This edition of Digital Asset Friday will be a bit shorter due to our Q3 market recap releasing next week, which we will give you a sneak peek of here. We will also highlight a high-impact partnership announcement from the last week. First, a run of the numbers…

By The Numbers

CPI came in Higher Than Expected: Que Roller Coaster

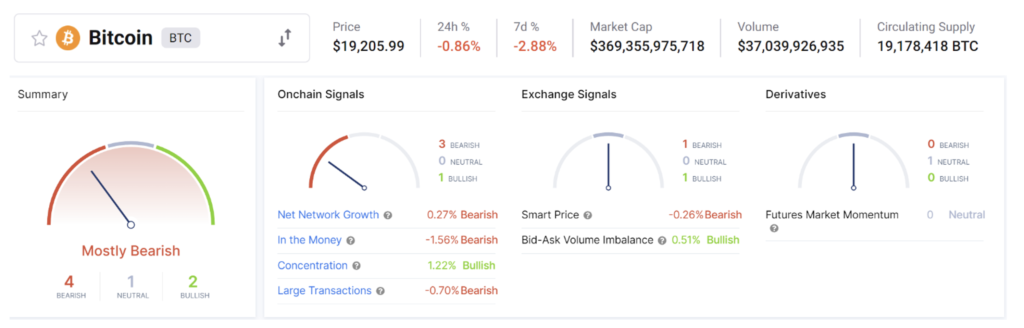

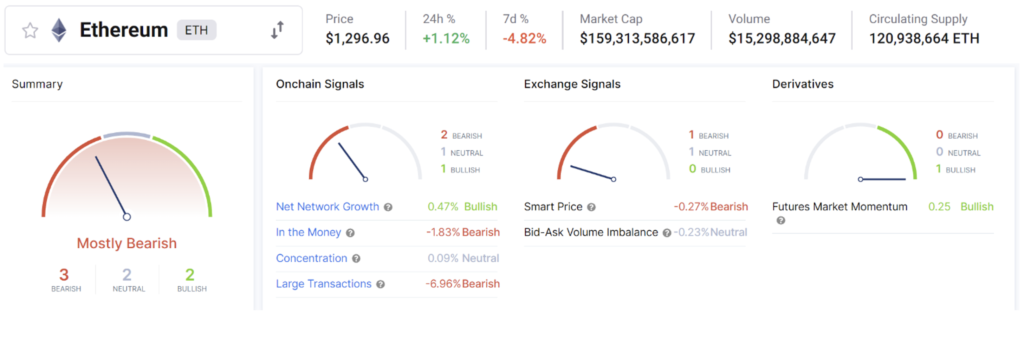

Equities and Digital asset markets were hit hard when the CPI numbers came in on Thursday. The S&P 500 and the tech-heavy Nasdaq each fell nearly 3% after markets opened Thursday but have since reversed those losses and are now up 1%. BTC dropped 7% and ETH dropped 10% and recovered by the end of the trading day.

While this is scary to look at, it’s essential to not let this distract you from the work that is being done in the space. Given the uncertainty of the macro backdrop, we expect it will continue to take time to realize all the value these networks will bring from a price standpoint, probably longer than many anticipate. This is an opportunity for investors to dollar cost average and takes advantage of tax loss harvesting strategies. The chess pieces are slowly getting to their positions on the board with firms establishing themselves for when regulatory clarity comes, and the macro environment improves.

Google Cloud to Let Users Pay With Bitcoin, Ethereum, and Dogecoin via Coinbase

On Tuesday this week internet giant Google announced a partnership with Coinbase to accept crypto payments for cloud services early next year. Google announced the deal at this year’s Cloud Next, a conference where Google pitches its state-of-the-art cloud computing business to companies. An important note is that Google Cloud accounts for nearly a tenth of Google’s revenue.

From Decrypt, “Coinbase Commerce is expected to move “data-related applications” from Amazon Web Services cloud to Google’s. Last month, Sky Mavis reached an agreement with Google Cloud enabling the tech giant’s cloud division to run a validator node on Ronin Network, an Ethereum sidechain set up by Axie Infinity creator Sky Mavis.”

Data runs the world. If you subscribe to this then you can’t understate the impact of this and future work Google will be doing in the space.

An excerpt from our Q3 Market recap…

“So, are networks establishing network effects, and are people using them? After reading all the above you may be telling yourself, “Well this doesn’t look like we are going to the moon.” You would be correct in the short term if you are only looking at mainnet. It’s full-on crypto winter there and we have our parkas on and generators ready. We are from Alaska; we live in the cold and welcome it.

