Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into decentralized blockchain technology (DDLT) adoption in financial services as well as digital asset market data and news that are important for investors and financial professionals to stay updated on.

Today’s edition will be our Q3 2023 Recap. The themes that dominated were:

- Tokenization of RWAs (Real World Assets)

- Digital Asset ETFs

- US crypto court cases in progress.

For questions on how to engage in the emerging asset class of Digital Assets safely and securely, be sure to Book a demo here to talk with us.

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

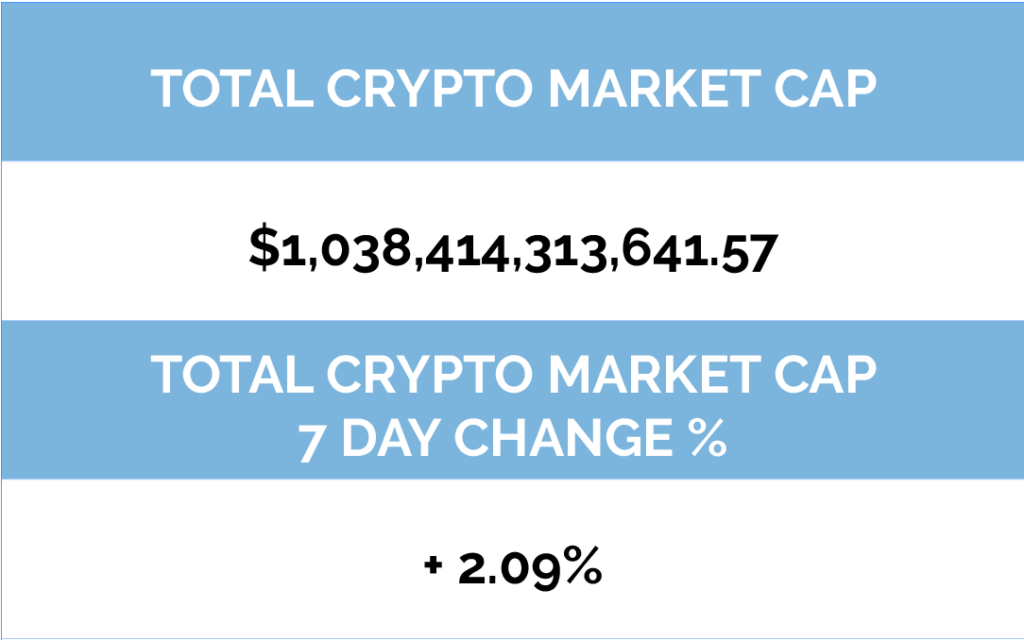

Digital asset markets were down this quarter with the total industry market cap hovering above $1.12 trillion. The price of Bitcoin (BTC) closed at $27,482, down 9.7% in Q3, while Ethereum (ETH) closed at $1,616, down 12.7% in Q3, respectively. The two largest and most Lindy (Lindy Effect Defined) Digital Assets, BTC and ETH, continue to outperform in 2023, however. Year to date, BTC is up 66.2%, and ETH is up 35.2%.

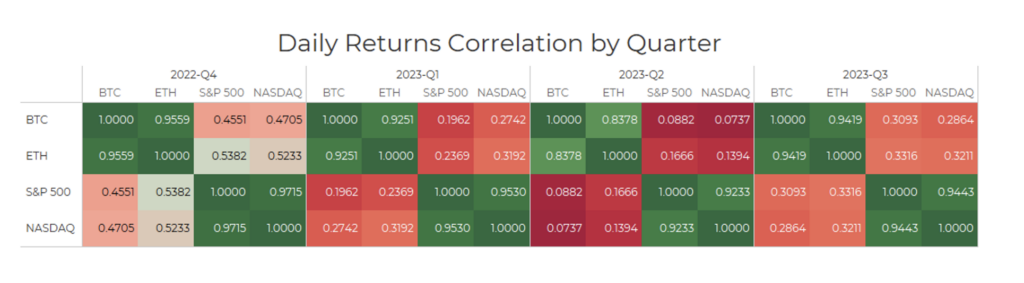

Bitcoin and Ethereum continue to return to historical correlation levels in 2023 relative to traditional indexes like the S&P500 and the NASDAQ (See below). This showcases how exposure to digital assets in traditional portfolios can improve the risk and return characteristics for investors.

Tokenization

In November 2022, JPMorgan executed the first live trade using tokenized versions of the yen and the Singapore dollar on the Polygon blockchain. Shortly after, WisdomTree unveiled nine digital funds which allow the transfer agent to keep a secondary record of shares on either the Stellar or Ethereum blockchains. This recent quarter many major financial institutions, including the ones above: Bank of America, Deutsche Bank, Franklin Templeton, The London Stock Exchange Group (LSEG), HSBC, and Blackrock all recently publicly released analyses or plans to offer digital asset custody services for crypto tokens and tokenized versions of real-world assets. With the theory of the benefits of tokenization becoming a reality, every major financial institution in the world is now devoting resources to this innovation.

