Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

Before jumping in, in case you missed it, be sure to check out our 2023 Digital Asset Market Outlook.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, February 9th 7:00pm ET

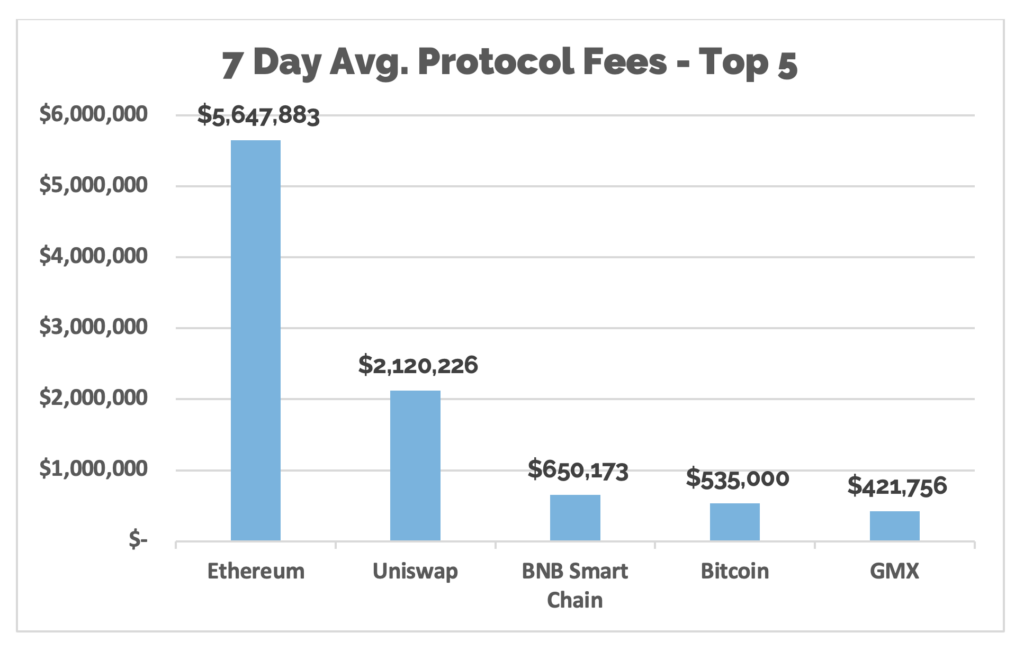

*7-Day Average

*Source: Cryptofees.info, Thursday, February 9th, 7:00 pm ET,

*Fees in USD

Week in Review

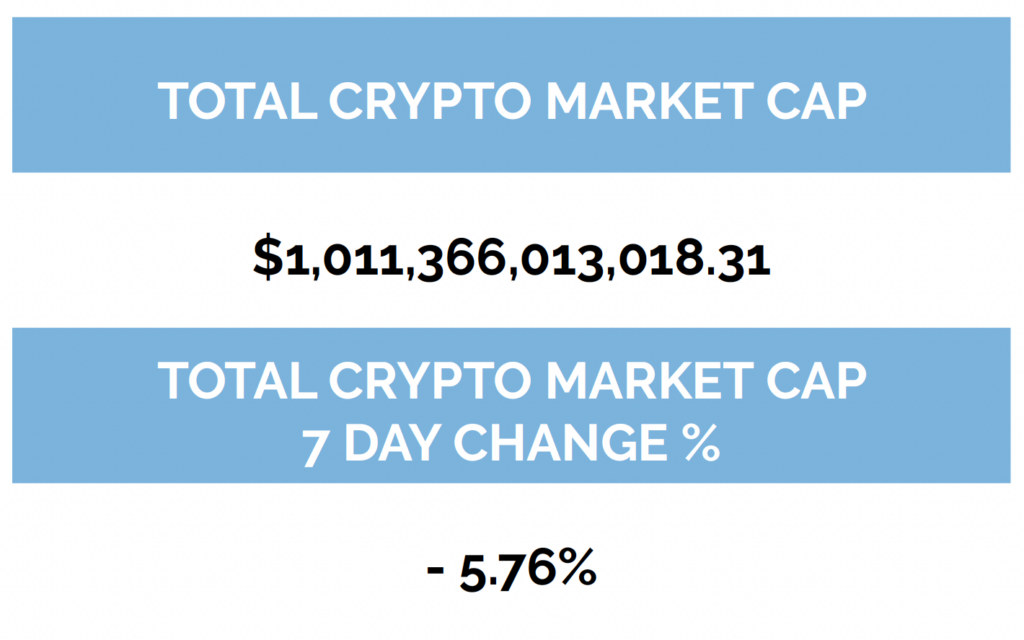

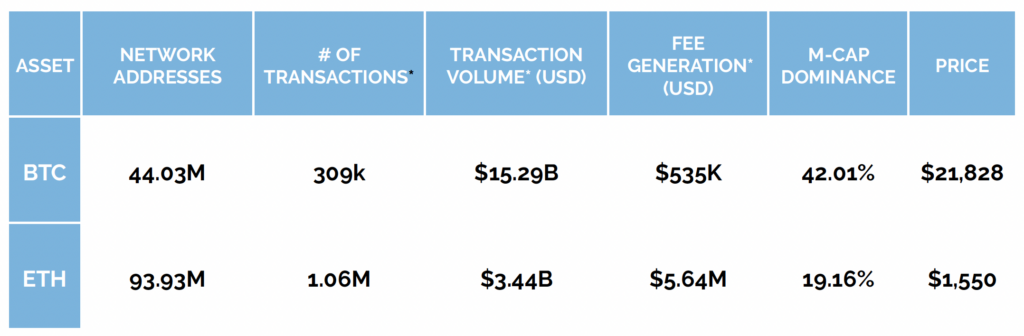

On the Bitcoin network, over the last week, roughly 300,000 new network addresses with a balance of BTC were added bringing the total to just over 44 million network addresses, bringing it to its new all-time high from November of last year at 43.96 million. Network activity was flat for the week at 975,000 for the daily average. Network fees saw a significant jump up roughly 63% this week generating $535,000 on a daily average; last week the daily average was $328,000 for the week. Daily average transaction volume (USD) for the week decreased by 14.8% moving from $17.95B to $15.29B.

ICYMI

This week saw Bitcoin Taproot adoption breach 5% for the first time ever. We have talked a lot so far about the Taproot and Taro upgrades. With nothing but negative headlines and price action over the last year that mostly ignored what was actually happening with the technology development, we have decided to try to help shape the narrative.

Be sure to read the above link from Chainalysis on the Taproot upgrade, but to take a small piece: The Taproot upgrade will improve Bitcoin in a number of ways, such as:

- Lower fees: Since the data size of complex transactions will be reduced, transaction fees will decline proportionally.

- Improved lightning network efficiency: Taproot will make transactions on the Lightning Network cheaper, more flexible, and more private.

- Enhanced smart contract functionality: With Taproot, Bitcoin will be able to host smart contracts with any number of signatories while retaining the data size of a single-signature transaction. This lays the technical foundation for DeFi on the Bitcoin network.

While many only look at the price of bitcoin as an indicator of its usefulness and anti-fragility, it’s important to look at the actual technology of the technology. Yes, it’s just as strange to write that as it is to read it.

On the Ethereum network, roughly 470,000 new network addresses with a balance of ETH were added bringing the total amount to 93,931,068 network addresses with a balance, an all-time high. Network activity for the week was down moving from 501,384 average daily active addresses to 477,810. Average daily fees for the week were significantly up, $5.64M from $4.39M. Transaction volume (USD) was slightly down, moving from $3.54B to $3.44B, and continues to stay in a healthy range.

dApps, decentralized applications (think like apps in the apple app store but on the Ethereum network) continue to contribute to Ethereum’s network adoption rates. One dApp to highlight is The Graph, which as you will see in the financials for the week, had a very good price week. But this section isn’t about price, it’s about adoption.