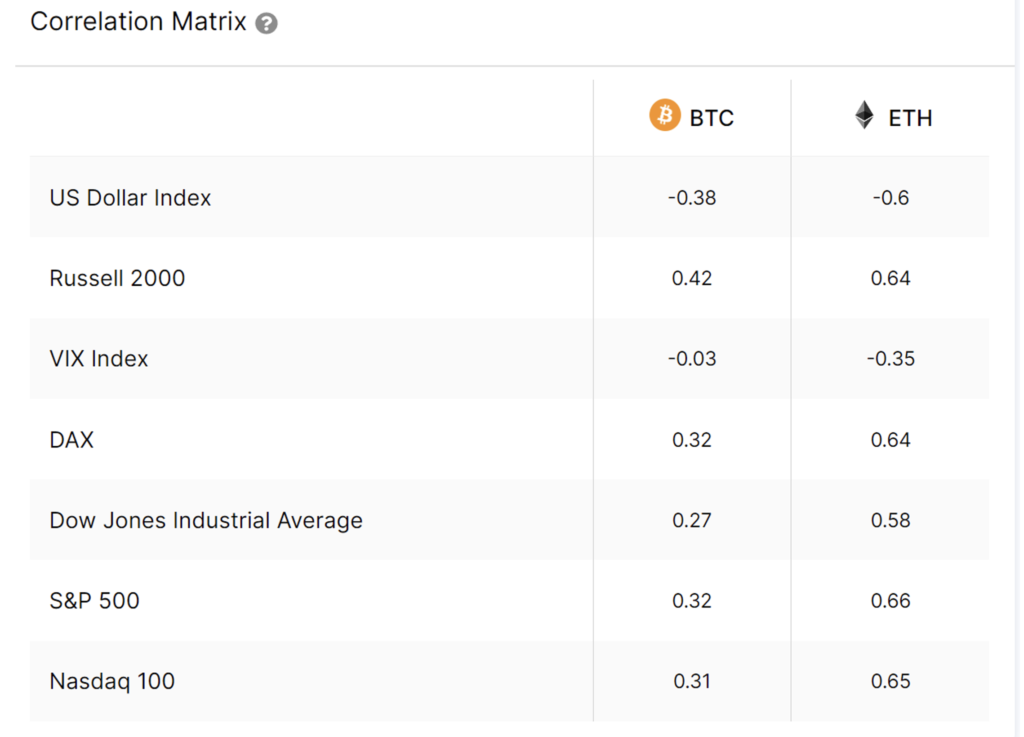

It’s true that network adoption and growth have stagnated on the mainnets, except for smart contracts on Ethereum, and we are back to levels just before the pandemic, i.e. pre-extreme quantitative easing. But Layer 2’s and scaling solutions are showcasing good growth that needs to be accounted for when evaluating the space. Therefore, it is important not to narrow your vision to just Bitcoin and Ethereum. Everyone is learning just like with other risk assets, specifically tech, Digital assets aren’t immune to cycles connected to the real world, as much as others want to say they aren’t, and we are seeing this play out. This is the healthy wash out of false growth exasperated by generous monetary policy that lifted all assets, not just digital.”

Look for our Q3 Market recap next week.

Other Digital Asset News

Crypto Exchange Uniswap Labs Raises $165M in Polychain Capital-Led Round

UK Passes Bill That Could See Trade Documents Stored Using Blockchain

Crypto Prime Brokerage FalconX Unveils Risk-Management Platform

51% of Ethereum blocks are now compliant with OFAC standards, raising censorship concerns

Several crypto exchanges reportedly block Russian users because of EU sanctions

Indian city deploys Polygon blockchain to manage public complaints

Digital Asset Learning:

Webinar: Regulating Crypto: What You Need to Know (Pending 1 CE Credit for IWI and CFP professionals)

When: Tuesday, October 18th, 2022, 3:30 pm ET

Presented by Barron’s & Galaxy Digital:

Recent volatility in cryptocurrency markets has renewed calls for increased better industry oversight. With regulating digital assets a top priority among several federal agencies, we invite you to join the third webinar co-hosted by Barron’s Custom Studios and Grayscale that will help you navigate the current regulatory landscape around cryptocurrencies.

Find out what is in the proposed legislation for regulating digital assets and what it means for investors. We’ll discuss how regulators can balance consumer protection and supporting financial stability without stifling the DNA of cryptocurrencies — innovation.

Reading: What is TVL?

Total value locked (TVL) is one of the key indicators to help us understand the value of a smart contract protocol. Smart contracts recreate traditional finance by codifying contractual logic and automating it.

While smart contracts enable the development of decentralized finance (DeFi), it’s TVL that measures the number of crypto funds bound by these programs. As a result, TVL is the primary indicator showing the public’s interest in a certain protocol, commonly known as a decentralized application (dApp).

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.