Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

“Effective markets need predictable and consistent rules that can be applied by all the market participants.” Well said, Emily Myers.

Before a run of the numbers, today we are going to focus on the important actions the SEC took this week. The most disciplined and well-presented state of where we are and where we should be looking towards comes from Laura Shin and her recent guest on the Unchained Podcast, Electric Capital General Counsel Emily Meyers. Everything below is taken from her interview with Laura Shin and the resources listed on the episode page.

Don’t Miss: Unchained Episode 504 – SEC Sues Binance and Coinbase

What Happened

- On Friday, June 2nd a new digital asset bill was proposed by Reps. Patrick McHenry, R-N.C., and Glenn Thompson, R-Pa.

- On Monday, June 5th the SEC sued digital asset exchange Binance

- On Tuesday, June 6th the SEC sued digital asset exchange Coinbase

The SEC Suits: Key Similarities

- The SEC alleges that both Binance and Coinbase are operating unregistered security exchanges.

- The SEC listed several tokens that both platforms were trading illegally.

- The SEC alleges that both Binance and Coinbase were offering unregistered securities in their staking offerings.

The SEC Suits: Key Differences

- The SEC alleges Binance committed Fraud.

- The SEC alleges Binance comingled customer assets.

- The SEC alleges Binance engaged in self-dealing and manipulative trade practices.

- The SEC alleges Binance misrepresented the organizational structure between Binance and Binance.US operations.

Even though the SEC brought these actions one right after another, it is important to separate them and understand the similarities and differences above. The allegations against Binance are much more serious than those brought against Coinbase and should be approached appropriately.

Unregistered Securities

Fundamental to both cases are the list of tokens in which the SEC is asserting are unregistered securities. The most important take away from this is that for the SEC to prove Coinbase and Binance were operating an unregistered securities exchange, only one of the SEC’s listed tokens needs to be deemed an unregistered security, not all. This is why the SEC labeled so many, this makes sense from their standpoint (see further below for a complete list of tokens cited in both cases).

Tokens cited by SEC in Coinbase case:

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Filecoin (FIL)

- The Sandbox (SAND)

- Axie Infinity (AXS)

- Chiliz (CHZ)

- Flow (FLOW)

- Internet Computer (ICP)

- NEAR Protocol (NEAR)

- Voyager (VGX)

- Dash (DASH)

- NEXO (NEXO)

- Coinbase Staking Service

Tokens cited by SEC in Binance case (not including duplicates from Coinbase):

-

- Cosmos (ATOM)

- Algorand (ALGO)

- COTI (COTI)

- Binance Token (BNB)

- Binance USD (BUSD)

- Binance Staking Services

Important Developments

In 2019, Gary Gensler offered to become an informal advisor to Binance. Binance lawyers are asking for Gary Gensler to recuse himself due to this and Gary Gensler predetermining that digital asset markets are unnecessary, and all digital assets are securities. What does this mean? Emily explains that:

The SEC’s mission:

- Protect Investors

- Maintaining Fair, Orderly, and Efficient Markets

- Facilitating Capital Formation

By the head of the SEC repeatedly stating that digital asset markets are unnecessary, and all digital assets are securities, this is Gary Gensler predetermining regulatory clarity, which is not within the SEC’s mission or scope, and for that reason Gary Gensler should recuse himself from the case.

Another important development is that the United States Court of Appeals for the Third Circuit has ordered the SEC to clarify its position on the rulemaking petition from Coinbase, which they filed back in April. The SEC has been ordered to explain within 7 days if it intends to decline Coinbase’s request, the reasons for such a decision, or a timeline of when it expects to come to a decision.

SEC Approving Coinbase to IPO

A common critique of the SEC is that they approved the IPO of Coinbase. In my opinion, this is overblown and has been addressed by many former SEC lawyers as to why this would happen, and there is a lot of precedent to turn to. Emily answers Laura’s question on this topic marvelously:

- Gary Gensler and his regime were not incorporated into the SEC during the process of Coinbase getting approved for its IPO.

- In a twist of fate, Gary Gensler was confirmed on April 14th, 2021, the same exact day Coinbase went public.

