Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

This week we spotlight Gemini’s Weekly Market Update. Gemini acts as Arbor Digital’s qualified custodian and transacts via Gemini’s Exchange through their trading platform Gemini BITRIA.

High-Level Takeaways

- Bitcoin Prices Rise: Bitcoin prices soared past $30K USD this week on news that BlackRock, Invesco, and other large traditional financial institutions applied to launch Bitcoin ETFs.

- New Bitcoin ETF Applications Promise More Transparency: Some of the new Bitcoin ETF applications include what are known as surveillance-sharing agreements, which aim to address concerns the SEC has had in the past with similar applications. These agreements would provide more visibility into the underlying Bitcoin markets.

- Rush of Activity in GBTC: There was heightened trading activity across bitcoin products spurred by the ETF filings, with the Grayscale Bitcoin Trust showing momentum.

- UK Interest Rate Hike: The Bank of England continued increasing its key interest rate as the United Kingdom struggles with stubborn inflation.

- First DAO-Funded Film Features NFT Characters: The Rise of Blus: A Nouns Movie, what is thought to be the first DAO-funded film, was released this week, bringing NFT characters to the screen.

But first. A run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

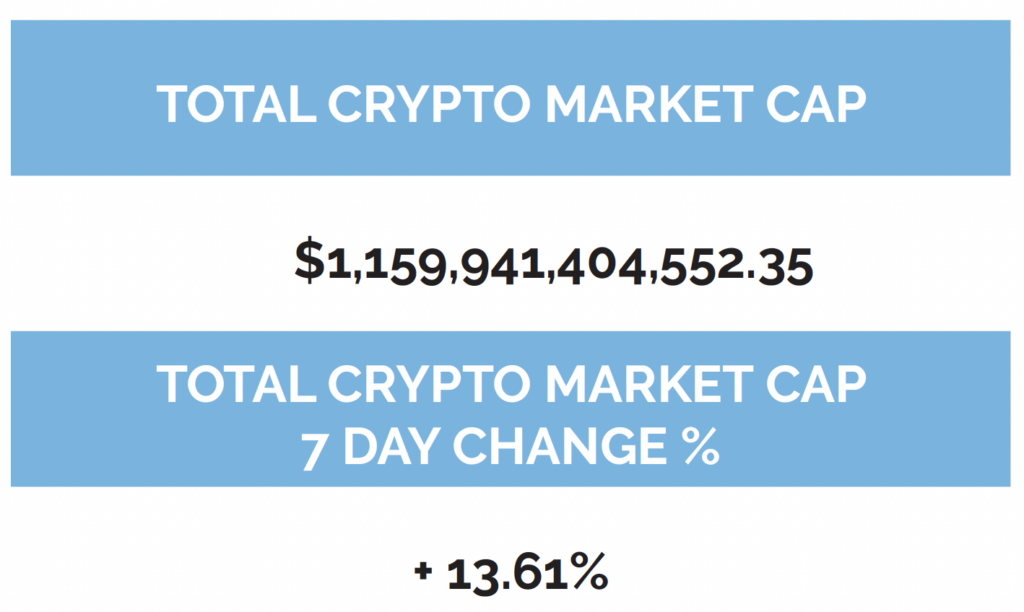

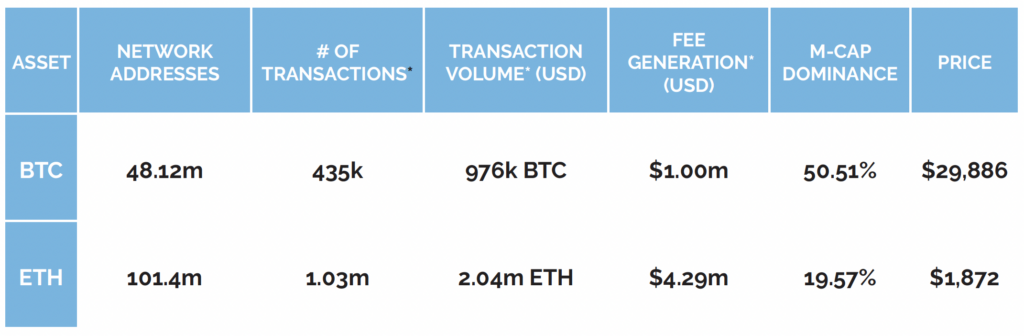

Digital asset markets were up this week with the total industry market cap hovering above $1.2 trillion. The price of Bitcoin (BTC) closed at $29,886.32, up 16.88% on the week, while Ethereum (ETH) closed at $1,872.15, up 12.42% on the week. Year to date, BTC is up 81.59%, ETH is up 56.55%.

