In this edition of Digital Asset Friday, we look at the historic week ahead with the Ethereum merge scheduled to take place. First, a run of the numbers…

By The Numbers

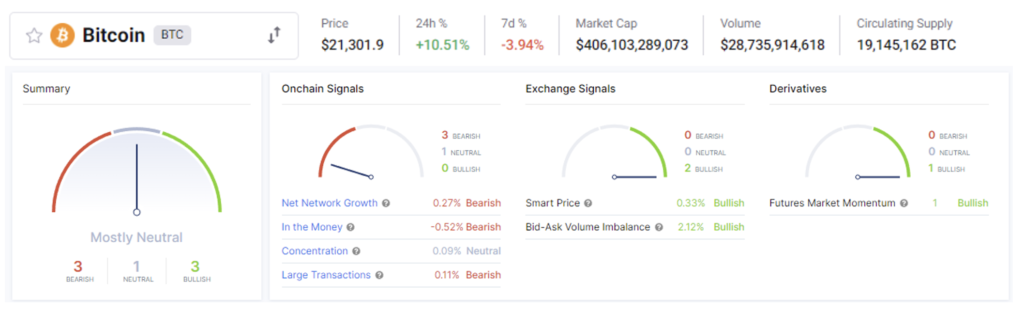

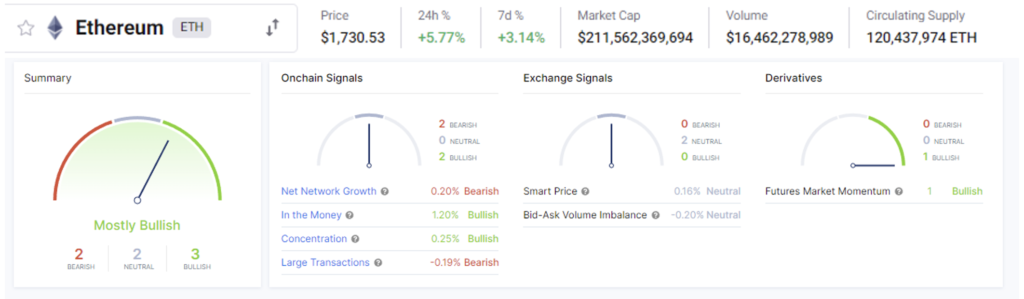

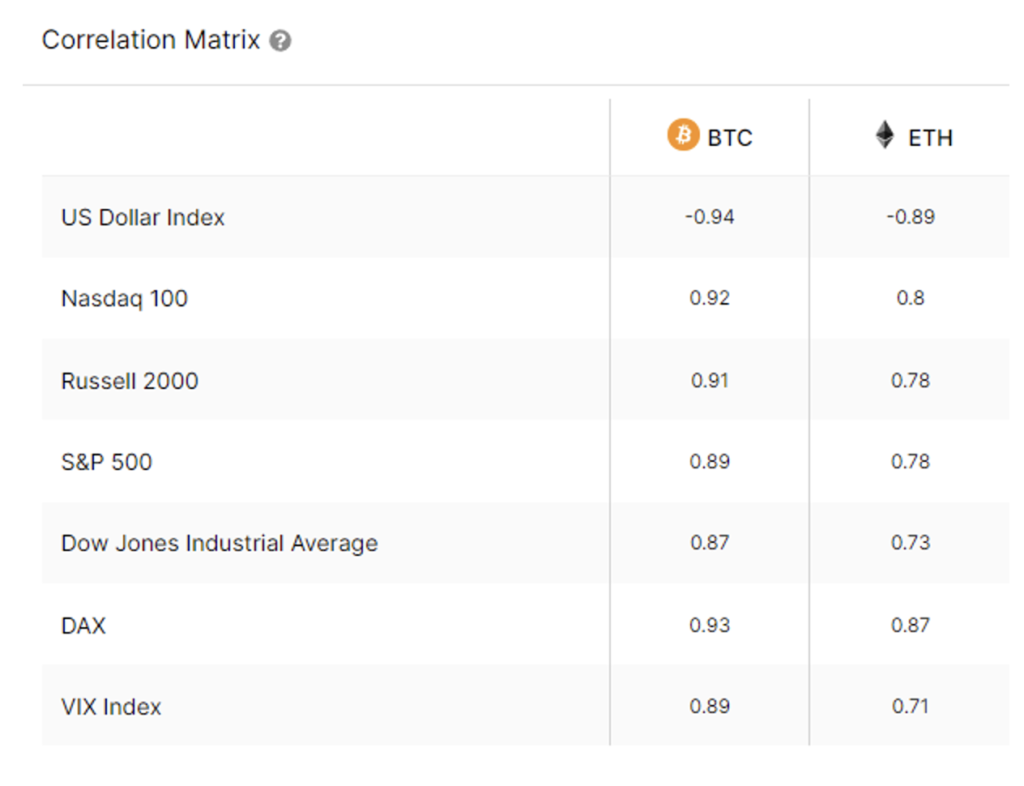

*All data above provided by CryptoQuant and Intotheblock

Dates to pay attention to:

- September 13/14th – Ethereum Merge

- September 13th & 14th – Digital Asset Summit NYC

- September 15th – Mt. Gox BTC repayments start as per the rehabilitation plan

A Historic Week

The Ethereum merge makes this upcoming week historic. We have been writing for several weeks about the merger, why it’s important, what is changing, and our thoughts in the short and long term. Our first writing to help prepares advisors on the subject was July 2021 and in recent market recaps. Be sure to check out past editions here.

