Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

Before jumping in, if there is one thing to take away this week, please take this: The first-ever digital bond on a public blockchain, not a private one, was issued on the Polygon Blockchain.

Blink and you would have missed it this week. But don’t worry we have you covered.

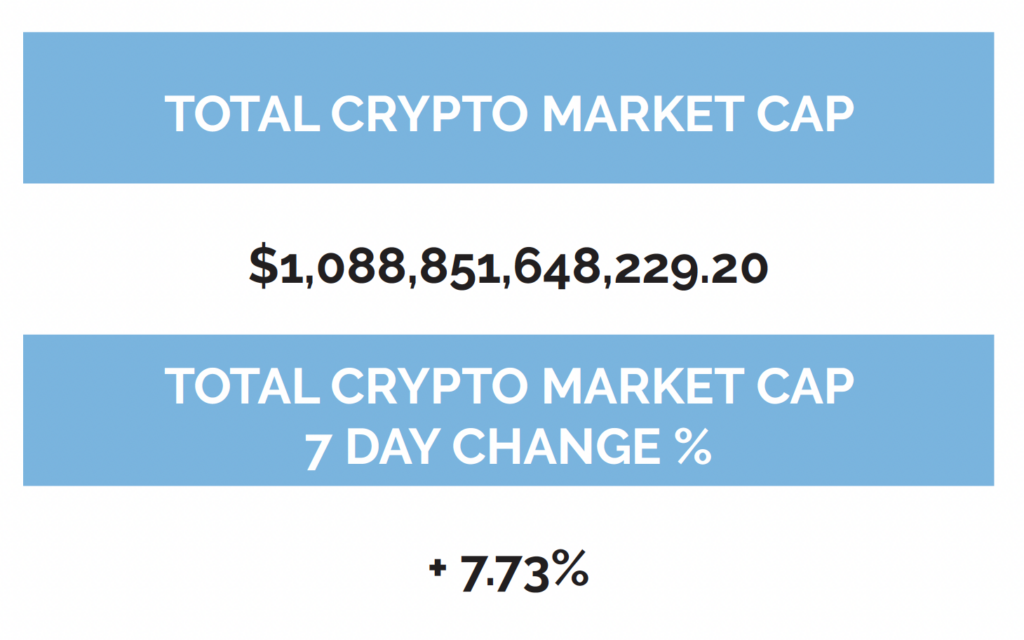

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

-as of Thursday, February 16th, 7:00pm ET

-as of Thursday, February 16th, 7:00pm ET

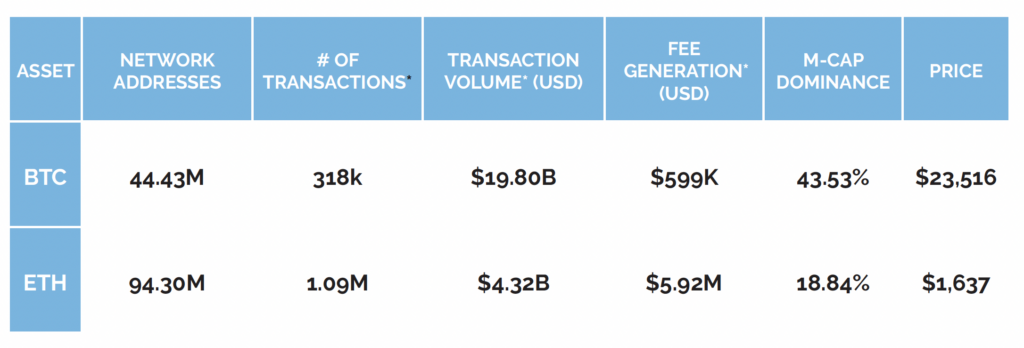

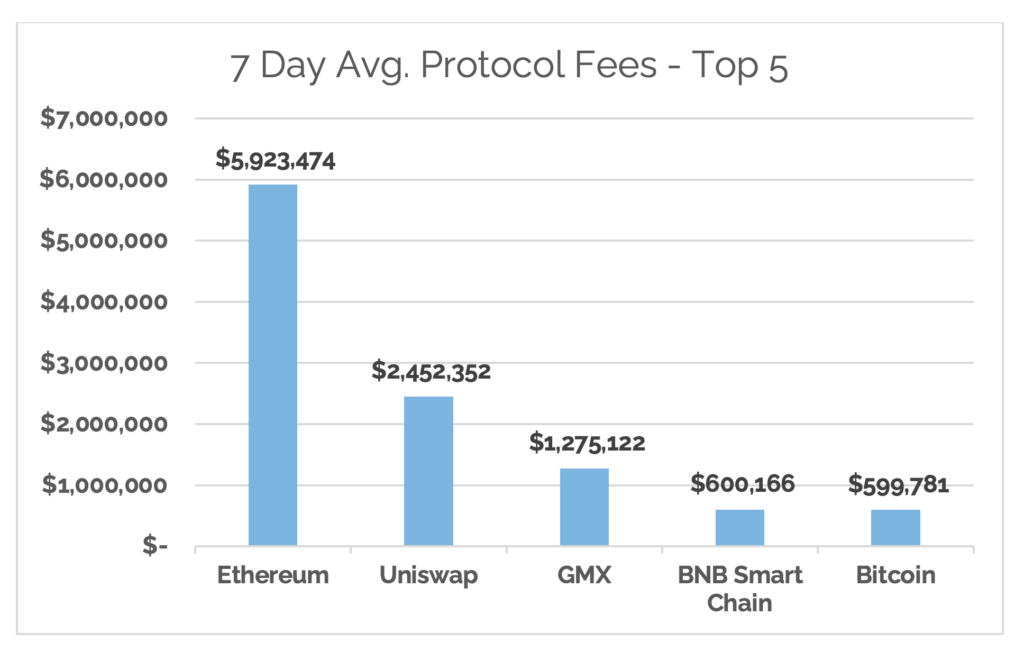

*7-Day Average

*Source: Cryptofees.info, Thursday, February 16th, 7:00pm ET,

*Fees in USD

Week in Review

On the Bitcoin network, over the last week roughly 350,000 new network addresses with a balance of BTC were added bringing the total to 44.43 million network addresses, bringing it to its new all-time high from November of last year at 43.96 million. Daily active addresses were up this week hitting 1 million for the daily average, up from 975k. Network fees continued to increase this week generating $599,781 on a daily average; almost overtaking BNB Smart Chain in this metric for the first time. Daily average transaction volume (BTC) for the week increased 39% moving from 828k BTC last week to an average of 1.01M this past week.

ICYMI

What is the deal with the increased adoption numbers this week? We have some thoughts.

- Stablecoin uncertainty – with the recent SEC announcements and headlines surrounding major stablecoins, USDC, Paxos, Binance USD, there has been a flight to more censorship-resistant digital assets.

- Bitcoin weekly fees continue to rise following the launch of Ordinals NFTs, reaching their highest in 10 months.

