Welcome to the latest edition of the Asset (r)Evolution newsletter where each week we dive into a recap of adoption and financial news in Digital Assets.

On Thursday, Digital Asset markets ripped higher on a ruling in the ongoing court battle between the SEC and Ripple, which is where we will focus this week.

Now is the time to establish your digital asset strategy and be ready to act. Arbor Digital’s mission is to take this opportunity with you. Book a demo here to learn more about how we enable financial advisors to plan and act on a disciplined digital asset strategy on behalf of their clients.

Important Takeaways this Week

First, a run of the numbers…

Run of the Numbers Sponsored by Digital Asset Research

*Data Provided By: Digital Asset Research. Digital Asset Research (DAR) drives the evolution of digital asset data integrity by emphasizing quality, transparency, and accuracy in our solutions for institutional crypto businesses. We help our clients operate confidently in the crypto space by delivering trustworthy ‘clean’ digital asset pricing, market data, research, and expert guidance.

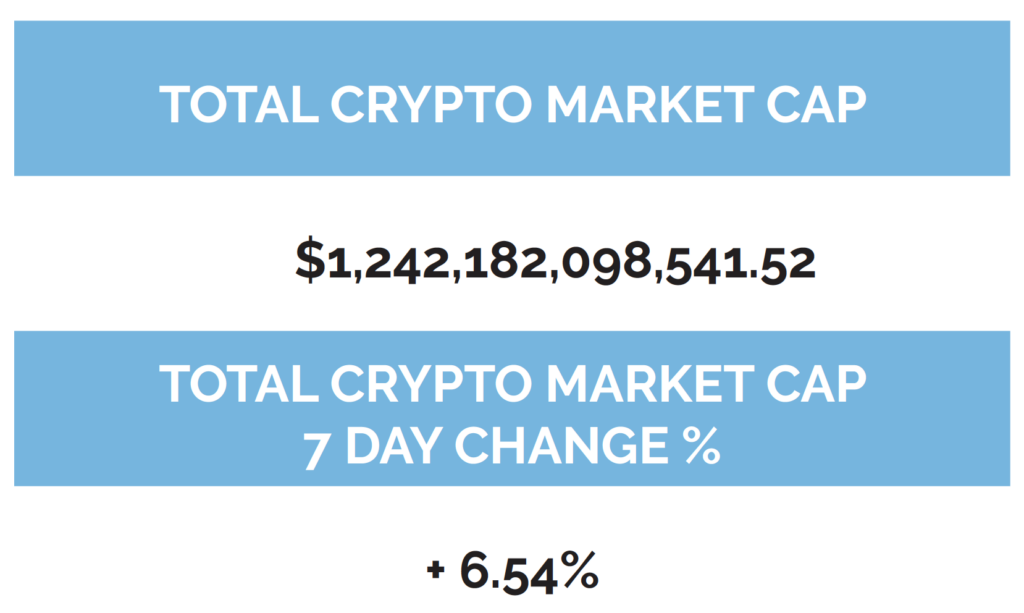

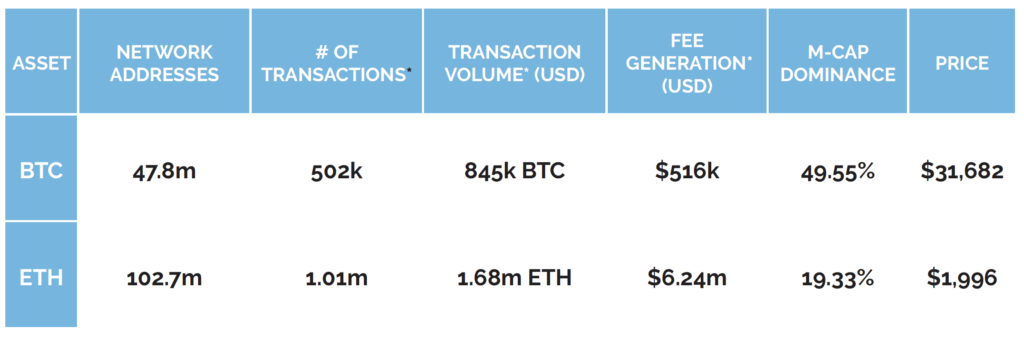

Digital asset markets were up this week with the total industry market cap hovering above $1.3 trillion. The price of Bitcoin (BTC) closed at $31,682.53, up 4.56% on the week, while Ethereum (ETH) closed at $1,996.98, up 5.87% on the week. Year to date, BTC is up 87.77%, ETH is up 66.20%.

