Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Crypto Asset markets and the adoption of decentralized blockchain technology.

Spot BTC ETF approved! For the Why, What, and Who be sure to read the previous edition of this newsletter. For a detailed toolkit, Ric Edelman and crypto-asset education company DACFP, have created a comprehensive Bitcoin ETF toolkit here.

With the ETF approval though the knock-on effects have started:

- Are clients calling and asking about the spot BTC ETF and wondering if it is right for them?

- Are your financial planners noticing more banks and crypto exchanges on client statements?

- Are your advisor teams asking more questions of you regarding adopting a crypto-asset investment product?

- Are you and your teams educated enough to Bitcoin, crypto, and blockchain to speak eloquently as to why, or why not, clients should be considering crypto-assets?

No, you don’t need to spend 10’s of hours to get educated to be a crypto-asset or blockchain expert. No, you don’t need to adopt crypto-asset-related products or services right away. The only thing needed now is to ensure that you are not ignorant of crypto-assets and that you will be prepared for when the above questions are inevitably being asked at your firm.

In today’s newsletter, we review what the focus is for wealth managers and financial advisors now that the spot BTC ETF has been approved with practical intelligence and action steps to implement. We also review in detail a very important announcement:

Arbor Digital is proud to now offer industry-leading consulting services for advisory firms who are on the journey to adopting crypto-asset-related products or services within their business.

Be sure to read the full newsletter to understand more about these services as well as an upcoming CE webinar for 1 CE credit towards CFP and CFA charter holders as well as CIMA®, CPWA®, CIMC®, and RMA® certifications where Arbor Digital dives into “How To Engage in Due Diligence of Digital Assets Managers, Products and Platforms.”

Before diving in, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

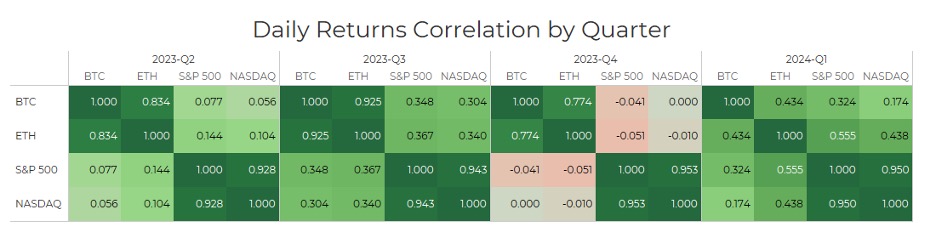

Digital asset markets were down this week with the total industry market cap hovering at $1.6 trillion. The price of Bitcoin (BTC) closed at $39,686.40, down 3.03% on the week, while Ethereum (ETH) closed at $2,216.37, down 9.38% on the week. The S&P 500 is now negatively correlated with Bitcoin when looking at a 30-day rolling correlation measurement, while Ethereum and gold continue to be statistically uncorrelated with Bitcoin by the same metric. (See Correlation Chart Below).

Total Value Locked (USD$) in DeFi verified by Digital Asset Research came in just over $56.03b a slight decrease from its recent peak of $58b on January 12th. Stablecoin market cap continues to see modest growth coming in at $134.5b, up from $132b.

Bitcoin remains in a downtrend following the launch of the spot ETFs, many are pointing to Grayscale as the potential culprit. Grayscale’s GBTC, which had been at a discount relative to its Bitcoin holdings for two years, was converted into an ETF and has seen major outflows since then.

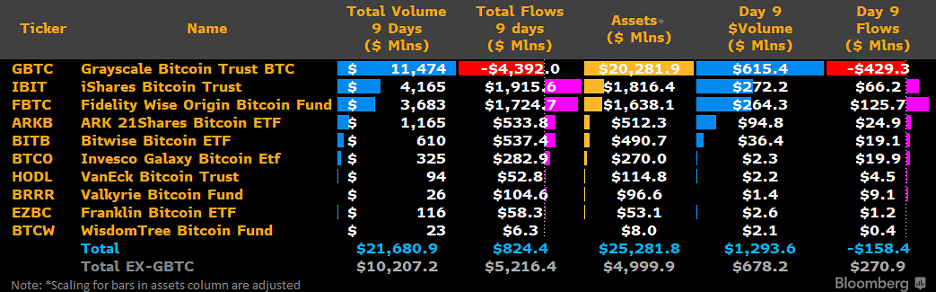

Source: Bloomberg ETF Analyst James Seyffart

- Since it’s launch, GBTC has recorded an outflow of over $4.3B

- Approximately $1B of those outflows were from FTX, which should be done selling its GBTC holdings per CoinDesk

- FTX’s bankruptcy estate had been holding GBTC at a discount and opted not to realize a loss by selling prior to the likely ETF conversion.

- Many other entities, including DCG (the parent company of Genesis) that had been holding at a loss likely decided to exit GBTC once it converted to an ETF and its discount went to near-zero.