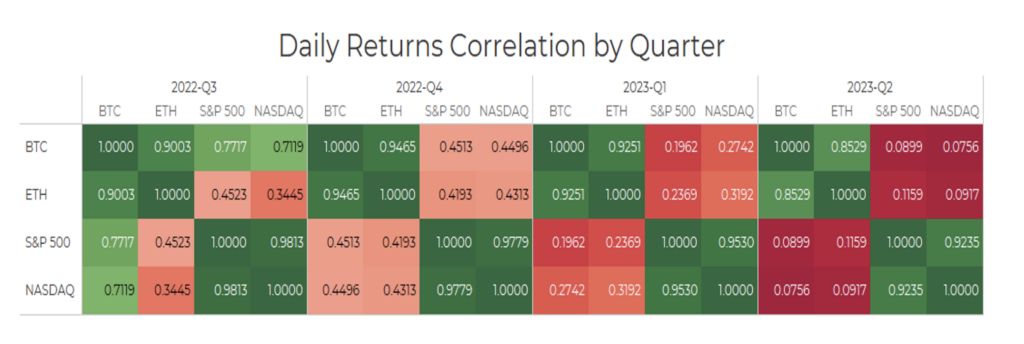

The S&P 500 is now uncorrelated with Bitcoin when looking at a 30-day rolling correlation. Gold continues to be statistically uncorrelated with Bitcoin, though it is approaching a negative correlation. Ethereum remains positively correlated with Bitcoin. (See correlation chart just below).

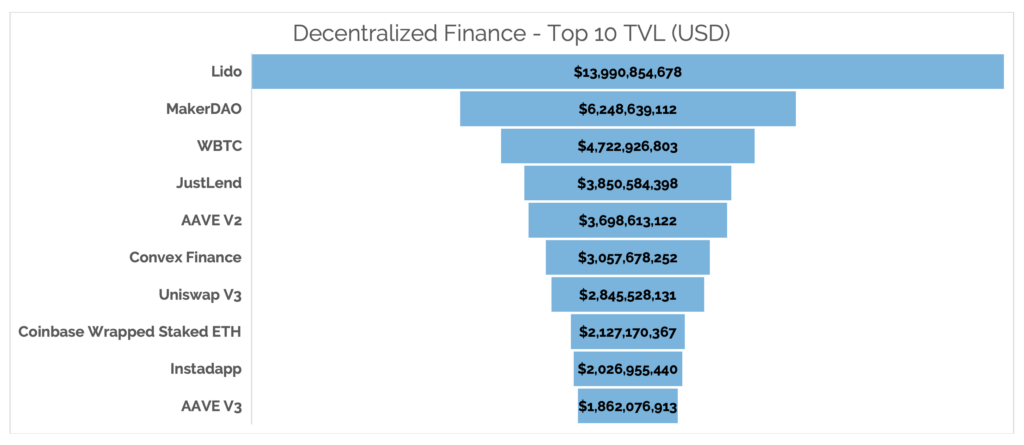

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was flat this week, coming in at $45.09b as of Thursday, June 22nd.

-as of Thursday, June 22nd, 7:00 pm ET

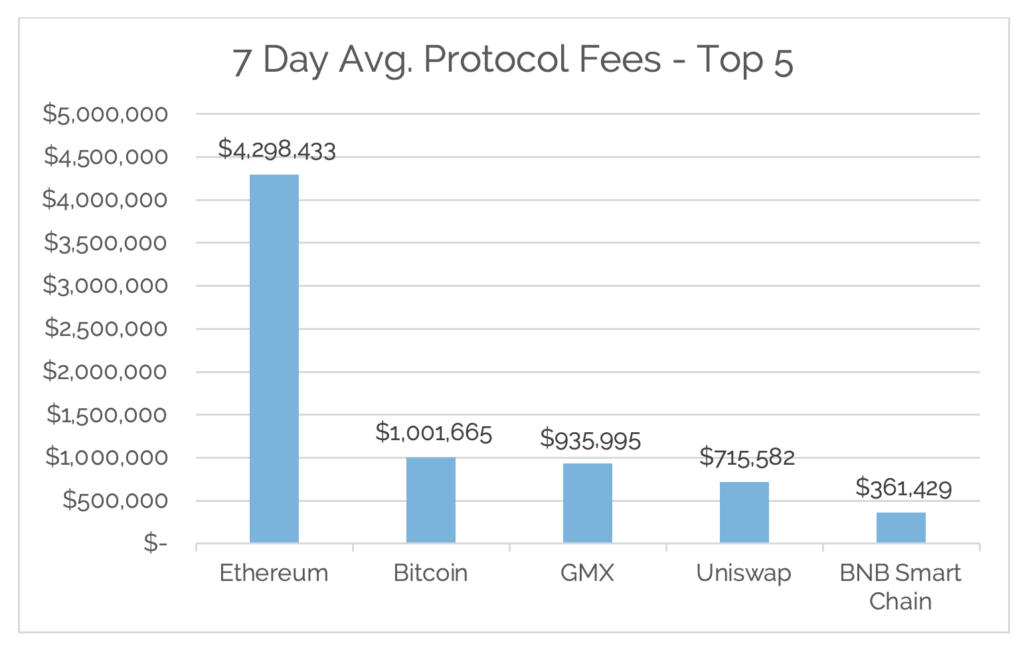

*7-Day Average

*Source: Cryptofees.info, Thursday, June 22nd, 7:00 pm ET

*Fees in USD

Weekly Update from the Gemini Trading Desk

Bitcoin Breaks $30K USD Leading Crypto Rally as TradFi Firms File for Bitcoin ETFs