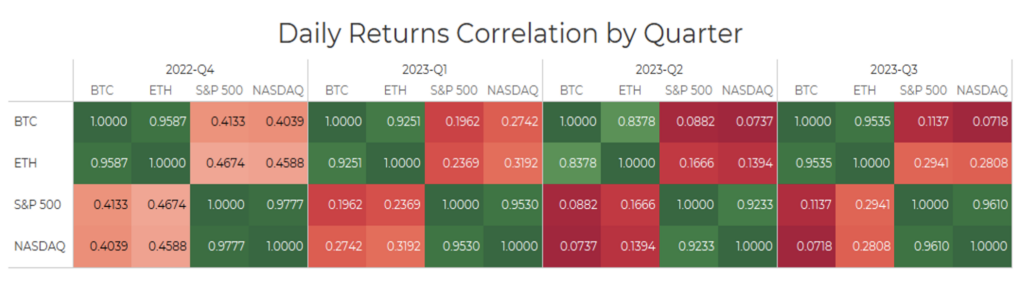

Ethereum continues to be positively correlated with Bitcoin when looking at a 30-day rolling correlation, while the S&P 500 continues to be uncorrelated with Bitcoin and gold continues to be negatively correlated with Bitcoin by the same metric. (See correlation chart just below).

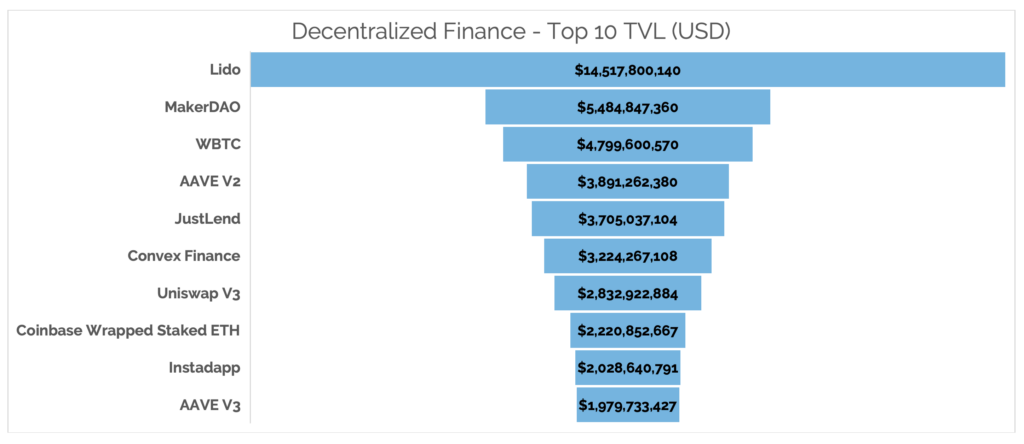

Total Value Locked in DeFi as tracked by DeFi Llama and verified by Digital Asset Research (in USD) was relatively flat this week, coming in at $45.93b as of Thursday, July 13th. The top 10 DeFi total value locked verified by Digital Asset Research showed no change in the ranking this week. Staked Ethereum continues to be at the forefront of DeFi with questions around centralization and what long term costs will come to bear from it.

-as of Thursday, July 13th, 7:00 pm ET

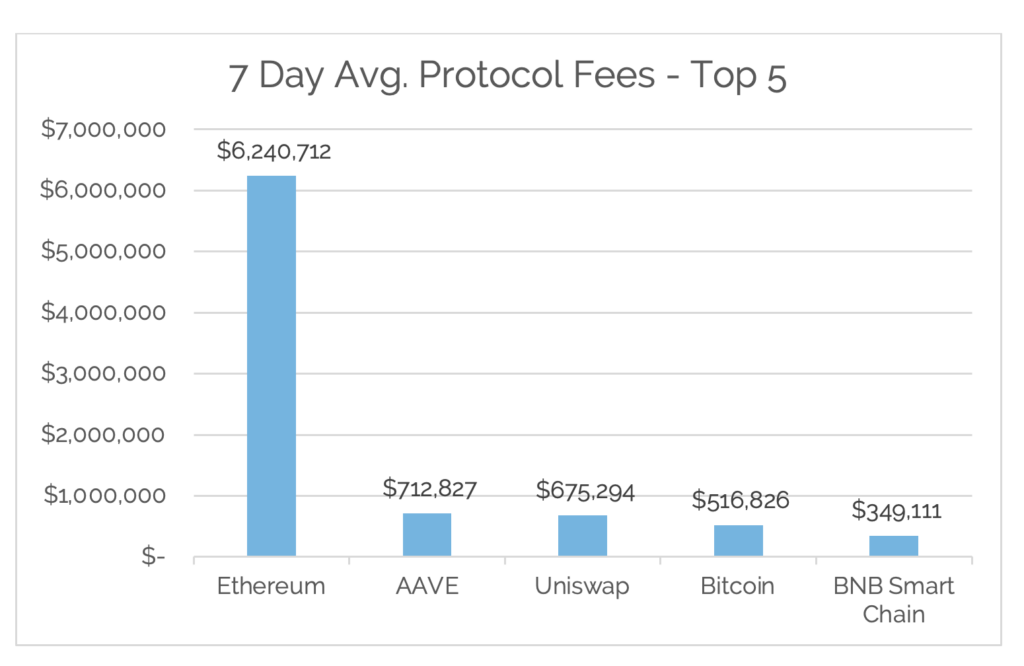

*7-Day Average

*Source: Cryptofees.info, Thursday, July 13th, 7:00 pm ET

*Fees in USD

SEC VS. RIPPLE

On December 22nd, 2020, the SEC charged Ripple Labs, and two of its executives, with conducting a $1.3 Billion unregistered securities offering of XRP tokens.

