Welcome to the latest edition of the Asset (r)Evolution newsletter where we dive into what is important for Financial Advisors to know in the continued evolution of Digital Asset markets and the adoption of decentralized blockchain technology.

There are two things we are going to address in this week’s newsletter:

Before that a quick announcement.

On November 25th, 2023, Arbor Digital officially turned 3. That is three years of successfully going to market and serving financial advisors and their clients. Three years of investment track record, three years of education support, three years of relationship support, and everything in between.

Three years of being a trusted partner to advisors.

At the end of the day this business is based on trust. Arbor Digital was built to serve financial advisors digital asset needs, and in turn, to be able to effectively serve their clients digital asset needs. No matter the price, Arbor Digital is built to serve in all scenarios.

To learn more about our SMA investment strategies and how we help position advisors as the trusted resource for digital assets for their clients, then make sure to join us for our first LinkedIn live event on Friday, December 15th at 2pm Central for an AMA (Ask Me Anything) to learn more and celebrate Arbor Digital’s three years of serving financial advisors and clients.

Now, a run of the numbers…

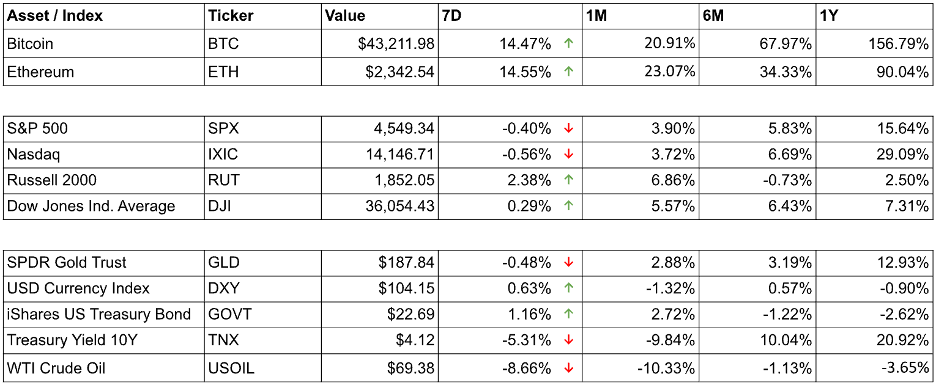

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

Digital asset markets were up this week with the total industry market cap rising above $1.6 trillion. The price of Bitcoin (BTC) closed at $43,211.98, up 14.47% on the week, while Ethereum (ETH) closed at $2,342.54, up 14.55% on the week. Year to date, BTC is up 161% and now ~40% off its all-time high of set in 2021. ETH is up 96% but is still ~50% off its all-time high set in 2021.

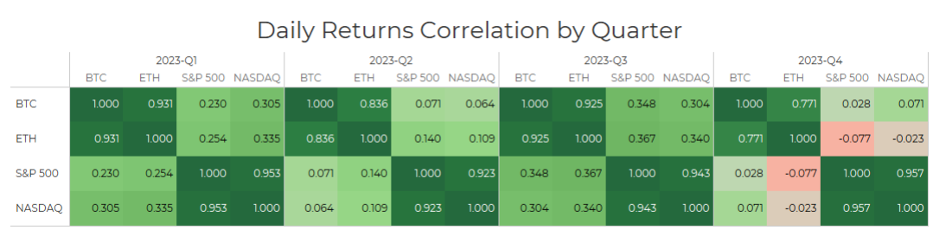

Ethereum, the S&P 500, and gold are all positively correlated with Bitcoin when looking at a 30-day rolling correlation, though the S&P 500 is very close to becoming statistically uncorrelated with Bitcoin (See Correlation Chart Below).

Total Value Locked (USD$) in DeFi verified by Digital Asset Research came in just over $52b in line with the price movement of BTC, ETH, and many DeFi protocols. Stablecoin market cap had modest growth at $128b showcasing the increase in TVL is mainly due to price action rather than new capital flowing on-chain.

Digital Assent Resurgence

- “Why are digital asset prices running now?”

- “Is now a good time to get in?”

- “What do you think is going to happen in the next 6 months?”

Advisor John (name changed for protection) is asking the same questions as many other advisors are asking. You probably read the questions and were like, “I want to know this too.”

Let me tell you a story.

It’s February 2022, Arbor Digital has signed contracts with Advisor John’s RIA in the US to bring our industry leading SMA solutions to their clients.

BTC is at $44,000 on the way down from its recent all-time high in 2021 at $69,000.

ETH is $3,100, on the way down from its recent all-time high in 2021 at $4,600.

Advisor John is excited to bring solutions to clients since he and the team are getting questions from clients as well as having their own on having something to go to market with so they don’t lose potential business and relationships.

Boom. The first wave of bad actors falls.

3AC, Celsius, BlockFI, Terra LUNA

“You know what we are going to hold off now. Clients are scared and we realize we aren’t ready. We can’t take the firm risk for taking direct exposure.”

“We believe in the asset class, but we just can’t damage our relationships and firm reputation. Can’t be associated with an asset class that is mainly seen as fraudulent.”

Boom. November 2022, FTX and the next set of dominos to fall. Prime Trust, Genesis, Voyager.

