Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

The past week has been a whirlwind, and while the Bitcoin ETF frenzy dominated headlines, there were a few other events that occurred vital to the future of crypto on a global scale as well. Our advice to all investors and advisors: Plan and be ready to act.

Arbor Digital’s conviction in the crypto economy has never been stronger. Now is the time to establish your digital asset strategy if you don’t have one, update your digital assets strategy, and be ready to act. Our mission is to take on this opportunity with you. Book a demo to learn more about how we enable financial advisors to plan and act on a disciplined digital asset strategy on behalf of their clients.

Important Takeaways

- UK passes bill recognizing Crypto as Regulated Financial Activity

- First-ever leveraged BTC ETF started trading this week.

- Major TradFi firms re-apply or put in new applications for a spot BTC ETF.

- Federal Reserve Chair Jerome Powell Says Crypto like Bitcoin Have “Staying Power”.

- EDX Markets launched its digital asset market on Tuesday while also completing a new investment round.

- EDX Markets is backed by Fidelity, Charles Schwab, & Citadel Securities to name a few.

- HSBC Enables BTC and ETH ETF Trading in Hong Kong.

- Mastercard Launches Blockchain App Store

We understand that many within the US investment and regulatory landscape are fearful of crypto’s demise at the hands of the SEC. However, we would encourage you to keep a clear mind and remain aware of what else is happening beyond the SEC’s crusade against crypto. Notice, we are not advocating ignoring what the SEC is doing regarding crypto, in fact, the opposite. You need to take a holistic view and account for everything within the crypto industry.

Based on evidence just from the last 10 days, it is fair to conclude that Global Crypto adoption is moving forward while the US continues to lag. Despite the SEC’s approach, trusted US and multinational financial institutions are building infrastructure to support crypto technology as well as investment in crypto assets.

Now, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

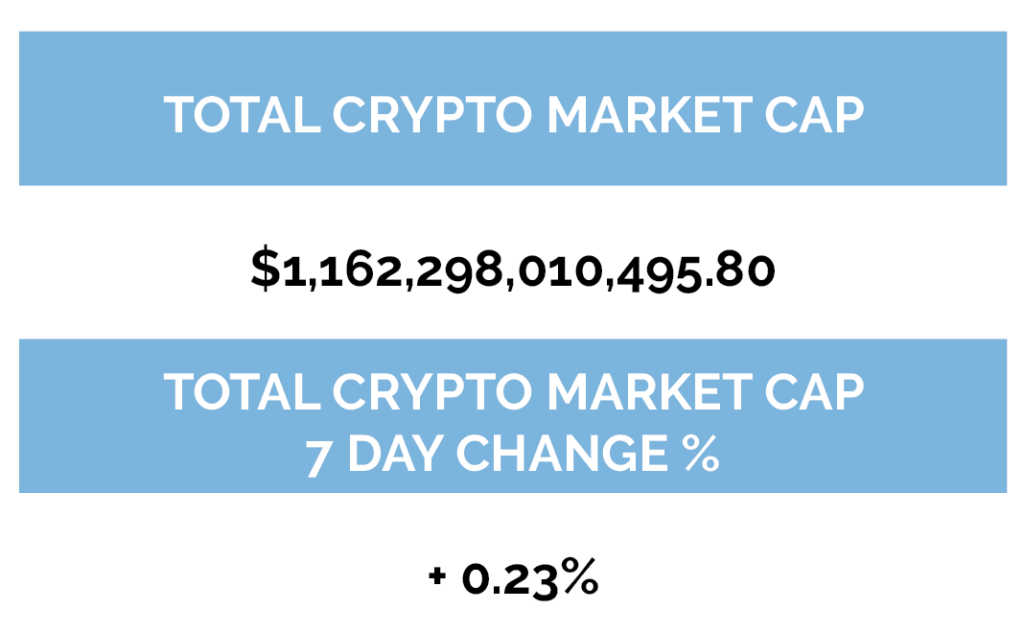

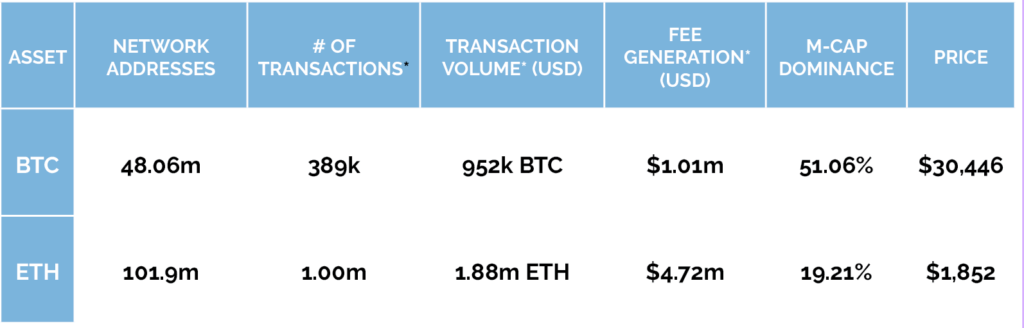

Digital asset markets were up this week with the total industry market cap hovering above $1.2 trillion. The price of Bitcoin (BTC) closed at $30,446.49, up 1.87% on the week, while Ethereum (ETH) closed at $1,852.13, down 1.07% on the week. Year to date, BTC is up 81.00%, ETH is up 54.00%.