The Graph is an indexing protocol that provides on-chain data to consumers from a wide spectrum of sources. It removes the need for data consumers (e.g., app developers) to build out complicated infrastructure to get on-chain data. Instead, data consumers pay to query APIs of on-chain data — called “subgraphs” — via the GraphQL API.

A recent research report on The Graph from our friends at Messari highlights The Graphs network growth:

“The Graph is primarily focused on migrating from a hosted service to a decentralized network (mainnet). As of Q4’22, 618 mainnet subgraphs were successfully migrated. Notably, The Graph’s ecosystem of staked Indexers (+33%), Delegators (+9%), and Curators (+2%) continued to grow QoQ.

Simultaneously, The Graph experienced a 66% QoQ increase in GRT revenue from query fees in Q4’22 and a 6,228% increase YoY. Query fees should continue to increase as more subgraphs are migrated to mainnet in the coming quarters. This increase in volume may attract more key participants to the protocol as it drives profitability for existing ones. By adding more subgraphs, The Graph will continue to remove technical barriers for developers, ultimately leading to faster innovation across Web3.”

Network Addresses

The sum count of unique addresses holding any amount of native units as of the end of that

interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens

would not be considered).

Daily Active Addresses

The sum count of unique addresses that were active in the network (either as a recipient or

originator of a ledger change) that interval. All parties in a ledger change action (recipients and

originators) are counted. Individual addresses are not double-counted.

Financial

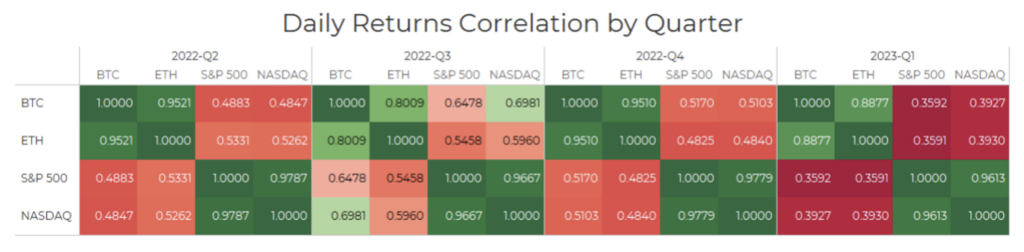

Over the past week, digital assets had their first week of the negative movement for the year along with traditional risk assets. Over the last 7 days the NASDAQ is down 3.2% and the S&P500 is down 2.7%, and BTC and ETH are down 6.74% and 6.90% respectively. Alternative Layer 1 tokens, which were leading the charge for digital asset markets to start the year naturally were the tokens to lead the downside with APT -22%, FTM -27%, SOL -15%, and AVAX -16% to name a few. That didn’t stop protocol The Graph, symbol GRT, from having a solo party and rallying 53% over the last 7 days.