- The S1 is not a total evaluation of a registered business. It’s a statement of what the company is and what it does. The SEC evaluates whether these statements are true.

- This is precisely what will make this case difficult for the SEC as the fundamental piece of Coinbase’s business both at its IPO and today.

Emily’s argument here is that the SEC has gone against its mandate by protecting investors by approving Coinbase’s S1 and giving investors’ confidence that Coinbase is an investible business and then subsequently suing them, which can be argued is causing the stock price to go down. The important piece to take away is that the SEC is not on trial here, so even if it is unfair, or whichever way you may feel around this piece, this is not the core of the cases.

Looking Ahead

Court cases take a long time, many years, to play out fully, and you need only to look as far as the SEC vs. Ripple case. Emily states that we could have legislation passed prior to these cases being settled which would give the markets the regulatory clarity they need. What has been overlooked due to the SEC headlines, is the bill that was introduced last Friday for sound crypto market infrastructure. Emily thinks this could be significant progress as it addresses the process at which to determine whether a networks token is a security or a commodity. What impedes this bill, however, is that the bill would need bipartisan support. Don’t expect significant regulatory clarity anytime soon and it is still a long road to go. The good thing is that Coinbase and Binance are up to defending themselves and are eager to do so.

In response to these cases, other US-based digital asset exchanges and companies will likely move to adjust their operations so as not to incur the SECs ire. What this may look like is:

- Digital Asset Exchanges operating in the US, like Crypto.com, Kraken, or Gemini, could delist tokens taking away the onramp for investors in certain tokens.

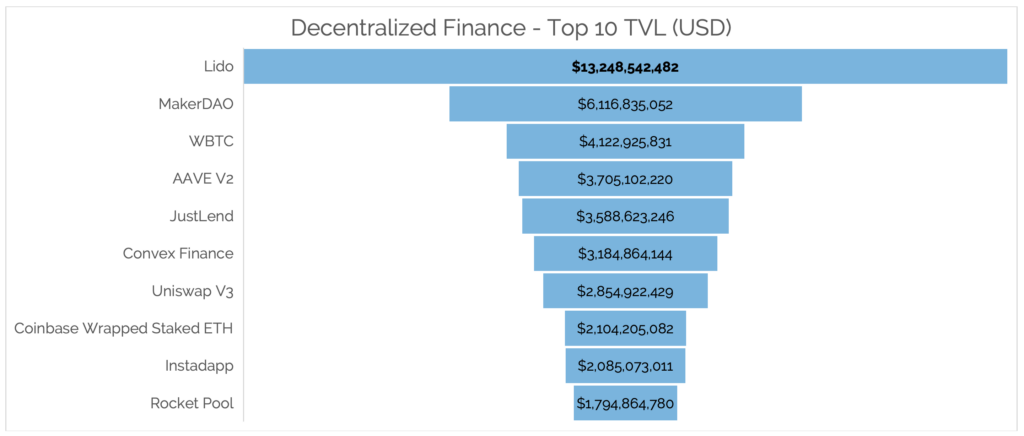

- Any centralized staking services on these platforms will pause. This does not include Lido or Rocketpool.

- Major platforms could look to pivot firm strategies to operate in other global jurisdictions which show more favorable regulation towards the crypto industry.

Arbor Digital Notes

We feel it is important to keep a disciplined and level head when approaching digital assets. The Digital Asset industry, and emerging digital asset markets, are global. While it would be favorable for the industry to have the US as an innovation and adoption hub, should that not be the case, other global jurisdictions are already passing their own legislation. You need only to look at MiCA and what has transpired recently in Asia.

Another important piece we urge everyone to keep in mind is that these SEC actions are not an indictment on the usefulness of the underpinning technology that is decentralized public blockchain technology. In fact, we would argue that the reason why we are seeing such a strong and visceral response from the SEC is that many of the current power structures see how powerful the technology can be and the disruption to those power structures it could cause. We are not surprised in the least that these power structures will fight to keep it. One of the first books I read when I came into this space was: Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages by Carlota Perez.

