Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Since our last edition here are the main Digital Asset topics that are important for investors and financial advisors to be aware of and have a fundamental understanding of:

- Spot BTC ETF: SEC chooses not to appeal loss in Grayscale Case; Larry Fink sees Bitcoin as ‘Flight to Quality’; Blackrock Spot BTC ETF Ticker shows up on DTCC

- JPMorgan Executes First Blockchain-Based Collateral Settlement

Are you a financial advisor or individual investor looking for help staying on top of important aspects to investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us!

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

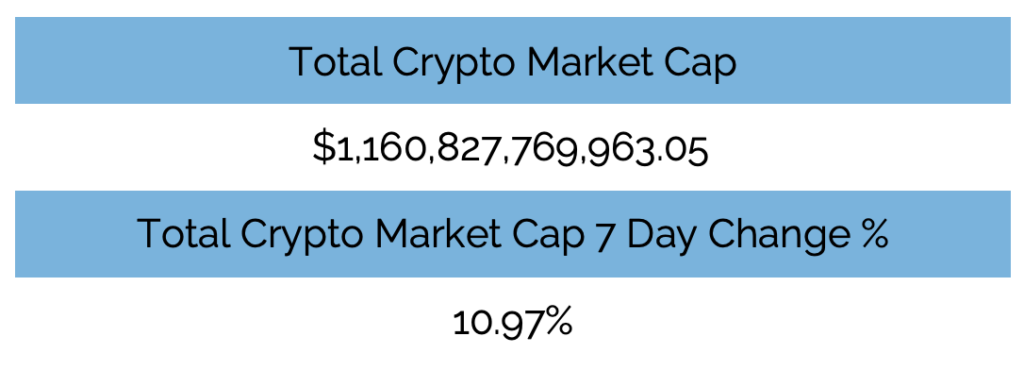

Digital asset markets are soaring from pent-up institutional demand and on news of BlackRock’s spot BTC ETF ticker symbol IBTC showing up on the DTCC’s website which houses ETF tickers and information. The industry market cap is now hovering around $1.16 trillion. The price of Bitcoin (BTC) broke $35,000 on Tuesday, October 24th, and closed at $33,790, while Ethereum (ETH) broke $1,820 and closed at $1,780. Year to date, BTC is up 73.96%, and ETH is up 31.30%.

It wasn’t just the two most lindy digital assets that saw significant price action, most major blue chip network tokens rallied, and all digital asset market sectors were up as well.

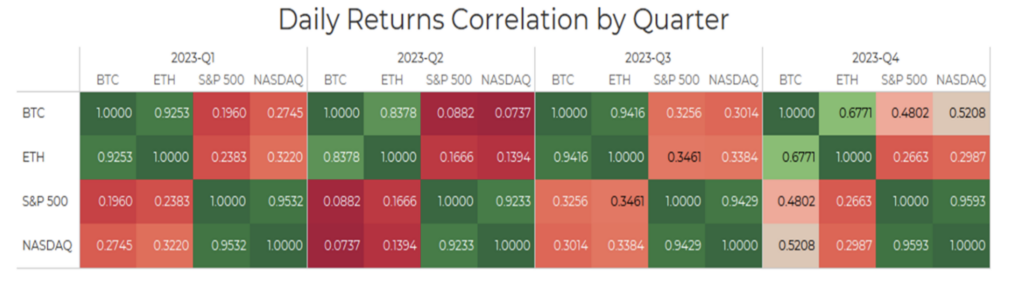

Ethereum, the S&P 500, and gold are now all statistically uncorrelated with Bitcoin when looking at a 30-day rolling correlation. (See Correlation Chart Below).

Total Value Locked (USD$) in DeFi verified by Digital Asset Research had its first major increase in quite some time along with the price action, closing the day at just over $40b.

