In this edition of Digital Asset Friday, we discuss the upcoming Tax deadline and considerations for digital asset investors. We will also review the main takeaway from the US Treasury report on the implications for consumers, investors, and businesses. Finally, we will discuss the major story of SWIFT and Chainlink’s partnership for a Cross-Chain Interoperability Protocol (CCIP) proof-of-concept in the continuing merge of traditional and web3 infrastructure. First, a run of the numbers…

By The Numbers

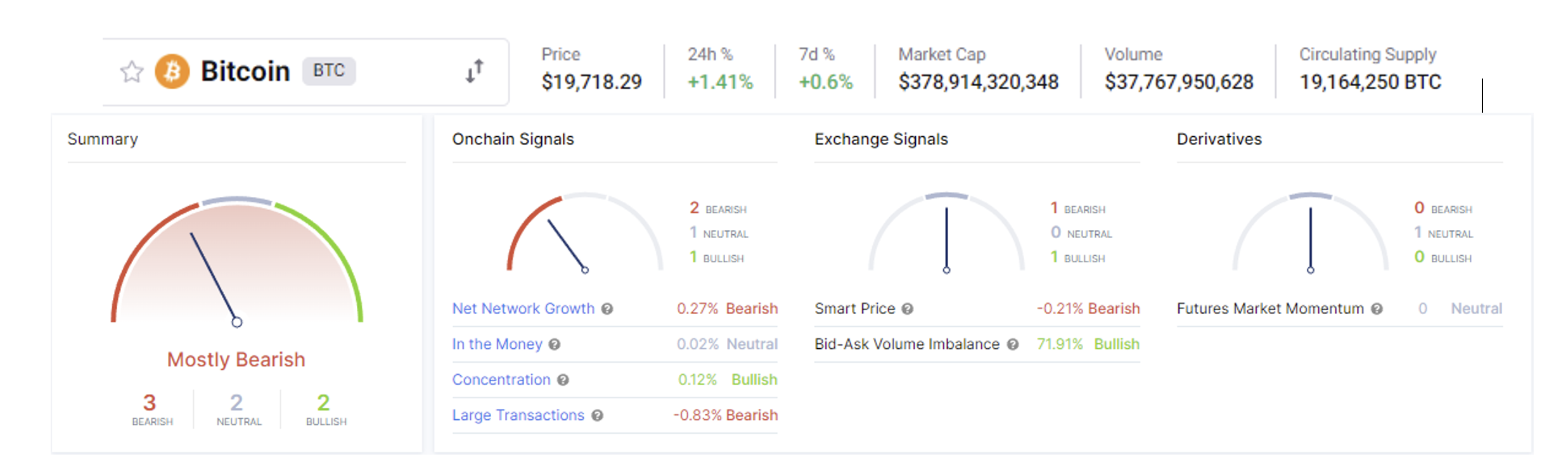

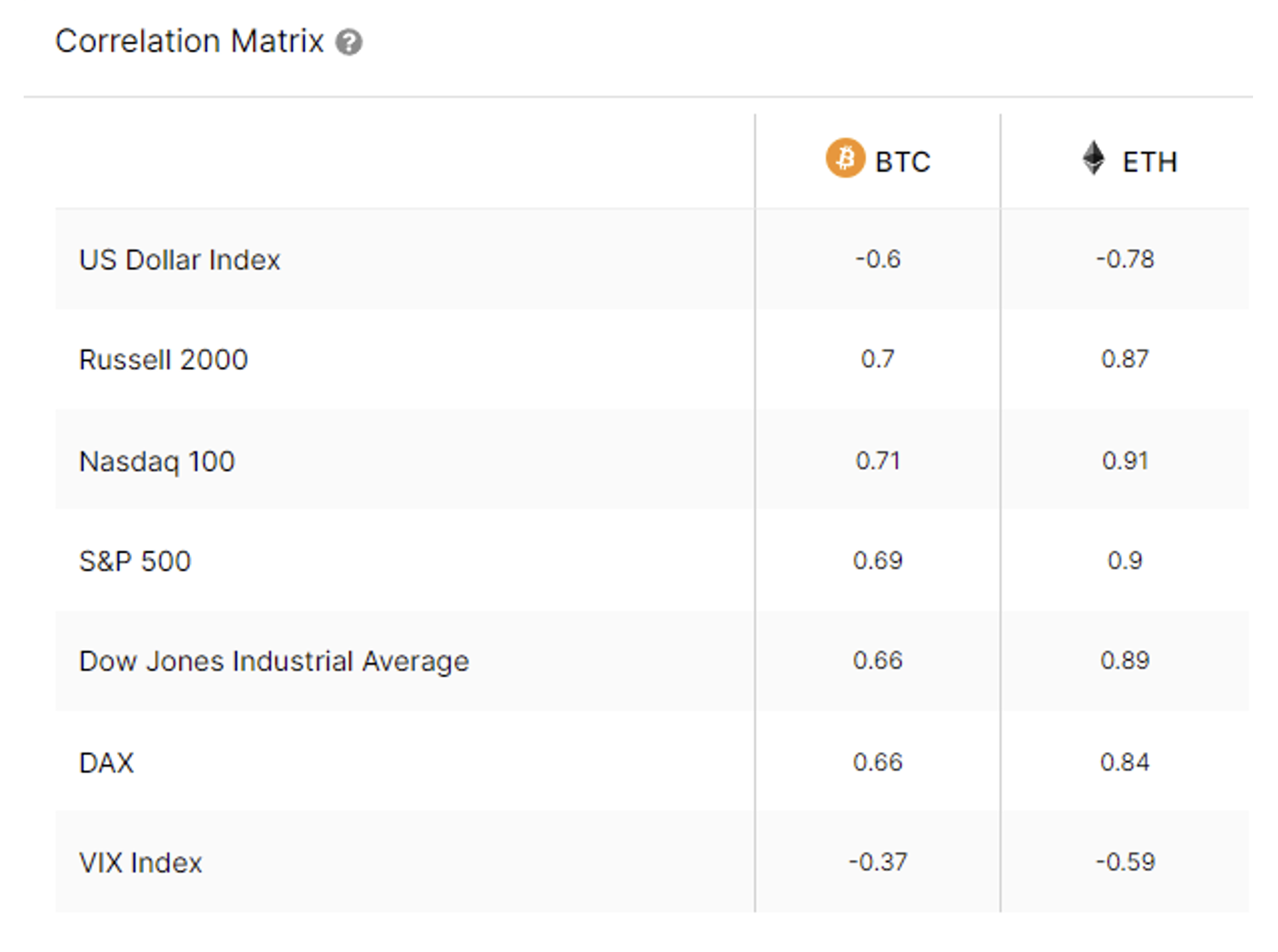

*all data above provided by CryptoQuant and Intotheblock and as of September 23rd, 2022, 2:29 pm EST

Tax Considerations for Digital Assets

Disclaimer: We are not CPAs or Tax Advisors; the following is meant for informational purposes only and should not be considered tax advice. If you have more questions or need help, please reach out to us. Arbor Digital has spent the last 18 months performing due diligence on best-in-class CPA firms who are the credentialed experts to who we have access to.

October 17th, 2022 marks the deadline for those who filed extensions back in April. With the IRS stepping up its efforts to target US taxpayers to report and pay taxes on digital asset transactions, it’s important to know how to ensure you aren’t doing anything that could potentially destroy your hard-earned wealth.

The IRS’s stance on cryptocurrency transactions is clear and treats digital assets as property subject to capital gains taxes. The IRS is less clear and hasn’t provided clear guidance on the tax treatment of non-fungible tokens (NFTs) or decentralized finance (DeFi) rewards.

Advisors need to be proactively asking about this to fulfill their fiduciary duty to clients.

Reporting Crypto/Digital Asset Transactions

We break down crypto transaction reporting into three levels:

Level 1: Centralized exchange spot trading of derivatives or underlying digital assets. This is your most basic level and easiest to aggregate. Example: Investor transacts on Coinbase, Kraken, FTX, or Binance.US

Level 2: In addition to Level 1, transactions between centralized exchanges, protocol wallets, or cold storage to spot trade on decentralized exchanges within those networks. Example: An investor sends assets they bought on a centralized exchange to their web3 wallets such as Metamask, Phantom, or Exodus. They then start transactions in spot or derivatives via decentralized exchanges like Uniswap or Synthetix.

