Arbor Digital Quarterly Report

Note: Please see Arbor Digital’s Glossary Page or Gemini’s Cryptopedia for definitions of any crypto jargon you come across. We understand the learning curve of a new language and hope to help guide you in this area.

Before diving into our quarterly market update, we wanted to highlight the following regarding our portfolio offer:

Given what has happened over the last quarter with centralized digital asset investment companies going bankrupt due to mismanaging risk and poor planning for long-term success (like Three Arrows Capital) which happened as well back in 2018 after the 2017 bull run, we felt it important to reiterate comments we have made in prior newsletters about how we approach digital asset investing.

- Arbor Digital purposefully chose a Separately Managed Account (SMA) as our investment vehicle: Our vision was to serve needs beyond just a simple gathering of assets via a fund structure. The efficiencies that come with an SMA on top of our belief that clients take more direct ownership of their investments guided us. We also knew education, operations support, and compliance consulting were of high importance.

- We are not traders, we are investors

- We do not invest in crypto hedge funds as a core strategy

- We do not use leverage

- We have never participated in staking, yield management, or other new and unproven strategies, and we believe that no one should until counterparty risk is well understood

- The core of the current crypto crisis is that traders and fund managers took significant levels of risk and leverage

There is no reason to change our investment thesis. We continue to focus our portfolio strategies in the following ways:

- Flagship: This is our “Beta Portfolio” providing market exposure via an actively managed balance between the two largest assets, BTC and ETH, which account for roughly 60% of digital asset markets.

- Compass: This is our “Early and Mid-Stage” decentralized blockchain opportunities portfolio. We have a disciplined approach to taking best practices from venture-style investing to diversifying across Gemini’s investible universe of digital assets.

We hope this gives clarity into why and how we do what we do.

Overview

We are now officially halfway through the year and there is no sugar coating it, this recent quarter was one of the most difficult in the history of digital assets. Digital assets don’t operate in a vacuum. The bear market started to unravel as the macro environment continued to worsen, diminishing risk appetite across the board. Combine this backdrop with counterparty risks with Decentralized Finance (DeFi) protocols, Centralized Finance (CeFi) lenders, and investment funds, and you get one of the most challenging quarters in Bitcoin and digital asset markets history.

Although price performance has suffered, investors should take solace in that we have been here before several times and that price cycles are a persistent feature for bitcoin and the digital asset class. Therefore, we set expectations early and often. Despite the challenges this quarter we see the long-term secular growth in terms of adoption, usage, and technology building has not changed. With that in mind and cyclical valuation measures that appear to be attractive (see more below and Digital Asset Friday from June 24th), we urge investors to think about the long-term case for the asset, because to us, that has not changed.

We frame the quarter up as an affirmation of two things:

- We need responsible regulation

- The use case for open decentralized finance has never been more apparent

The truth is no one knows exactly when the market will reach the absolute bottom or what will happen in the near term. The best we can do is try to identify signs that characterize a price bottom (see Digital Asset Friday from June 24th), so we can shift probabilities more in our favor. Nothing has changed that most of the value digital assets, crypto, and web3 technologies will create is still ahead of us, what we’re investing in today is the potential growth that such a future will bring.

What shaped Q2?

Internal:

Digital assets went through their own credit crisis starting at the beginning of May with the collapse of the Terra (LUNA) blockchain and its algorithmic stablecoin UST. Terra’s collapse was triggered by a selloff in traditional risk markets and its experimental economic design was exposed quickly. This resulted in the largest crypto wealth destruction event, roughly $60 Billion (listen to our special edition podcast episode here). Terra’s collapse created knock-on effects through centralized platforms and decentralized protocols that we are still assessing. Prominent digital asset hedge fund Three Arrows Capital and Centralized Finance (CeFi) lending platform Celcius’s excessive leverage was exposed, as they were unable to repay loans to BlockFi, Genesis, Voyager, and possibly others through the subsequent weeks.

Another core piece to the credit crisis was around stETH (staked Ethereum). One of the most crowded trades institutions were doing was propelled by leverage involving Lido’s staked Ether token (stETH). Billions worth of ETH were staked in return for stETH at a price of 1-to-1, which earns a passive 4%-5% yield.

This worked out well until the market’s demand for liquidity grew sharply as the deleveraging took place. Then stETH’s price dropped to as low as 0.93 ETH as institutions were forced to sell to cover other positions. deleveraging led to liquidity imbalance and further deleveraging:

- Millions of ETH were borrowed against stETH collateral to get leveraged staking yields close to 10%

- As stETH’s price dropped, borrowers were forced to sell it for ETH to cover their collateral

- This further dropped the price and led liquidity providers in the Curve pool to withdraw their ETH to avoid too much exposure to stETH

stETH’s liquidity dropped and the pool ended up with only 20% ETH (a large departure from its intended split), making slippage from selling even worse.