In the book, there is a review of how incumbent institutions have historically responded to technological revolutions like the advent of the railway, cars, technology attached to the industrial revolution, and the internet. History is certainly rhyming with blockchain technology. What is important to take away though is that just because in the past the technological revolutions ended a certain way, does not mean we will end in the same place in the US with blockchain technology.

Our conviction remains that this technology will have a fundamental impact on all information and financial market infrastructure. We believe that this technology will work with upcoming technological advances in AI, Quantum Computing, and the next generation wireless, not against it.

We are here and we encourage you to set time with us if you are looking for a disciplined partner in formulating and executing a digital asset strategy. Whether for your business or if you are looking to allocate. Book time here.

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

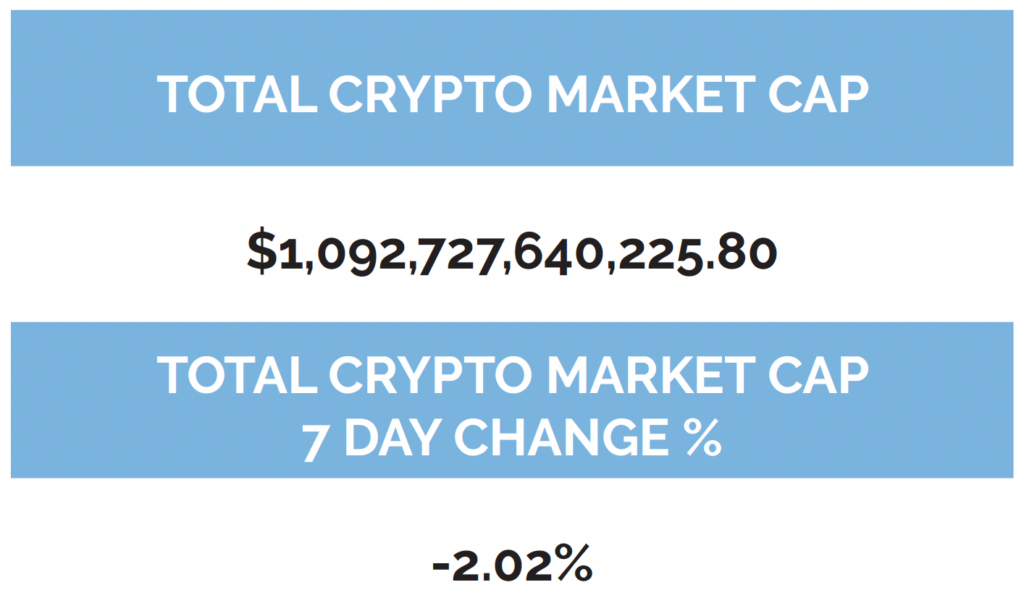

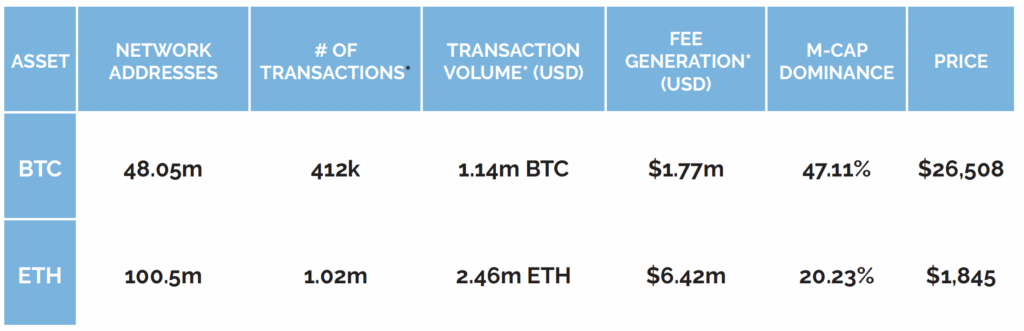

Digital asset markets were slightly down this week with the total industry market cap hovering above $1.1 trillion. The price of Bitcoin (BTC) closed at $26,508.31, down 1.19% on the week, while Ethereum (ETH) closed at $1,845.97, down 0.88% on the week. Year to date, BTC is up 59.56%, ETH is up 53.53%.