- However, even despite the $4.4B in outflows from GBTC, it is worth highlighting that all the Bitcoin ETFs received in aggregate $820M+ in inflows.

With this Spot BTC ETF approval, what is important now?

Q1 and Q2 are some of the busiest times of the year for financial advisors. After spending the latter half of the previous year strategizing and fortifying client situations for the short and long term, the focus turns to executing and tax time.

With the spot BTC ETF now approved, we understand that a new wave of financial professionals will be entering the market to get educated and perform research and due diligence related to crypto-asset products and services. Given these dynamics here are three resources to arm advisors and teams regarding crypto-assets now that the spot BTC ETF has been approved:

Crypto Asset Tax Education Series

Dive into the ultimate guide to Crypto-Asset Taxation in our comprehensive YouTube series with Polygon Advisory. In this series, set up as quick 2-5 minutes videos, we uncover the following:

- Common tax mistakes to avoid.

- IRS treatment of crypto.

- de-code Fair-Value Accounting

- and more!

Learn how professionals stay informed and understand the crucial steps for tax compliance. This series unravels the intricate world of crypto taxation, providing insights for both professionals and investors.

View the Series Here

Crypto Asset Due Diligence Webinar

Conducting due diligence is never easy – and it’s particularly complex when crypto is involved.

In this vitally important webinar led by Ric Edelman, you’ll hear from Matthew Kolesky, Arbor Digital’s Co-Founder and Compliance Officer, and Alexander Nary, Head of BitGo’s HeightZero.

You’ll discover what to look for – and what to avoid – when you’re conducting due diligence for crypto asset management platforms and managed crypto solutions for client portfolios.

Whether you’re interested in Separately Managed Accounts or other direct exposure investment solutions, this session is for you.

1 CFP CE credit | 1 CFA PL credit

Investments & Wealth Institute® has accepted this webinar for 1 hour of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA® certifications.

Register for the Webinar Here

Mastering Crypto Assets

With the spot ETF approved many are asking questions about crypto-assets beyond Bitcoin, and even Ethereum. Look no further than my recent podcast episode with Jörg Willig and Martin Leinweber, co-authors of Mastering Crypto Assets: Investing in Bitcoin, Ethereum, and Beyond.

In this episode, we discuss and make clear the critical links between accepted principles in conventional finance and how they can apply to crypto assets, as well as their differences. As well as:

- crypto asset valuation.

- crypto allocation strategies.

- How blockchain is introducing an evolution of Trust in global financial markets.

- And so much more.

This episode will help professionals understand crypto assets on a deeper level.

Listen to the Episode Here or Watch the Interview Here

Arbor Digital Consulting

State and/or SEC-registered independent financial advisor firms typically have several important business units that make up their business infrastructure. These units may vary depending on the size and focus of the firm. When adopting any new products or services there are many critical steps that are taken by advisory firms prior to adopting. There are knock-on effects for the business units that make up an advisory firm. Specific to crypto-assets, the SEC simply approving a regulated Spot ETF does not lead to automatic adoption within financial advisory firms of crypto-asset products and services.

Our consulting services are here to help with those critical steps. We have categorized our core services based on the important business units that make up an advisory firm:

- Executive Leadership, Business Strategy, and Risk Management

- Legal, Compliance, and Regulatory Affairs

- Crypto Asset Education: Internal Team & End Client

- Operations, Client Services, and Relationship Management

- Investment Advisory, Financial Planning, and Wealth Strategy

- Marketing and Business Development

Why trust Arbor Digital?

Arbor Digital is a division of Arbor Capital Management, LLC, an RIA based in Alaska, incorporated in 1998. Arbor Capital began its journey in 2018 to advise clients in this emerging asset class and industry. The Arbor Digital team consists of licensed advisors along with an operational team with proven success in the RIA business operations. Our wisdom and intelligence are rooted in managing an advisory business over the long term. Whether you are in the early stages of building an advisory practice or have a mature book of business, we understand the specific pain points that are faced by wealth managers and financial advisors when adopting new products or services, specifically in crypto-assets.

It may not be your reality now, but if the past 6 years have been any indication to Arbor, it is that this will be your reality soon. To fast-track and speak with a team who has been committed to crypto-assets and has also walked in the wealth manager and financial advisory shoes, be sure to schedule an introductory call with us today.

Arbor Digital does also offer a full-service crypto-asset SMA product, but it may not be suitable for you and your firm. The products, services, and technology landscape has evolved rapidly for wealth managers and financial advisors regarding crypto-assets, and we have the blueprint for navigating. We work with firms to help them adopt systems and processes that fit into their current business model and operational workflows. Arbor Digital has gone through the good, the immature, and everything in between to bring you the intelligence needed to set your business up for successful inclusion of crypto-asset-related products and services.

Book time with us today to learn more about how we can help.

Thank you for your continued trust. Be sure to tell someone today you care about them!