Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

Since our last edition, there are three main Digital Asset topics that are important for investors and financial advisors to be aware of and have a fundamental understanding of:

- SEC Delays all spot BTC ETF deadlines until March 2024

- Coinbase obtained regulatory approval to offer crypto futures trading.

- Future-based ETH ETFs Set for Approval

Are you a financial advisor or individual investor looking for help staying on top of important aspects to investing safely and securely in digital asset markets?

Then you need to Book a demo here to talk with us!

Other News:

- Sei Mainnet is Live After Testnet Sees More Than 7.5M Wallets Created – CoinDesk

- Bankman-Fried in Custody After Bail Is Revoked Over Leaks – Bloomberg

- Visa Tests Way to Make Paying Ethereum Gas Fees Easier – CoinDesk

- Paradigm, a16z File Brief Supporting Coinbase in Battle With SEC – The Block

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

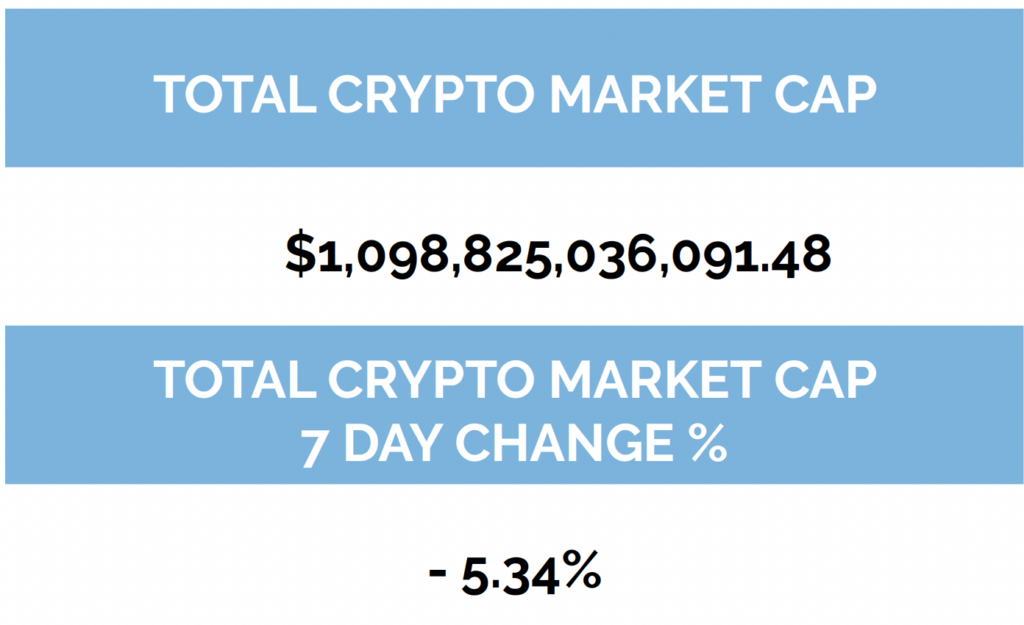

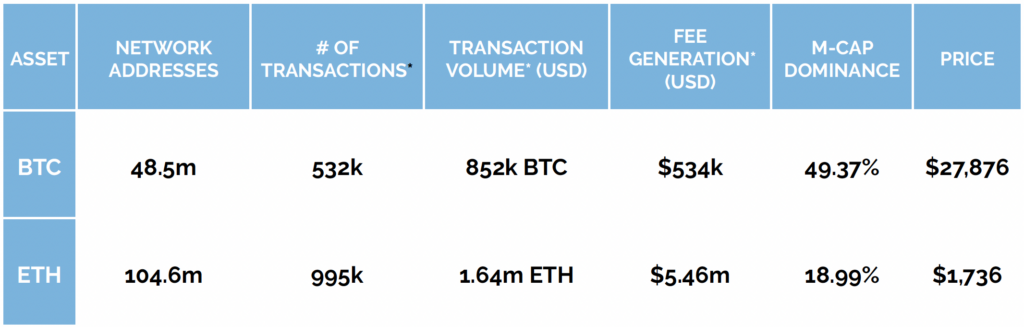

Digital asset markets were down this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $27,876.48, down 5.17% on the week, while Ethereum (ETH) closed at $1,736.65, down 6.00% on the week. Year to date, BTC is up 57.53%, ETH is up 43.78%.