Level 3: In addition to Levels 1 & 2, transactions that interact with DeFi borrowing and lending and investor engages in yield farming via protocols like AAVE and MAKER, participate in liquidity pools on decentralized exchanges like Uniswap and lastly move assets between different networks through bridges. Another element to Level 3 is workers on these networks and protocols who earn their income and livelihood via working on and are paid in the network’s native token. Example: Investor engages with Lido to stake their ETH tokens, they then take that stETH across protocols and wrap them to go across networks to engage in other DeFi opportunities. Investors operated a node to offer the service the network enables, like Helium, and earn the HNT token as compensation. The earner then either keeps the native token, transitions to USD, or to a stablecoin like USDC.

If the investor is engaging with Level 1 transactions like Robinhood, Gemini, or other exchanges then you can access this data via their online dashboard with transaction reports as well as 1099Ks, 1099Misc, or 1099-B if clients have qualifying transactions. These can simply be downloaded and uploaded to existing tax software, most of them anyway, or given to CPAs to have them report for you.

It is important to report these and past transactions. Andrew Gordon, president of Gordon Law Group said it best, “The IRS has indicated this is a very high priority for them.” The IRS will be issuing what they call “John Doe Summons” to exchanges, and they have started with digital asset prime broker sFOX and digital asset bank M.Y Safra to turn over digital asset transaction data since 2015.

Going beyond Level 1 is where you need elevated solutions:

Solution #1: Utilize Tax aggregation software services such as TaxBit, ZenLedger, or Cointracker. For level 1 and basic level 2 transactions this could suffice. It’s important you spend the time and energy to ensure no mistakes.

Solution #2: Work with a Digital Asset CPA firm. We at Arbor Digital have two firms we work with to refer clients wherever they lie on the crypto transaction spectrum, but especially if investors are doing Level 2 and 3 activities, we highly recommend going this route to ensure no mistakes and you are sufficiently protected against any actions.

Gifting & Donating Digital Assets

Abor Digital partners with The Giving Block to add value to clients and non-profits looking to gift or donate digital assets. To understand more about gifting, donating, and how it’s done you can view their Crypto Tax Prep Guide for Donating and Gifting here where they partnered with TaxBit.

If you have a specific situation, you need help with. Please reach out to us and we can partner together to plan and strategize what fits best for you and your situation. A couple of high-level points to be aware of:

- The IRS makes a distinction between a donation and a gift for tax purposes depending on who receives the cryptocurrency.

- If you send cryptocurrency to a qualified charitable organization, this is considered a donation, also referred to as a charitable contribution.

- If you send cryptocurrency to family, friends, or a crowdsource campaign for someone with medical bills, it’s considered a gift.

- The IRS classifies cryptocurrencies as property, so cryptocurrency donations to 501c3 charities receive the same tax treatment as stocks.

Contributing to a Digital Asset IRA

The deadline also represents the last opportunity for clients to contribute to Self-Directed IRAs for which they hold digital assets. It is important investors don’t make any mistakes when contributing or executing complex strategies like a Roth IRA conversion. Many investors are doing this for the first time on their own and are more prone to making mistakes due to now thinking past the transaction of contributing, not consulting what it means for their overall situation, or thinking about how it will impact them in the future.

At Arbor Digital, we understand that this space is equally complex and confusing in its current state. The value of having a trusted partner like us to help you continue to add value and fulfill your fiduciary duty is why we exist. We hope this overview helps in breaking it down so you can be empowered when approaching clients about digital assets.

Read More:

US Treasury Report: An Important Take-Away

The US Treasury Department and The Department of Justice recently released their first reports that examine aspects of digital asset markets for the purposes of informing future policies. The four main reports were:

- The Future of Money and Payments

- Implications for Consumers, Investors, and Businesses

- Action Plan for Illicit Financing Risks

- The Role of Law Enforcement in Activity Related to Digital Assets

We will be releasing a full episode on the Asset (r)Evolution podcast with the compliance officer and president of Arbor Digital Matt Kolesky, but for the purposes of this article, we will focus on our main takeaway from the second report: Implications for Consumers, Investors, and Businesses since that is who we interact with and service.