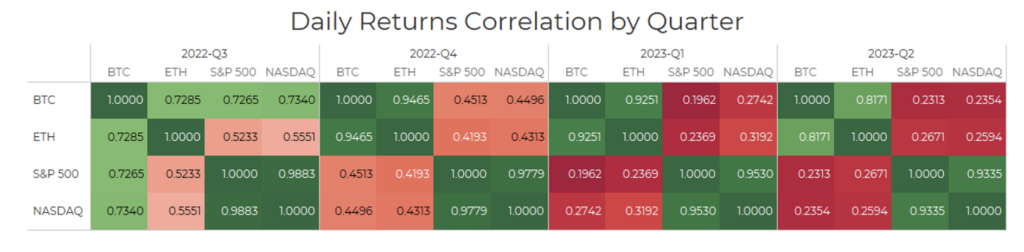

Gold is now uncorrelated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 continues to also be uncorrelated with Bitcoin. Ethereum continues to be positively correlated with Bitcoin, though the strength of that correlation has declined over the past week. (See correlation chart just below).

Total Value Locked in DeFi as tracked by DeFi Llama (in USD) was flat this week, coming in at $45.38b as of Thursday, June 8th.

-as of Thursday, June 8th, 7:00 pm ET

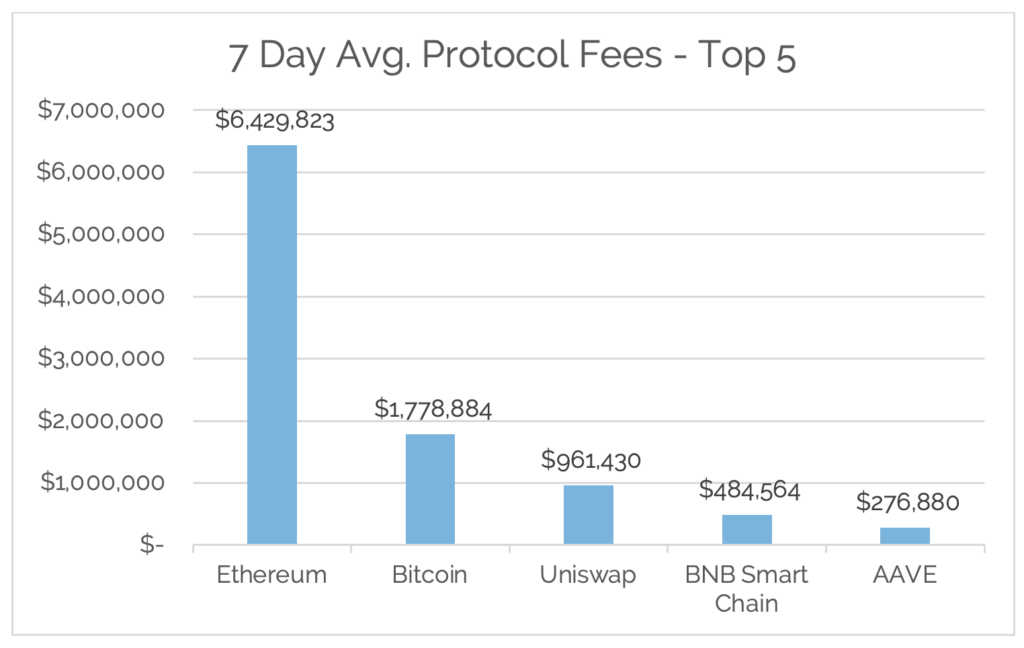

*7-Day Average

*Source: Cryptofees.info, Thursday, June 8th, 7:00 pm ET

*Fees in USD

Digital Asset Learning

On-Demand Learning: Unchained Episode 504 – SEC Sues Binance and Coinbase

Created By: Unchained Podcast Hosted by Laura Shin

Abstract: Electric Capital General Counsel Emily Meyers joins the show to read between the lines of an action-packed week for Gary Gensler’s SEC. Meyers lends her lawyerly eye to the key differences between the two lawsuits, the SEC’s potential strategy, and whether federal legislation will beat the courts in providing clarity.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.