- The amount of Bitcoin held by addresses that have been holding for at least a year surpassed two-thirds of all circulating supply for the first time in history. This percentage had been climbing in 2022 and highlights the transition from weak hands to strong hands holding Bitcoin.

On the Ethereum network, roughly 320,000 new network addresses with a balance of ETH were added bringing the total amount to 94,306,794 network addresses with a balance, an all-time high. Daily active addresses for the week were flat this week staying in the range of 477k-480k. Average daily fees for the week continued to move up, $5.92M up from $5.64M. Transaction volume (ETH) was slightly up, moving from 2.7M ETH to 2.9M ETH, and continues to stay in a healthy range.

- First digital bond on a public blockchain in accordance with Germany’s Electronic Securities Act (eWpG)

- OpenSea, one of the dominant NFT marketplaces, saw the launch of a new competitor, Blur which helped spur adoption numbers this week.

- Shanghai upgrade may suffer a delay with developer Marius VanDerWijden finding a vulnerability with the public test network Shapella. Although it seems like an easy fix.

Siemens is responsible for the biggest crypto adoption news so far in 2023. Taken from their press release:

“Siemens is one of the first companies in Germany to issue a digital bond, in accordance with Germany’s Electronic Securities Act (Gesetz über elektronische Wertpapiere, eWpG). Worth 60 million, it has a maturity of one year and is underpinned by a public blockchain. Issuing the bond on a blockchain offers a number of benefits compared to previous processes. For instance, it makes paper-based global certificates and central clearing unnecessary. What’s more, the bond can be sold directly to investors without needing a bank to function as an intermediary.”

The line to pay attention to is: “…it makes paper-based global certificates and central clearing unnecessary.”