On Thursday, July 14th, the U.S. District Court of the Southern District of New York ruled that the sale of Ripple’s XRP tokens on exchanges and through algorithms did not constitute investment contracts, thus, did not violate federal securities law. However, the judge held that Ripple violated federal securities law by selling XRP directly to sophisticated investors. Matt Levine, Bloomberg Crypto writer, said it well, “Both Ripple and the SEC would have reason to view this outcome as a potential win, as it gives credence to the security-or-not debate on either side.”

On this pseudo-win, the XRP token was re-listed back on exchanges like Coinbase, Kraken, and iTrustCapital and subsequently, the price went from $0.48 to a high of $0.91, roughly a 90% gain. XRP is now the 4th largest Digital Asset by market cap.

A few weeks ago, when the SEC initially sued Coinbase and Binance for selling unregistered securities, you can read this edition where we reviewed the full list, those tokens all suffered double-digit losses. Those losses have been recuperated in those tokens, as well as the overall crypto market, in the last 36 hours of trading since the ruling that tokens on exchanges and through algorithms do not constitute investment contracts, via the SEC v. Ripple case.

What do others think of the ruling?

Crypto Council for Innovation CEO Sheila Warren: “This is a big deal. It’s been clear since this case was filed that it would have implications across the entire industry. This fundamentally undercuts the SEC’s argument that it has the authority over these underlying assets and that regulatory clarity already exists.”

Katten Muchin Rosenman Attorney Gary DeWaal: “The ruling should help Coinbase in fighting its own SEC case.”

Majority Whip Tom Emmer: “The ruling established that a token is separate and distinct from an investment contract it may or may not be part of. Now, let’s make it law.”

What is next in the SEC v. Ripple case?

The SEC will likely appeal this ruling and argue against it. There remains a lot of uncertainty as it pertains to the “Are tokens a security or not” debate. Reuters, “The SEC spokesperson said the regulator was reviewing the decision.” There is a long way to go before there is full clarity with the US.

While we at Arbor Digital view the recent ruling as positive for the industry and see this as the beginning of a bigger momentum swing in the US regulatory landscape, we strongly urge that no decisions be made while on an emotional high. Rather, you should have a disciplined plan to engage and simply execute that plan over time. It would be premature to assume that the SEC will lose their case against Ripple, and by extension, the others against other crypto entities.

The trend we have observed in the past during these emotional highs is outsized bets with investors going all-in, or close to it, based on a singular event without a broader plan. This is where advisors can come in and add value. If you want to learn more about how Arbor Digital helps investors systematically invest in crypto in a responsible way, be sure to book time with us.

To end, please review this list of resources to get caught up on the history of the SEC v. Ripple case, the current state, and analysis from legal professionals:

- Unchained Podcast: New Order in SEC vs. Ripple Over XRP Is a Win for Crypto: What Happens Now?

- Unchained Podcast: The SEC’s Lawsuit Against Ripple and 2 Execs: What You Need to Know

Other Digital Asset News:

- Ex-Celsius CEO Alex Mashinsky Charged With Crypto Fraud- Bloomberg

- Three Arrows Capital Liquidator May Try to Claw Back About $1.2B From DCG, BlockFi – Coindesk

- SEC Approval of Spot Bitcoin ETF Is Unlikely to Be a Game Changer for Crypto Markets: JPMorgan – CoinDesk

- Mantle Network Is Voting to Form a $200 Million Ecosystem Fund- The Block

- Standard Chartered Revises Bitcoin Price Target to $120,000 – The Block

- FTX Bankruptcy Lawyers Ask Court for $323M Recovery From FTX Europe Leadership – CoinDesk

Digital Asset Learning

On-Demand Learning: Regulated Liability Network: Proof-of Concept

Moderated By: Roy Ben-Hur, Managing Director at Deloitte & Touche LLP

Speakers Include:

- Raj Dhamodharan, Head of Crypto and Blockchain at Mastercard

- Tony McLaughlin, Head of Emerging Payments and Business Development at Citi Treasury & Trade Solutions

- Rebecca Simmons, Partner at Sullivan & Cromwell

- Per von Zelowitz, Director of the New York Innovation Center at the Federal Reserve Bank of New York

Abstract: Learn more about key findings from the Regulated Liability Network US proof of concept. Event panelists shared their views and learnings from the three workstreams in the PoC across two use cases: domestic interbank payments, and cross-border payments in US dollars. The webcast also covered topics related to technical feasibility and legal viability in addition to the business applicability report findings.

Thank you for your continued trust. Be sure to tell someone today you care about them!

The content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.

Definitions:

Network Addresses:

The sum count of unique addresses holding any amount of native units as of the end of that interval. Only native units are considered (e.g., a 0 ETH balance address with ERC-20 tokens would not be considered).

Daily Active Addresses:

The sum count of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that interval. All parties in a ledger change action (recipients and originators) are counted. Individual addresses are not double-counted.