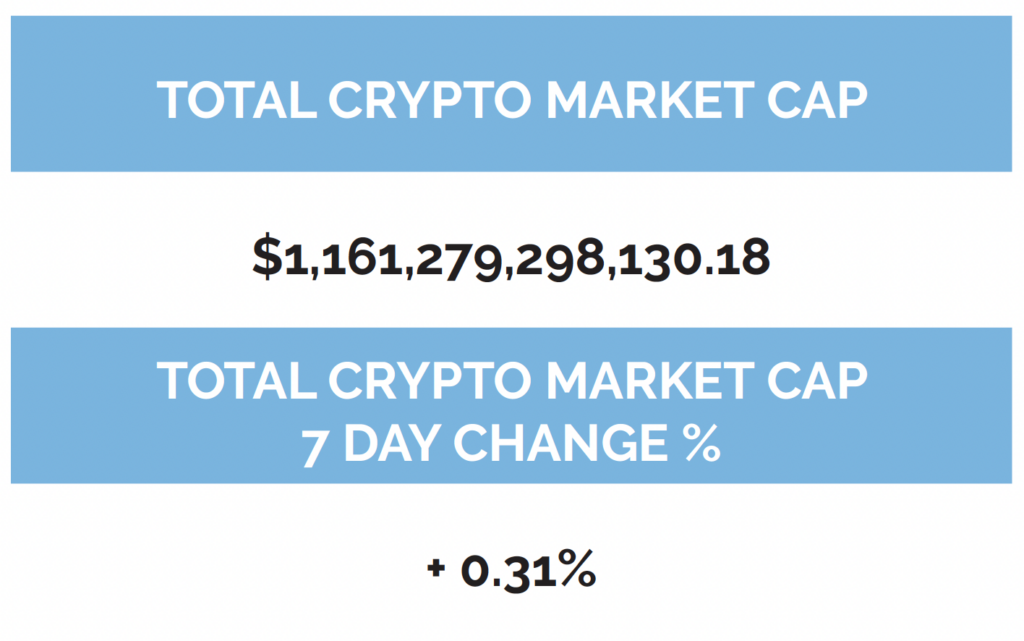

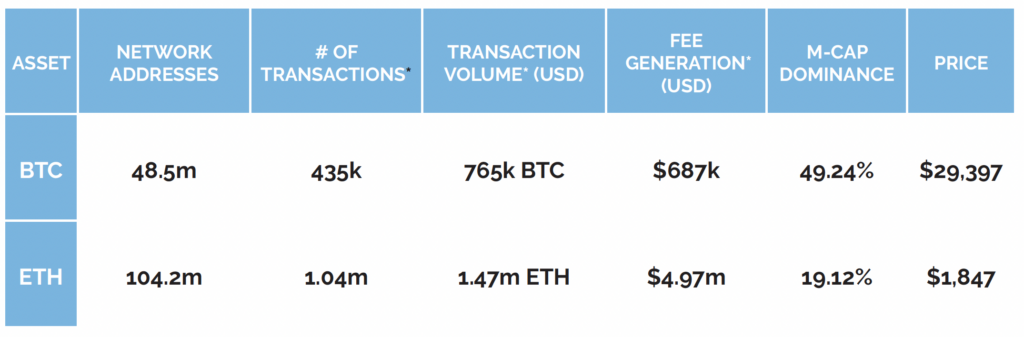

Digital asset markets were slightly up this week with the total industry market cap hovering above $1.2 trillion. The price of Bitcoin (BTC) closed at $29,397.50, up 0.46% on the week, while Ethereum (ETH) closed at $1,847.50, up 0.20% on the week. Year to date, BTC is up 76.64%, ETH is up 53.64%.

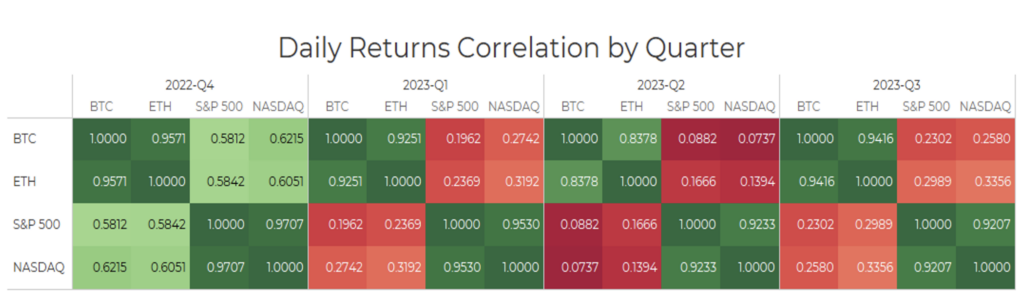

The S&P 500 is now uncorrelated with Bitcoin when looking at a 30-day rolling correlation, while gold continues to also be uncorrelated with Bitcoin. Ethereum continues to be positively correlated with Bitcoin by the same metric. (See correlation chart just below).

