Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Now more than ever it is important for financial advisors to be ready for what is coming regarding digital asset investing. Arbor Digital has been safely engaging in digital asset markets on behalf of advisors and their clients since 2020. For over three years, we have successfully helped advisors position digital assets in portfolios and client relationships.

To learn more about our investment strategies and how we help position advisors as the trusted resource for digital assets for their clients, then make sure you book Book a demo here so we can help you take advantage of the upcoming business opportunity.

Here are the main Digital Asset topics that are important for investors and financial advisors to be aware of and have a fundamental understanding of:

- NASDAQ Confirms BlackRock Spot ETF Plan

- Ark Invest and 21Shares to Offer Crypto ETF Suite of Products

- Digital Asset Fund Flows Highest since 2021

Are you a financial advisor or individual investor looking for help staying on top of important aspects to investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us!

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

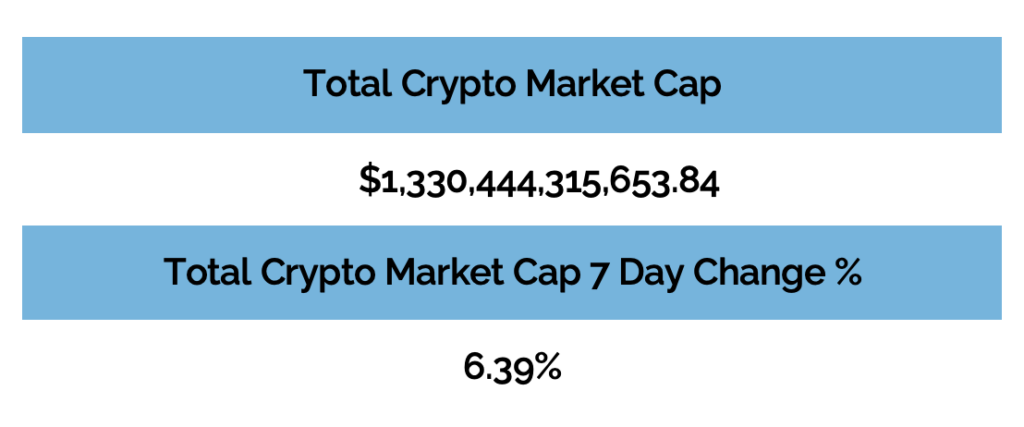

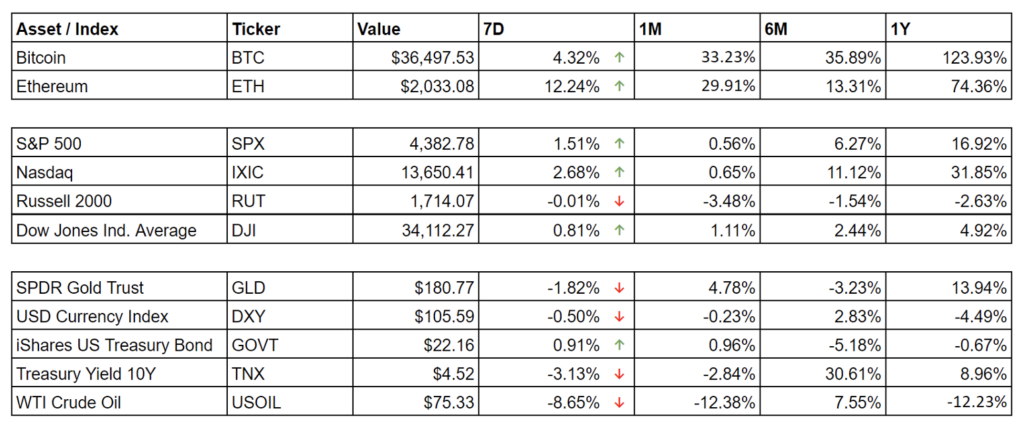

Digital asset markets were up this week with the total industry market cap hovering around $1.4 trillion. The price of Bitcoin (BTC) closed at $36,497.53, up 4.32% on the week, while Ethereum (ETH) closed at $2,033.08, up 12.24% on the week. Year to date, BTC is up 120%, ETH is up 72%.

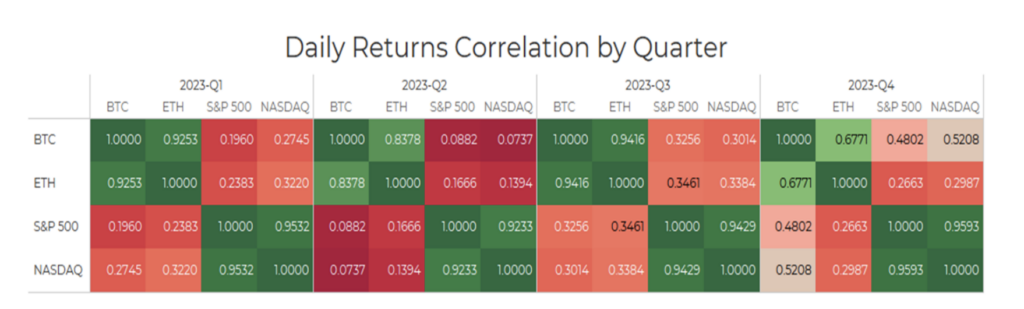

Ethereum, the S&P 500, and gold are now all statistically uncorrelated with Bitcoin when looking at a 30-day rolling correlation. (See Correlation Chart Below).