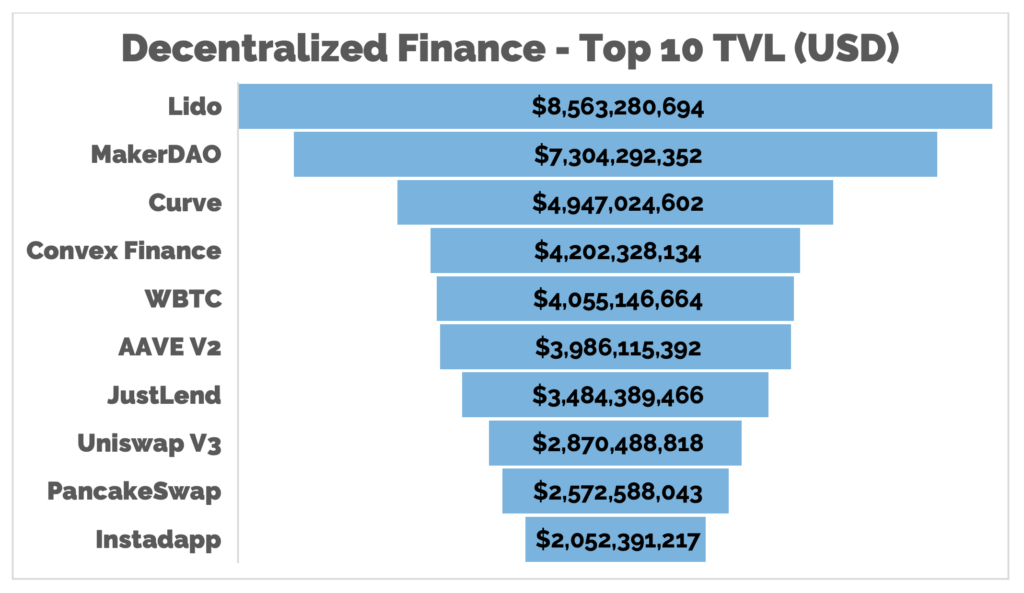

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) is down 4% for the last 7 days, sitting at $47.23B as of Thursday, February 9th. Digital Asset Research verified and sent clean data for the top 10 DeFi TVL. Convex Finance, a yield optimizer for CRV token holders and Curve protocol liquidity providers overtook WBTC (wrapped bitcoin on the Ethereum network) as the 4th largest token by TVL. Lido, Curve, Convex Finance, and AAVE V2 saw the biggest gains in the top ten while MakerDAO, JustLend, Uniswap V3, PancakeSwap, and Instadapp all were relatively flat. WBTC was the only token to lose TVL over the last week.

This week’s mainstream headlines have been dominated by the SEC and its efforts to crack down on crypto operations, starting with regulated centralized players like Coinbase and Kraken for their token staking services. Breaking news on Thursday was Kraken is immediately shutting down its staking-as-a-service platform for U.S. customers and paying $30 Million in fines. See here for the SEC’s official press release.

“Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws,” said SEC Chair Gary Gensler. “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

Our view is that this isn’t a bad thing. More disclosure and protection for investors is a good thing. This potentially means that decentralized staking protocols like Lido could be the benefactors should staking-as-a-service cease to exist on centralized entities like Kraken and Coinbase. Look for Coinbase and other centralized entities to be next.

The other major news in crypto was Binance, not Binance US, suspending U.S. dollar bank transfers starting on Wednesday. “We are temporarily suspending USD bank transfers as of February 8th,” a Binance spokesperson said, noting just 0.01% of monthly active users use USD bank transfers. “Affected customers are being notified directly.”

While Binance.us is not affected you can be sure that they are on notice and there is still more to learn regarding Binance and all its underlying entities. In previous newsletters, we mentioned there are still potential industry risks that could cause more strikes in digital asset markets. This is one of them.

In previous editions of our newsletter and in all of our materials we showcase that tokens within this asset class experience high bouts of volatility moving daily and weekly sometimes between 20-40% in either direction This is a prime reason why we continue to preach a disciplined process of dollar cost averaging into markets and proper allocation sizing, and not one based on pure emotion or randomness. We have seen all too many situations of investors trying to time the markets and it rarely ends well. One poor decision then leads to more poor decisions.

To learn more about how we help financial advisors and investors navigate digital assets be sure to schedule time with us here.

Other News

- Demystifying the Banking Regulators’ Recent Crypto Actions: Key Takeaways for Fintech Companies (Wilson Sonsini blog)

- Tether’s shareholder capital cushion is full of contradictions (Protos)

- Su Zhu unveils new OPNX exchange for trading trapped crypto funds (The Block)

- MakerDAO adds Chainlink back DAI (Maker Forum)

- S. Accused Of Trying To ‘Quietly’ Ban Bitcoin, Ethereum, And Crypto (Forbes)

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Digital Asset Learning

Reading: MetaMask Learn

Created By: MetaMask

Abstract

You may have heard a lot of jargon related to Web3: distributed ledgers, crypto, and NFTs. But what’s revolutionary about the technology is more than the sum of the technical parts; it’s the power it gives you. Our lives are increasingly digital and interconnected. Our screens are our windows, our data define our identity, and more and more of our time is spent online.

Historically, trust in society comes from subjective sources — from personal connections, platforms, and institutions. At its core, Web3 is a new foundation for trust, where everything can be verified and you don’t need to place your trust in a single source or entity.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.