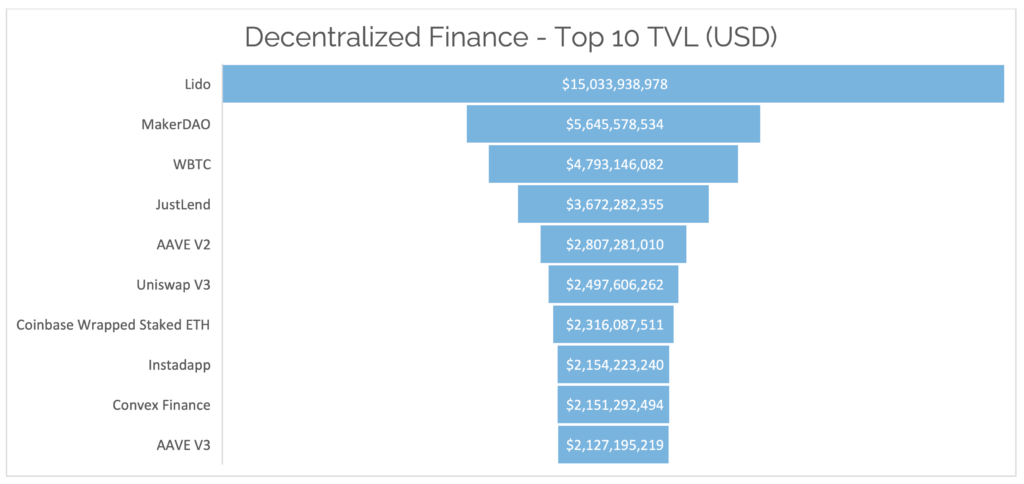

Total Value Locked (USD$) in DeFi as tracked by DeFi Llama and verified by Digital Asset Research was down this week in line with price movements, coming in at $41.88b as of Thursday, August 10th. The top 10 DeFi total value locked verified by Digital Asset Research showed stakedETH continues to be one of the most popular crypto assets, lead by Lido and Coinbase wrapped stETH and Rocketpool just outside the top 10 at #11 with $1.8b TVL.

