Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

It’s Digital Asset Friday… on a Monday! Last week, Digital Asset markets cooled off from the recent headwinds caused by a pseudo-win for crypto in the SEC v. Ripple case and the flurry of BTC ETF filings, most notably, Blackrock’s, with the now public backing of CEO Larry Fink.

Over the last few weeks, as these positive headwinds have come to fruition, we have cautioned disciplined decisions when allocating to digital assets. When digital asset markets ripped higher, demand followed, and we continued to see retail investors make outsized risk allocations based on single events driven by emotion.

Want to know how Arbor Digital develops and executes disciplined plans on behalf of clients? Want to know the process by which we actively manage our investment strategies?

Book a demo here to learn more!

Important Takeaways

- House Republicans Introduce New Crypto Bill

- Not so fast on Ripple: SEC to appeal judge’s decision.

- Google Cloud Exec: “Become transformational players in the Web3 ecosystem”

- Uniswap: In June, launched Uniswap 4. Now has launched UniswapX which addresses the customizability of AMM (automated market maker) pools and efficiency by introducing cross-pool fillers.

- Chainlink: After 3 years of development, Chainlink launched CCIP (Cross-Chain Interoperability Protocol.

First, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

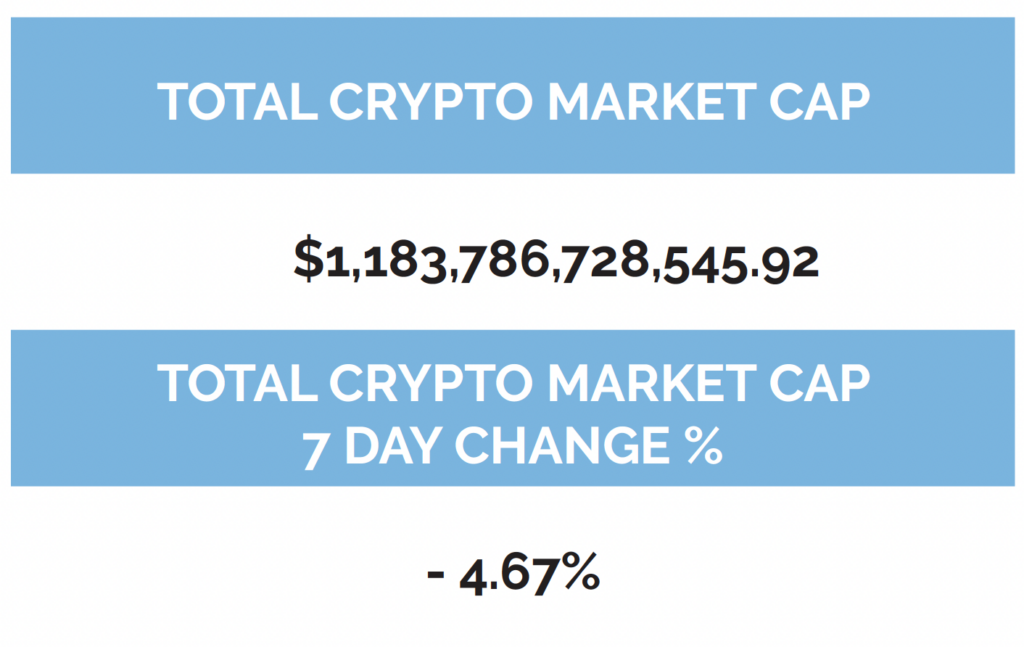

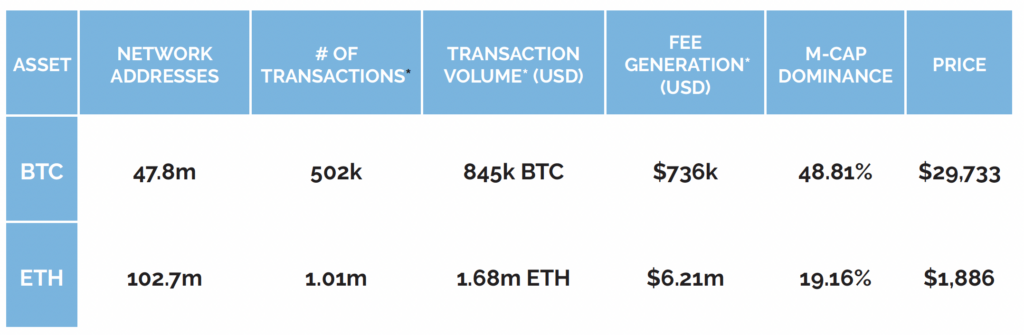

Digital asset markets were down this week with the total industry market cap hovering above $1.2 trillion. The price of Bitcoin (BTC) closed at $29,733.79, down 6.15% on the week, while Ethereum (ETH) closed at $1,886.49, down 5.53% on the week. Year to date, BTC is up 76.11%, ETH is up 54.38%.

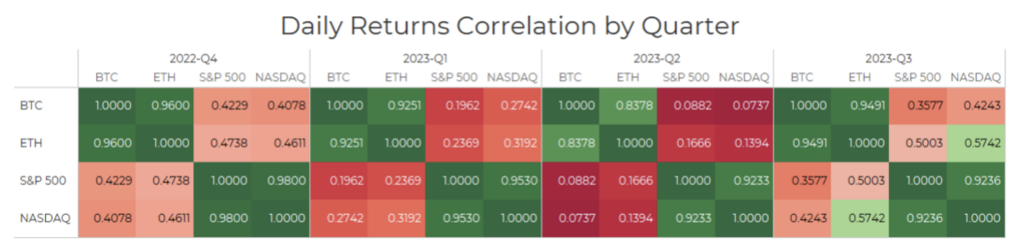

When looking at a 30-day rolling correlation, gold has joined the S&P 500 in being uncorrelated with Bitcoin. Ethereum continues to be positively correlated with Bitcoin by the same metric. (See correlation chart just below).