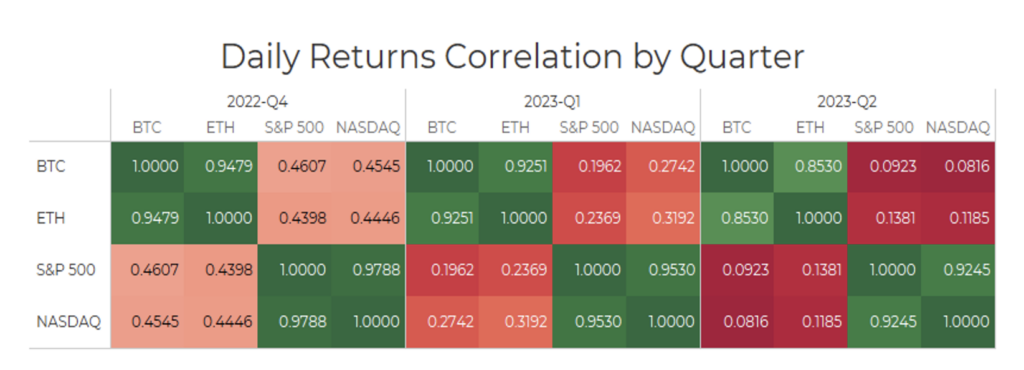

Gold is now negatively correlated with Bitcoin when looking at a 30-day rolling correlation. Ethereum continues to be positively correlated with Bitcoin and the S&P 500 continues to be uncorrelated with Bitcoin by the same metric. (See correlation chart just below).

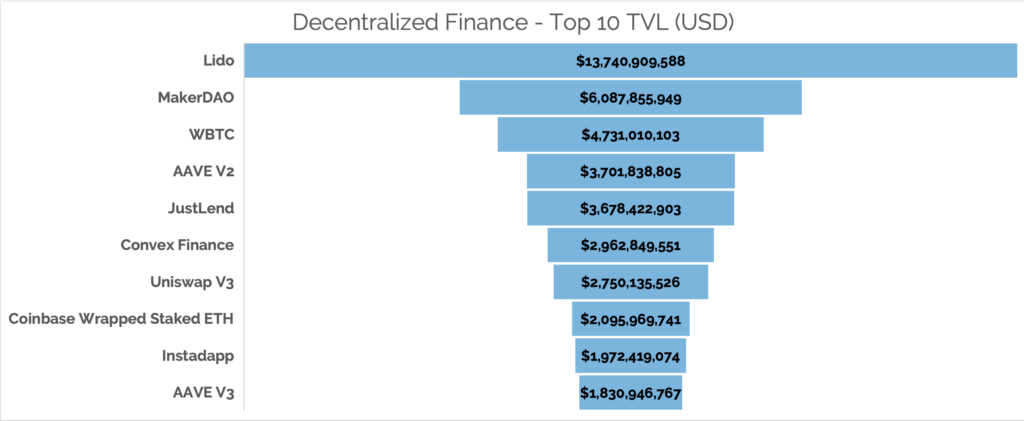

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was relatively flat this week, coming in at $44.03b as of Thursday, June 29th. The top 10 DeFi total value locked verified by Digital Asset Research showed that AAVE V2 and V3 continue to increase while Ethereum staking service Rocketpool fell outside the top 10. Staked Ethereum saw a decrease across the board with LIDO decreasing roughly $200m.