We believe Jenny Johnson, CEO of Franklin Templeton, said it best, “Tokenization — the process of converting asset ownership rights into digital tokens on a blockchain — is akin to securitization done on steroids.”

Digital Asset ETFs

The previous quarter ended with a flurry of BTC Spot ETF applications, most notably from Blackrock, which created positive momentum. That quickly died off as the SEC proceeded to delay the seven-plus applications due in October and November. With a government shutdown looming, an election year upcoming, and the SEC resources already cut thin due to their enforcement actions, it is highly likely we won’t see BTC Spot ETF clarity until early next year, the latest the SEC must decide on the first BTC Spot ETF application from ARK/21Shares.

What we did get this quarter was the SEC’s simultaneous approval of nine ETH Futures-based ETFs. Notably, Bitwise Asset Management launched multiple versions, along with ProShares and Valkryie. While this is great progress for the adoption of digital assets as an investment, ETH Futures ETFs severely underperformed relative to when BTC Futures ETFs were approved. Halfway through the first day of trading, the assets had only collected nearly $2 million. In comparison, the Proshares Bitcoin Strategy ETF collected about $200 million in its first fifteen minutes on the market, according to Bloomberg analyst Eric Balchunas. It is important to note however that the first BTC Futures ETF was approved at the height of the 2021 bull market when BTC was above $60,000 and these recent ETH Futures were approved close to the bottom, with most digital assets still 70+% off their all-time highs.

To finish off the quarter there were a few spot ETH ETF applications. Grayscale filed to convert its Grayscale Ethereum Trust into a spot Ethereum exchange-traded fund, ARK/21Shares applied, and so did VanEck. The SEC swiftly has delayed these decisions as well.

US Crypto Court Cases

The SEC has had a tough time on the courts with setbacks against Grayscale and Ripple. The federal appeals court ordered the SEC to rescind its rejection of Grayscale’s bid to convert the Grayscale Bitcoin Trust into an exchange-traded fund and provide a new decision. Against Ripple, a partial win. The U.S. District Court of the Southern District of New York ruled the sale of Ripple’s XRP tokens on exchanges and through algorithms did not constitute investment contracts. However, the court said the institutional sale of the tokens did violate federal securities laws. Outside the SEC, another win for the digital asset industry, Judge Katherine Polk Failla, the same judge overseeing the Coinbase vs. SEC case, dismissed a class action lawsuit against Uniswap, brought on by a trader on behalf of other Uniswap users in April of 2022. Uniswap developers and investors were accused of violating securities laws, alleging the exchange was an unregistered broker-dealer offering unregistered securities, and allowed token issuers to scam investors.

Looking Ahead

Decentralized blockchain technology integrating and upgrading current financial services infrastructure has hit overdrive. We expect that there will be extreme consolidation of centralized crypto entities with traditional financial institutions looking to get great deals on technology platforms that drive them toward achieving their goals. The results from academic and experimental research showcasing the benefits and value creation for institutions in adopting this technology will bring more leadership at traditional institutions on board with the direction.

Our non-consensus view, however, is that the lead time to when this translates into exponential fundamental network adoption, and then digital asset price growth, is longer than most want to admit. In the short term, we expect small incremental network adoption along with digital asset market cap and prices staying within a tighter range. Next year the combination of a potential BTC Spot ETF approval and the next Bitcoin network halvening should have a positive impact on prices. In previous market cycles price has led to fundamentals, but in the next cycles, we believe, fundamentals will lead to price.

Even though there is as much positive as we outlined above, digital asset markets remain in a period of high pessimism. Now is the time to stay disciplined and dollar cost average into your overall digital asset allocation targets. Benjamin Graham’s famous quote rings true, “The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The Intelligent Investor is a realist who sells to optimists and buys from pessimists.”

Digital Asset Learning:

White Paper – Beyond Crypto: Tokenization

Created by: Bank of America

Abstract: Today’s financial systems continue to be built on centralized (company-owned) and fragmented infrastructure that requires third-party intermediaries. But distributed ledger technology (DLT) and blockchain technology (BCT) applications like tokenization can help facilitate the transformation of this legacy infrastructure.

BofA Global Research expects the tokenization of traditional assets to reshape financial and non-financial infrastructure and public and private financial markets over the next 5 to 15 years. Corporates are leveraging this technology in ways such as reducing credit risk, optimizing supply chains, and increasing data transparency.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.