Happy New Year!

The Financial Planning Association Austin Chapter will be holding an in-person lunch event on Ethereum and Decentralized Crypto Finance Tuesday, January 10th from 11:30 am-1:00 pm CT where Adam Blumberg, CFP will be presenting. If you would like your local Financial Planning Association chapter to host any crypto-specific events be sure to reach out to your local admin to request Adam or Arbor Digital. You can also reach out to FPAs learning coordinator Rachel Starling at rstarling@onefpa.org.

Tuesday, January 17th at 1:00 pm ET we will be hosting our 2023 Market Outlook Webinar where we will take a look back to the year that was 2022, where we currently stand heading into 2023, and the themes that we feel will dominate the digital asset industry. Spoiler Alert: We are optimistic and looking forward to 2023.

Please register here and be sure to share with a friend!

Digital Asset Learning

Reading: CFA Institute – Cryptoassets: Beyond the Hype

Written By: Stephen Deane, CFA and Olivier Fines, CFA

Abstract: This research paper is a practitioner analysis of the manner in which investment professionals have considered crypto assets and cryptocurrencies for integration purposes into their investment decision process or asset allocation portfolios. It is based on a series of interviews held with industry experts and investment practitioners over the course of 2022

Run of the Numbers sponsored by Digital Asset Research

-

Total Crypto Market Cap: $780,549,851,306.01

-

7-day Change % -1.25%

-

BTC Dominance 40.89%

-

ETH Dominance 18.56%

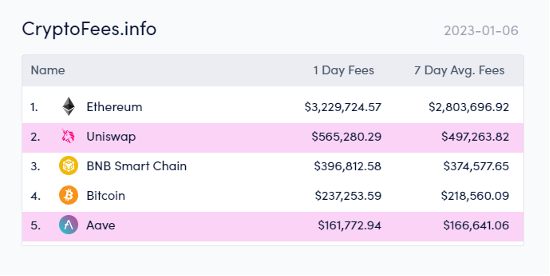

Top 5 Fee Generation

Macro Overview

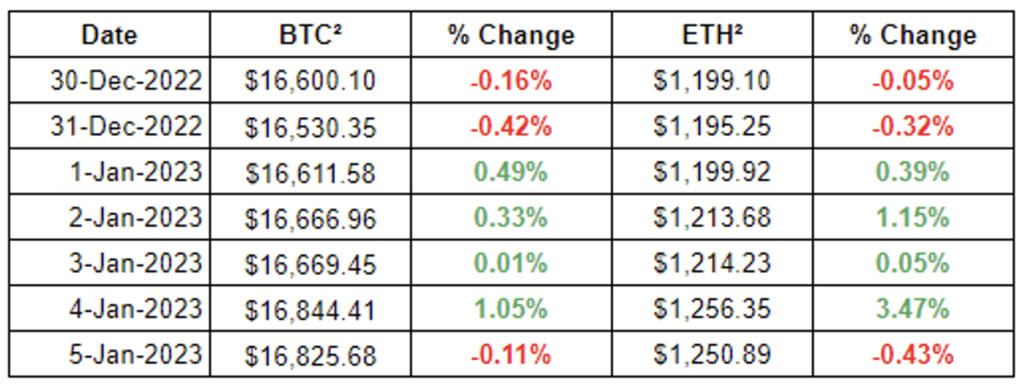

Digital asset markets were flat this week with the total industry market cap hovering above $850 billion. The price of Bitcoin (BTC) closed at $16,825.68, up 1.19% on the week, while Ethereum (ETH) closed at $1,250.89, up 4.26% on the week.