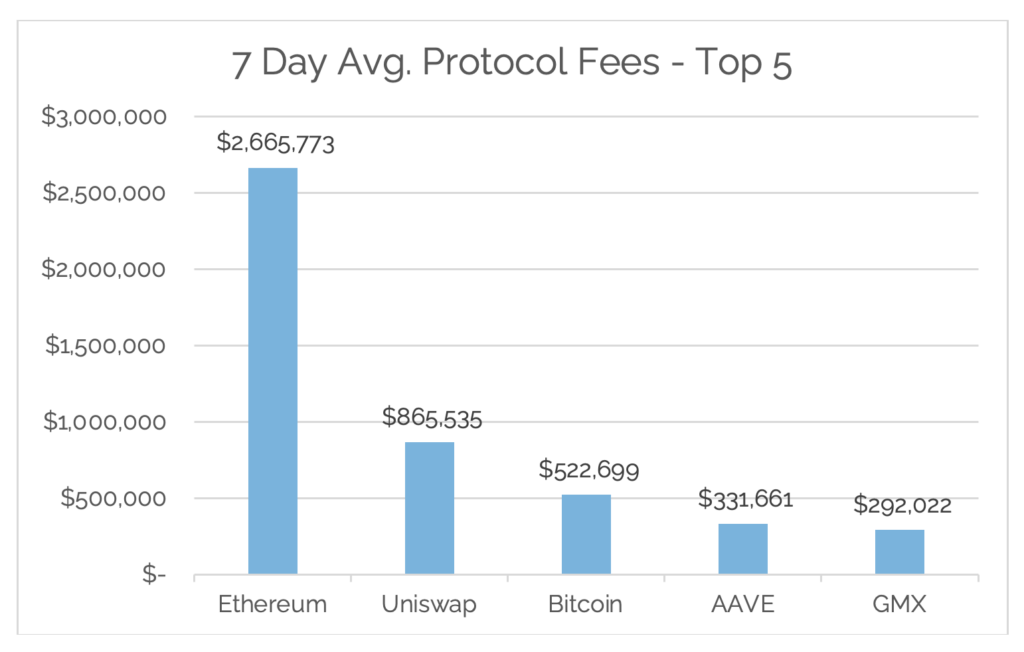

*Source: Cryptofees.info, Tuesday, October 24th, 7:00 pm ET

*Source: Cryptofees.info, Tuesday, October 24th, 7:00 pm ET

*Fees in USD

Spot BTC ETF: SEC chooses not to appeal loss in Grayscale Case; Larry Fink sees Bitcoin as ‘Flight to Quality’; Blackrock Spot BTC ETF Ticker shows up on DTCC

- “Should I be investing in the Bitcoin ETF?”

- “I thought this was a scam, why would the SEC approve this?”

- “Is there something to this blockchain thing?”

- “What do I invest in when I invest in Bitcoin?”

In 2017 during the ICO craze, I was sitting in one of the largest Schwab branches in the US as an advisor in Paramus, NJ where I remember getting many inquiries about this ‘crypto thing’ and bitcoin. We are about to hit the next version of that where advisors across the country are going to be fielding questions like the ones above.

You may be wondering how we got here. A short recap of recent events:

Back on October 13th, the SEC decided not to appeal a court’s reversal of its decision not to let Grayscale convert its bitcoin trust into an exchange-traded fund. BTC rallied to $27,000 on the news with the market taking this in as an important step towards an approved spot BTC ETF.

On October 16th, crypto native media company Cointelegraph made a post on X declaring that Blackrock Spot BTC ETF was approved by the SEC. Shortly after this report was disputed and verified to be misinformation. However, in the minutes between the post and its removal, BTC rallied to $30,000 on the news.

Later that day, Blackrock CEO Larry Fink appeared on Fox Business Monday calling BTC a “flight to quality” and how the price rally was “an example of the pent-up interest in crypto.” “We are hearing from clients around the world about the need for crypto.” He said.

On Tuesday, October 24th, an interesting new ticker showed up on the DTCC’s website which houses all the listed ETF ticker symbols. IBTC, the iShares Bitcoin Trust, which is Blackrock’s proposed spot BTC ETF. Bloomberg senior ETF analyst Eric Balchunas wrote in a thread on X, “This is the first spot ETF listed on DTCC, none of the others on there (yet). Def notable BlackRock is leading charge on these logistics (seeding, ticker, dtcc) that tend to happen just prior to launch. Hard not to view this as them getting signal that approval is certain/imminent.”