-as of Thursday, August 10th, 7:00pm ET

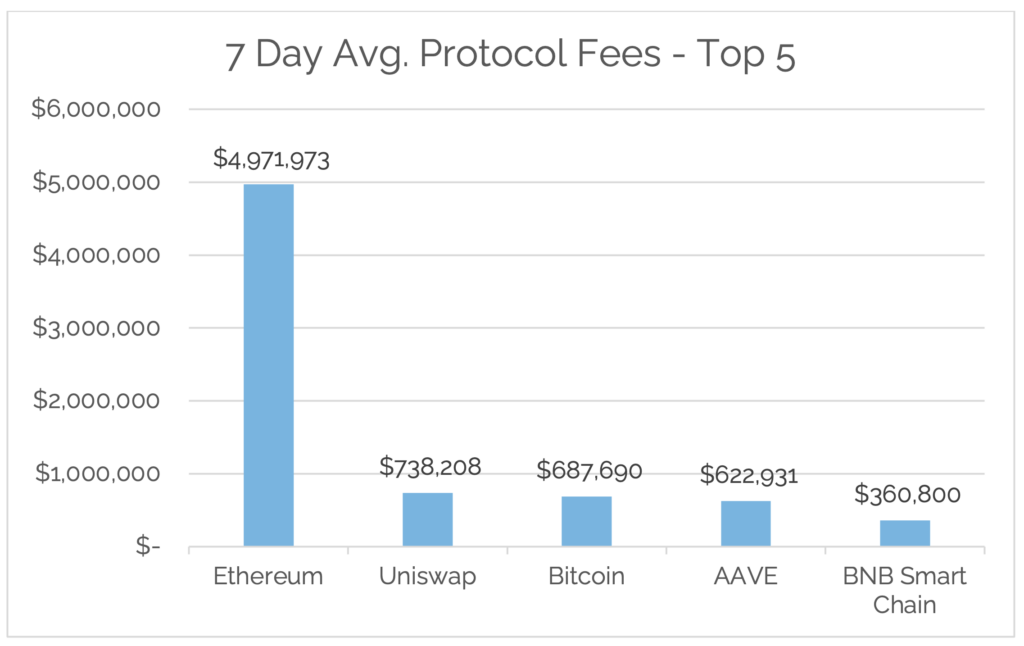

*7-Day Average

*Source: Cryptofees.info, Thursday, August 10th, 7:00pm ET

*Fees in USD

IRS Ruling 2023-14 – Tax Implications of Cryptocurrency Staking

*From our partners over at Polygon Advisory be sure to check out their full blog post here. We are not tax advisors, please consult a tax advisor for any tax needs you have.

In the run of the numbers, we stated how staked ETH is one of the most popular DeFi assets. This means that there is a high probability that if you advise or know anyone investing actively in the digital asset space, they have some staked assets. Integral to ensuring investors don’t run into any potential needless wealth destruction events, adhering to current tax laws is where advisors can come and add extreme value to an investor’s situation.

With so many investors holding or earning staking rewards, the core question is:

“When a taxpayer uses the cash method of accounting stakes cryptocurrency and receives staking rewards, when and how should this be treated for tax purposes?”

TLDR; According to the new IRS Ruling; Taxpayers must include cryptocurrency reward value in income after they gain control, which contradicts what many believe is the actual rule. Whether you believe this should be the case, the IRS has provided clarity, and this is the rule.

If you are an investor, or financial advisor with clients who invest in crypto, and are unsure of how to approach this topic, please contact us.

PayPal Launches its own US dollar-backed Stablecoin, PYUSD

You might be thinking, “What is a stablecoin?” A stablecoin is a type of crypto asset whose value is pegged to another asset class, such as a fiat currency like the US Dollar, or a commodity like gold, to stabilize its price.

PayPal is no stranger to the online payment ecosystem and is one of the world’s leading online payment providers. They’ve been around for a long time making it easy for people to send and receive money with just a few clicks. But now, they’re diving into the world of cryptocurrencies with their very own stablecoin. PayPal created PYUSD, a stablecoin that can be used within their platform, allowing users to buy, sell, and hold digital assets with ease. By offering a stablecoin, PayPal hopes to provide a more reliable and secure form of digital currency for its users.

PayPal will use Paxos as its issuer and is the first major U.S. financial or payments company to issue its own stablecoin. Like both the Tether and Circle models, PYUSD is “fully backed by U.S. dollar deposits, short-term U.S. treasuries, and similar cash equivalent,” according to its press release. PYUSD is live on Ethereum Mainnet as an ERC-20 token. Support for the stablecoin is yet to launch for PayPal users, though is expected to be rolled out over the coming weeks to users in the U.S.

You now might be wondering, “Why should I care about PayPal stablecoin?” Well, for starters, it could potentially open a whole new world of possibilities for online transactions. Imagine being able to buy your favorite products or services using a stablecoin that retains its value, no matter what’s happening in the market. It could make online shopping a lot more convenient and hassle-free. Additionally, stablecoins could also be a game-changer for people in countries with unstable economies. They could provide a more reliable alternative to traditional currencies, allowing individuals to protect their wealth from inflation and other economic uncertainties.

The other piece you may be wondering is, “Why would PayPal care about having its own stablecoin?” Well, many reasons. First, issuing stablecoins in this manner is a lucrative model, especially when short-term U.S. treasuries can yield 5% or higher. Second, on the merchant side, if PayPal can position PYUSD to reduce merchant fees (ranging between 1.5% to 3.5%) at PoS systems or incentivize consumers to hold and spend PYUSD, then the economics may begin to make sense, given the high fees many retailers currently face.

There are still some challenges and regulatory hurdles that need to be addressed before PayPal stablecoin becomes widely adopted. PYUSD distribution channels are in place, but adoption may be slow due to regulatory uncertainty.

Digital Asset Learning:

On-Demand Learning: Understanding the Tax Implications of Cryptocurrency Staking: Revenue Ruling 2023-14

Created By: Polygon Advisory Group

Abstract: Cryptocurrency, specifically its staking mechanisms and its tax consequences, continues to be a hot topic. Recently released Revenue Ruling 2023-14 clarifies some previously ambiguous areas, especially in the realm of staking rewards. This blog post aims to give a comprehensive view of the IRS’s stance on the taxation of staking rewards, combined with insights from the most recent ruling.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.