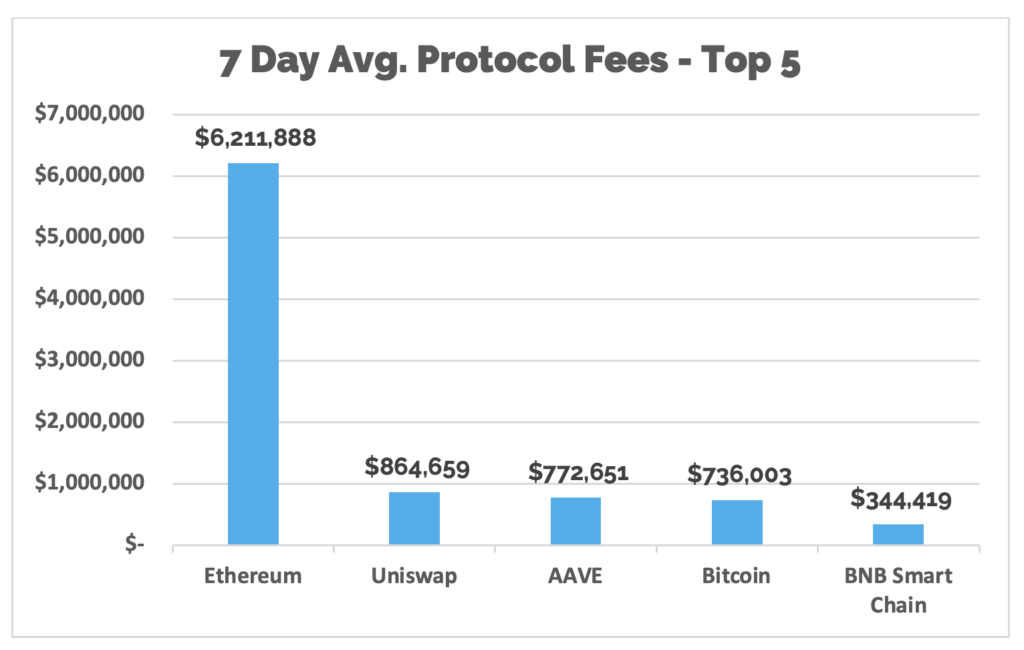

Total Value Locked (USD$) in DeFi as tracked by DeFi Llama and verified by Digital Asset Research was down this week in line with price movements, coming in at $43.66b as of Thursday, July 20th. The top 10 DeFi total value locked verified by Digital Asset Research showed no change in the ranking this week. Most notably in DeFi, AAVE launched its stablecoin GHO on the Ethereum mainnet.

-as of Thursday, July 20th, 7:00 pm ET

*7-Day Average

*Source: Cryptofees.info, Thursday, July 20th, 7:00 pm ET

*Fees in USD

Clarity vs. Confusion: SEC vs. Ripple Update

Advisor Note: Many investors may be operating on false, misleading, and emotional information regarding the recent decision by Judge Torres in the SEC v. Ripple case. Social Media and other platforms purposefully create extremely positive, or negative reactions, to incite emotional reactions. It is important for all crypto investors to stay disciplined with their investment decisions regarding digital asset markets. Please reach out to us if you have clients who need help making sense of everything.

If you haven’t read last week’s Digital Asset update, we strongly urge you to read it here for a quick recap of the SEC v. Ripple case so far.

Many are celebrating Judge Torres’s ruling in the Ripple case that XRP is and isn’t a security, depending on when it was transacted, and depending on the environment, and depending on the investors XRP was sold to. Confused after that sentence? You should be.

Rather than bringing more clarity, this judgment has clearly brought on more questions and confusion for legal professionals. Yes, there should be excitement as this is a win that brings some positive regulatory momentum. It diminishes the SEC’s ‘all tokens are securities’ arguments and adds nuance. Scott Mascianica and Jessica Magee, with Holland & Knight, wrote a great piece, which you can read here.

The takeaways are:

- Significant Impact on Exchange-Based Sales

- Crypto Industry Claims of Victory May (or May Not) Be Overstated

- Fair Notice Badly Wounded for Direct Sales but Still Alive for Other Transactions

Other resources to review to get caught up on the history of the SEC v. Ripple case, the current state, and analysis from legal professionals:

- Unchained Podcast: New Order in SEC vs. Ripple Over XRP Is a Win for Crypto: What Happens Now?

- Unchained Podcast: The SEC’s Lawsuit Against Ripple and 2 Execs: What You Need to Know

Digital Asset Learning:

On-Demand Learning: Regulated Liability Network: Proof-of Concept

Moderated By: Roy Ben-Hur, Managing Director at Deloitte & Touche LLP

Speakers Include:

- Raj Dhamodharan, Head of Crypto and Blockchain at Mastercard

- Tony McLaughlin, Head of Emerging Payments and Business Development at Citi Treasury & Trade Solutions

- Rebecca Simmons, Partner at Sullivan & Cromwell

- Per von Zelowitz, Director of the New York Innovation Center at the Federal Reserve Bank of New York

Abstract: Learn more about key findings from the Regulated Liability Network US proof of concept. Event panelists shared their views and learnings from the three workstreams in the PoC across two use cases: domestic interbank payments, and cross-border payments in US dollars. The webcast also covered topics related to technical feasibility and legal viability in addition to the business applicability report findings.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.