Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

The past week allowed some time and space to analyze and process the previous week’s flurry of headlines around global regulatory progress and the many spot BTC ETF applications within the US. A major experimental study utilizing blockchain technology conducted by the NY Fed released detailed information and findings this week.

Now is the time to establish your digital asset strategy, or update your digital assets strategy, and be ready to act. Our mission is to take on this opportunity with you. Book a demo to learn more about how we enable financial advisors to plan and act on a disciplined digital asset strategy on behalf of their clients.

Important Takeaways this Week

- BTC ETFs Update: Surveillance-sharing partner released

- BlackRock CEO Larry Fink Says Bitcoin Could ‘Revolutionize Finance’

- Big Banks, NY Fed’s Innovation Group See Merit in Digital Ledgers for Global Payments

First, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

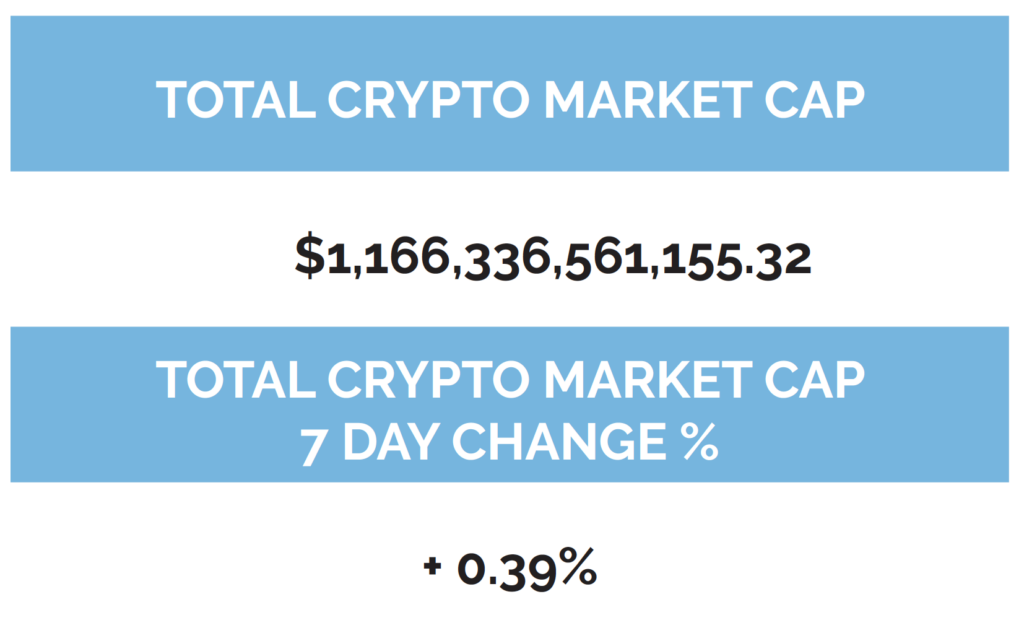

Digital asset markets were slightly down this week with the total industry market cap hovering above $1.2 trillion. The price of Bitcoin (BTC) closed at $29,899.39, down 1.80% on the week, while Ethereum (ETH) closed at $1,845.81, down 0.34% on the week. Year to date, BTC is up 81.35%, and ETH is up 54.86%.

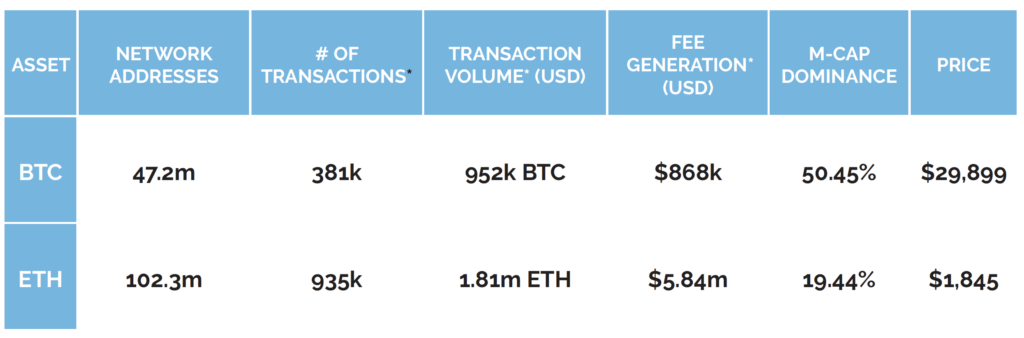

Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 continues to be uncorrelated with Bitcoin and gold continues to be negatively correlated with Bitcoin by the same metric. (See correlation chart just below).

