Financial Planning has created a sister event to their industry-popular INVEST event done every year focused on digital assets and crypto, aptly titled “Cryptocurrency for Advisors.” Arbor Digital will be sponsoring and spending time on a panel to discuss the essential pieces to incorporate digital assets into their advisory practice, and most importantly why they should be doing it.

We will be hosting our panel live on Monday, December 12th from 12:30-12:50 pm ET. Be sure to go here to register for this free event.

Now, let’s dive in.

Trust

Whether it’s code or people, trust is paramount in financial services.

Crypto natives may not like it but there is a realization that most users will need to trust to some degree an intermediary. Traditional Finance professionals may not like it, but public decentralized blockchain technology will completely disrupt their business models and create new trust models. What both ends miss is that a meeting in the middle will benefit everyone.

We are learning that trust has been misused and tarnished on both sides of the spectrum. We will end up somewhere in the middle where new trust models that are transparent, verifiable, and secure while giving end users greater control and autonomy of their financial lives, identities, and data will come to fruition.

But where do we start?

I decided to do a “trust series” of episodes for our podcast. I brought in people who know a thing or two about trust and hope you take something away from them.

Digital Asset Macro Overview sponsored by Digital Asset Research

Digital asset markets were flat this week with the total industry market cap hovering above $850 billion. The price of Bitcoin (BTC) closed at $17,226.02, up 1.45% on the week, while Ethereum (ETH) closed at $1,280.35, up 0.30% on the week.

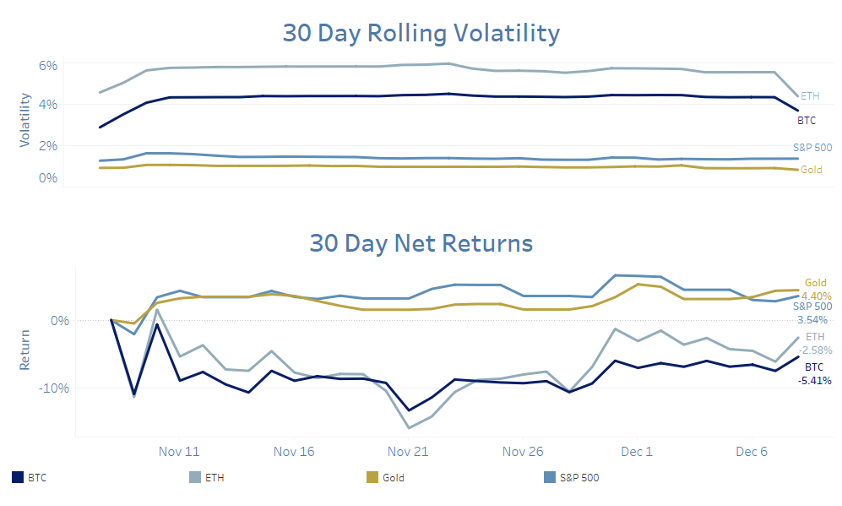

Ethereum has slightly outperformed Bitcoin over the last 30 days, though both assets have posted negative returns in that time, with Ethereum down 2.58% and Bitcoin falling 5.41%. Ethereum continues to record higher rolling volatility than Bitcoin.

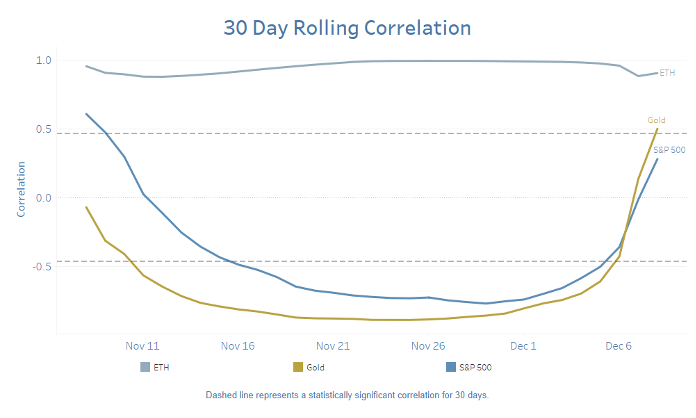

The S&P 500 and gold are no longer negatively correlated with Bitcoin when looking at a 30-day rolling correlation, with the S&P 500 now being uncorrelated with Bitcoin and gold becoming positively correlated with Bitcoin. Ethereum continues to be positively correlated with Bitcoin when looking at the same metric. Below is Bitcoin’s performance correlation to Ethereum, gold, and the S&P 500 over the last month.

Gemini Earn Updates

There are reports that crypto lender Genesis owes Gemini and it’s Gemini Earn customers $900 million. Genesis closed withdrawals from Gemini, and thus Gemini Earn customers in early November and have not reopened them as of this writing.

To communicate and provide transparency, on December 6th Gemini created a transparency page where customers can go for updates here.

“Gemini — acting as an agent on behalf of Earn users — has been in ongoing conversations with Genesis Global Capital, LLC (Genesis), Digital Currency Group, Inc. (DCG), the parent company of Genesis, and Barry Silbert (CEO of DCG) in an effort to find a resolution as soon as possible.”

One thing centralized crypto native tech firms offering financial services are learning the hard way is how easily trust can be lost, even if you aren’t the one directly causing it. We have always celebrated Gemini’s effort and mission to be proactive in their efforts to be regulated. However, there is a lot of work to be done in this area even if customers are made whole.