Crypto advocates (*raises hand) have long touted the operational efficiencies that can be realized through the adoption of open public blockchain technology. Another reason for advocation is the adoption of new trust models. Moving from human based trust through intermediaries to mathematical and computational-based trust. The entire transaction was completed in two days while still using traditional fiat funding methods. Imagine when a secure global digital currency exists to make this even more efficient. Anyone have any ideas on this?

It’s important to note there will be some learnings and there are still many risks that will come about as these early concepts turn into real-life applications. We will be paying close attention to this over the next 12 months.

I can’t write about Digital Assets this week without reviewing all the SEC activity. First, let’s list out the major recent headlines:

- SEC Defines Terra Tokens as Securities, charges Do Kwon & Terraform with Fraud

- SEC to Sue Crypto Trust Co. Paxos Over Binance Stablecoin

- Bloomberg: The SEC comes after Crypto Custody

- Rumors of SEC’s wells notice to USDC are Squashed by Circle

In our Digital Asset Market 2023 outlook, we noted that a major theme will be regulation through the courts, and it came swiftly after. I’m not a lawyer or a compliance expert but we do have a pretty darn good compliance officer in Matt Kolesky, who interacts with our legal counsel. That being said I will purely give some high-level thoughts on each of these pieces and finish zooming out.

- Terra tokens, UST, and LUNA as securities: Great, this is the first step in working towards meaningful legal precedence for what is and isn’t a security when it comes to digital assets. This is imperative to unlocking the next wave of adoption, especially in the US.

- SEC Charges Do Kwon with Fraud: Even better. I won’t comment on the timing but better late than never. I guess that was a comment.

- SEC sues Paxos for Binance USD Stablecoin: I’ll start with this quote from Patrick Hillmann, Binance’s chief strategy officer – “Binance grew quickly and began as a business powered by software engineers unfamiliar with laws and rules written to address the risk of bribery and corruption, money laundering, and economic sanctions. The company has been working to fill gaps in its early compliance efforts,… “ Let that sit for a minute. The SEC gets another Great from me on this one. Let’s hold everyone accountable in crypto. The standards need to rise, and this is simply unacceptable.

- SEC Crypto Custody Rules: Let’s take some of the good things we have in the traditional world and bring it over, qualified custody rules. Important to mention is that even qualified custody in the traditional world needs a lot of work, which is happening in conjunction with digital asset/crypto custody. Players like Gemini, Coinbase, and BitGo who have proactively established themselves to follow rules will be positioned well moving forward. The exchanges and custodians operating without licenses, aren’t regulated by any US-based regulatory body, and are based outside of the US will be priority targets.

My ending thoughts are what is missing from all of this. What is missing is the ‘US to ban all crypto activity’ language from any of these actions. I also think it is important that while the SEC has jurisdiction in the US, regulation is very different across the globe. Even if US were to ban crypto, other regions are setting themselves up to allow and regulate. Just look at:

It is a high probability that if the US bans crypto the industry will move to jurisdictions that are friendly. While I believe the US outright banning crypto is becoming lower every day, you still can’t count it out.

Read More

Network Addresses

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.

Financial

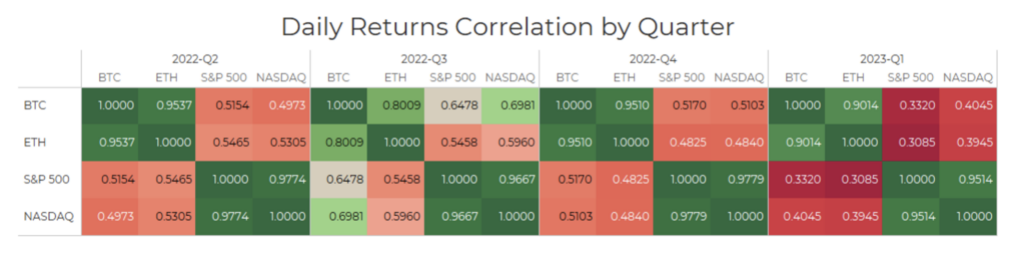

Digital asset markets, along with traditional markets, were up this week, ignoring higher-than-expected inflation numbers, and continued to climb toward new yearly highs. The Digital Asset industry market cap hovered around $1.1 trillion. The price of Bitcoin (BTC) closed at $23,516.14, up 7.87% on the week, while Ethereum (ETH) closed at $1,637.95, up 5.97% on the week. Bitcoin and Ethereum both continue to show positive returns when looking across the last 30 days, with Bitcoin up 14.93% and Ethereum rising 6.53% in that period.