“We don’t trust the asset class and we are suspending any plans to offer crypto to our clients.”

Completely understand.

Financial Advisory business is based on trust. This has been true for 100 years, is true now, and will be true for another 100 years.

It’s 2023 Advisor John and team keep asking us:

“More dominos to fall?”

“Is now a good time?”

BTC is ranging $16-20k consistently, ETH is $900-1,200.

Our response: “Now is the best time to allocate as what has been happening in crypto has nothing to do with the technology or what it does. It wasn’t the tech that failed, it was people. Just like we have seen dozens of times in traditional finance and will more than likely see in the future. In fact, I’ll guarantee you will see more fraud in crypto in the future, just like how you see fraud in traditional financial markets today. This was true 100 years ago, its true today, and will be true in 100 years.”

Now, it is the end of 2023 and Advisor John is asking the questions I opened this section with.

“Why are digital asset prices running now?”

There is no complex technical analysis reason for the prices running. The answer is simple.

Trust is coming back to the markets. The largest bad actors are gone, regulators are coming in, and the merge of trusted financial institutions like Blackrock and Franklin Templeton with digital asset tech are here. We are still 40-60% off all-time highs in all digital assets.

The tech has only gotten better, more tested, and the right people are now at the helm.

Don’t be fooled by money managers calling for outrageous price targets, they don’t know. The one thing that has been true, just like in traditional financial markets since the beginning of time, humans are terrible predictors of the future.

I don’t know what digital asset prices will be in 6 months, or a year from now. I caution everyone to be weary of anyone predicting outlandish prices in short time frames.

I do know that people will act as they have done over the history of financial markets. Arbor Digital is built to serve with these truths in mind.

“Is now a good time to get in?”

This was the best question to answer. For the last 18 months I have been saying Yes to this question, in fact, pleading with advisors to allocate over time with dollar cost averaging.

Nothing.

The answer is still the same, Yes. In fact, let us take the burden of bringing to your investment process, talking with clients, doing education, and helping you grow your practice while protecting money and relationships from leaving.

“What do you think is going to happen in the next 6 months?”

I don’t know what the price is going to do. Anyone who tells you otherwise is lying to you.

I write about the true innovation and industry progress in this very newsletter. All the things related to the technology underpinning the investments is going to happen. Nothing has changed.

ETF’s are on the horizon, the Bitcoin halvening is scheduled in April 2024, and you only need go back to my most recent newsletter to see what is coming.

What I do know is going to happen is that humans will behave in financial markets the same way they have behaved for hundreds of years. Investors will pile in at highs when sentiment is at its peak, investors will eventually have a down year again, more fraud will happen in both traditional and digital asset markets, and advisors will mainly be reacting to everything when it comes to digital assets, just like in 2021 and 2022.

That is where we come in though. Let us help you be proactive this time around and benefit from not following the crowd. Your clients will thank you for it. We know because people have been thanking us at $16k.

Jamie Dimon Calls for Government to Ban Crypto

To everyone, especially my crypto evangelists, I want you to do a quick exercise with me. Put aside your human nature and bias and put yourself in the shoes and mind of Jamie Dimon.

- This thing called blockchain, crypto, and DeFi is threatening to disrupt or displace everything we do for clients.

- My firm is deeply rooted into global financial service and the US political system. We have allegiances and protections in place so that way our firm is successful.

- I know how financial systems work. I see what this tech can do. We need to get ahead of this.

What is the action plan if you are Jamie Dimon?

Step 1: Lets quietly reverse engineer the tech to learn how it works.

Step 2: Lets quietly develop our own version knowing everything we know about the current global financial systems and having the global allegiances/relationships we do.

During Steps: All the while we need to ensure the public trusts us and has distrust in crypto system so when we go to market with our version, there won’t be any reason for them to use the crypto version.

This actually makes a lot of sense now. Jamie is fooling everyone in crypto.

It’s not because he ‘doesn’t get it’ and it’s not because he isn’t smart. I would wager Jamie is playing an entirely different game than you think he is.

Maybe it’s you that doesn’t get it.

The probability of the US government banning decentralized blockchain tech is extremely low. The probability of the US banning is the same low probability back in the late 90’s and early 00’s when institutions called for the internet to be banned. Just like the internet, public blockchain is a globally unstoppable public good.

Even if the US were to ban it, its global technology infrastructure is valuable.

Financial advisors please don’t be fooled. Dig deeper and ask, “If this tech weren’t valuable, would Jamie Dimon even care?”

Digital Asset Learning:

Free Live Webinar: Arbor Digital AMA – Celebrating 3 Years Serving Advisors

Created By: Arbor Digital

When: Friday December 15th, 2023, at 2pm Central/3pm Eastern

Abstract:

On November 25th, 2023, Arbor Digital officially turned 3. That is three years of successfully going to market and serving financial advisors and their clients. Three years of investment track record, three years of education support, three years of relationship support, and everything in between. Join us for our first AMA (Ask Me Anything) to learn more and celebrate Arbor Digital’s three years of serving financial advisors and clients.

Thank you for your continued trust. Be sure to tell someone today you care about them!

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that

interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens

would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or

originator of a ledger change) that interval. All parties in a ledger change action (recipients and

originators) are counted. Individual addresses are not double-counted.