Bitcoin (BTC) surpassed $30K USD on Wednesday, hitting its highest level since April and gaining more than 18% this week. The rally was fueled by bitcoin exchange-traded fund (ETF) filings with the U.S. Securities and Exchange Commission (SEC) over the past week from traditional financial institutions including BlackRock, Invesco, WisdomTree, and Valkyrie. The approval of a BTC ETF would allow retail traders to purchase shares representing the value of BTC on major U.S. exchanges, like the Nasdaq.

The crypto rally was led by BTC, with BTC dominance rising to over 51%, its highest level since April 2021. Ether (ETH) and other altcoins rallied in sympathy, with ETH surpassing $1,900 USD. BTC had a similar rally in October and November 2021 when the first futures-based bitcoin ETF, BITO, sponsored by ProShares, was approved by the SEC.

Bitcoin ETF Applicants Focus on Spot BTC Surveillance-Sharing Programs

The inclusion of a Spot BTC Surveillance-Sharing Agreement in BlackRock’s ETF application is among the nuances differentiating it from previously rejected applications. This type of agreement would attempt to address concerns the SEC has had in the past with approving bitcoin ETFs. The surveillance sharing agreement is outlined in a filing by the Nasdaq, the venue where the BlackRock ETF would be listed.

Bitcoin ETFs have been rejected by the SEC for years, including a recent one filed by VanEck. The SEC has pointed to the potential for manipulation and shortcomings in the surveillance of BTC markets as reasons for rejecting various applications. Instead, the SEC has preferred to approve futures-based ETFs, as the agency can monitor trading activity for futures listed on the Chicago Mercantile Exchange (CME).

A shared surveillance agreement would require the exchanges listing the ETF, like the Nasdaq or CBOE, to have access to the spot venue (crypto exchanges, or exchanges) where the underlying asset is traded. The type of information shared could include trading and clearing activity, as well as the identity of traders. Shortly after BlackRock’s filing, a few other ETF issuers followed suit and included a sharing surveillance agreement in revised filings.

Notable Trading Activity in GBTC After ETF Filings

With traders potentially betting on the increased likelihood of an approved bitcoin ETF, the Grayscale Bitcoin Trust (GBTC) discount to net asset value (NAV) tightened to ~33%, from as low as ~48% in December 2022. This discount represents the difference between the price of GBTC and the price of spot BTC.

GBTC is a closed-end fund, meaning no redemptions are currently permitted. Grayscale has previously said their goal is to convert GBTC to an ETF once the SEC approves one, which would then allow for the opening of redemptions.

Bank of England Continues to Raise Interest Rates Amid Stubborn Inflation

The Bank of England hiked its key interest rate by 50 basis points to 5% in a surprise decision on Thursday. This is the highest key interest rate level since April 2008. The magnitude of the move outpaces the actions of its G7 peers as the United Kingdom struggles to curb inflation that has reached double-digit percentages year-over-year in recent months. UK May consumer price index (CPI) showed an increase of 8.7%.

The British Pound (GBP) fell to 1.27 vs. the U.S. dollar (USD) despite the rate increase as the economic concerns outweighed the higher interest rate. FTSE 100 declined 0.76% on Thursday.

First DAO-funded Animated Film Released

A pilot for the The Rise of Blus: A Nouns Movie was released this week, in what appears to be the first DAO-funded animated film. The project raised $2.75 million USD and includes animators who have worked at the likes of Netflix, Pixar, and Marvel.

The film was funded through a proposal passed in March by NounsDAO. The film features characters based on 8-bit NFT characters known as Nouns. According to nft now, the film “centers around the lively floating cloud city of Blus, wherein a daring 13-year-old Noun uncovers a malevolent scheme by the city’s aristocrats.” The title character bands “together with a motley crew of unlikely allies (other Nouns) to thwart the threat and protect those they hold dear.”

Digital Asset Learning

On-Demand Learning: The Chainalysis Guide to On-Chain User Segmentation for Crypto Exchanges

Created By: Chainalysis

Abstract: Nothing sets cryptocurrency apart from other asset classes and industries more than its transparency. The activity of virtually every wallet is visible on the blockchain in near real time, which has huge implications for cryptocurrency businesses. Inside, you’ll learn everything you need to know about segmenting users with on-chain data, using wallet characteristics like:

- Age

- Wealth level

- Churn rate

- And more!

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.