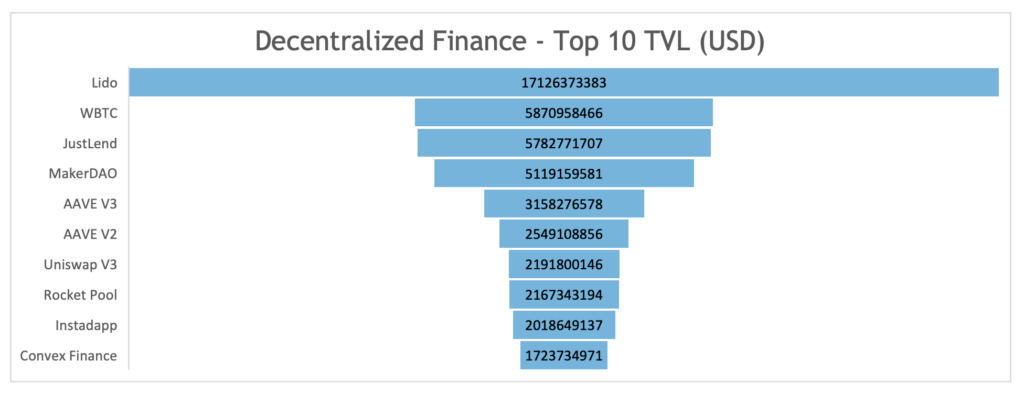

The total Value Locked (USD$) in DeFi verified by Digital Asset Research came in at just over $46b in line with the price movement of BTC, ETH, and many DeFi protocols. Stablecoin market cap remained flat at $125b showcasing the increase in TVL is mainly due to price action rather than new capital flowing into DeFi.

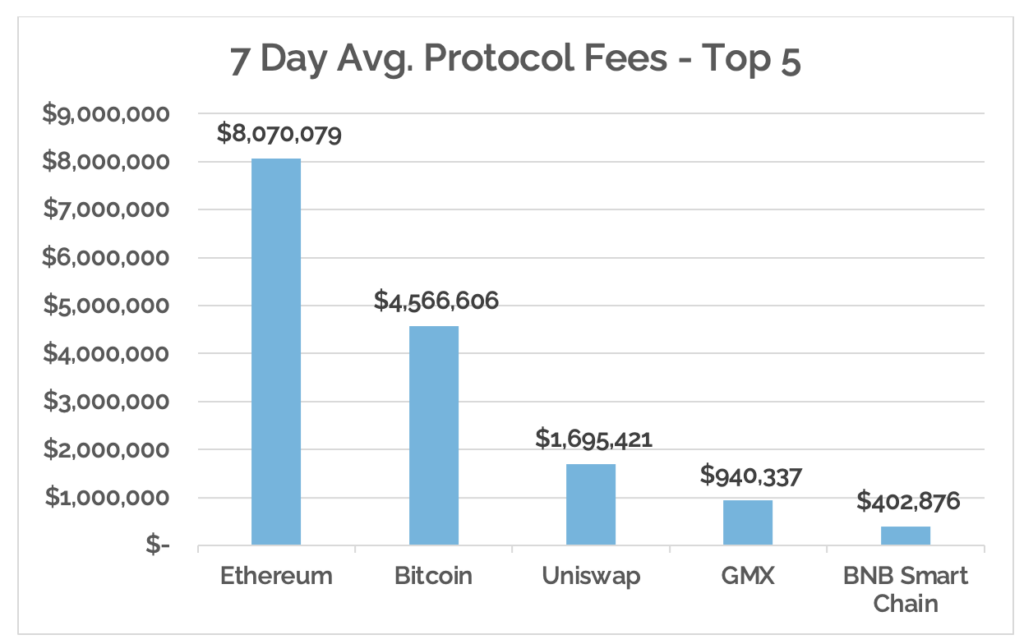

*Source: Cryptofees.info, Friday, November 10th, 7:00 pm ET

*Fees in USD

NASDAQ Confirms BlackRock Spot ETF Plan

BlackRock has made another significant crypto move by confirming its plans to launch an Ethereum Exchange-Traded Fund (ETF), which has garnered attention and interest from institutions, financial advisors, and retail investors. This groundbreaking development was officially announced on NASDAQ, further solidifying the growing acceptance and adoption of digital assets in the traditional financial sector.

BlackRock’s confirmation of its Ethereum ETF plans on NASDAQ marks a pivotal moment in the merging of decentralized blockchain and traditional finance. It highlights the increasing recognition of digital assets as a legitimate investment option and the growing demand for easy access.

Ark Invest and 21Shares to Offer Crypto ETF Suite of Products

Ark Invest and 21Shares have unveiled their plans to offer a comprehensive suite of digital asset exchange traded Funds (ETFs). This development reflects the increasing demand for diversified investment vehicles in the digital asset space.