It looks like Wednesday afternoon is when the merge will happen with some speculation it could be earlier or later.

We have been continuously asking ourselves “How will the Merge impact our DeFi and Web3 strategy?”

Thanks to a partner of ours, Blockworks research, we have access to an insight report in which MetaMask Institutional and the ConsenSys Cryptoeconomics Research team compiled insights examining the impact of the Merge on institutions like ours. It walks through:

- Why Ethereum is ultrasound money

- The key changes the Merge will deliver across Ethereum network activity, network security, and network valuation

- How the Merge will impact institutions

- The future of Ethereum and Institutional DeFi

Taken from the report they highlight the top 5 outcomes that the Merge will deliver:

- Sustainability: Ethereum will use 99.95% less energy to validate transactions, tremendously reducing its carbon footprint, and increasing its appeal toward institutions with environmental, social, and governance (ESG) mandates and energy-efficiency concerns.

- Rewards: In switching from the Proof of Work (PoW) to the Proof of Stake (PoS) consensus mechanism, the Merge will change the way value is accrued across the Ethereum network. While a validator will earn rewards of 5.5-13.2% for validating transactions and adding them to blocks, token holders will earn rewards through a token-burning mechanism. The burning mechanism creates a powerful flywheel of ultrasound money, which incentivizes long-term holding and staking of ETH for all Web3 participants.

- Deflationary supply of ETH: Reduced ETH issuance and increased burns will systematically reduce ETH supply. putting deflationary pressure on ETH, thereby alleviating institutional concerns of token price dropping to zero and increasing the likelihood of an increase in value.

- Improved security: With the democratized participation and improved decentralization of the PoS mechanism, the cost to attack the Ethereum blockchain will be more than $11B at current prices, roughly 10-20X more expensive than PoW. The Merge will make Ethereum significantly more secure, producing stronger security guarantees for institutional investors. In addition, the security of the network running PoS will rise over time as more validators will come on board, and the amount of staked ETH will increase.

- Ecosystem growth: On-chain apps and Layer 2 solutions will likely leverage the above-improved security conditions and multiply on top of Ethereum. stimulating an increase in applications, and opportunities for institutional investors.

On the flip side, they also dive into Threats as well. The TLDR here:

- Transaction Costs and Processing: Long-standing criticisms of Ethereum such as high transaction costs and slower transaction processing, will remain after the Merge.

- Centralization, Censorship, and Collusion: The poS mechanism could introduce an existential risk of increasing centralization, censorship, and collusion in the Ethereum network. Following the Merge, large holders of ETH could theoretically interfere with the network performance. While this does not extend to catastrophic events like reversing transactions, it could potentially prevent finality from happening for an extended period, such as a day. One example of this existential threat is the growth of liquid staking derivatives on protocols like Lido Finance, Rocket Pool, and similar protocols. Lido, for instance, now controls nearly a third of all staked ETH. While there is decentralization within Lido (e.g. 21validators on Lido responsible for staking), the potential attack vector is still there.

- Interoperability’s Existential Threat: Improvements in interoperability pose an existential threat to Ethereum. This includes the emergence of cross-chain messaging protocols such as Axelar, the proliferation of protocols with built-in interoperability such as Cosmos and Polkadot, as well as improvements to bridge technology. All of these factors enable developers to build applications that are chain-agnostic while allowing users to move frictionlessly across chains with more security.

It is so important to reiterate that this has never been done before within the space. No one knows how this is going to go in the short term. While the Merge may not directly address some of these criticisms, it does set Ethereum up for further upgrades outlined in its roadmap. The Merge is a step in the right direction. However, it is only the first one in the journey towards a better Ethereum.

If everything above seemed like an alien language and have no idea how this connects to investing for clients, then give us a call. We work directly with advisors and their clients to make sound decisions when engaging and investing in digital assets.

Other Digital Asset News

- US Treasury to Recommend Issuing Digital Dollar if in National Interest

- Whitehouse Suggests Banning PoW

- Coinbase Employees and Ethereum Backers Sue US Treasury

- Gary Gensler is Onboard with CFTC Taking Over BTC Oversight (maybe Ethereum)

- Gamestop Partners with FTX and Sorare Create NBA Fantasy Game

- Ticketmaster partners with Dapper Labs to issue NFT tickets

Crypto Learning:

Webinar: The ETH Merge: What does it mean?

When: Friday, September 16th, 2022, 2:00 pm ET

Presented by DACFP: For many investors, their entrance into crypto starts with bitcoin. As they explore the landscape, their next stop is often Ethereum, the world’s second-most valuable blockchain. Indeed, many now believe Ethereum represents a bigger market opportunity than bitcoin. After all, Ethereum is the platform on which DeFi, NFTs, and stablecoins are largely built!

And, in September, Ethereum is completing what many say is the most significant software upgrade in crypto history. It’s called the “Merge.”

Join us for this special one-hour webcast, where Ric Edelman and Bitwise CIO Matt Hougan will reveal what the “Merge” means for Ethereum and holders of ETH – and how you can answer your clients’ questions about crypto’s second-largest asset.

1 CFP CE credit

1 CFA PL credit

Investments & Wealth Institute® has accepted this webinar for 1 hour of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA® certifications.

Reading: The Impact of the Merge on Institutions, by Consensus

A review of where we are in Ethereum’s protocol development and how the Merge to Proof of Stake will impact institutions.

Thank you for your continued trust. Be sure to tell someone today you care about them.