-as of Thursday, June 29th, 7:00 pm ET

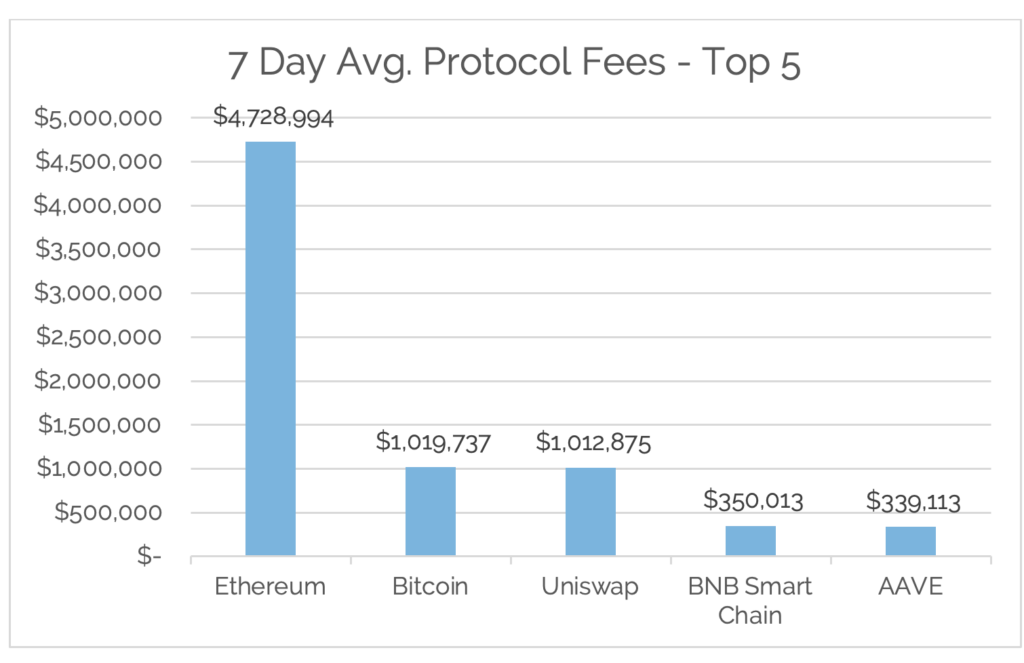

*7-Day Average

*Source: Cryptofees.info, Thursday, June 29th, 7:00 pm ET

*Fees in USD

BTC ETFs

/cloudfront-us-east-2.images.arcpublishing.com/reuters/C7EQHOSCK5L5TN7DQSLUYO6JQQ.jpg)

On Tuesday, the first leveraged digital asset ETF, The Volatility Shares’ 2x Bitcoin Strategy ETF (BITX), started trading. A leveraged 2x ETF allows customers to gain bitcoin exposure by only putting up half the value of the bitcoin.

TradFi Players all with spot BTC ETF applications:

- Blackrock

- Wisdom Tree

- Bitwise

- Valkyrie

- Invesco

- Fidelity

- ARK Invest and 21Shares US

- VanEck

Previously, the SEC rejected spot BTC ETFs because they did not meet the rules of practice and Exchange Act requirements for listing a financial product. What is different this time? Surveillance-sharing Agreements for one.

Both Blackrock and ARK/21Shares applications now include a surveillance sharing agreement, which has not been in past applications. Firms believe this will satisfy the SECs thirst to prevent “fraudulent and manipulative acts and practices” and “to protect investors and the public interest.”

ARK is first in line to get a response at the end of August from the SEC. Depending on the result, this could spark more price action in crypto markets. What stands out to us at Arbor Digital is the public signaling of a shift in mindset from Blackrock CEO Larry Fink. In 2017 Larry Fink called Bitcoin “an index of Money Laundering”. Fast forward to 2023 and the company he leads is applying for a Bitcoin spot ETF.

Global Crypto Foundation

The Financial Services and Markets Bill (FSMB) received Royal Assent from King Charles on Thursday. The passing of the bill means that crypto will now be recognized as a regulated financial activity bringing it within the established regulations for the market. The bill, according to the UK government, also contains new powers available due to Brexit. Reportedly it could unlock around £100 billion for productive investment and help cultivate innovation and grow the economy in the country.

Following the approval, the United Kingdom joined the European Union in spirit, as the bloc was one of the first major administrations in the world to bring crypto under the scope of regulations. The EU Markets in Crypto Assets (MiCA) bill paved the way for other governments to bring regulations at a large scale, allowing crypto development at a rapid rate.

HSBC Hong Kong, the largest bank in the special administrative region of China, now allows customers to trade bitcoin and ether exchange-traded funds (ETFs) listed on Hong Kong’s stock exchange. There are three crypto ETFs listed on HSBC Hong Kong’s investment platform:

- CSOP Bitcoin Futures ETF

- CSOP Ethereum Futures ETF

- Samsung Bitcoin Futures Active ETF

Despite the SECs crackdown on US-based crypto financial service firms, that hasn’t stopped other global industry leaders with a US presence from continuing to establish the crypto foundation necessary for the industry to thrive. Mastercard on Wednesday said the payment processor would roll out a test version of its Multi-Token Network (MTN) this summer in the UK. Developers will be encouraged to create apps on Mastercard’s permissioned blockchain, which is built on Ethereum.

EDX Markets, the crypto asset marketplace backed by some of the most trusted financial institutions both globally and in the US, successfully launched. EDX’s launch and the announcement of EDX Clearing come as the company recently closed a new funding round that welcomed additional strategic investors, including Miami International Holdings, DV Crypto, GTS, GSR Markets LTD, and HRT Technology. These firms join a coalition of founding investors, including Charles Schwab, Citadel Securities, Fidelity Digital AssetsSM, Paradigm, Sequoia Capital, and Virtu Financial. The new funding will support EDX as it continues to develop its trading platform and solidifies its market leadership position.

As we noted in our welcome message, it may seem scary within the US when the SEC has pushed so hard against the crypto industry along with certain US political players making its demise as their campaigning foundation for elections. Our goal through this newsletter is to bring awareness to the thoughtful and positive progress in the industry on a global scale.

Digital Asset Learning

On-Demand Learning: Account Abstraction

Created By: Ethereum Foundation and Meta Mask

Abstract: “Account abstraction” is a proposal seeking to improve user interactions with Ethereum—one that’s increasingly the subject of many discussions in the crypto community. You may, however, be thinking: “What exactly is account abstraction and why should I care about it?” These resources are designed to help you make sense of account abstraction by putting its past, present, and future into context.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.