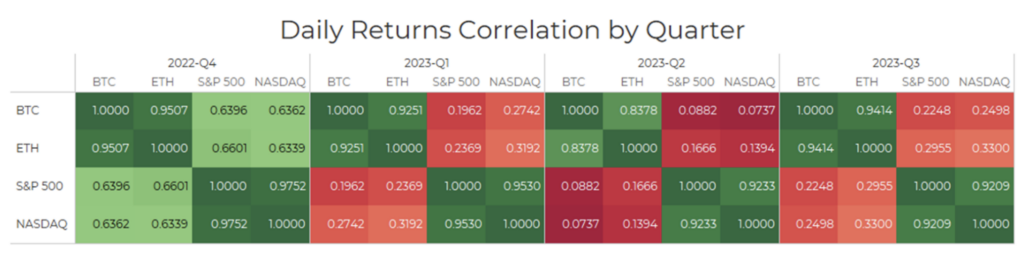

Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation. The S&P 500 and gold remain uncorrelated with Bitcoin by the same metric, though both appear to be trending toward a positive correlation with Bitcoin. (See correlation chart just below).

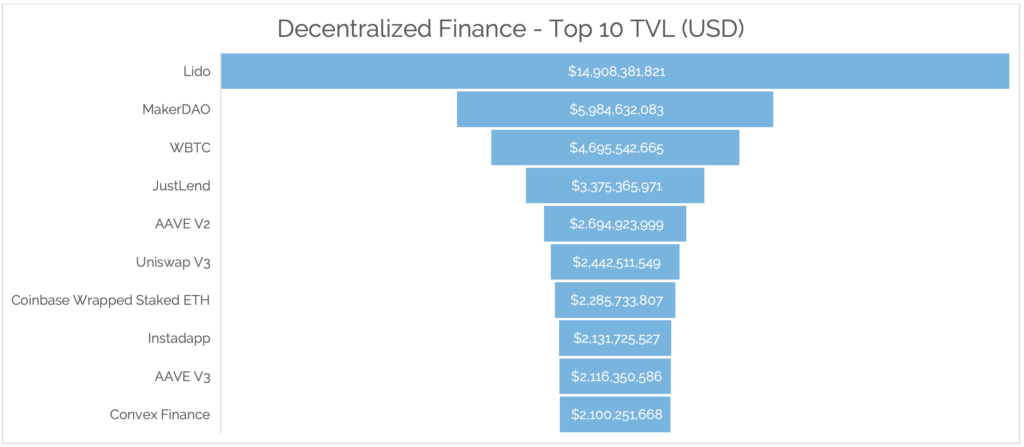

Total Value Locked (USD$) in DeFi verified by Digital Asset Research was down this week in line with price movements, coming in at $38.24b as of Thursday, August 17th. The top 10 DeFi total value locked verified by Digital Asset Research no change in ranking and TVL fall is proportionate with the recent price actions.