The deleveraging of institutions like Celsius and Three Arrows Capital, both of which managed over $10 billion according to several sources led to broad-scale liquidations in their largest holdings. Many are calling this digital asset market’s “Lehman Moment”, with a key difference that no bailout is coming for irresponsibly managed firms. Despite the turbulence, Bitcoin, Ethereum, and DeFi networks continue to operate without issue showing great resilience.

In our view, this only strengthens the need for open decentralized finance. While CeFi exchanges and companies are all suffering due to irresponsible business practices, Uniswap, Synthetix, Maker, Aave, and other open decentralized finance protocols have worked as intended. Many detractors say, “DeFi doesn’t actually do anything or solve problems.” We would argue that DeFi solves the issue of opaque business practices among financial companies and would take the practice of risk management to new heights. The dirty little secret in traditional markets is the ability to fully identify and quantify market risk in the form of beta. History has shown time and time again that this is not true.

An excerpt from Arthur Hayes, co-founder of 100x, recent piece: “But what’s conveniently going unmentioned by much of the media is that both centralized and decentralized lending companies/platforms had exposure to 3AC — and only the players in one of these two markets went belly up. The centralized lenders failed en masse, while their decentralized counterparts liquidated collateral and operated with no hiccups.”

External:

Global macro factors continue to drive both the digital asset and traditional markets with central banks combating high inflation expectations and enacting tighter monetary policies. In the US, CPI prints came in higher than expected at 8.3% in April, 8.6% in May, and June numbers due on July 13th. Risk assets have broadly sold off, with digital assets leading to way. Combine this with other geopolitical events like Russia’s continued invasion of Ukraine, COVID-19 shutdowns in China, and recession fears and you have a digital asset market where macro is, and will continue to be, the driver.

If you would like to read more of Arbor’s thoughts on the traditional macro landscape, how it’s affecting traditional markets (equities, fixed income, etc.), and how Arbor Capital is navigating this landscape, you can read the market update here, spearheaded by CIO Matt Schechter.

Regulation

This past quarter we saw higher than normal activity on the regulatory front globally for digital assets. See below for aggregated highlights:

- On June 7thS. Senators Kirsten Gillibrand (D-NY), a member of the Senate Agriculture Committee, and Cynthia Lummis (R-WY), a member of the Senate Banking Committee, introduced the Responsible Financial Innovation Act, landmark bipartisan legislation that could create a complete regulatory framework for digital assets that encourages responsible financial innovation, flexibility, transparency, and robust consumer protections while integrating digital assets into existing law.

- The United States Securities and Exchange Commission (SEC) Chair Gary Gensler proposed a one–rule–book approach to regulating digital assets in coordination with the Commodities Futures Trading Commission (CFTC), and bank regulators. The rule book would cover digital assets regardless of whether they are a security or commodity with the aim of guarding investors against market manipulation, fraud, and front running.

- Japan’s Financial Services Agency (FSA) has passed legislation that defines stablecoins as digital currencies, imposing a mandatory link with the yen and the right to redeem them at face value. The issuance of stablecoins will be restricted to banks, trust companies, and certain licensed money transfer agents.

- Consumer protection-oriented legislation in Australia is set to address crypto-related issues in the proposed Digital Services Act (DSA), expected to cover licensing, custody, taxes, debanking, and decentralized autonomous organizations.

- European Central Bank (ECB) President Christine Lagarde suggested a separate framework for crypto–asset staking and lending in addition to the Markets in Crypto-Assets (MiCA) regulation in the works, which is expected to be finalized by the end of June. She expressed her concerns about the risks of fraud, illegitimate valuation claims, speculation, and criminal elements.

- Austrian digital exchange Bitpanda obtained two licenses, a digital currency exchange, and a digital asset custody service provider license, to operate in Spain. This adds to its licenses to operate in the Czech Republic, France, Italy, and Sweden. In Singapore, Crypto.com gains in–principle approval to deal in digital payment tokens along with two other firms – Genesis and Sparrow Tech.