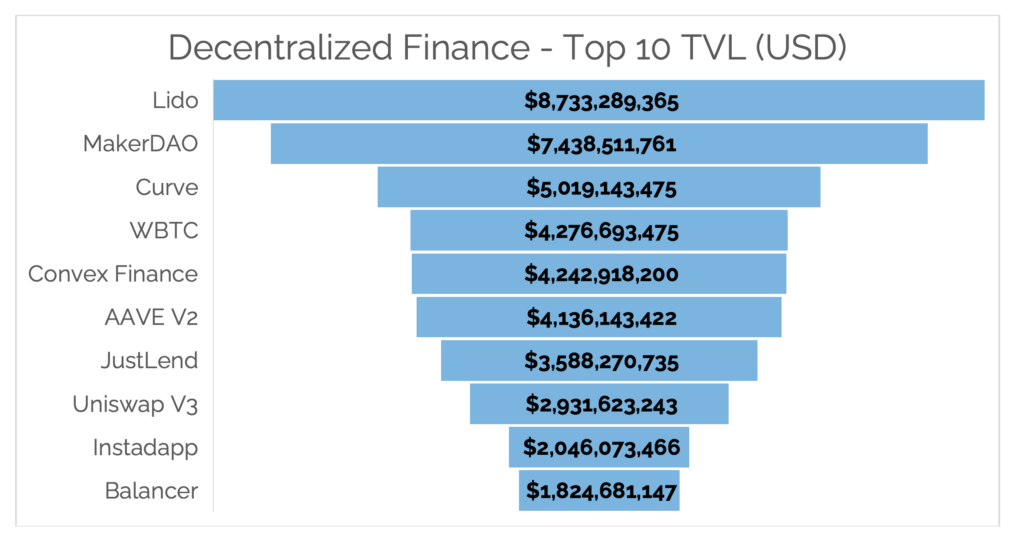

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) is up slightly over the last 7 days, sitting at $50.5B as of Thursday, February 16th. Digital Asset Research verified and sent clean data for the top 10 DeFi TVL. The top 10 DeFi TVL this week didn’t see many changes in the rankings. WBTC and Convex Financial continue to go back and forth with WBTC getting a bump this week, which we can attribute some to the flight from stablecoins to BTC and WBTC. The biggest change is Pancakeswap’s removal from DeFi TVL in our data from Digital Asset Research. The mission is to bring verified high-quality data and due to the recent troubles facing Binance, it is no wonder that Pancakeswap, Binance’s primary DEX (like Uniswap on Ethereum), is not getting the verified check mark. This paved the way for Balancer to enter the top 10 DeFi TVL.

Digital Asset Learning

Reading: Chainalysis 2023 Crypto Crime Report & Two-Part Webinar

Created By: Chainalysis sponsored by PwC

Abstract: Did you spend 2022 navigating the fallout from the blowups of FTX, Terra, and the like? You weren’t alone — crypto criminals had to face the same market conditions. And in some cases, one could argue their actions moved markets. How did the market tumult of 2022 affect cryptocurrency-based crime?

In Part 1 of our webinar series on March 2, we’ll cover cryptocurrency-based crime as it relates to national security. In Part 2 on March 16, we’ll cover forms of cryptocurrency-based crime affecting average consumers.

Crypto Security Alert

Source: MetaMask Twitter

Wallet Address Poisoning: Meant to take advantage of users who don’t pay close attention to details of their activity and transactions. General users of DeFi and crypto have been coached to check the beginning and ending characters of a wallet address to confirm transactions prior to sending. This is done to mitigate the potential of sending tokens to the wrong address. This is important because in crypto there is no recourse for erroneous transactions. There is no one to call or help get your crypto back. Scammers know this and have developed address poisoning. Scammers will use wallet addresses generated from address generators and match the first and last characters of a potential victim’s wallet address. This gets unsuspecting users to send their funds to the wrong copycat address.\

What to do: Check every single character of the wallet address to ensure the funds are sent to the correct wallet. Be wary of random tokens or transactions showing up in your wallet that you don’t know where they originated. A quick scan of the address via Etherscan is also a best practice.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.