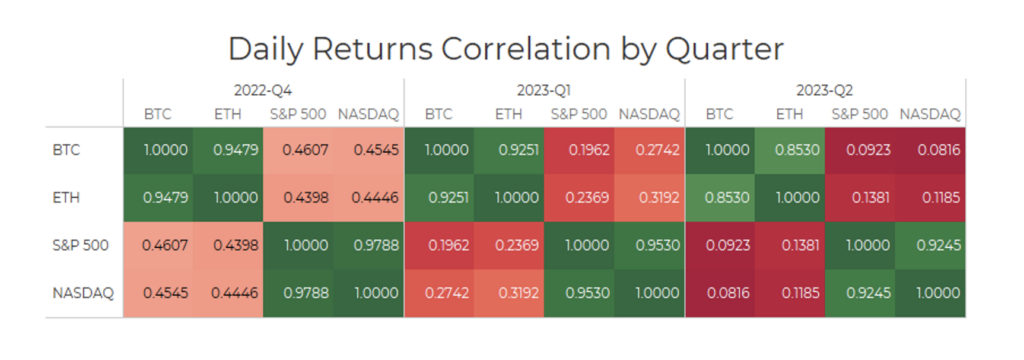

Total Value Locked in DeFi as tracked by DeFi Llama and verified by Digital Asset Research (in USD) was relatively flat this week, coming in at $44.2b as of Thursday, July 6th. The top 10 DeFi total value locked verified by Digital Asset Research showed no change in the ranking this week. Staked Ethereum continues to be at the forefront of DeFi with questions around centralization and what long-term costs will come to bear from it.

-as of Thursday, July 6th, 7:00 pm ET

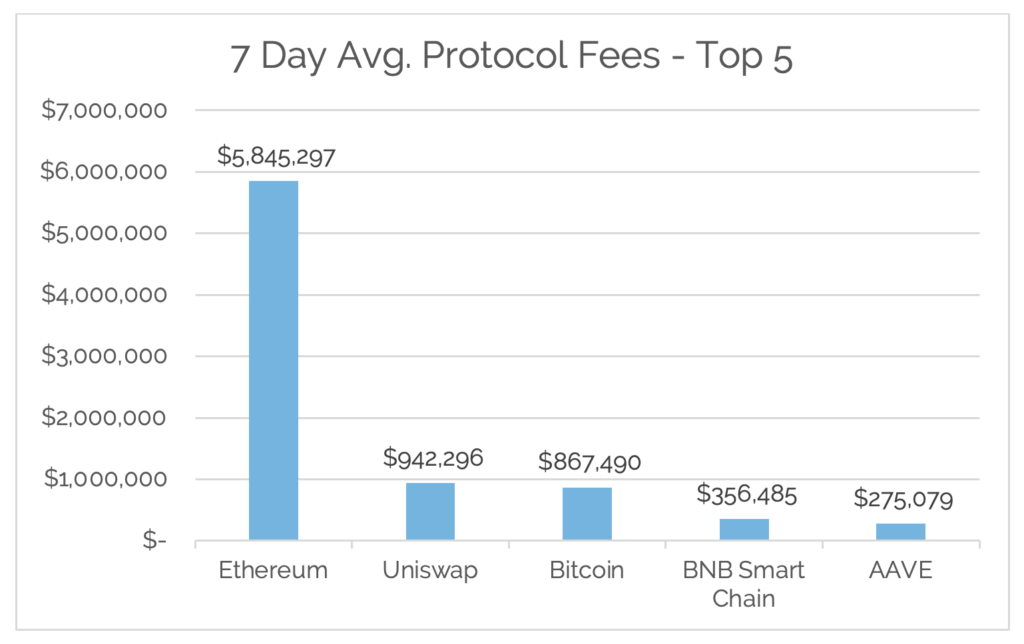

*7-Day Average

*Source: Cryptofees.info, Thursday, July 6th, 7:00 pm ET

*Fees in USD

BTC ETF Update

As we wrote last week, these firms all announced spot BTC ETF applications:

- Blackrock

- Wisdom Tree

- Bitwise

- Valkyrie

- Invesco and Galaxy Digital

- Fidelity

- ARK Invest and 21Shares US

- VanEck

Missing in the previous year’s applications from these firms was a Surveillance-Sharing Agreement. While that was included in the recent flurry of applications, what still wasn’t shared was the partner executing this. This week Coinbase was listed by many of the above firms (Blackrock, Fidelity, VanEck), while others have yet to name their partners for Surveillance Sharing. Decrypt released a great piece going through the high-level details of each firm’s ETF filing, which you can read here.=

Also missing from previous environments is the public support and acknowledgment of Bitcoin and its underpinning technology. This week Larry Fink, CEO of Blackrock, went live on-air with Fox Business and said Bitcoin could revolutionize finance. You could boil this down to talking your own book, but regardless of that, when someone with the relationships he has, and leads a firm with the global influence and ownership Blackrock has, it goes a long way to galvanizing others in the traditional world towards serious adoption.