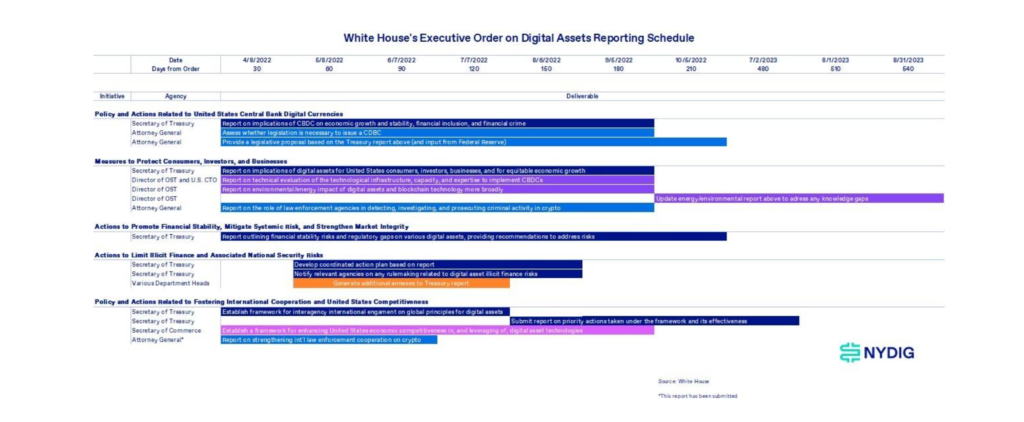

NYDIG put together a great infographic on the Digital Asset reporting schedule from the White House Executive Order released back in March. From this, you can see that most of the reports are set to come in Q3.

Other Quarter News

- SEC rejects Grayscale and BITWISE’s Bitcoin spot ETF applications. Grayscale responded by filing a lawsuit against the SEC to challenge the decision. We will follow this closely.

- S. retirement accounts held with Fidelity Investments will allow Bitcoin to be included as an investable asset, subject to employer participation. The plan will have a maximum cap of 20% of assets held in the account.

- Goldman Sachs led the financial sector towards a critical milestone when it allowed a borrower to use bitcoin as collateral for a cash loan. This initial step in accepting a cryptocurrency for use as collateral could pave the way for more institutions to consider following, and offering other types of loans based on digital assets.

- The Australian Dollar Stablecoin, A$DC, was launched by Australia and New Zealand Banking Group (ANZ), one of the largest Australian banks, on the Ethereum blockchain, where $30 million was minted using Fireblocks’ tokenization solution, and traded on the registered digital currency exchange Zerocap.

- On June 30, Circle launched the Euro Coin (EUROC) on Ethereum, backed by Euro reserves. Demand for Euro stablecoin is expected to increase as DeFi applications offer more Euro-denominated products. EUROC will remove currency exposure of European users of U.S. Dollar-based DeFi applications that require a USD stablecoin. Meanwhile, Tether plans to issue a British pound-backed stablecoin, GBPT, also on Ethereum.

Portfolio Update

We wrote a piece in a recent Digital Asset Friday addressing the question on everyone’s mind: Have we hit the bottom? It’s a very natural question to ask given everything we have gone through. In that piece we reviewed ways we determine attractive opportunities to establish long term positions. You are encouraged to read that piece here, but at a high level, most indicators are suggesting we are very close to the bottom. History does not guarantee future results, and no one knows where things will go in the near term, but we can use on-chain and off-chain data to help guide us.

Historically, Bitcoin has followed a four-year cycle based on the Bitcoin halving event. Within this four-year cycle, there have been four phases: 1. Exponential Highs, 2. Correction, 3. Accumulation, and 4. Recovery and Continuation (See here for an overview). Looking at the historical return chart of Bitcoin, specifically the yellow areas on the chart, it is clear we have entered a period in the four-year cycle that has historically provided great entry points into the markets.

*Source: Block Asset Management /BitStamp

Ending thoughts & looking ahead to Q3

In the coming second half of the year, we expect well-positioned centralized finance firms, like the ones mentioned below, and traditional finance firms to look for merger and acquisition opportunities and talent looking to move to firms. Interest in digital assets remains stable from wealthy individuals and institutional investors. FTX, Binance, and Nexo are examples of entities that have already taken action, or actively looking to.

As we covered previously, we will be watching intently for the next Digital Asset Reports from the White House’s Executive order. Don’t expect any actionable regulation to come about in the US until the primaries are finished later this year. Along with this, there are many pieces of the regulatory environment that will come about not from proactive implementation but will be settled in the courts. A case currently underway in which the results will have a profound effect on digital asset markets is the SEC vs. Ripple, which could drag into 2023.

Historically, in price downtimes, like we are experiencing, is when the highest quality emerging networks are being updated and new networks that take learnings from previous failures are built. Ethereum’s highly anticipated migration from Proof-of-Work to Proof-of-Stake is still to come but may be further delayed. Other networks are exploring business verticals to expand their network effects, for example:

- MakerDAO community approved proposal to connect to U.S. Bank Huntington Valley Bank

- Solana with Solana Mobile

- Uniswap with NFT integration

- Aave debuted Lens Protocol, a decentralized social media platform

Thank you for joining us on this journey and please don’t hesitate to reach out with any questions. -The Arbor Digital Team