It is not a matter of if, but when, on-the-spot BTC ETF approval it seems. BTC is rallying, and the ETF hasn’t been officially approved yet. If the first day and week of trading of the first BTC Futures ETF is any indicator, the first day and week of trading of the spot BTC ETF is going to be something for the record books. Combine this with the institutional pent-up demand Larry mentioned and the likely approval of all 12 ETF applications at once, and we have exciting times ahead. Even Charles Schwab, who historically has been very quiet on the crypto front, recently had Adam Blumberg on their network to discuss the BTC ETF and what it means.

If you need help educating your advisor teams, talking with clients, and helping clients allocate then be sure to reach out and book time with us. We are here to help.

JPMorgan Executes First Blockchain-Based Collateral Settlement

In May 2022, JP Morgan transferred tokenized shares of a BlackRock money market fund to serve as collateral on its private blockchain platform Onyx Digital Assets.

In November 2022, JP Morgan executed its first cross-border transaction using Ethereum layer2 network Polygon because of its low transaction costs, and leveraged Aave Protocol’s permission pool concept. This was part of Project Guardian, led by the Monetary Authority of Singapore (MAS) in partnership with DBS Bank and SBI Holdings.

In October 2023, JP Morgan went live with their Tokenized Collateral Network (TCN), a blockchain-based application that enables JPMorgan clients to utilize tokenized assets as collateral. Their first two clients, Blackrock and Barclays completed their first transactions, converting shares in one of its money market funds into digital tokens, which were then transferred to Barclays as collateral for an over-the-counter derivatives trade between the two institutions.

Along with TCN, JP Morgan has JPM Coin, a blockchain system that facilitates payments in dollars and euros for wholesale clients.

Why is this important?

Many point to how ETFs brought efficiency to capital markets. Tokenization will boost this even further, eventually reducing costs and making the global financial markets more accessible to the broader population.

In 2021, digital asset detractors had plenty of ways to challenge the thesis that blockchain technology and digital assets were going to unlock new efficiencies in global markets and usher in the next wave of global value creation. DeFi summer was enough for crypto natives, but traditional institutions needed to do their own building and testing. While many were making destructive business decisions and crypto Twitter was filled with outrageous price predictions, others got to work. JP Morgan was one of the others.

Fast forward to 2023, it is becoming harder, dare I say almost impossible, for those same detractors in 2021 to make the same claims they did then. We have written extensively about working groups, experimental studies, and research initiatives all testing whether decentralized blockchain technology and tokens can deliver on their efficiency and value promise. The results from these groups have revealed a resounding Yes, they do deliver.

Digital identity, privacy, regulation, and scalability are next for the development of products and services, building on top of the work being done by JP Morgan and others like Ernst and Young.

It doesn’t matter if you believe in crypto, blockchain, or digital assets. The day is coming when you will be engaging with it without even knowing. Companies like JP Morgan, the networks they are building on top of, and any other organizations using or building products and services utilizing blockchain tech will be some of the largest organizations in the coming 10 years from now. You are going to look up and not recognize the landscape.

In that moment, remember when you were here reading this newsletter.

Digital Asset Learning:

White Paper: What You Need To Know About Spot BTC ETFs

Created By: Ric Edelman & DACFP

Abstract: Any day now, the SEC may let spot bitcoin ETFs onto the market. You can expect client questions, so you need to understand how these ETFs work.

Although the SEC has rejected all prior spot bitcoin ETF applications, there are indications the SEC will say yes. Among other reasons, BlackRock filed for the first time – quickly followed by ARK/21Shares, Bitwise, Fidelity, Global X, Invesco Galaxy, Valkyrie, VanEck and WisdomTree, along with Grayscale’s request to convert GBTC into a spot bitcoin ETF.

Approval by the SEC would be a game-changer for crypto, as an introduction of a spot bitcoin ETF has long been considered the “Holy Grail” for broad investor adoption.

Read Here

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.