Over the next few weeks, until mid to late August when deadlines for the SEC to respond approach, there will likely be many Twitter threads and articles downplaying or hyping up the significance of a spot BTC ETF. Our view is that a spot BTC ETF will not be a network adoption igniter but will go a long way in making BTC and the Bitcoin network more Lindy, which is extremely important. Approval or denial will bring short-term price volatility but likely change the current adoption trajectory of the Bitcoin network.

The trend we have observed in the past is outsized bets based on events like this occurring. Investors go all-in, or close to it, based on a singular event without a broader plan. This is where advisors can come in and add value. If you want to learn more about how Arbor Digital helps investors systematically invest in crypto in a responsible way, be sure to book time with us.

NY Federal Reserve Experiment Findings

In November 2022 the NY Fed announced an experiment with US financial services firms on a proof-of-concept network utilizing distributed ledger technology. This week they released more information about the experiment and their findings, which you can read here or re-watch the live webinar they conducted with Deloitte on July 6th here. The experiment was conducted by the NY Fed’s innovation center, working alongside Citi, HSBC, and other banks, on the concept of a network for wholesale payments on a shared ledger.

Important to initially take away is the acknowledgment by the NY Fed and the consortium of US Financial Services providers in the US that, “While existing payment systems function effectively, certain frictions remain, particularly around speed, cost, accessibility, and the settlement process.” This is significant because many detractors of the technology point to their being little to no value to the technology and that current systems work just fine. It will be hard for these detractors to push this further when the entire US Financial Services sector collectively identifies and acknowledges that there is indeed a valuable problem to solve for and that distributed ledger technology solves it.

Another important takeaway, “Distributed ledger technology has enabled certain capabilities in asset exchange, like a common source of truth and atomic settlement.” In other words, “Blockchain Technology is what enables capabilities in financial markets which we are incapable of experiencing with current financial market infrastructure.”

Even more important, are their findings, taken from the NY Fed Website:

The experiment successfully simulated both the domestic and cross-border scenarios, identifying shared ledger technology as a potential solution to support payment innovation. Three workstreams analyzed the technical feasibility, business applicability, and legal viability of using shared ledger technology:

- Technical: The technical workstream validated that the proposed architecture was able to deliver the benefits of settlement finality, a common source of truth, standard transaction data, and privacy for all participants on the network.

- Business: The business workstream concluded that the network has the potential to deliver improvements in the processing of wholesale payments due to its ability to synchronize U.S. dollar-denominated payments and facilitate settlement on a near-real-time, 24 hours a day, 7 days a week basis.

- Legal: The legal workstream considered the application of certain U.S. rules and regulations to the RLN system in the proof of concept. It found that the use of shared ledger technology, including tokens, to record and update the ownership of central bank and commercial bank deposits should not alter the legal treatment of such deposits. Although further analysis, research, and engagement with regulators would be required before final conclusions can be reached, the legal workstream did not identify any insuperable legal impediments under existing U.S. legal frameworks that would prevent the establishment of an RLN system as contemplated in the project.

To summarize here, technology does what it says it does, but from a legal standpoint, there is work to be done. While it is great, we have spot BTC ETF filings, we believe that this experiment has major significance to the future success of the adoption of distributed blockchain technology.

Digital Asset Learning

On-Demand Learning: Regulated Liability Network: Proof-of Concept

Moderated By: Roy Ben-Hur, Managing Director at Deloitte & Touche LLP

Speakers Include:

- Raj Dhamodharan, Head of Crypto and Blockchain at Mastercard

- Tony McLaughlin, Head of Emerging Payments and Business Development at Citi Treasury & Trade Solutions

- Rebecca Simmons, Partner at Sullivan & Cromwell

- Per von Zelowitz, Director of the New York Innovation Center at the Federal Reserve Bank of New York

Abstract: Learn more about key findings from the Regulated Liability Network US proof of concept. Event panelists shared their views and learnings from the three workstreams in the PoC across two use cases: domestic interbank payments, and cross-border payments in US dollars. The webcast also covered topics related to technical feasibility and legal viability in addition to the business applicability report findings.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.