The scope of this report provides an overview of digital assets, entities that provide related services or products, and detail on market size, trends, and uses. The report also outlines digital asset opportunities, risks, and exposures and offers recommendations to protect and inform consumers, investors, and businesses. We will be focusing on that last bit and the Treasury’s recommendation:

Promoting consumer access to financial education and trustworthy information on crypto assets.

Financial education and trustworthy information. This is an important takeaway.

Why? Because this is what we as advisors can control and have a positive influence on now. We don’t need regulatory clarity to get educated and become a trustworthy source for clients to come to us for their digital asset needs or questions.

We understand the amount of lift it takes to gain a foundational knowledge of the space to initially engage, as well as the impossible amount of lift to maintain that knowledge and stay up to date, is too much. It’s not a core part of most financial advisors business. So, what do responsible business owners do when something isn’t a part of their core business to maintain efficiency and quality? You outsource it to the professionals who are dedicated to that space. This is why Arbor Digital exists. We live in a digital asset space so you don’t have to.

The time is now to follow the recommendations of the US Treasury and promote and deliver on digital asset financial education and trustworthy information.

Read More:

The Merge Continues

SWIFT and Chainlink Partner for CCIP Proof-of-Concept

From Coindesk: SWIFT, the interbank messaging system that allows for cross-border payments, is working with Chainlink, a provider of price feeds and other data to blockchains, on a cross-chain interoperability protocol (CCIP) in an initial proof-of-concept. CCIP will enable SWIFT messages to instruct on-chain token transfers, helping the interbank network to be able to communicate across all blockchain environments.

SWIFT’s Strategy Director Jonathan Ehrenfeld Solé said that one of the reasons working with Chainlink on CCIP has been successful is that there is “undeniable interest” in crypto from institutional investors. Traditional finance (TradFi) players want access to various digital and traditional assets on one network that can connect different types of asset classes, Solé said.

The merge continues.

Other Digital Asset News

A smart banknote is a physical banknote that interacts with a CBDC solution and acts as a transitional device between traditional and CBDC based payment…

Digital Asset Learning

Webinar: Quantifying Opportunities and Risks in Liquidity Protocols

When: Monday, October 3rd, 2022, 12:00pm ET

Presented by Coindesk: Moderator Nick Lord will be joined by Shawn Douglass (Co-founder and CEO of Amberdata), Tarun Chitra (Founder and CEO of Gauntlet), Shiliang Tang (Chief Investment Officer of LedgerPrime), and Darius Sit (Co-founder and CIO QCP Capital) for an in-depth-discussion-on:

- Data-driven approaches to analyzing liquidity protocol risk

- Quantitative strategies for enhancing yield/achieving superior returns

- Decreasing volatility in returns and leveraging stablecoins as collateral

Reading: Crypto-Assets: Implications for Consumers, Investors, and Businesses from the U.S. Department of Treasury

As part of Executive Order, 14067 on Ensuring Responsible Development of Digital Assets; Section 5(b)(i)—the implications of developments and adoption of digital assets and changes in the financial market and payment system infrastructures for U.S. consumers, investors, businesses, and for equitable economic growth.

Digital asset markets have changed and grown dramatically over the past decade based on estimates of market capitalization, transaction volumes, and the number and types of assets. Millions of people globally have some exposure to crypto-assets, including at least 12% of Americans. President Biden’s Executive Order on Ensuring Responsible Development of Digital Assets (Executive Order) observes that the continued expansion of crypto-based technology could have profound implications for the users of crypto-assets—namely, consumers, investors, and businesses.

Content presented is for information purposes only and should not be considered specific or individualized financial advice. Arbor Digital is a Division of federally registered Arbor Capital Management, Inc. (ACM) CRD # 111362. Registration does not imply a level of skill or knowledge. Past performance is no guarantee of future results. The digital asset class is speculative and has unique risks compared to traditional assets. See our regulatory disclosures or contact us for more information.