-as of Thursday, August 17th, 7:00 pm ET

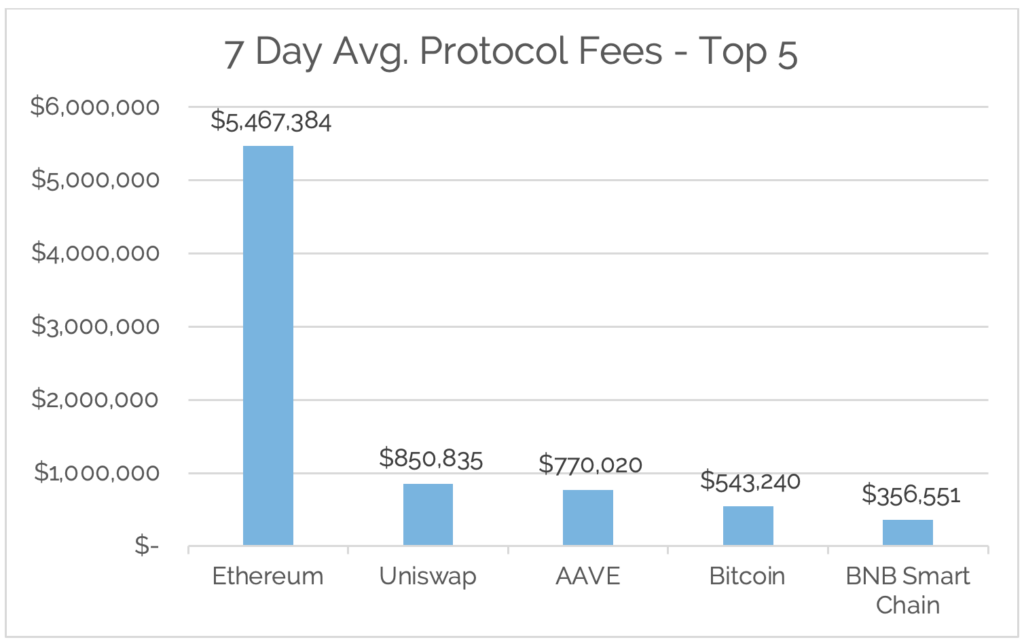

*7-Day Average

*Source: Cryptofees.info, Thursday, August 17th, 7:00 pm ET

*Fees in USD

SEC Delays Spot BTC ETF Deadlines

The SEC has delayed the set deadlines for spot Bitcoin ETF approval to early 2024.

The United States Securities and Exchange Commission (SEC) is reviewing several spot Bitcoin exchange-traded fund (ETF) applications, including one from BlackRock, the world’s largest asset management firm. BlackRock also entered into a surveillance-sharing agreement with cryptocurrency exchange Coinbase, potentially indicating that the SEC may be more open to accepting an ETF application under such conditions. BlackRock is just one of many firms with crypto ETF applications in the SEC pipeline.

As we mentioned previously, many investors end up making quick decisions making outsized allocations based on singular events like when the initial flurry of BTC ETF applications came in late July 2023, with the expectation a spot BTC ETF would be approved in the short term. At Arbor Digital we remain disciplined with our systematic process of helping advisors allocate into crypto on behalf of clients, ignoring the noise.

Coinbase Approved for Crypto Derivatives

Coinbase filed an application with the National Futures Association, NFA, in September 2021 to register as a Futures Commission Merchant, or FCM. This week, Coinbase has obtained regulatory approval from the NFA to operate as a futures commission merchant and offer crypto futures trading services to eligible customers in the U.S. This approval allows Coinbase to be the first crypto-native leader to offer traditional spot crypto trading alongside regulated and leveraged crypto futures for verified customers. The global crypto derivatives market represents approximately 75% of crypto trading volume worldwide and is an important access point for traders.

While Coinbase is still fresh into a legal battle with the SEC over operating an unregistered securities offering, one business line that the SEC won’t be able to come after them for in the future (pun intended) is for operating as a Futures Commission Merchant offering services in crypto derivatives. The is a major step toward the continued maturation of digital asset markets and only furthers the likelihood of ETH futures-based ETFs being approved in the near future.

Digital Asset Learning:

Upcoming Webinar: The Institutional Integration of Digital Assets

When: Tuesday, August 22nd, 2023, 10:15am EDT

Created By: Inveniam

Abstract: This webinar provides a comprehensive overview of how digital assets are evolving within the institutional landscape. From blockchain technology to tokenization, the pair explores the infrastructure and strategies reshaping how institutions manage, invest, and interact with assets. Other topics include: understanding the role of blockchain in Institutional finance, real-world case studies, and navigating regulatory requirements.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.