I recently had Dan Eyre, head of Gemini BITRIA, which is a separate division within Gemini and the platform which Arbor Digital utilizes for its services, talk about trust and how Gemini BITRIA is uniquely positioned to help gain back trust. You can listen to that episode above.

Regulation Update

On Thursday, December 1st, the New York Division of Financial Services (NYDFS) submitted a proposal for regulation on how they would assess Ney York regulated crypto companies with a BitLicense for costs of their supervision. Earlier this year, the New York State Senate authorized the NYDFS to charge crypto companies with a BitLicense to bring this more in line with how they oversee traditional banks and financial services firms.

Read More: Capital Fund Group – What is the BitLicense?

Also out of New York, as reported by Fortune Crypto, U.S. Rep. Ritchie Torres (D-N.Y.) announced the introduction of two pieces of crypto legislation that, in the wake of FTX’s collapse, would provide the volatile industry with transparency.

“Sam Bankman-Fried is not representative of crypto finance any more than Bernie Madoff is representative of traditional finance,” Torres said. “Crypto has a place in the American economy, but it must be carefully regulated.”

The UK doesn’t plan to halt any of its plans to be a crypto hub. As reported by Coindesk.com, U.K. Economic Secretary Andrew Griffith reiterated the country’s commitment to becoming a key center for the crypto industry, saying the collapse of FTX isn’t a reason to change course.

“For me, recent events in the crypto market reinforce the case for timely, clear, and effective regulation,” Griffith said. “The Financial Services and Markets Bill already enables us to establish a framework for regulating crypto assets and stablecoins in the U.K., and we will be consulting on a world-leading regime for the rest of the crypto-asset market later this year.”

Back to the Basics

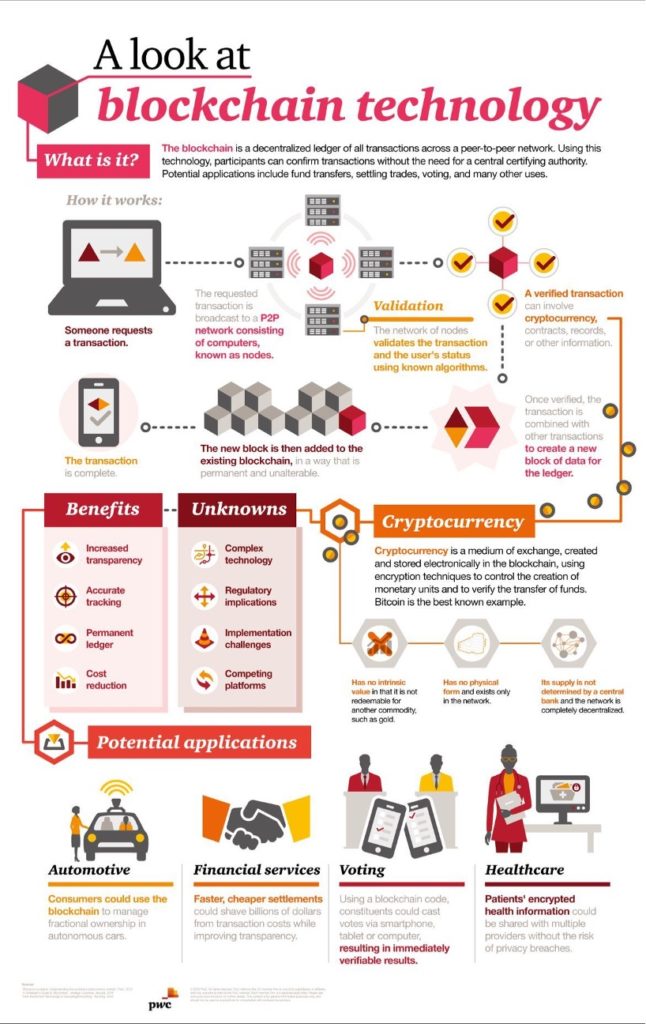

What is blockchain technology? PricewaterhouseCoopers, PWC, recently published an elegant one-pager on how public decentralized blockchain technology works, which is different than closed private blockchain technology.

Other News

- Genesis Owes $900 Million to Gemini Customers: Financial Times – The Block

- Three Arrows Capital Liquidators Begin Taking Control of Failed Hedge Fund’s Assets – The Block

- ‘TWITTER Coin’ Hints Unveiled by Tech Sleuth – The Block

- Coinbase CEO Sees Revenue Falling 50% Or More on Crypto Rout – Bloomberg

- Grayscale Bitcoin Trust Discount Widens to Record High Near 50%- CoinDesk

Digital Asset Learning

Webinar: Incorporating Digital Assets/Crypto

When: Monday, December 12th, 2022, 12:30-12:50 pm ET

Presented by: Arbor Digital

Marc Nichols, Matt Kolesky, and Chris Leap will discuss:

- Why advisors need to incorporate digital assets and how

- Due Diligence and Implementation

- Action Steps

Reading: Ponzi Economics in the Blockchain World

From Lisa JY Tan:

- What is Ponzinomics and how does it work?

- Which games have suffered the most from Ponzinomics and how was that exemplified?

- Our thoughts on Ponzinomics over the last year or two

- Detriments of the “Get-Rich-Quick” Mentality

- How economically sustainable are in-game NFTs if games do not typically have long life spans?

- What criteria must be met for these blockchain games to be adopted mainstream by someone who doesn’t necessarily play a combination of both of these games?

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.