BTC/ETH Dominance

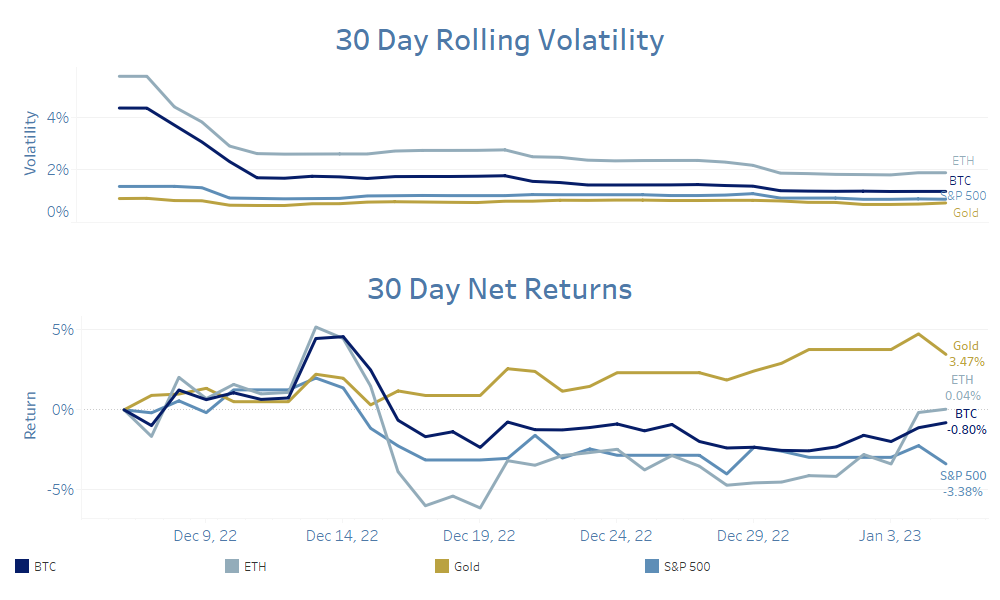

Bitcoin and Ethereum have posted similar flat returns over the last 30 days, with Bitcoin falling -0.80% and Ethereum up 0.04% in that time period. Both assets have seen a decline in their rolling volatility when looking across the last month.

See a comparison of rolling volatility and net returns across Bitcoin, Ethereum, gold, and the S&P 500 over the last month in the chart below.

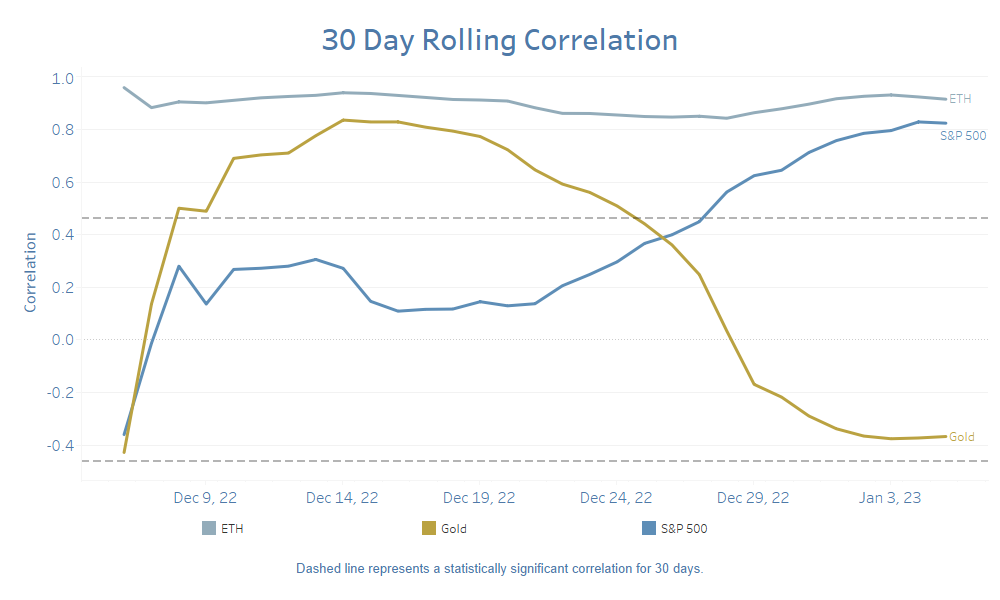

Ethereum and the S&P 500 are positively correlated with Bitcoin when looking at a 30-day rolling correlation, while gold is now uncorrelated with Bitcoin by the same metric.

See how Bitcoin’s performance was correlated to Ethereum, gold, and the S&P 500 over the last month in the chart below.

Other News

- Crypto Conglomerate DCG Closes Wealth-Management Business – CoinDesk

- Coinbase to Pay $100 Million Over Failure to Scale AML as Business Boomed – The Block

- SEC Files Limited Objection to Binance.US’s $1B Deal for Voyager Assets – CoinDesk

- Celsius ‘Earn’ Assets Belong to Bankrupt Crypto Lender, Judge Rules – CoinDesk

- Genesis-DCG Loan Leads to Class Action Arbitration Case From Gemini Clients – CoinDesk

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.