The suite of cryptocurrency ETFs being developed by Ark Invest and 21Shares is expected to encompass a wide range of investment strategies. This diversity will enable investors to choose from ETFs focused on various aspects of the crypto market, such as:

Broad Market Exposure: ETFs that track the overall performance of the cryptocurrency market, including Bitcoin, Ethereum, and other prominent digital assets.

Sector-Specific Funds: ETFs targeting specific sectors within the crypto space, such as DeFi (Decentralized Finance) or NFTs (Non-Fungible Tokens).

Innovative Strategies: ETFs that incorporate innovative investment strategies, such as actively managed portfolios or thematic approaches to crypto investing.

Digital Asset Fund Flows Highest since 2021

CoinShares, a digital asset management firm, has released a comprehensive report shedding light on the recent increase in digital asset fund flows. This surge in investor interest and capital allocation reflects the growing acceptance and adoption of digital assets as investible assets.

From the report, “Digital asset investment products saw inflows totaling US$261m, representing the 6th week of consecutive inflows that now totals US$767m, surpassing the total inflows of US$736m seen in 2022.”

This surge can be attributed to several key factors:

Institutional Interest

Institutional investors, including hedge funds, family offices, and even traditional financial institutions, have increasingly recognized the potential of cryptocurrencies as a valuable addition to their portfolios. As a result, they have been actively allocating capital to digital asset funds.

Evolving Regulatory Landscape

The digital asset industry has seen improved regulatory clarity in various jurisdictions on a global scale. Specifically in the US, with the Grayscale vs. SEC case progressing the way it is, along with BlackRock’s BTC ETF application, it seems the regulators may have no choice but to approve a spot BTC ETF. This has provided a level of confidence for investors who were previously cautious due to regulatory uncertainties.

Enhanced Investment Infrastructure

The infrastructure supporting digital asset investments, including custody solutions and trading platforms, has matured significantly. This increased reliability and security have attracted a broader range of investors.

Have you noticed a theme in this week’s newsletter?

“Your 88-year-old grandmother isn’t going to buy BTC, she is going to be sold a BTC ETF.” – Anthony Scaramucci

A common retort when discussing BTC’s (or digital assets as a whole) role in a modern portfolio, and why it potentially will fail as an asset class, is that it won’t achieve ubiquity among all investors and will remain a fringe asset.

Grayscale’s Bitcoin Trust, GBTC, currently sits as a top 5 investment in Charles Schwab accounts whose owners are millennial age and younger. Now infuse the trust and creditability of an iShares Blackrock ticker, then the holdings of all generations of investors are likely to see a BTC holding of some sort. Just like other alternatives are sold within diversified model portfolios meant for all types of investors across the risk paradigm, regardless of age, digital assets will now sit beside them.

No one will call it a crypto fund. Investment managers and sales associates will sell the same diversified portfolio products, and any of them who invest in technology will consider the BTC ETF as an investment. The scary volatility will be wrapped up alongside other investments which will make an allocation much more palatable from a client experience perspective, which is a big deal for advisors.

BTC and other digital assets, statistically, have had an outsized positive risk/return impact on a traditional 60/40 portfolio since 2010, and that is saying a lot considering the historic recovery of traditional markets since the 08’ financial crisis.

Thankfully Arbor Digital has you covered and has been safely engaging in digital markets on behalf of advisors and clients since 2020. For over three years, we have successfully helped advisors position digital assets in portfolios and client relationships. If you want to learn more about our investment strategies and how we help position advisors as the trusted resource for digital assets for their clients, then make sure you Book a demo here so we can help you take advantage of the upcoming business opportunity.

Digital Asset Learning:

Free Webinar: What Advisors and Investors Are Saying Today About Digital Assets

Created By: Ric Edelman & DACFP

Abstract: Is your thinking about crypto in sync with advisors around the country? What are other financial advisors saying about the thawing of the crypto winter – and are they excited about the new spot bitcoin ETFs that are coming soon? Be the first to see the results of the latest survey of financial advisors, which was conducted by McKinsey & Company and Lionsoul Global. You’ll discover what advisors are thinking and doing about crypto, the products they want, and the essential services they say they need to help them attract and retain new clients. You’ll discover if you’re ahead of the competition – or falling behind. A can’t miss event!

Digital Asset Learning:

Free Webinar: What Advisors and Investors Are Saying Today About Digital Assets

Created By: Ric Edelman & DACFP

Abstract: Is your thinking about crypto in sync with advisors around the country? What are other financial advisors saying about the thawing of the crypto winter – and are they excited about the new spot bitcoin ETFs that are coming soon? Be the first to see the results of the latest survey of financial advisors, which was conducted by McKinsey & Company and Lionsoul Global. You’ll discover what advisors are thinking and doing about crypto, the products they want, and the essential services they say they need to help them attract and retain new clients. You’ll discover if you’re ahead of the competition – or falling behind. A can’t-miss event!

Register Here

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.